The choice between Shopify and Stripe is not merely a technical decision but a strategic one that can significantly impact the ease of operations, customer experience, and ultimately, the success of an online business. In the subsequent sections, we will delve into the features, user experience, security measures, pricing structures, and customer support services of Shopify and Stripe. By providing a detailed overview of these critical aspects, this blog post will guide business owners and entrepreneurs in selecting the right payment platform that not only meets their current business requirements but also supports their growth over time.

Detailed Comparison: Shopify vs Stripe

While Shopify offers a comprehensive eCommerce platform ideal for building and managing an online store, Stripe focuses primarily on facilitating powerful payment processing solutions. We aim to help you understand which service might best meet the specific needs of your business, and this comparison will provide clear insights to assist you in making an informed decision tailored to your business strategy.

Core Features and Offerings

Exploring the core features and offerings of eCommerce and payment platforms is crucial for understanding how they can support and enhance your business operations. In this section, we delve into the detailed capabilities of Shopify and Stripe, highlighting their distinct functionalities and services. By examining each platform’s robust offerings, we aim to equip you with the insights needed to determine which platform best suits your business requirements and growth ambitions.

Shopify Payment

Shopify is a comprehensive eCommerce solution designed to support businesses of all sizes—from small startups to large enterprises—in creating and managing their online stores. As a cloud-based platform, it offers a wide range of features that allow users to customize their storefronts, manage inventory, process payments, and handle logistics, all from one central dashboard. This unified approach makes it particularly appealing for entrepreneurs looking for a streamlined way to enter the online market.

eCommerce Platform Capabilities

Shopify’s eCommerce platform provides a robust set of tools that enable merchants to build and customize their online stores. These tools include a user-friendly website builder with customizable templates, an intuitive content management system (CMS), and integrated blogging capabilities. Merchants can manage products and collections, set up customer accounts, and use SEO features to help enhance their visibility online. Additionally, Shopify supports multi-channel selling, allowing users to integrate their online store with various marketplaces and social media platforms, increasing their reach and sales potential.

Built-in Payment Gateway

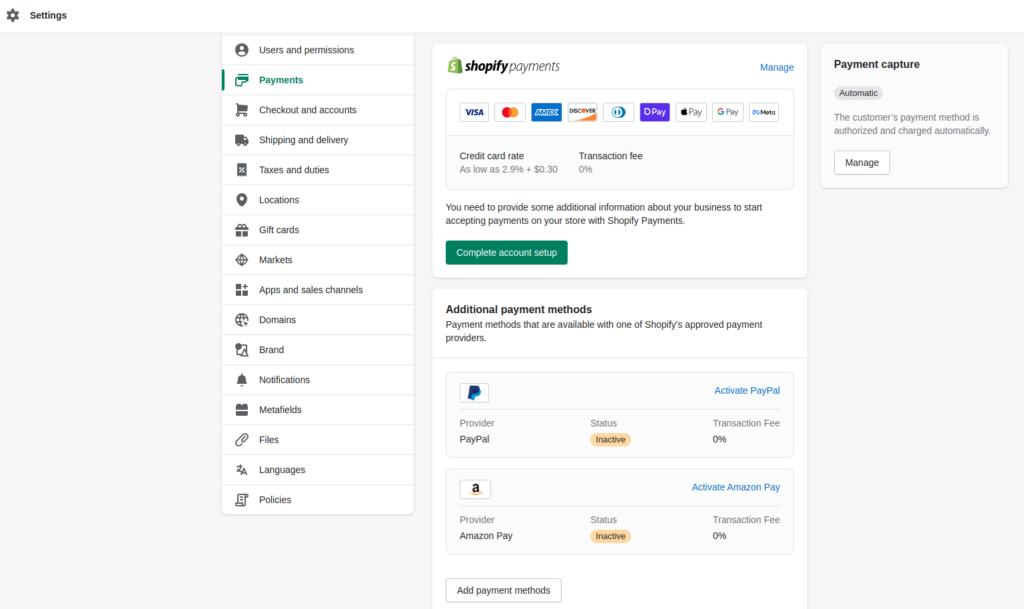

One of the core components of Shopify’s offerings is Shopify Payments, its built-in payment gateway. This feature allows merchants to accept payments directly through Shopify, simplifying the setup process and reducing the need for third-party payment gateways. Notably, Shopify Payments is powered by Stripe technology, which means it relies on Stripe’s infrastructure to process transactions. This collaboration brings Stripe’s robust payment processing capabilities directly into the Shopify ecosystem, offering users a seamless and secure way to handle sales.

Shopify Payments integrates deeply with the Shopify platform, providing a cohesive experience for both merchants and customers. It supports multiple payment methods, including credit cards, Google Pay, and Apple Pay, making it versatile for global commerce. Additionally, Shopify Payments simplifies the reconciliation process by linking sales directly with Shopify’s backend, offering merchants an integrated view of their finances.

Additional Services

Beyond its core eCommerce and payment capabilities, Shopify offers a range of additional services designed to support the broader needs of an online business. These include:

- Marketing Tools: Shopify provides a suite of marketing tools that help businesses attract customers and drive sales. These tools include email marketing integrations, the ability to create discount codes and gift cards, and advanced analytics to track the effectiveness of marketing campaigns. Shopify also offers built-in SEO features, which help improve the visibility of online stores in search engine results.

- Shopify POS: For businesses that operate both online and offline, Shopify offers a point-of-sale (POS) system that integrates with the online store. Shopify POS enables merchants to manage their sales, inventory, and customer data across both physical and digital channels from a single platform. This integration ensures a seamless customer experience, whether the sale occurs online or in a brick-and-mortar store.

The combination of these features makes Shopify a powerful and versatile platform for managing an online business. When comparing Shopify vs Stripe, it’s essential to note that while both platforms offer payment solutions, Shopify’s suite of additional services encompasses a wider range of business needs, making it a comprehensive solution for eCommerce.

Stripe

Stripe is a global technology company that builds economic infrastructure for the Internet. Established to simplify online payments for developers and businesses, Stripe has evolved into a comprehensive suite of financial products that power businesses of all sizes. Notably different from Shopify, which is primarily an eCommerce platform, Stripe focuses extensively on integrating financial services into any online business model.

Payment Processing Capabilities Across Various Platforms

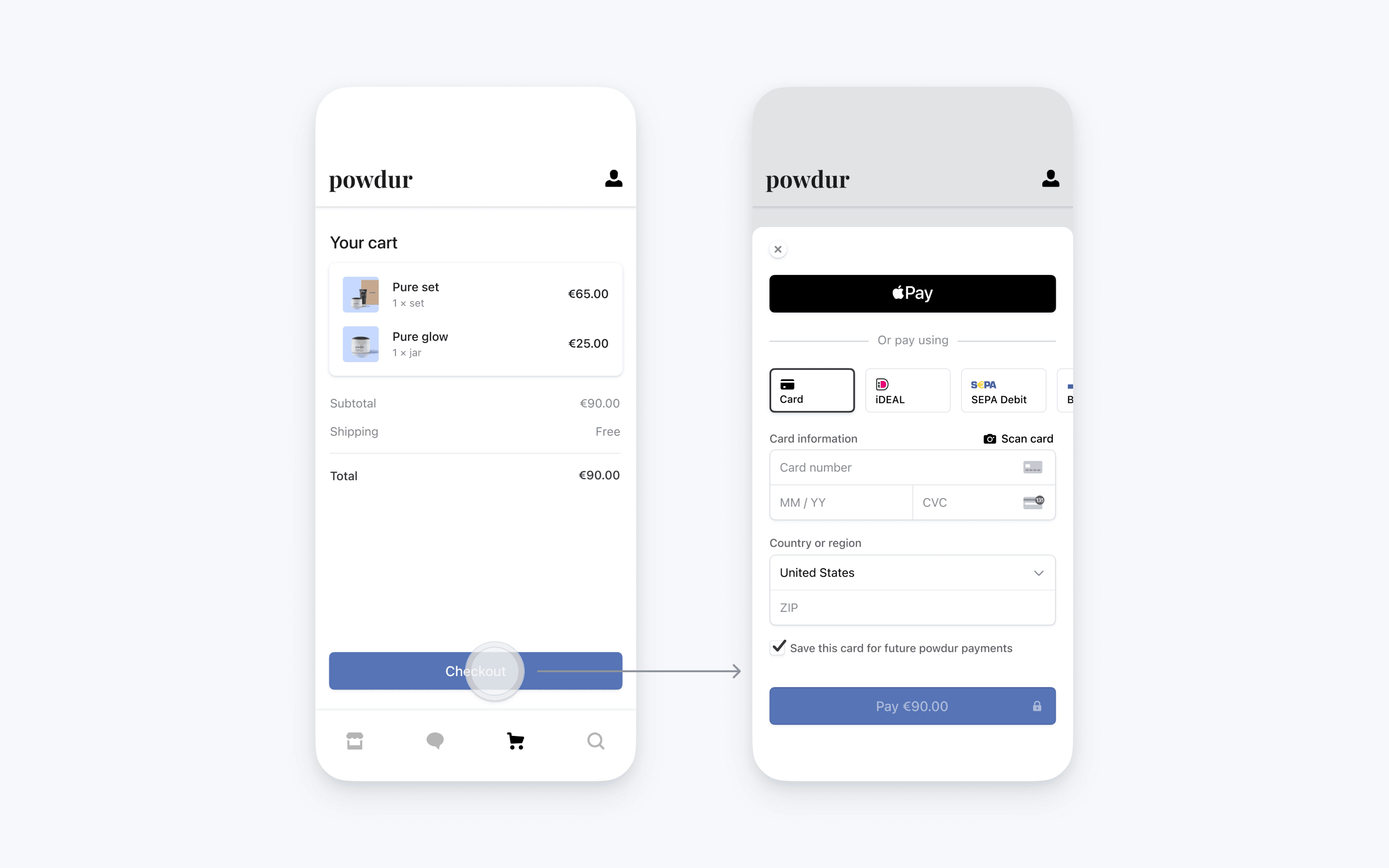

Stripe’s foundational service is its payment processing capabilities, which are designed to be highly adaptable and functional across various platforms—from small personal projects to large-scale enterprises. It supports a vast array of payment methods including credit cards, bank transfers (ACH), and more modern solutions like Apple Pay and Google Pay. This versatility is crucial for businesses looking to expand globally, as it accommodates the varied payment preferences of a worldwide audience.

Stripe’s API (Application Programming Interface) is particularly noted for its flexibility, allowing businesses to integrate Stripe’s payment processing into their websites or mobile apps seamlessly. This API-first approach means that Stripe can be embedded into platforms without disrupting the user experience, making it ideal for businesses that operate across multiple digital fronts. Whether it’s a mobile app, a subscription-based service, or an on-demand marketplace, Stripe provides the backbone needed to accept payments effectively and securely.

Customization and Developer Tools

One of the standout features of Stripe compared to Shopify Payments is its robust set of developer tools that allow for extensive customization. Stripe’s APIs and developer tools are designed to be both powerful and user-friendly, providing businesses with the ability to tailor their payment experiences precisely. Developers can create custom checkout experiences, automate payments for subscriptions, and integrate advanced features like machine learning models for fraud detection.

Furthermore, Stripe offers extensive documentation and SDKs (Software Development Kits) that cover a wide range of programming languages, making it accessible to a global developer community. This inclusivity ensures that regardless of the technical stack or the size of the business, integrating Stripe is straightforward and enhances the capabilities of the business’s digital infrastructure.

Additional Financial Services

Beyond its core payment processing capabilities, Stripe offers additional financial services that help businesses manage and scale their operations. Two significant services are Stripe Atlas and Stripe Capital:

- Stripe Atlas: This service is designed to help startups get off the ground quickly and efficiently. Stripe Atlas helps businesses incorporated in the United States, open a U.S. bank account, and provides guidance on legal and tax issues. This is particularly advantageous for international entrepreneurs who wish to tap into the U.S. market but face logistical and bureaucratic hurdles.

- Stripe Capital: To support growing businesses, Stripe Capital provides access to financing. This service offers loans to businesses based on their history with Stripe, making it easier for them to get funding without the lengthy approval processes typical of traditional banks. This can be especially beneficial for eCommerce businesses looking to expand inventory, invest in marketing, or manage cash flow during growth phases.

When comparing Shopify vs Stripe in terms of their offerings, it’s clear that Stripe positions itself as more than just a payment processor. It acts as a partner in growth for businesses, providing a suite of tools and services that support various aspects of financial operations and business development. This makes Stripe a compelling choice for businesses looking for a robust, scalable financial infrastructure tailored to their specific needs, beyond just handling online transactions.

Comparative Analysis

In the comparison of Shopify Payments versus Stripe, it becomes evident that each platform serves distinct yet overlapping functions with tailored features suited for different business needs. Shopify Payments is deeply integrated into the Shopify ecosystem, designed to offer a seamless experience for users who run their online stores on this platform. This integration simplifies transaction processing by eliminating the need for third-party gateways and unifies backend operations such as inventory and customer management. Additionally, Shopify Payments supports multi-channel selling and includes marketing and SEO tools that integrate directly with the store’s operations, along with a Shopify POS system for brick-and-mortar sales, making it ideal for merchants who appreciate a centralized platform for both online and offline sales activities.

On the other hand, Stripe stands out with its flexibility and robust customization capabilities, primarily through its powerful API that caters to a broad spectrum of businesses from different sectors. Stripe supports a wide array of payment methods and is designed to be integrated into any website or application, regardless of the underlying platform. This makes it exceptionally versatile for businesses targeting an international market or those that require specific payment workflows. Beyond mere payment processing, Stripe also offers substantial additional financial services like Stripe Atlas for business incorporation and Stripe Capital for accessing financing, which are invaluable for startups and growing businesses looking for more than just a payment processor.

Overall, the choice between Shopify Payments and Stripe will hinge on the specific needs of the business. If a merchant seeks a straightforward, tightly integrated solution within their Shopify environment, Shopify Payments is the go-to option. Conversely, for businesses in need of extensive payment options, high levels of customization, and additional financial tools that extend beyond basic transaction processing, Stripe offers a compelling package. Each platform’s offerings are designed to enhance business operations but cater to different aspects of the commercial spectrum.

User Experience and Interface

Navigating the user experience and interface of payment gateways can significantly impact a merchant’s ability to manage transactions efficiently and affect overall customer satisfaction. In this section, we compare Shopify Payments and Stripe, focusing on their user interfaces and the overall user experience they provide.

Shopify

When considering the user experience and interface of Shopify Payments, several core aspects stand out, particularly when comparing Shopify vs Stripe. Shopify Payments is not just an add-on but an integral part of the Shopify ecosystem, designed to enhance the merchant’s ability to manage payments as seamlessly as managing their eCommerce store.

Ease of Setup and Use

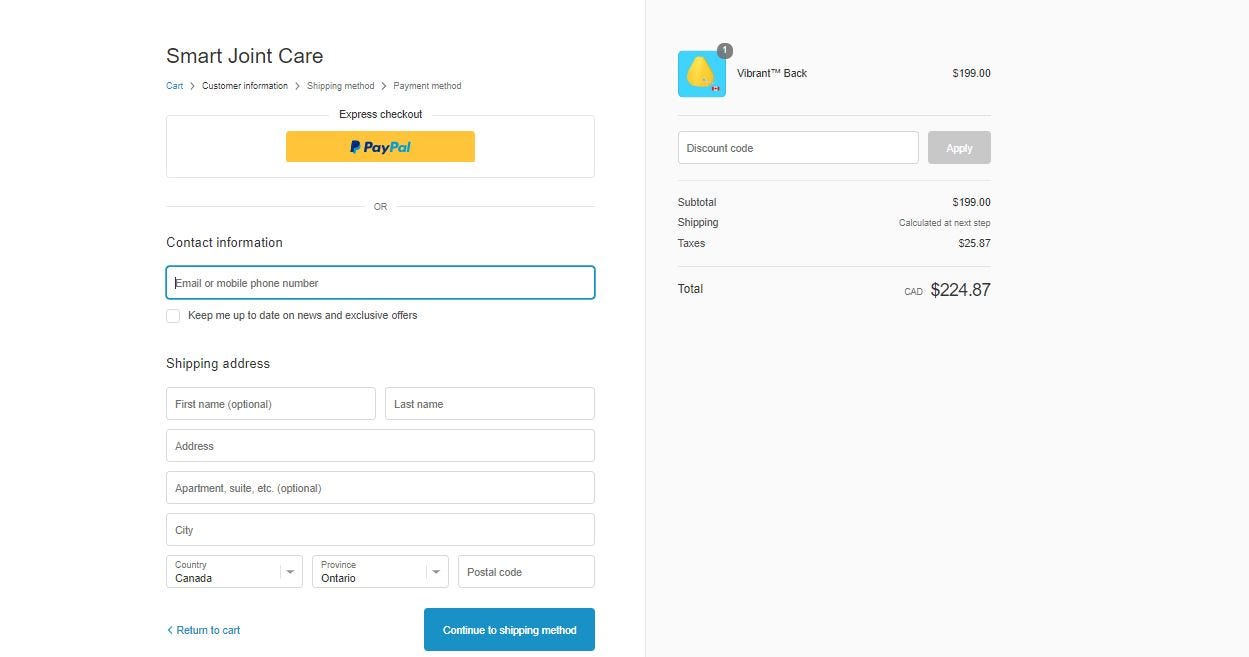

Setting up Shopify Payments is remarkably straightforward, particularly for existing Shopify users. Since it is a built-in feature of the Shopify platform, merchants can activate Shopify Payments directly from their Shopify admin panel without the need to deal with third-party services or complex integrations. This integration simplifies the initial setup process, allowing store owners to manage their payments directly through Shopify, thereby reducing the hurdles typically associated with online payment processing.

Shopify Payments eliminates the need for a separate merchant account, which is often a significant barrier for new store owners. Users can start accepting payments almost immediately after completing a few quick steps to configure their account settings. This process includes entering basic business details and banking information to ensure that payments are securely processed and deposited.

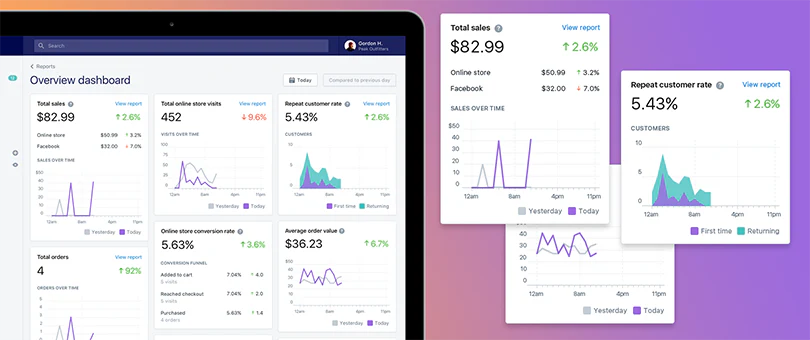

Dashboard and Management Tools

The Shopify Payments dashboard is designed to be intuitive and user-friendly, offering a comprehensive overview of all transaction activities. This dashboard allows users to monitor their sales, refunds, and chargebacks in real-time, providing them with actionable insights into their business’s financial performance. The integration with Shopify’s admin panel means that users have a unified interface to manage both their storefront and financial data, enhancing the efficiency of operations.

The dashboard also provides detailed reports and analytics that help merchants understand their sales trends, track payment methods, and assess customer buying behaviors. These insights are crucial for making informed business decisions and strategizing future sales and marketing efforts. Moreover, the interface allows for easy navigation between different areas of account management, including payment settings and payout schedules, all accessible from one central location.

Mobile Usability

In today’s mobile-driven world, the ability to manage an online business on the go is essential. Shopify Payments caters to this need with a mobile-friendly interface that is accessible through the Shopify app. This app not only allows merchants to manage their store from anywhere but also includes full capabilities to handle payments, monitor transactions, and respond to customer inquiries from their mobile devices.

The Shopify app ensures that users receive notifications on their transactions, giving them up-to-date information on their sales and customer activities. This mobile support is a critical aspect of Shopify Payments, as it empowers merchants to stay connected and responsive to their business needs without being tied to a desktop.

Customer Support and Resources

Shopify Payments benefits from Shopify’s overall approach to customer support. Users have access to a comprehensive range of support options including 24/7 live chat, email support, and phone services. This ensures that any issues related to payment processing can be quickly resolved, minimizing downtime and potential sales loss.

In addition to direct support, Shopify offers an extensive knowledge base that includes guides, tutorials, and FAQs specifically tailored to help users understand the nuances of payment processing. For deeper issues or more strategic financial management, Shopify also provides access to a community forum and various professional services. These resources are invaluable for new merchants who may be unfamiliar with eCommerce or for seasoned users looking to optimize their payment processes.

Stripe

Stripe is widely recognized for its robust API and comprehensive suite of developer tools, which are central to its user experience. This section will delve into various facets of Stripe’s user interface and user experience, such as integration complexity, dashboard usability, API and developer tools, and customer support and resources, providing insights into how it compares with Shopify Payments.

Integration Complexity

Unlike Shopify Payments, which is seamlessly integrated into the Shopify platform, Stripe is designed to be platform-agnostic, offering flexible integration options that can cater to any online platform or application. This flexibility comes with an increased level of complexity in terms of integration, particularly for users who may not have extensive technical skills.

Stripe’s API is incredibly powerful and is a standout feature of the platform, but utilizing it to its full potential typically requires a good understanding of programming. For businesses with development resources, Stripe’s integration allows for a highly customized payment experience that can be tailored to specific needs and workflows. For those without technical expertise, Stripe offers pre-built integrations and partnerships with many eCommerce platforms and website builders, making it easier to set up without deep coding knowledge.

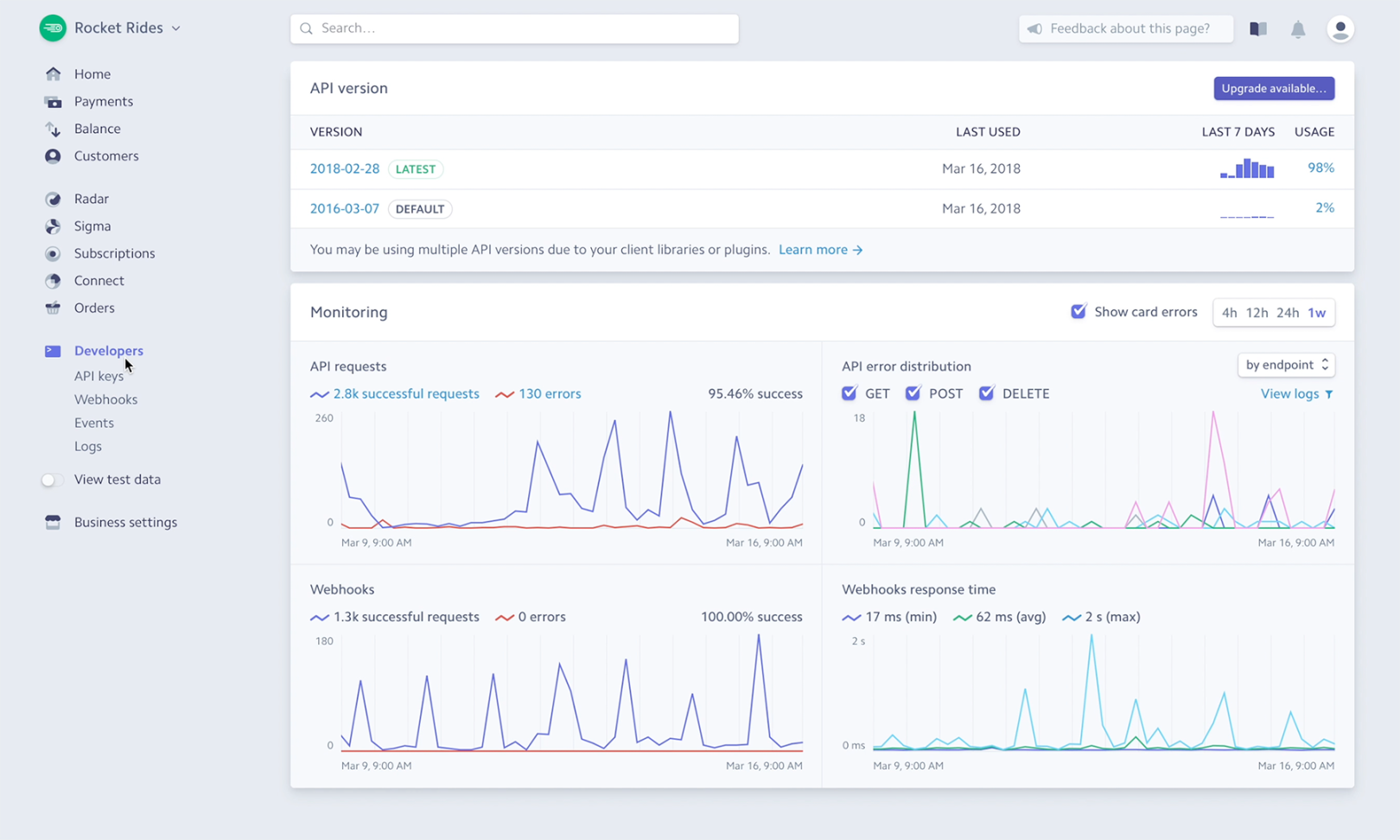

Dashboard Usability

Stripe’s dashboard is designed with a focus on functionality and analytics, providing users with a clean, intuitive interface that offers a comprehensive overview of their transactions. It allows users to manage and track payments, refunds, and transfers with ease. The dashboard also provides insights into payment behavior, conversion rates, and other financial metrics critical for business decision-making.

The usability of Stripe’s dashboard is enhanced by its ability to be customized according to the user’s specific needs. Users can create and manage reports that help them track their business performance over time. The dashboard is also equipped with advanced filtering options, making it easy to drill down into the data, from broad trends to granular details.

API and Developer Tools

Stripe’s most significant advantage perhaps lies in its API and the array of developer tools it offers. The Stripe API is robust, well-documented, and developer-friendly, making it a favorite among tech communities for its ease of use and comprehensive capabilities. It allows developers to build custom payment solutions that can fit virtually any use case, from simple one-time payments to complex subscription models.

In addition to its API, Stripe provides a suite of developer tools that include extensive SDKs, a powerful CLI (Command Line Interface), and detailed debug and test capabilities. These tools are designed to help developers implement, test, and scale their payment solutions efficiently. Stripe also frequently updates its API and tools to reflect new features and technologies, ensuring that businesses always have access to cutting-edge functionalities.

Customer Support and Resources

Stripe offers extensive customer support and resources tailored to developers and businesses. Support channels include 24/7 email support, an extensive online help center, and a community forum where users can seek advice and share solutions. For more complex integration needs or specific technical challenges, Stripe also offers premium support services that include dedicated assistance and prioritized responses.

Moreover, Stripe’s extensive documentation is often praised for its clarity and comprehensiveness, covering everything from basic setup to advanced features. This documentation is invaluable for developers looking to implement custom integrations or troubleshoot issues on their own.

Comparative Analysis

Shopify Payments and Stripe cater to distinctly different user bases, each with its own set of preferences and needs. Shopify Payments offers a seamless, integrated experience specifically for users of the Shopify platform. Its setup is notably straightforward, allowing merchants to quickly enable and manage their payment processing within Shopify’s ecosystem, without the need for extensive technical know-how. The dashboard is user-friendly and well-integrated with Shopify’s comprehensive management tools, making it easy for users to monitor transactions, handle payments, and access financial data. Additionally, Shopify’s mobile app extends this functionality, enabling on-the-go management of sales, which is complemented by robust customer support.

Conversely, Stripe’s user experience is designed with a high degree of flexibility and customization in mind, primarily appealing to a technically adept audience or businesses with developer resources. The integration process can be complex, given its platform-agnostic nature, but it allows for deep customization to precisely fit diverse business models and workflows. Stripe’s dashboard is powerful and highly functional, providing detailed analytics and extensive data filtering options that cater to businesses needing detailed insights into their transactions. Stripe’s standout feature, its API, offers extensive capabilities and is supported by comprehensive documentation and developer tools, making it ideal for creating customized payment solutions. Customer support is robust, focusing on assisting with technical integration and offering resources that are valuable to both developers and businesses.

Overall, when comparing Shopify Payments vs Stripe in terms of user experience and interface, the choice largely depends on the user’s technical ability and specific business needs. Shopify Payments is optimal for those who prefer a straightforward, integrated solution within the Shopify platform, providing ease of use without requiring technical depth. Stripe, on the other hand, is best suited for businesses that require a customizable payment solution with the ability to support complex, tailored workflows, assuming the user has the necessary technical expertise or resources to fully leverage its powerful capabilities.

Pricing and Fees

Pricing structures and associated fees are often decisive factors for businesses when selecting a payment gateway. This section scrutinizes the pricing models of Shopify Payments and Stripe, two major players in the market. We will dissect their fee structures, including transaction fees, monthly charges, and any additional costs involved, such as chargebacks and international payments. Understanding these financial implications is crucial for merchants as they aim to balance cost-efficiency with feature-rich payment processing capabilities.

Shopify

The cost structure of using Shopify Payments is intricately tied to the broader Shopify platform, making it crucial for potential and current Shopify users to understand how the pricing and fees align with their business model. Here’s a detailed breakdown of the financial commitments associated with Shopify Payments, including monthly subscription tiers, transaction fees, and additional costs.

Monthly Subscription Tiers

Shopify offers several pricing tiers to cater to businesses of varying sizes and needs, each tier providing different features and capabilities. These tiers are designed to scale with your business:

- Basic Shopify: This plan is ideal for small businesses or new sellers just starting out. It includes all the basics for starting a new business. Pricing typically starts at $29 per month.

- Shopify: This mid-level plan offers a good balance of cost and functionality, suitable for growing businesses with one retail store. It generally costs $79 per month.

- Advanced Shopify: Designed for scaling businesses that require advanced reporting and lower transaction fees. This plan is priced at around $299 per month.

Each tier not only affects your access to various features but also influences the fees you’ll pay per transaction through Shopify Payments.

Transaction Fees

One of the most attractive aspects of Shopify Payments is its direct integration with the Shopify platform, which eliminates the need for third-party payment gateways. Here’s how transaction fees are structured:

- Basic Shopify: Credit card rates start at 2.9% + 30¢ per transaction for online credit card rates. For in-person credit card rates, the fee drops slightly.

- Shopify: Reduces the online credit card rate to 2.6% + 30¢ and further decreases the in-person rate.

- Advanced Shopify: Offers the lowest transaction fees, with online credit card rates at 2.4% + 30¢ and even lower for in-person transactions.

Additionally, if you choose to use a payment provider other than Shopify Payments, Shopify charges an additional fee of up to 2% depending on your plan. However, this fee is waived if you use Shopify Payments.

Additional Costs

While the core functionality of Shopify covers many business needs, the platform also hosts an extensive app store and theme store, which can add to the overall cost:

- Apps: Shopify’s App Store includes thousands of apps that extend the functionality of your store. These can range from free to premium apps requiring monthly subscriptions. Costs can vary widely based on the functionality—from a few dollars per month to several hundred.

- Themes: Shopify provides a variety of free and paid themes. Premium themes can cost between $140 and $180 as a one-time fee. These themes are professionally designed and offer a broader range of customization options than the free versions.

- Additional Services: Depending on your business needs, you might also incur costs for additional services like Shopify Email, Shopify POS, or advanced shipping settings.

In summary, Shopify Payments can be a cost-effective solution for merchants already utilizing the Shopify platform, particularly because it eliminates the extra fees associated with third-party payment gateways. The all-in-one pricing of Shopify, which covers hosting, support, and no additional transaction fees when using Shopify Payments, makes it a convenient choice for many businesses. However, potential users should consider the cumulative impact of additional costs like apps and premium themes, which can add up but are often critical for enhancing store functionality and improving customer experience. When comparing Shopify vs Stripe, consider how the integrated nature of Shopify Payments might offset some of these costs against the more flexible, but potentially more developer-intensive, offerings of Stripe.

Stripe

When it comes to pricing and fees, Stripe adopts a transparent and flexible approach that is attractive to businesses of all sizes, from small startups to large enterprises. This section details Stripe’s pricing structure, including pay-as-you-go transaction fees, custom pricing for larger volumes, and an overview of any hidden or additional costs, providing a comparative lens against Shopify Payments.

Pay-as-you-go Transaction Fees

Stripe is well-known for its straightforward, pay-as-you-go pricing model, which is particularly appealing to new and scaling businesses that prefer a clear and predictable fee structure. The model is designed to scale with the size of the business — as transaction volumes increase, the costs per transaction can decrease. Here are the typical fees:

- Credit and Debit Card Charges: Stripe charges a standard fee of 2.9% + 30¢ for each card charge for businesses with standard pricing. This applies to most credit and debit card transactions, which is consistent with industry standards.

- International Cards and Currency Conversion: Transactions involving international cards or currency conversions incur an additional 1% fee, and an additional 1% if the currency conversion is required. This is something businesses targeting international markets need to consider.

- ACH and Direct Debit: For ACH direct debits, Stripe charges 0.8% per transaction, capped at $5, which is a cost-effective option for larger B2B transactions.

The pay-as-you-go nature means there are no setup fees, monthly fees, or hidden costs, which provides a high degree of cost predictability and flexibility for businesses.

Custom Pricing for Larger Volumes

For businesses with larger transaction volumes or unique business models that require specific payment logistics, Stripe offers custom pricing. This tailored pricing can include lower transaction fees, additional feature access, and enterprise-grade support services. Custom pricing is particularly beneficial for large-scale enterprises or tech-heavy platforms that process a large number of transactions and require more complex service arrangements.

Businesses interested in custom pricing need to contact Stripe directly to discuss their needs and negotiate terms that suit their transaction volumes and specific requirements. Stripe’s willingness to adapt pricing according to customer needs makes it a versatile choice for growing businesses looking to scale efficiently.

Hidden or Additional Costs

One of Stripe’s standout features is its transparency in pricing. Most fees are straightforward and listed on their website, but there are a few additional costs that businesses should be aware of:

- Refunds: Unlike some payment processors, Stripe does not charge a fee to refund a transaction, although the original transaction fees are not returned.

- Chargebacks: If a customer disputes a charge and it results in a chargeback, Stripe charges a $15 fee per occurrence. However, if the dispute is resolved in the merchant’s favor, this fee is refunded.

- Instant Payouts: For businesses that want access to funds faster than the standard payout schedule, Stripe offers instant payouts for an additional 1% fee.

Moreover, while not exactly hidden, businesses should account for potential costs associated with using premium features and integrations that Stripe offers, such as advanced fraud protection services, billing for subscriptions at scale, and specialized solutions for marketplaces.

In comparison to Shopify Payments, Stripe’s fee structure offers similar basic transaction fees but excels in providing options for high-volume businesses through its custom pricing. The lack of monthly fees and the flexibility of its pay-as-you-go model make Stripe particularly attractive for businesses looking for scalability without the commitment of monthly charges. This is in contrast to Shopify Payments, where transaction fees are tied into the broader Shopify platform fees, potentially influencing overall cost efficiency for users depending on their specific Shopify plan and sales volume. When comparing Shopify vs Stripe, businesses must consider not only the straightforward costs but also the potential for additional fees and the benefits of custom pricing arrangements offered by Stripe.

Comparative Analysis

When comparing the pricing and fee structures of Shopify Payments and Stripe, both platforms cater to different business needs with their unique approaches. Shopify Payments is deeply integrated with the Shopify platform, and its pricing is tied to Shopify’s subscription tiers. This can be a convenient option for users already entrenched in the Shopify ecosystem, as it provides an all-in-one solution where transaction fees, including credit card rates, vary depending on the Shopify plan chosen (Basic, Shopify, and Advanced). These fees decrease as merchants opt for higher-tier plans, incentivizing growth, and scale within the Shopify environment. Additionally, Shopify eliminates additional transaction fees if Shopify Payments is used, although costs can accrue through the use of additional apps, premium themes, and other enhanced features.

On the other hand, Stripe’s pricing is straightforward and transparent, favoring a pay-as-you-go model that charges a flat fee per transaction without requiring monthly subscriptions or setup fees. This model is appealing for its simplicity and transparency, making Stripe an attractive option for businesses of all sizes, particularly those that do not require a full eCommerce solution like Shopify. For larger businesses, Stripe offers custom pricing, which can reduce transaction fees and provide enhanced support, tailored to the specific needs and volumes of the business. Stripe’s additional costs are few but include fees for chargebacks and optional services like instant payouts.

In essence, Shopify Payments is ideally suited for merchants already utilizing the Shopify platform, offering a simplified financial workflow integrated with their online store management. Stripe, conversely, offers greater flexibility and is ideal for businesses seeking a dedicated payment solution that can be customized for their specific needs, without the necessity of a broader eCommerce platform. Businesses comparing Shopify vs Stripe must consider not only the base transaction fees but also the broader context of how these fees integrate with their overall operating costs and business model.

Integration and Compatibility

The ability of a payment gateway to integrate seamlessly with existing platforms and tools is crucial for creating a cohesive digital ecosystem. This section compares Shopify Payments and Stripe in terms of their integration capabilities and compatibility with other software. Whether you’re a small business owner looking for an all-in-one solution or a developer needing to build a highly customized shopping experience, understanding these aspects can significantly influence your choice between Shopify Payments and Stripe.

Shopify

Shopify Payments is seamlessly integrated into the Shopify ecosystem, designed to work cohesively with both Shopify’s core functionalities and its extensive range of integrations and applications. This section explores how Shopify Payments fits into the larger framework of Shopify’s eCommerce and marketing tools and leverages the Shopify App Store ecosystem, crucial considerations for merchants comparing Shopify vs Stripe.

eCommerce and Marketing Tool Integrations

Shopify Payments is not just a payment gateway but a part of Shopify’s broader eCommerce platform, which offers an array of tools designed to create a comprehensive shopping experience for both the store owner and their customers. The integration of Shopify Payments with Shopify’s eCommerce platform means that merchants can manage their payments, inventory, customer data, and marketing from a single interface, creating a streamlined workflow that can significantly enhance operational efficiency.

Key integrations include:

- Shopify Marketing Tools: Shopify Payments works closely with Shopify’s built-in marketing tools to facilitate promotions directly related to payment methods, such as special pricing and discounts for using preferred payment methods. This can increase conversion rates by offering customers smoother and potentially rewarding payment experiences.

- Advanced Store Features: From shipping and tax calculations to customer account management, Shopify Payments integrates deeply with every part of the Shopify store setup. This ensures that payment processes are not just added on but are a core part of the customer’s shopping experience, helping to streamline checkout processes and reduce cart abandonment rates.

- Analytics and Reporting: Shopify Payments is integrated with Shopify’s analytics tools, which track sales performance, payment method usage, and other critical metrics. These insights allow merchants to make informed decisions to optimize their sales strategies and payment processes.

Shopify App Store Ecosystem

The Shopify App Store is a critical part of the Shopify ecosystem, offering a wide variety of apps that extend the functionality of Shopify stores in many ways, including but not limited to, marketing automation, accounting, customer service, and inventory management. Shopify Payments’ compatibility with this ecosystem enhances its utility by enabling merchants to add features and functionalities that are specific to their business needs without compromising on the integrity of their payment processing.

A few notable aspects include:

- Third-party Integrations: Numerous third-party apps available on the Shopify App Store can integrate directly with Shopify Payments, allowing for enhancements in loyalty programs, recurring billing, and finance management. These integrations are usually seamless, involving little to no additional coding, which is crucial for merchants without extensive technical expertise.

- Customization and Scalability: As businesses grow, their needs become more complex. Shopify Payments’ compatibility with a wide range of apps means that merchants can scale their operations, adding functionalities as needed without switching their payment processing system. This is especially beneficial for growing businesses that need to adapt quickly to market changes or customer demands.

- Developer Support: For merchants with specific needs, Shopify’s extensive developer resources allow for the creation of custom apps that can work with Shopify Payments. This level of support ensures that even the most unique payment processing requirements can be met within the Shopify ecosystem.

In summary, Shopify Payments’ integration into the Shopify platform offers a tightly knit solution that leverages the extensive capabilities of the Shopify App Store. This integration not only simplifies the technical complexities associated with online payment processing but also enhances the overall functionality of Shopify stores, making it a robust choice for businesses seeking a unified eCommerce solution. When comparing Shopify vs Stripe, it’s important to consider that while Stripe offers broader application across various platforms, Shopify Payments provides deep integration specifically tailored to enhance and streamline the Shopify user experience, which can be a decisive factor for businesses already invested in the Shopify ecosystem.

Stripe

Stripe’s approach to integration and compatibility is significantly different from Shopify Payments, reflecting its broader aim to serve a wide variety of businesses across different platforms. Known for its flexibility and extensive developer-friendly tools, Stripe excels in providing services that are not only compatible with numerous eCommerce platforms but also highly extensible through its APIs and developer resources. This section delves into Stripe’s integration capabilities, focusing on its compatibility with various eCommerce platforms and the extensibility provided by its sophisticated APIs and developer tools.

Compatibility with eCommerce Platforms

Stripe’s design as a payment infrastructure is intended to be universally compatible with a multitude of eCommerce platforms, from large-scale enterprises to niche online stores. This wide-ranging compatibility is a key strength, especially when comparing Shopify vs Stripe, as it allows businesses to implement Stripe’s payment processing solutions regardless of the underlying technology or platform they are using.

- Major eCommerce Platforms: Stripe integrates smoothly with popular eCommerce systems such as WooCommerce, Magento, BigCommerce, and more. It also works seamlessly with smaller or specialized platforms, providing the same level of functionality and security. This universality is beneficial for businesses looking to maintain or expand their eCommerce capabilities without being tied to a single platform.

- Custom Integrations: For businesses with bespoke needs, Stripe’s flexible API allows for custom integration into virtually any eCommerce environment. This capability is particularly important for companies that require tailored workflows or specific compliance measures that standard platforms may not support.

- Marketplaces and Platforms: Stripe is not limited to traditional eCommerce setups but is also highly effective for marketplaces, SaaS (Software as a Service), and other online business models. Its Stripe Connect product is designed specifically for handling complex money movement in platforms that need to process payments to multiple parties.

Extensibility through APIs and Developer Tools

Stripe’s API is perhaps its most defining feature, known for its robustness and flexibility. It allows businesses to create customized payment solutions that are deeply integrated into their applications or websites, offering a level of customization that is unmatched by Shopify Payments.

- Comprehensive API Capabilities: Stripe’s APIs cover every aspect of the payment process, from creating charges to managing subscriptions and handling refunds. The APIs are continually updated and refined to include new features and support emerging payment methods and requirements. This ongoing development ensures that businesses can stay at the forefront of payment technology.

- Developer-Friendly Tools: Stripe provides an extensive suite of tools that are designed to make the integration process as straightforward as possible for developers. These include detailed documentation, SDKs for various programming languages, and tools like Stripe CLI (Command Line Interface), which allows developers to interact with Stripe directly from their development environments.

- Scalability and Customization: The ability to customize payment processes using Stripe’s API means that businesses can scale their payment infrastructure as they grow. Whether it’s adapting to increased transaction volumes or expanding into new markets with different payment needs, Stripe’s platform can adjust accordingly.

- Innovative Features: Beyond basic payment processing, Stripe’s API also supports advanced features such as machine learning-based fraud detection, automated invoicing, and real-time analytics. These capabilities are designed to not only streamline payment operations but also enhance the overall efficiency and security of business transactions.

In comparison to Shopify Payments, Stripe offers a level of flexibility and extensibility that is ideally suited for businesses looking for a payment solution that can seamlessly integrate with a diverse array of eCommerce platforms and be customized to fit specific business needs. While Shopify Payments is optimized for users within the Shopify ecosystem, Stripe provides a universally adaptable solution that can support a wide range of business models and applications, making it a powerful option for businesses prioritizing extensive customization and platform independence.

Comparative Analysis

When evaluating the integration and compatibility features of Shopify Payments and Stripe, each platform offers distinct advantages tailored to different business needs and environments. Shopify Payments is deeply integrated within the Shopify ecosystem, providing a seamless and cohesive user experience for those already utilizing Shopify for their eCommerce needs. This integration extends to Shopify’s vast app store, allowing users to enhance their Shopify environment with numerous add-ons for marketing, SEO, and more, without worrying about compatibility issues. This makes Shopify Payments an ideal choice for merchants seeking a unified solution where payment processing is smoothly embedded into the broader range of Shopify services.

Conversely, Stripe stands out for its universal compatibility and extensibility, designed to function across a wide array of eCommerce platforms and custom applications. Its strength lies in its robust API and comprehensive developer tools, which allow for extensive customization and integration into virtually any digital environment, from large eCommerce frameworks to individual custom-built sites. Stripe’s flexibility is enhanced by its support for complex payment models like those needed by marketplaces and multi-vendor platforms, making it an excellent option for businesses that require a versatile and adaptable payment solution that can grow and evolve with their operational needs.

In sum, while Shopify Payments offers an optimal solution for those committed to the Shopify platform, seeking ease and consistency within that ecosystem, Stripe provides broader applicability, catering to businesses that need a highly customizable payment processor capable of integrating with multiple platforms and handling a variety of payment scenarios. This comparison of Shopify vs Stripe in terms of integration and compatibility highlights the importance of considering the specific context and future scalability of your business when choosing between these two payment solutions.

Security and Trustworthiness

Security and trustworthiness are paramount in the selection of a payment processing service, as they directly influence the safety of financial transactions and the protection of sensitive customer data. In this section, we explore and compare the security measures and trustworthiness of Shopify Payments and Stripe, two leading payment gateways. his comparison aims to shed light on how each platform ensures the security of its users’ data and transactions, helping merchants make an informed decision based on the level of trust and security offered by Shopify Payments and Stripe.

Shopify

Security and trustworthiness are crucial aspects of any payment platform, as they directly impact a merchant’s ability to protect their customers’ data and maintain a reliable online presence. Shopify Payments, integrated within the Shopify ecosystem, provides a robust suite of security features designed to safeguard merchant and customer information. This section explores the key components of Shopify Payments’ security and trustworthiness, including SSL certification, PCI compliance, and fraud analysis tools.

SSL certification

One of the fundamental aspects of security for any online store is SSL (Secure Socket Layer) certification. Shopify provides a free 256-bit SSL certificate for all stores using Shopify Payments. This certification ensures that all data passed between the web server and browsers remains private and integral. SSL certification is a critical feature for maintaining customer trust, as it encrypts the data during transactions, including credit card processing, and ensures that sensitive information is transmitted securely over the internet. This not only protects against eavesdropping and network attacks but also helps in boosting the SEO of the store and improving the overall user experience by displaying security badges.

PCI compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is mandatory for any organization that handles credit card transactions. Shopify Payments adheres to PCI compliance standards at a high level (PCI Level 1), which is the most stringent level of certification available. This compliance means that Shopify Payments is regularly reviewed by an external auditor, who ensures that Shopify keeps all customer payment information secure throughout the transaction process.

By managing all aspects of the payment process, Shopify Payments simplifies the PCI compliance process for merchants, reducing the scope and complexity of compliance on their end. This not only mitigates the risk of data breaches but also alleviates merchants from the significant burden and potential liability of handling sensitive payment data directly.

Fraud analysis tools

Shopify Payments includes built-in fraud analysis tools that help merchants identify and respond to suspicious or potentially fraudulent transactions. These tools use machine learning and other advanced techniques to analyze transaction patterns and flag transactions that fall outside of normal purchasing behaviors.

The fraud analysis features include:

- Risk Scores: Shopify Payments provides a risk score for each transaction, determined based on several factors, including the transaction amount, speed of order placement, and discrepancies in billing and shipping information.

- Fraud Recommendations: Based on the risk score, Shopify offers recommendations on how to proceed with the transaction — whether it’s safe to proceed, needs a manual review, or should be canceled.

- Customizable Fraud Rules: For merchants with specific security needs, Shopify allows the creation of customizable fraud rules that can trigger automatic actions or flags based on predefined criteria.

These proactive measures are essential for minimizing the risk of chargebacks and fraud, thereby protecting both the merchant and their customers. Moreover, Shopify’s ongoing updates to its security protocols ensure that merchants have access to the latest tools to combat emerging security threats.

Stripe

Stripe’s reputation for security and trustworthiness is one of its core strengths, making it a favored choice for businesses globally. The platform is designed with an emphasis on protecting sensitive payment information, utilizing state-of-the-art security measures to ensure that merchant and customer data are safeguarded. This section discusses key features related to Stripe’s security mechanisms, including data encryption, PCI compliance, and fraud prevention strategies. These features are crucial when comparing Shopify vs Stripe, especially for businesses that prioritize advanced security solutions.

Data encryption

Stripe employs rigorous data encryption methods to secure cardholder data both at rest and in transit. Using AES-256 encryption for stored data and TLS (Transport Layer Security) for data transmitted between servers, Stripe ensures that all payment information is protected from unauthorized access. This approach to encryption is akin to the security protocols used by leading financial institutions worldwide, reflecting Stripe’s commitment to maintaining high security standards.

Additionally, Stripe uses tokenization to further enhance the security of transactions. In this process, sensitive payment information is replaced with non-sensitive equivalents called tokens that cannot be reversed-engineered. These tokens can be safely stored and reused for future transactions without exposing actual card details, significantly reducing the risk of data breaches.

PCI compliance

Stripe not only adheres to the highest level of PCI DSS requirements but also helps its users maintain their compliance. As a PCI Service Provider Level 1, Stripe undergoes regular security audits performed by external auditors and is required to maintain a robust security framework. For Stripe users, this level of compliance is beneficial because it significantly reduces the complexity and cost associated with PCI compliance.

For businesses using Stripe, PCI compliance is largely managed by Stripe’s integrated solutions. By handling all card data according to PCI DSS standards, Stripe allows businesses to minimize their own PCI requirements. Merchants simply need to ensure that their checkout processes are secure and that they comply with the PCI Data Security Standards for handling card data.

Fraud prevention

Stripe’s approach to fraud prevention is comprehensive and multifaceted, incorporating advanced machine learning algorithms to detect and prevent fraudulent transactions in real-time. Stripe’s Radar is a suite of fraud prevention tools that uses sophisticated machine learning trained on data across millions of global companies to identify and block fraud. Radar’s capabilities include:

- Adaptive Algorithms: Stripe Radar continuously adapts its algorithms based on shifting fraud patterns, ensuring effective prevention measures against both known and emerging threats.

- Customizable Rules: Businesses can set specific rules based on their risk tolerance, enabling them to block transactions that fall under certain risk thresholds or exhibit suspicious characteristics.

- Chargeback Protection: Stripe offers chargeback protection services that help businesses contest fraudulent chargebacks, providing evidence collection and automated dispute handling.

Moreover, Stripe also provides additional security measures such as 3D Secure, an authentication step that adds an extra layer of security by requiring buyers to complete an additional verification step with the card issuer when making a payment.

Comparative Analysis

In comparing the security and trustworthiness of Shopify Payments and Stripe, both platforms demonstrate robust measures to ensure the safety and integrity of user data, though their approaches cater to slightly different user needs.

Shopify Payments leverages the security infrastructure of the Shopify platform, providing merchants with a seamless and secure payment process. This integration includes automatic SSL certification for all stores, ensuring data encryption that protects both merchant and customer information during transactions. Additionally, Shopify Payments simplifies PCI compliance for merchants by managing it directly through its platform, which is compliant with PCI Level 1, the highest certification level. This reduces the compliance burden for store owners significantly. Shopify also incorporates built-in fraud analysis tools that use machine learning to assess the risk of transactions, providing merchants with alerts and actionable advice on handling potentially fraudulent transactions.

On the other hand, Stripe offers a broader range of security features that cater to a wide variety of business models, not limited to eCommerce. Stripe’s security measures include comprehensive data encryption, both at rest and in transit, and the use of tokenization to safeguard sensitive information. As a PCI Service Provider Level 1, Stripe not only ensures its compliance but also simplifies PCI compliance for its users by handling sensitive customer data on their behalf. In terms of fraud prevention, Stripe utilizes advanced machine learning through its Radar technology, which adapts to shifting fraud patterns and allows businesses to customize fraud detection settings according to their specific risk thresholds.

Overall, while Shopify Payments is an excellent choice for merchants who prefer a straightforward, integrated payment solution within the Shopify ecosystem, Stripe stands out for businesses that require a highly customizable payment processor with advanced security features and extensive fraud prevention capabilities. Both platforms provide strong security foundations, but the choice between Shopify vs Stripe will depend on the specific security needs of the business, the level of customization required, and the business model they operate.

Market Presence and Reputation

The market presence and reputation of a payment gateway can significantly influence a merchant’s choice, impacting trust and perceived reliability. In this section, we compare Shopify Payments and Stripe, two giants in the payment processing arena, examining their standing in the global market and their reputations among users. This comparison aims to provide insights into which platform may offer greater advantages in terms of market presence and reputation, aiding merchants in choosing a partner that not only meets their needs but also enhances their own credibility and appeal.

Shopify Payments

Shopify Payments, as an integral component of the Shopify ecosystem, inherits and contributes to the substantial market presence and reputation of its parent company, Shopify. As we delve into the aspects of Shopify Payments’ market presence, it’s crucial to consider the size and diversity of its user base, its geographical reach, its penetration into various industries, and some of its notable clients. These factors collectively paint a picture of Shopify Payments’ standing in the competitive landscape of eCommerce payment solutions, particularly when comparing Shopify vs Stripe.

User base

Shopify boasts a large and continuously growing user base, thanks in part to the ease of use and comprehensive nature of its platform which includes Shopify Payments. As of recent reports, Shopify supports over 1.7 million businesses worldwide, a number that reflects its appeal to a broad range of merchants from small startups to large enterprises. This extensive user base is not only indicative of Shopify’s popularity but also serves as a testament to the trust and reliability that merchants place in its integrated payment solution, Shopify Payments. The platform’s ability to provide a seamless, all-in-one commerce solution encourages strong loyalty among its users, who benefit from the convenience of having their payment processing needs tightly integrated with their online stores.

Geographical reach

Shopify’s geographical reach is another testament to its robust market presence. The platform, along with Shopify Payments, is available in numerous countries and territories across the globe, supporting multiple currencies and payment methods tailored to local markets. This extensive reach enables Shopify to cater to a global audience, providing localized shopping experiences that are crucial for businesses looking to expand internationally. Shopify’s ability to adapt to various market regulations and consumer preferences in different regions makes it a versatile choice for merchants aiming for global market penetration.

Industry penetration

Shopify Payments has made significant inroads across a variety of industries, from retail and fashion to electronics and art supplies. This versatility is largely due to Shopify’s wide array of features that can be customized to suit the specific needs of different business models, whether they operate solely online, in brick-and-mortar locations, or both. Shopify’s platform facilitates not just traditional eCommerce but also supports drop shipping, digital products, and services, making it a preferred choice for a diverse set of industries. This broad industry penetration also highlights the platform’s flexibility and the effectiveness of its integrated payment system in handling a range of transaction types and volumes.

Notable clients

Shopify’s client list includes a range of notable names that underscore its capability to support large-scale enterprises alongside small businesses. Among its users are big brands such as Gymshark, Penguin Books, and Heinz to name a few, which leverage Shopify to power their online stores. The presence of such high-profile clients serves as a strong endorsement of Shopify Payments’ reliability and scalability, factors that are critical for businesses with substantial transaction volumes and high customer traffic.

Stripe

Stripe’s market presence and reputation stand as a testament to its role as a major innovator and leader in the financial technology sector. Known for its developer-friendly platform, robust API, and versatile payment solutions, Stripe competes at the forefront of the payment processing industry. The comparison of Shopify vs Stripe in terms of market presence is fascinating, reflecting Stripe’s strategic positioning and influence across various markets. This section explores Stripe’s expansive user base, geographical reach, industry penetration, and notable clients.

User base

Stripe has cultivated a diverse and expansive user base that ranges from startup companies to some of the world’s largest corporations. It caters to businesses looking for a scalable, flexible payment solution that can adapt to complex, varied payment needs. Stripe’s appeal to a tech-savvy audience—particularly developers—has enabled it to grow substantially and maintain a strong presence in the competitive payment processing landscape. The platform’s user-friendly APIs and extensive customization capabilities have made it a favorite among internet businesses and eCommerce platforms, which rely on Stripe’s ability to handle massive volumes of transactions securely and efficiently.

Geographical reach

Stripe’s geographical reach is extensive, supporting businesses in over 40 countries with the ability to accept payments from anywhere in the world. This global footprint is crucial for its users, from eCommerce sites to subscription-based services, who must cater to a global audience. Stripe not only facilitates a multitude of currency conversions but also adapts to local payment methods, which is a significant advantage for businesses aiming to maximize their international customer base. This capability ensures that Stripe remains a leading choice for companies with international market aspirations, providing them with the necessary tools to execute cross-border transactions seamlessly.

Industry penetration

The versatility of Stripe’s services has allowed it to penetrate a wide array of industries. Beyond eCommerce, Stripe is heavily utilized in areas such as software as a service (SaaS), non-profits, and platforms that facilitate marketplace transactions. Its capability to handle complex payment models like on-demand marketplaces, pay-as-you-go systems, and subscription services has made Stripe particularly popular among innovative business models, including gig economy platforms and online marketplaces. This broad industry adoption underscores Stripe’s capability to meet specific industry demands and innovate payment solutions that address unique business challenges.

Notable clients

Stripe’s clientele includes some of the most influential and recognized names in the tech industry and beyond. High-profile clients such as Amazon, Google, Shopify (ironically, for their payments infrastructure), Lyft, and Slack demonstrate Stripe’s capacity to support large-scale enterprises with demanding payment processing needs. These companies require a payment processor that not only offers reliability and security but also scalability and advanced technological integration—qualities that Stripe delivers consistently.

Comparative Analysis

Between Shopify Payments and Stripe, each platform showcases distinct strengths tailored to its user base and market strategy. Shopify Payments benefits significantly from its integration with the Shopify ecosystem, renowned for its comprehensive eCommerce solutions. With a user base that includes over 1.7 million businesses globally, Shopify Payments leverages Shopify’s strong presence, especially among small to medium-sized enterprises looking for an all-in-one platform. This presence is further bolstered by Shopify’s geographical reach and industry penetration, particularly within the eCommerce sector, where it has become synonymous with ease of use and reliability. Notable clients, including major brands across various industries, underscore Shopify Payments’ capability to handle diverse eCommerce needs on a large scale.

On the other hand, Stripe commands a formidable presence in the broader digital payments sphere, characterized by its flexibility and powerful API integrations that appeal to a tech-savvy clientele. Stripe supports businesses in over 40 countries, facilitating a broad range of transactions including complex payment systems required by large marketplaces and subscription services. This global reach and adaptability have allowed Stripe to penetrate a vast array of industries beyond traditional eCommerce, including tech startups, large tech companies, and innovative business models in the gig economy. Stripe’s impressive list of notable clients, such as Amazon, Google, and Lyft, highlights its capability to support high-demand environments and complex payment infrastructures, making it a trusted partner for major enterprises and innovative platforms worldwide.

When comparing the market presence and reputation of Shopify Payments vs Stripe, it is evident that while Shopify Payments is ideal for users seeking a seamless and integrated eCommerce and payment experience within the Shopify platform, Stripe offers a more versatile and widely adaptable payment solution suitable for a diverse range of business models and industries. This distinction underlines the differing focuses of each platform: Shopify Payments as a specialized eCommerce integrated solution within Shopify, and Stripe as a comprehensive, globally oriented payment processor catering to a wide spectrum of businesses seeking advanced payment functionalities and extensive customization options.

Pros and Cons of Shopify Payment vs Stripe

When comparing Shopify Payments and Stripe, it’s important to delve into the specific advantages and disadvantages of each to provide a well-rounded view. This not only helps businesses understand what each platform excels in but also illuminates potential drawbacks they might face. Here’s a concise breakdown of the strengths and weaknesses of both Shopify Payments and Stripe, along with contextual advice to help businesses choose the right platform based on their specific needs.

Summary of Shopify’s advantages and limitations

Advantages

- Seamless Integration with Shopify: Shopify Payments is fully integrated with the Shopify eCommerce platform, offering a streamlined experience where merchants can manage their store and payments all in one place without the need for third-party services. This integration simplifies the user experience significantly.

- Simplified PCI Compliance: Since Shopify Payments handles all the aspects of online payment processing, it also takes care of PCI compliance, greatly reducing the merchant’s burden and ensuring that transactions are secure.

- No Additional Transaction Fees: Shopify Payments does not charge additional fees if you use it as your primary payment processor, unlike other payment gateways that might incur extra charges.

- Unified Dashboard: Merchants can view their payments, orders, and other relevant data from a single dashboard, which enhances ease of use and operational efficiency.

Limitations

- Limited to Shopify Users: Shopify Payments is only available to Shopify platform users, which means it is not an option for businesses not using Shopify as their eCommerce platform.

- Geographical Limitations: Currently, Shopify Payments is only available in a select number of countries, which can be a significant limitation for global businesses wanting to use Shopify outside these areas.

- Variability in Fees Based on Plan: The transaction fees and credit card rates can vary significantly depending on the Shopify plan you choose, which might not always be competitive compared to other payment processors.

Summary of Stripe’s advantages and limitations

Advantages

- Extensive Customization and Flexibility: Stripe’s API allows for significant customization, making it possible for businesses to tailor the payment experience to their specific needs. This is particularly advantageous for tech-savvy businesses that require custom payment flows.

- Global Reach: Stripe supports businesses in numerous countries and can handle 135+ currencies, making it ideal for global operations. It also supports a wide array of payment methods suited to different regions.

- Advanced Fraud Protection: Stripe utilizes advanced machine learning techniques to detect and prevent fraud, offering tools like Stripe Radar that help safeguard transactions.

- Scalability: Stripe’s infrastructure is designed for scalability, supporting everything from small startups to large enterprises with ease.

Limitations

- Requires Technical Expertise: The customization capabilities, while a strength, also mean that getting the most out of Stripe’s platform typically requires a good degree of technical knowledge or access to developer resources.

- Potentially Higher Costs for Smaller Businesses: Stripe’s fee structure, while transparent, can be relatively high for smaller businesses or those just starting out, especially when additional features or premium support are factored in.

- No Built-In eCommerce Tools: Unlike Shopify Payments, Stripe does not offer an integrated suite of eCommerce tools since it is strictly a payment processor, requiring businesses to set up their online store platform separately.

Contextual Advices for Businesses Choosing Between Shopify and Stripe

The choice between Shopify Payments and Stripe should be influenced by the specific needs and circumstances of the business:

- Shopify vs Stripe for eCommerce Needs: If you are looking for an all-in-one eCommerce solution that combines the store and payment processor with minimal setup, Shopify Payments is likely the better choice. It’s particularly suitable for those who prioritize ease of use and are already on or plan to use the Shopify platform.

- Customization and Global Operations: For businesses that need highly customized payment processing solutions or have a global customer base, Stripe is more appropriate. Its ability to handle various payment methods and currencies, along with its advanced fraud protection capabilities, makes it suitable for businesses aiming for extensive reach and customized transaction flows.

- Technical Resources: Consider your access to technical resources. Stripe’s robust API and need for technical implementation may require a dedicated developer, whereas Shopify Payments offers a more plug-and-play approach with its built-in features.

Understanding these pros and cons will aid businesses in making an informed decision that aligns with their operational priorities and growth aspirations, ensuring they choose the right platform to facilitate their payment processing needs efficiently.

Conclusion

Choosing between Shopify Payments and Stripe should be based on several strategic considerations:

- Business Model and Size: Small to medium-sized businesses looking for an all-in-one eCommerce solution might find Shopify Payments more suitable, as it offers a direct, hassle-free integration with the broader Shopify features. In contrast, larger businesses or those needing bespoke payment solutions might prefer Stripe for its scalability and extensive customization options.

- Technical Resources: If your business has access to developers or technical expertise, Stripe’s advanced features and customization capabilities can be fully leveraged. For businesses without such resources, Shopify Payments provides a more accessible platform without the need for extensive technical setup.

- Global Reach: For businesses aiming to expand internationally, Stripe’s support for multiple currencies and international payment methods can be a decisive factor. Shopify Payments, while robust, is more limited in terms of international functionalities outside of the available Shopify markets.

- Industry Requirements: Consider the specific needs of your industry. For example, if your business model involves subscriptions or complex marketplace transactions, Stripe’s flexible API can be invaluable. Conversely, for standard retail models, Shopify Payments might suffice.

As the eCommerce landscape continues to evolve, so too will the solutions that facilitate online payments. The ongoing innovations in AI, machine learning, and blockchain are likely to further transform how businesses handle transactions, manage security risks, and enhance customer experiences. Both Shopify Payments and Stripe are poised to adapt to these changes, continuously updating their offerings to meet new technological standards and business needs.

Ultimately, the choice between Shopify Payments and Stripe will depend on where your business stands today and where you plan to take it in the future. Each platform offers distinct advantages that can help propel your business forward, provided they align with your operational requirements and growth strategies. By carefully considering your needs and the capabilities of each payment solution, you can make an informed decision that not only meets your current demands but also positions your business for future success in the ever-changing world of eCommerce.

If you love our content, please subscribe to our newsletter right below so that we can send you updates just like this one!