Shopify Payments is the payment gateway offered by the popular eCommerce platform Shopify since 2013. In this post, we cover everything from what Shopify Payments is and its features to how it compares to other payment gateways in terms of cost and features. We’ll also walk you through the step-by-step process of setting up Shopify Payments, and more.

Table of Contents

What is Shopify Payments?

Shopify Payments is a payment processing solution that allows Shopify merchants to accept payments directly through their online stores. It’s an all-in-one solution that eliminates the need for third-party payment gateways, streamlining the payment process for merchants and customers alike.

Shopify Payments is available in select countries, and it supports multiple currencies and payment methods such as credit and debit cards, Apple Pay, and Google Pay. The platform is secure and compliant with Payment Card Industry Data Security Standards (PCI DSS), ensuring that all transactions are protected against fraud and other security risks.

When a customer makes a purchase on a Shopify store that uses Shopify Payments, the funds from the sale are deposited directly into the merchant’s bank account, minus any transaction fees. Shopify Payments also provides merchants with detailed transaction reports and analytics, making it easy to track sales and monitor business performance.

Shopify Payments Supported Country

Shopify Payments is only available to stores in certain countries. Here is a list of the countries that are currently supported for Shopify Payments, which includes 23 countries: Australia, Austria, Belgium, Canada, Czechia, Denmark, Finland, France, Germany, Hong Kong SAR, Ireland, Italy, Japan, Netherlands, New Zealand, Portugal, Romania, Singapore, Spain, Sweden, Switzerland, United Kingdom, and the United States.

If you’re a store owner in one of these countries, you can use Shopify Payments to accept payments from customers using credit cards, debit cards, and other popular payment methods. However, it’s important to note that Shopify Payments has certain requirements and restrictions that vary depending on the country you’re operating in. Therefore, it’s important to review the requirements and regulations for your specific country before setting up Shopify Payments.

Shopify Payments Review: Fees and Pricing

To use Shopify Payments, you have to have a Shopify store that subscribes to one of the Shopify plans. Shopify currently offers five pricing plans to suit different business needs and budgets. The plans range from the Starter plan, which has a monthly fee of $5 and a credit card transaction rate of 5% plus 30¢ per transaction; to the Shopify Plus enterprise plan, which has a monthly fee of $2,000 and a credit card transaction rate of 2.15% for every transaction. With a range of plans to choose from, businesses can select a plan that fits their budget and payment processing needs.

Here, we have summarized it into a table for you to follow easily:

| Shopify Plan | Monthly Fee | Online Credit Card Transaction Rates |

| Starter | $5 | 5% + 30¢ per transaction |

| Basic | $29 | 2.9% + 30¢ per transaction |

| Standard | $79 | 2.6% + 30¢ per transaction |

| Advanced | $299 | 2.4% + 30¢ per transaction |

| Shopify Plus | $2000 | 2.15% per transaction |

As you can see, Shopify fees involve two main charges: the processing fee for credit card payments and the transaction fee. The processing fee is paid to Shopify Payments for handling the different steps in a payment transaction, and it depends on the Shopify plan, the order value, and the number of sales. The transaction fee, on the other hand, is paid to Shopify for monetary transactions on the store and is not required once Shopify Payments is activated. These fees can vary depending on the plan and the sales volume, so it’s important to choose the right plan based on your business needs and budget.

In addition to the processing and transaction fees, Shopify also charges a currency conversion fee for international transactions, with a rate of 2% for stores outside the US and 1.5% for US stores. Chargebacks can also result in fees, with the standard chargeback fee in the US being $15 per dispute. However, if you win a chargeback dispute, the fee is refunded. Finally, when refunds are issued, Shopify doesn’t charge any fees, but credit card transaction fees are not refunded. It’s important for businesses to factor in these additional fees when considering using Shopify for their payment processing needs.

Shopify Payments Review: Features of Shopify Payments

Shopify Payments offers a range of features that can benefit businesses of all sizes, from small startups to large enterprises. These features can benefit businesses in terms of increasing sales, streamlining payment processes, and improving the overall customer experience.

Multiple payment methods

One of the most crucial factors in running a successful online business is providing customers with a seamless and convenient checkout experience. One way to achieve this is by accepting multiple payment methods. First and foremost, the ability to accept multiple payment methods provides customers with flexibility, resulting in increased customer satisfaction and potentially more sales. With Shopify’s easy payment integrations and options, businesses can offer a range of payment methods, including credit cards, PayPal, Apple Pay, and more, to cater to their customers’ payment preferences.

Moreover, Shopify supports newer payment options like Apple Pay, Google Pay, and Amazon Pay, which allow customers to complete their transactions quickly and easily, without having to enter their payment information manually. This feature not only increases customer convenience but also provides a secure checkout experience for customers. Shopify ensures that its secure checkout protects customers’ sensitive information, giving them the confidence to make purchases on your website.

Lastly, Shopify Payments supports a wide range of payment methods, including credit cards, debit cards, Apple Pay, Google Pay, and more. This enables merchants to cater to the payment preferences of their customers and increase sales. This feature is particularly beneficial for businesses with a global customer base, as it allows them to accept payments in various currencies and payment methods, giving customers more flexibility and convenience.

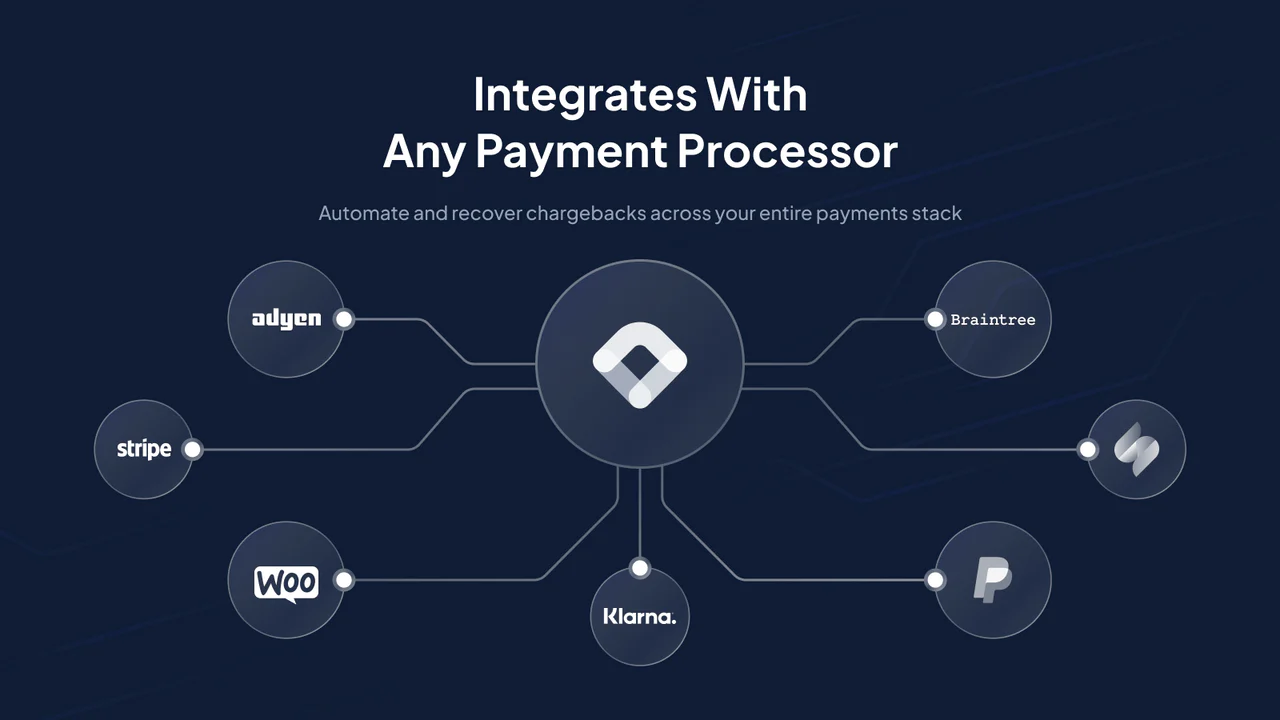

Chargeback protection

Chargebacks are a significant concern for businesses, especially for those who accept online payments. Chargebacks occur when a customer disputes a transaction, and the funds are withdrawn from the merchant’s account. This can be incredibly damaging to a business, as it not only results in the loss of funds but also in chargeback fees and potential damage to the business’s reputation.

To combat this issue, Shopify Payments offers chargeback protection to its merchants. With this feature, Shopify monitors transactions for fraud and disputes, and they provide assistance to merchants in resolving any chargeback issues that arise. This can be extremely beneficial for businesses as it helps them to save time and resources by preventing and managing chargebacks.

Furthermore, chargeback protection can help businesses maintain customer satisfaction by ensuring that disputes are resolved quickly and efficiently. This can lead to increased customer loyalty and trust, which can ultimately result in more sales and revenue for the business.

In addition, chargeback protection can also help businesses avoid potential penalties from credit card companies and banks. In some cases, excessive chargebacks can result in the suspension or termination of a merchant’s account, which can be devastating for a business. By using Shopify Payments’ chargeback protection, businesses can mitigate the risk of account suspension and ensure that they are in compliance with the relevant regulations.

Fraud prevention

One of the most significant concerns for any business accepting payments online is fraud. Shopify Payments offers several features and tools to help businesses prevent and manage fraudulent transactions. These measures include automated fraud analysis, chargeback protection, and 3D Secure technology.

The automated fraud analysis feature uses machine learning algorithms to scan transactions and identify potential cases of fraud. The system analyses various data points, such as the customer’s location, IP address, and purchase history, to determine the likelihood of fraud. If a transaction is flagged as suspicious, the business is notified, and the payment is placed on hold until the issue is resolved. This feature can help businesses identify and prevent fraudulent transactions before they occur, reducing the risk of chargebacks and losses.

Finally, Shopify Payments’ use of 3D Secure technology adds another layer of security to transactions. 3D Secure is a fraud prevention tool that requires customers to enter an additional password or authentication code when making a purchase. This authentication process helps to ensure that the customer is a legitimate cardholder and not a fraudster using stolen credit card information.

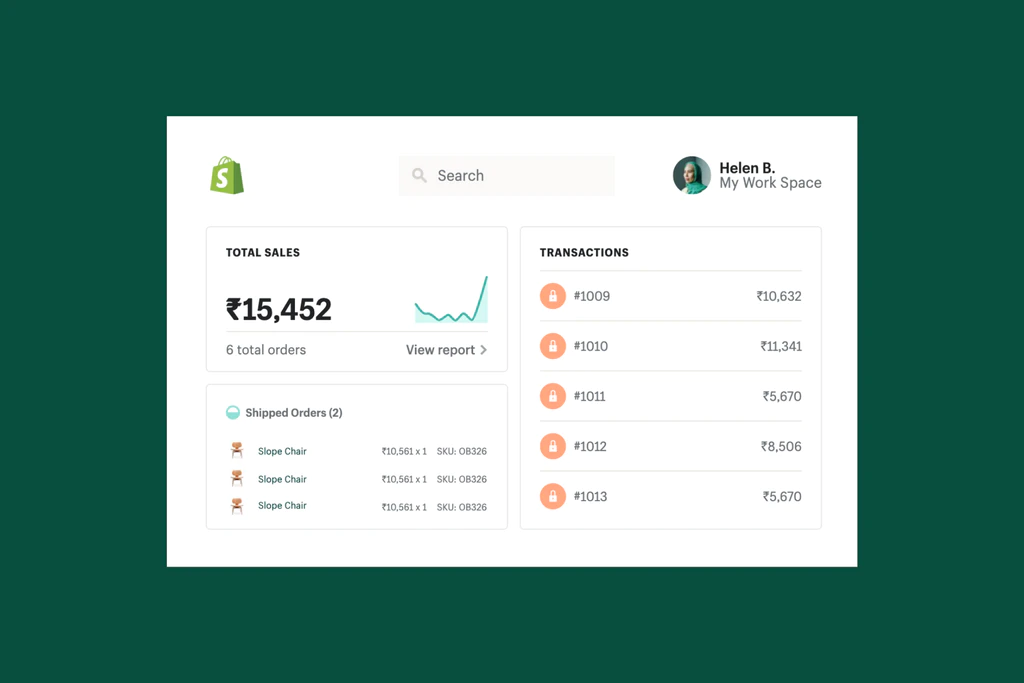

Analytics

Shopify Payments offers businesses the ability to view and manage payment transactions from a single dashboard. This dashboard includes a variety of analytics and reporting tools that allow merchants to easily track their payment activity and identify areas for improvement. Merchants can view detailed reports on their payment transactions, including the number of orders, total revenue, and average order value. They can also track payment disputes, chargebacks, and refunds, enabling them to quickly and easily manage these transactions and resolve any issues that arise.

The analytics and reporting tools provided by Shopify Payments can also help businesses to make more informed decisions about their payment processing strategies. For example, merchants can use these tools to track the performance of different payment methods and determine which ones are most effective at driving sales. They can also use these tools to identify patterns in customer behavior, such as the times of day when customers are most likely to make purchases or the types of products that are most popular.

By using the analytics and reporting tools offered by Shopify Payments, businesses can gain a deeper understanding of their payment activity and make more informed decisions about their payment processing strategies. This can ultimately help them to increase sales, reduce fraud and chargebacks, and improve overall customer satisfaction.

Shopify Payments Review: Compare to other payment gateways to see how it stacks up in terms of cost

Shopify Payments, PayPal, Stripe, Authorize.net, and Elavon are popular payment methods available to Shopify store owners. Shopify Payments is an all-in-one payment processing solution with every feature a merchant needs to manage and process payments efficiently without involving any third-party solution. It offers a free card reader for physical payments and charges lower credit card transaction fees when store owners upgrade their Shopify subscription plan. On the downside, it is available in a restricted number of countries and may withhold funds temporarily.

PayPal

When comparing Shopify Payments to PayPal, one of the key advantages of Shopify Payments is that it doesn’t charge any additional transaction fees. This means that Shopify store owners can save money on fees, which is especially beneficial for smaller businesses. Additionally, Shopify Payments offers real-time monitoring, a quick checkout process, and high-security features.

On the other hand, PayPal is a well-known and trusted payment provider, with over 220 million customers worldwide. It offers both paid and free plans for Shopify store owners and has a predictable flat-rate pricing structure. PayPal also supports a wide range of currencies, making it ideal for international businesses.

However, the fact that PayPal does charge a fee for every payment transaction is surely a disadvantage. Additionally, its customer service can be inconsistent, and there is always a risk of PayPal unexpectedly closing your account.

Stripe

When compared to Stripe, Shopify Payments offers several advantages. First and foremost, Shopify Payments is available in more countries than Stripe. While Stripe is only available in about 39 countries, Shopify Payments is available in 23 countries, including the UK, Australia, New Zealand, and Sweden.

Another advantage of Shopify Payments over Stripe is that it doesn’t charge any setup or cancellation fees. Stripe, on the other hand, charges a $10 monthly fee if you’re using its recurring billing feature. Additionally, Shopify Payments offers a free card reader for physical payments, whereas Stripe charges for its card reader.

Finally, Shopify Payments’ transaction fees are slightly lower than Stripe’s. While Stripe charges a flat rate of 2.9% + $0.30 per transaction, Shopify Payments’ transaction fees are slightly lower for Shopify merchants who upgrade their subscription plan.

That being said, Stripe does offer a few advantages over Shopify Payments, such as support for more payment options and a highly customizable checkout flow. However, if you’re a Shopify merchant looking for a payment gateway that is easy to use, offers lower transaction fees, and is available in more countries, Shopify Payments may be the better option.

Authorize.net

Authorize.net is a payment gateway that has been around for a long time and has a well-established reputation. While it offers many features, Shopify Payments stands out for its ease of use, competitive pricing, and the fact that it is fully integrated into the Shopify platform.

One major advantage of Shopify Payments over Authorize.net is that Shopify Payments does not require any additional transaction fees, while Authorize.net charges a monthly gateway fee in addition to per-transaction fees. This means that Shopify Payments can be a more cost-effective option for merchants who are just starting out or who process a lower volume of transactions.

Shopify Payments also offers real-time monitoring, ensuring that merchants can keep track of their transactions and sales as they happen. Additionally, Shopify Payments has a simple and straightforward interface that makes it easy for merchants to use, even if they have limited technical experience.

Elavon

Shopify Payments and Elavon (formerly Sage Pay and Opayo) are both payment gateways that allow businesses to accept payments online. But when considering the cost, Shopify Payments charges a flat transaction fee for all plans, while Elavon’s fees vary based on the plan you choose. However, Shopify Payments does not support all currencies and is only available in certain countries. Elavon, on the other hand, supports a wider range of currencies and is available in more countries.

Shopify Payments is built directly into the Shopify platform, making it easy to set up and use for Shopify store owners. Elavon also has integrations with many popular eCommerce platforms, but it may require additional setup and integration time. More than that, Shopify Payments has a simple and user-friendly interface that is easy to navigate. Elavon may require more technical knowledge and experience to set up and use. Additionally, Shopify Payments offers features such as chargeback protection and fraud prevention, while Elavon provides additional security features such as 3D Secure and AVS/CV2 checks. Shopify Payments also offers a free card reader for physical payments, while Elavon does not.

Shopify Payments Review: How to set up

Step-by-step details for setting up Shopify Payments

Choose your store currency

Before starting the setup process for Shopify Payments, you’ll first need to decide on a store currency. To choose a currency, go to Settings in your admin, then under Store Currency, choose the currency for your store. Your store currency can be different from the currency your bank account is in.

Activate Shopify Payments

Once you’ve picked a currency, you’re ready to activate Shopify Payments. If you haven’t already set up a payment provider, you can do so by clicking the onboarding card on the home screen, and then clicking Set Up Shopify Payments. This will take you to the Payment section of your settings, where you’ll be able to click Complete Account Setup for Shopify Payments.

Provide your personal and business information

You’ll be prompted to enter your personal and business information, including your business registration number, banking information, and tax ID. If you’re a corporation or LLC, you will still need to provide the name and date of birth of someone associated with the business.

Submit required documentation

Shopify may ask you to submit additional documentation to verify your identity, home address, and proof of entity documents. Because of the sensitive nature of personal information, the requested documents can only be submitted through your Shopify admin, not through their live chat support team or email.

Wait for review

Reviews of your Shopify Payments account can take up to 3 business days to complete. Once your account is fully verified, you can start accepting payments through Shopify Payments.

Set up two-step authentication

Before using Shopify Payments, you must secure your account by setting up two-step authentication. This is a requirement to protect your account and financial information from potential criminal attacks.

Review requirements

Before using Shopify Payments, make sure to review the requirements for your region, which may include additional information needed to set up Shopify Payments.

After setting up Shopify Payments, your customers can make payments on your store using both credit and debit cards that have a CVV number. Shopify Payments allows customers to check out on your store using popular credit card options. Customers only need to enter their address and shipping method, then enter their credit card details on the payment screen. If they have Apple or Google Pay enabled, they can also use those options to pay on the cart page. After placing the order, it will show up in your order section and the customer will receive a notification.

To guide you through the process of configuring Shopify Payments, we’ve put together a helpful video tutorial. Whether you’re just starting or looking to optimize your current setup, this video serves as a comprehensive guide to configuring Shopify Payments seamlessly.

Configuring Shopify Payments to suit your preferences

Turn on the payout notifications feature

- Go to your account settings by clicking on your profile icon in the top right corner of the screen.

- From the dropdown menu, select Settings.

- In the left-hand menu, click on Payments.

- Under the Payments section, click on Manage.

- Scroll down to the Payout Schedule section.

- To turn on payout notifications, check the Enable notifications box.

- To turn off payout notifications, uncheck the Enable notifications box.

By enabling this feature, you will receive notifications whenever a payout is processed to your account. This can be helpful if you want to keep track of your payments and ensure that you are receiving your funds in a timely manner.

Change your payout statement descriptor to reflect how your payouts appear on your bank statement

If you are a business owner or freelancer who receives payments online, it’s important to have a clear and recognizable payout statement descriptor that reflects your brand or business name. The payout statement descriptor is the name that appears on your customers’ bank statements when they make a payment to you.

To update your payout statement descriptor, you can follow these steps:

- Log in to your account and navigate to the Settings menu.

- Click on Payments and then select Manage from the dropdown menu.

- Click on Payout statement descriptor.

- Edit the descriptor to reflect your brand or business name. Keep in mind that the descriptor must be between 5 and 22 Latin character letters only.

- Click Save to apply the changes.

It’s important to note that it may take up to three days for your updated payout statement descriptor to be reflected in your bank account. This is because the descriptor needs to be processed by your payment processor and your customers’ banks.

Having a clear and recognizable payout statement descriptor can help your customers easily identify their transactions and reduce the risk of chargebacks or disputes. It can also help to build trust and credibility with your customers and improve the overall customer experience. So, take the time to choose a descriptor that accurately reflects your brand or business and update it as needed to ensure your customers can easily identify their transactions.

Configure the fraud prevention settings

Fraud prevention is a critical aspect of any business that accepts payments, and it’s important to take the necessary steps to protect both your business and your customers. One way to do this is by configuring the fraud prevention settings in your payment system.

To configure your fraud prevention settings, start by going to the Payments section of your account settings. From there, select the Manage option and then click on Fraud Prevention. This will take you to a page where you can choose to activate various fraud prevention tools, including the Address Verification System (AVS) and Card Verification Value (CVV).

When you activate the AVS tool, it checks the billing address entered by the customer during checkout against the address on file with the credit card issuer. If the addresses do not match, the charge will be declined. This helps to prevent fraudulent purchases made with stolen credit card information.

Similarly, the CVV tool checks the three or four-digit code on the back of the customer’s credit card to ensure that it matches the card number and expiration date. If the CVV code is incorrect or missing, the charge will be declined.

By enabling both AVS and CVV, you can significantly reduce the risk of fraudulent transactions on your website. It’s important to note that while these tools can help prevent fraud, they are not foolproof, and some fraudulent charges may still slip through the cracks.

In addition to AVS and CVV, there may be other fraud prevention tools available, depending on your payment provider. Be sure to explore all of your options and choose the ones that best fit your business needs. And always remember to regularly review your transactions for any suspicious activity.

If configuring Shopify Payment is hard for you, let’s streamline your eCommerce success with our expert Shopify development service. We ensure your Shopify Payments configuration is tailored precisely to your business’s unique needs for seamless transactions and optimized financial flow.

Update your bank account information

If you need to update your bank account information to receive payouts, it’s a straightforward process. You can easily update your bank account information by following a few simple steps.

- Log in to your account and go to the Settings menu.

- Click on Payments and then select Manage.

- Under Payout account, click on Change bank account.

- Enter your new bank account information, including the routing number, account number, and account type.

- Double-check the information you entered to make sure it is accurate.

- Click Save to update your bank account information.

After you update your bank account information, make sure to double-check that the changes have been saved correctly. You may also need to verify your new bank account before you can start receiving payouts to the updated account.

It’s always a good idea to keep your bank account information up to date to avoid any delays or issues with receiving your payouts. You may also want to check with your bank to see if they have any specific requirements or restrictions for receiving electronic payments. With the updated information in place, you can rest assured that your payouts will continue to be deposited in a timely and secure manner.

Edit your customer billing statement to reflect your brand

Customizing your customer billing statement to reflect your store’s branding can help increase brand awareness and trust with your customers. Here are step-by-step instructions on how to edit your customer billing statement:

- Log in to your account and click on Settings from the main menu.

- In the Settings menu, find the Payments section and click on it.

- Within the Payments section, click on the Manage tab.

- Scroll down to the Customer billing statement section, and you will see two fields for the store’s name and phone number. Enter the correct details that you want to appear on the customer’s billing statement.

- After entering the updated store name and phone number, click the Save button to apply the changes.

Outro

With its multiple payment methods, chargeback protection, and fraud prevention, Shopify Payments provides a secure and reliable way for customers to purchase from your store. By following our step-by-step guide, you can easily activate and configure Shopify Payments to suit your preferences.

If you wish for more assistance with Shopify payments, contact our Shopify expert team for the best advice and support. With years of experience with website development services, we can tailor to your business needs.