The rise of the internet and wireless technology has transformed traditional commerce into eCommerce, with mobile commerce technology advancing rapidly. This shift has made mobile devices essential for businesses to reach consumers. Today, people can interact with businesses anytime and anywhere using their smartphones, creating abundant marketing opportunities and new sales channels through digital marketing.

eCommerce is increasingly favoring mobile applications over traditional websites and computer platforms, fueled by consumer preference and the emerging trend of super apps and all-in-one applications. These feature-rich, visually appealing shopping apps are gaining momentum. Understanding mobile commerce and its significant growth can be a valuable asset for businesses, including local ones, to tap into this lucrative market.

Let’s dive into the world of mobile commerce!

Table of Contents

What Is Mobile Commerce?

Mobile commerce, also known as mCommerce for short, refers to the buying and selling of goods and services among buyers and sellers via wireless devices, such as tablets or mobiles. Thus, online shopping via a desktop computer will not be counted as mobile commerce.

Let us take digital wallet apps as a typical example.

Do you use electronic payment applications, such as Apple Pay, Samsung Pay, or Android Pay? They are created by app developers so that users can make money payments through a direct connection to their bank account. To ensure safety and security, often, they will have two-factor authentication enabled. That is, in addition to the password of the application account, the user also needs to authenticate the account via his phone number.

Thus, you do not need to log in to the website on your computer to make payment transactions like before. Not limited to in-app purchasing, and mobile banking apps, now mobile commerce technology also allows you to locate, shop, buy tickets, book hotel rooms, meals, and more.

Differences between mCommerce and eCommerce

Mobile commerce is a part and a new evolution of eCommerce. Of the total eCommerce sales of 2017, 34.5% were mobile commerce sales, and now, it has grown to more than half, or 54%.

However…

It is not simply part of eCommerce and there are some huge differences between them.

Mobile commerce technology can do a number of things more than we would expect from eCommerce, facilitating a number of new and existing industries and services, such as mobile money transfers, digital content purchases, and delivery, contactless payments, location-based services, etc.

Mobility

A fundamental difference lies in their mobility. eCommerce, often conducted through desktop computers, confines users to a fixed location. This restricts mobility, as desktops are not easily portable. mCommerce, in contrast, is enabled through handheld devices like smartphones and tablets, offering the flexibility to conduct transactions anywhere with an internet connection, be it on public transport, in cafes, or during a gym session.

Location Tracking

eCommerce platforms typically track user location via IP addresses, which only provide a general region. This limitation impacts the precision of targeted advertising. mCommerce, however, utilizes advanced technologies like Wi-Fi and GPS for location tracking, enabling highly personalized content and recommendations. For example, mCommerce apps can send custom discounts to users as they pass by a particular store, enhancing the shopping experience.

Security

The security measures in eCommerce and mCommerce also differ significantly. Traditional eCommerce often relies on credit card payments, which, despite multifactor authentication, remain susceptible to data breaches and identity theft. mCommerce addresses some of these security concerns with features like biometric authentication, mobile wallets, QR codes, and even the use of cryptocurrencies, offering a more secure transaction environment.

Reachability and Convenience

mCommerce has an edge in reaching and engaging the target audience. Mobile apps facilitate easier and quicker shopping experiences, making it more convenient for users to browse and purchase on the go.

These are just a few of the primary distinctions between mCommerce and eCommerce. Additionally, there are other noticeable differences, such as:

- User Experience: mCommerce apps are typically designed for smaller screens and touch-based interactions, necessitating a user-friendly and responsive design. eCommerce websites, on the other hand, are optimized for larger screens and mouse-based navigation.

- Payment Methods: mCommerce often incorporates mobile-specific payment solutions like Apple Pay or Google Wallet, which are not commonly used in traditional eCommerce.

- Marketing Strategies: Marketing tactics in mCommerce often leverage push notifications and SMS, capitalizing on the immediate and personal nature of mobile devices. eCommerce strategies might focus more on email marketing and online advertisements.

- Internet Connectivity: While eCommerce relies on stable internet connections, mCommerce can sometimes leverage offline capabilities, allowing users to browse products or services without an active internet connection and complete transactions once they are back online.

- Social Integration: mCommerce apps tend to have stronger integration with social media platforms, encouraging social shopping experiences and easy sharing of products or deals.

Types of Mobile Commerce

Mobile Commerce has revolutionized the way we engage in commercial transactions, offering convenience and speed in various forms. It is primarily categorized into three essential types:

Mobile Shopping

These are optimized eCommerce platforms that allow users to conveniently shop on mobile devices without having to zoom in. In addition, shopping applications and social media platforms, such as Facebook, Twitter, Pinterest, and Instagram, also use mobile commerce technology for the same purpose.

A notable subtype of mobile shopping is application commerce, which involves transactions conducted within a native mobile app. For eCommerce businesses, it’s crucial to integrate secure payment gateways in these apps, reassuring customers about the safety of their transactions and payments.

Mobile Banking

Tailored for portable devices, mobile banking is essentially internet banking on the go. It enables customers to access their bank accounts and brokerage services, carry out financial transactions, make payments, and trade stocks, primarily through a bank’s secure, specialized app.

Modern mobile banking apps often incorporate SMS, chatbots, and other conversational interfaces for added functionality. These interfaces can send notifications and allow users to monitor account activity. For instance, banking services integrated into messaging platforms like WhatsApp enable customers to check balances, transfer payments, manage loans, and more in real-time.

Mobile Payment

This type replaces traditional payment methods like cash, cheques, and credit/debit cards with mobile device-based transactions. Mobile payments allow consumers to make in-person purchases using their mobile devices.

Digital wallets, such as Apple Pay, facilitate transactions without the need for a card reader or carrying physical cash. QR codes are also commonly used, enabling shoppers to scan and pay for items directly through their mobile devices. Additionally, mobile payment systems allow users to send money directly to someone’s phone number or bank account, further simplifying the process of transferring funds.

Mobile Commerce Development: from Searching to Shopping

Mobile commerce development is associated with the application of the Internet through mobile devices. In 1997, Coca-Cola allowed buyers to pay via SMS at two vending machines in Finland, and it laid the foundation for later applications by other brands.

2007 was the breakthrough of mobile commerce technology when Apple released the first smartphone that did not use the SMS system. Digital payment applications have also developed gradually with many popular names, such as Amazon Pay, Paypal, Apple Pay, Google Pay, Samsung Pay, etc. By 2010, a significant percentage of internet users started using mobile devices for online searches, with a growing trend in online purchases through mobile platforms.

Currently, not only businesses but also banks are increasingly investing in mobile commerce technology to improve their mobile apps. It is estimated that by 2023, the revenue of the mobile payment market will reach $4.574 billion. The integration of advanced technologies such as AI, AR, and VR into mobile devices further enhanced the shopping experience. Retailers started offering personalized shopping experiences, augmented reality-based try-ons, and more.

The journey of mobile commerce from basic searching capabilities to the sophisticated shopping platforms of today highlights the rapid evolution of technology and consumer habits. As we look to the future trends, mCommerce is set to become even more integrated into our daily lives, driven by technological innovations and a deeper understanding of consumer needs. This progression not only represents a technological triumph but also reflects the dynamic nature of the global marketplace.

4 Main Mobile Commerce Technologies

Mobile commerce leverages a range of technologies to facilitate commercial transactions via mobile devices. These technologies are integral to the seamless operation and widespread adoption of mCommerce. Here are 4 main technologies used in mobile commerce:

SMS

SMS, or text messaging, is familiar to everyone. It is the oldest mobile commerce technology, supporting two-way interactive messaging. It is so easy to use that anyone can access it no matter what type of mobile device they are using.

Text messages are capable of transmitting push notifications, which are one-way alerts that can include news, special offers, and other information from content providers to subscribers. This feature has made SMS a valuable tool for businesses to disseminate timely information and promotions to a broad audience.

Beyond simple text, SMS can also carry binary data. This capability enables it to act as a delivery mechanism for various downloads, such as ringtones, operator logos, and even encrypted messages. This versatility has expanded the scope of SMS beyond mere communication to include various facets of digital content distribution.

A significant feature of SMS in the realm of mobile commerce is its support for two-way interactive messaging. For example, bank customers can easily check their account balances by sending a specific command, like BAL, to a designated phone number or shortcode. This interaction represents a convenient and immediate way for consumers to engage with services and access information.

The ubiquity and ease of use of SMS are its main advantages. It’s a universal service, available on virtually all mobile devices and networks, making it accessible to a vast user base irrespective of their specific device or carrier.

However, SMS is not without drawbacks. A notable limitation is the lack of encryption in standard SMS communication, raising concerns about data security. Additionally, SMS services cannot use Personal Identification Numbers (PINs) for authentication in a secure manner. This is because copies of SMS messages, including potentially sensitive ones, are stored in the unsecured Sent folder of a device.

As a result, services requiring secure authentication often need to resort to out-of-band methods, such as requesting the PIN through a separate medium like an Interactive Voice Response (IVR) call.

While Multimedia Messaging Service (MMS), or picture messaging, exists alongside SMS, it is generally not utilized extensively in mobile commerce services. This is partly due to MMS being costlier than SMS and the challenges in controlling how MMS content is displayed across different devices. There are niche uses, such as MMS for barcode delivery, but these remain limited in scope.

USSD

Unstructured Supplementary Service Data (USSD) is an early mobile commerce technology, nearly as old as SMS. It’s available for external services in select markets, including parts of Africa, Central America, Europe, India, and Southeast Asia, where it enjoys considerable popularity.

USSD differs from SMS in that it establishes a real-time connection, enabling session-based communications. This feature makes it akin to the mobile equivalent of Interactive Voice Response (IVR) systems used in customer service but without the voice component.

Like SMS, USSD can transmit push notifications, respond to user queries (like checking the balance of a prepaid mobile account), and facilitate account top-ups.

One of USSD’s key advantages is its wide accessibility, as it can be used on almost any mobile phone and is relatively straightforward to operate. Moreover, it enhances security by allowing the integration of password or mobile PIN protection, a significant feature since messages sent via USSD are not stored on the device.

However, USSD has its limitations. One major challenge is the difficulty in implementing service charges, as carriers typically don’t have a built-in billing mechanism for USSD. Additionally, USSD services may not function reliably when roaming, and the phone needs to be powered on to receive messages.

Unlike SMS, USSD doesn’t have the capability to resend messages if the phone is off, out of range, or in an area with no service, such as an elevator. This limitation makes USSD unsuitable for critical services like fraud alerts.

While USSD can provide maximum reach in markets where it’s available, its deployment depends on carrier support for external services, which restricts its overall availability. Despite these drawbacks, in regions where it’s supported, USSD remains a valuable tool in the mobile commerce toolkit, particularly for basic transactional and informational services.

WAP/Mobile Web

The first mobile commerce technology, WAP (Wireless Application Protocol), played a crucial role in the early stages of mobile web access. WAP 2.0, which became widely available on feature phones around 2004, marked a significant advancement in mobile web technology. It utilized XHTML, a variation of HTML, to deliver a mobile web experience.

With the advent of smartphones, particularly following the launch of the iPhone, most of these devices supported browsers capable of handling HTML, broadening the scope and capabilities of mobile internet access.

WAP 2.0 offered an experience much closer to what users were familiar with on desktops and laptops, although it was not identical. The mobile web experience via WAP differed in various aspects from the traditional web experience due to the limitations and design of mobile devices.

Despite these differences, the user experience on WAP could closely resemble that of basic mobile apps. However, a key limitation was that WAP did not provide access to the full range of features available on a mobile phone, unlike dedicated applications.

Nonetheless, WAP served as a vital backup option for accessing web content on mobile devices, especially for users who did not own smartphones.

STK

STK stands for SIM Toolkit, which is used by appearing in the menus of mobile devices as a permanent application through being stored on the Subscriber Identity Module (SIM) card. This mobile commerce technology uses the SIM to receive requests from the application and then sends the information to give commands to the mobile device.

One of the key advantages of STK is its robust security. By offering identity verification and encryption, STK applications provide a level of security comparable to having a dedicated terminal.

This aspect makes it particularly suitable for financial or mobile commerce operations, especially in settings where customers frequently interact with networks of cash-in/cash-out agents. A notable example of this application is the M-Pesa system in Kenya, as well as in other peer-to-peer marketplaces where subscribers trade commodities like airtime.

However, STK technology does come with its challenges. One significant hurdle is the requirement for carriers to issue new SIM cards to accommodate these applications. Due to this limitation, STK is generally more effective in environments with limited distribution, where the logistical and infrastructural demands of issuing new SIM cards can be feasibly managed.

Despite these challenges, STK played a crucial role in the early stages of mobile commerce, particularly in regions with a high prevalence of feature phones.

Mobile Commerce Technology’s Advantages

Mobile Commerce Technology offers a range of advantages that have significantly transformed the retail and service industries, enhancing both consumer experience and business operations. These advantages include:

Increase Customer Retention

Similar to the purpose of eCommerce in general, mobile commerce technology was born to serve customers and provide them with a better overall experience, thereby increasing customer retention for businesses. Even, customers now no longer need a desktop computer. It is not only convenient but also diverse in product types and competitive in price.

Have good potential for revenue growth

The percentage of mobile commerce in eCommerce sales is increasing day by day and shows no sign of stopping. Retailers are investing more in mobile commerce technology. Obviously, it’s a gold mine that needs to be explored, so why are you still hesitating?

Provide a multi-channel experience

Mobile commerce technology allows businesses to advertise and sell products through multi-channel more easily than any other form. It is great for you to implement strategies to put your product on the website and attract customers to visit it wherever they spend their time.

Diversify payment options

The variety of payment options is also an advantage as it can help the customer’s purchase process go faster. Specifically, about these options, we will explain these more clearly below.

Can be expanded

With mobile commerce technology, all parts of your business can be expanded to suit the growth of each stage of the company. It is also partly thanks to the support of platform providers as a competitive factor to attract businesses looking to invest in this area.

Below the opportunities that mobile commerce technology brings, we should not ignore some of the following mobile commerce threats:

- Optimization’s threat: If you don’t pay attention to changes in technology, practices, design, etc., you will not be able to take advantage of mobile commerce to increase sales but, on the contrary, will fall behind your competitors.

- Competitors’ threat: While you can easily reach customers and competitors to exploit their information through mobile commerce, this also means they can do the same with you.

- Core value threat: When you focus all your resources on developing mobile commerce technology, it may affect your core business activities, such as the traditional in-store shopping experience.

Mobile Commerce Features

From high-performing mobile apps, we’ve researched and compiled some must-have features. You can refer to and apply these mobile commerce features for your application to be more successful.

- Push notifications: Make sure it’s useful and relevant to your customer’s interests, i.e., promotions, new developments, order statuses, etc.

- Location tracking: This feature will make your push notification content more useful and can improve your mobile commerce marketing strategy.

- User profiles: It not only provides benefits to you but also to your customers. Based on it, you can personalize the customer experience, increase sales, and boost customers’ loyalty as well.

- Social media integration: Social media is a huge source of potential customers. Therefore, you should not ignore the integration of popular platforms like Facebook or Instagram into your app.

- Customer loyalty program: This is an effective way for you to take care of your longtime customers. They tend to benefit the business more than new ones by spending more money on each order and are also willing to introduce your brand to those around them.

- Lots of mobile commerce payment methods: As we said, limited payment options can lead to payment delays for some customers for a period of time and even forever.

- Speedy checkout process: The payment process taking place in just a few seconds on mobile devices will bring a surprisingly high conversion rate.

- App analytics: Customers are always changing. As a result, your app will also need to be continuously improved through app analytics to keep up with them and meet their needs.

Mobile Commerce Payment Methods

Mobile Wallets

You’ve probably heard of this concept before. It is a digital version of a regular wallet that anyone uses to store cash and coins. It will be connected to your bank account for you to top up or use in a way that doesn’t require money in your bank account, for example, using cash or a phone card to exchange money in your wallet. When you pay for something, it will deduct money from your mobile wallet. As such, it minimizes the need to use cash or swipe cards for users, so it is very convenient.

Popular mobile wallets are PayPal, Amazon Pay, Apple Pay, Google Pay, and Samsung Pay.

Mobile Transfer

Most banks have developed an application specifically for their members to make it more convenient to transfer money without going to physical transaction points and even to use a desktop computer. What they need is an internet-connected smartphone. In addition to banks, some other payment gateways, such as Paypal or Google, have also soon applied this mobile commerce technology.

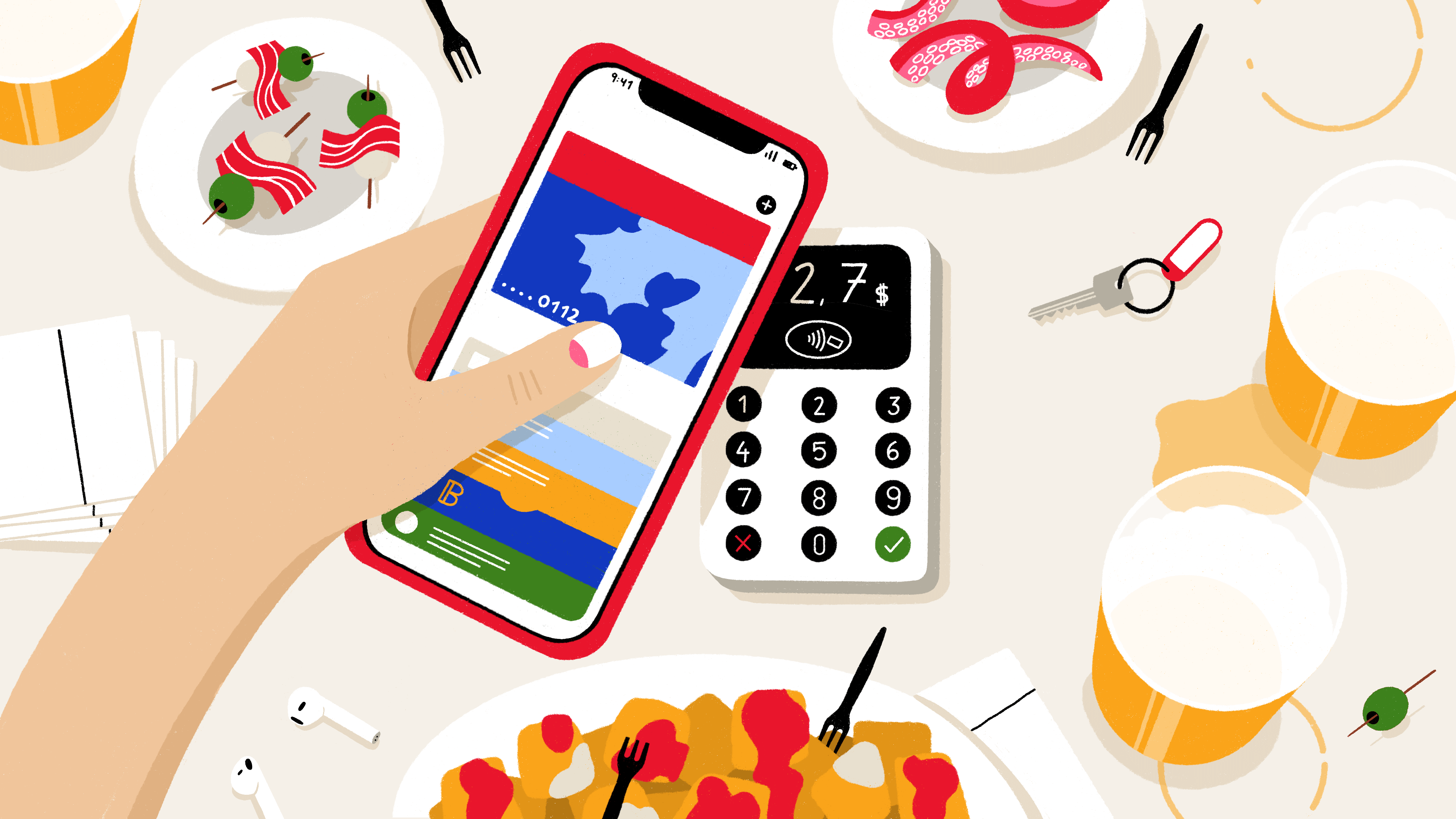

Contactless Mobile Payments

With this form of payment, customers at the store will not need to swipe a card or use cash but simply download and install select mobile wallets. They can then put their smartphone close to a supported terminal at the checkout to validate and transmit payment. Money will be automatically deducted from their wallet.

Closed-loop Mobile Payments

It is similar to mobile wallets, except that it is only used when the customer is transacting at the store or point of sale of a single brand with which it is affiliated. To do this, the customer must register an account and provide his/her information on the dedicated mobile application provided by the brand. Names that use this mobile commerce technology are Walmart, Starbucks, Taco Bell, etc.

Mobile Point-of-sale (POS)

If you need to install a complex and fixed card reader in one place in the traditional card payment method, the mobile POS uses a mobile card reader, which is portable. Not only that, but the purchaser only needs their mobile phone coming with a small attached card reader or contactless card reader.

Final Thoughts

According to technology experts around the world, mobile devices will be used more often thanks to the development of mobile apps. It can be said that mobile commerce technology is a great way for your business to reach customers and increase sales. Now, that you’ve understood the concept and how it works, let’s visit our blog for more guides, tips, and tricks on mobile commerce, or subscribe to our newsletter to receive the latest technology trends and news worldwide, and the knowledge and insights of the eCommerce arena. Thank you!