Black Friday, a term deeply ingrained in the retail lexicon, signifies more than just a single day of frantic shopping. It has evolved into a colossal event that shapes consumer behavior and sales strategies across the eCommerce landscape. This pivotal period marks a drastic shift in shopping patterns, with consumers eagerly anticipating the slew of deals and discounts that flood the digital marketplace.

To truly capitalize on Black Friday eCommerce, it’s crucial to comprehend the underlying consumer behavior that drives this shopping frenzy. We’ve collected insights from three esteemed authorities in the field: SimilarWeb, Adobe, and Shopify. These reports reveal a significant surge in online activity, with shoppers not just seeking the best deals but also valuing the convenience and variety offered by online platforms. Retailers who effectively tap into these consumer preferences are likely to see a substantial increase in sales and customer engagement.

Table of Contents

- How Are the Reports Conducted?

- The Overview of the Market during the Black Friday Period

- A Robust Beginning for the Holiday Season Sales

- The Rise of Buy Now – Pay Late Payment Method

- Amazon Achieves Greater Success in the Initial Two Days of Cyber 5

- Apple Maintains Its Status as a Consumer Favorite

- Some Black Friday Highlights from the Shopify Merchants

- Additional Insights That You Should Know

How Are the Reports Conducted?

Before delving into the intricate statistics and metrics, it’s crucial to meticulously understand the research methodologies employed by SimilarWeb, Shopify, and Adobe in producing these reports.

Beginning with SimilarWeb, their analysis utilizes traffic data from the top 716 eCommerce entities during Black Friday. Black Friday, as an eCommerce phenomenon, spans from Thanksgiving (observed on Thursday, Nov 23 in the US) to Cyber Monday, a period often termed as the Cyber 5, the zenith of online shopping. However, their report initially concentrates on the initial two days, providing insights into digital performance.

With Shopify, their approach for analyzing 2023 Black Friday- Cyber Monday statistics hinges on the Gross Merchandise Volume (GMV) generated by Shopify merchants globally from November 23 at 11:00 UTC to November 28 at 8:00 UTC. This data, encompassing worldwide sales, is approximate, based on various assumptions, and remains unaudited with potential for adjustments. This data encapsulates both online and offline sales conducted by Shopify’s international merchants.

Adobe’s methodology for analyzing Black Friday statistics, instead, offers a broad perspective on the eCommerce market during the peak shopping period. Their focus encompasses Cyber Week, spanning the five-day stretch from Thanksgiving through Black Friday and Cyber Monday. Utilizing data from Adobe Analytics, their report delivers an extensive overview of U.S. eCommerce. This is achieved by examining online commerce transactions, encompassing over one trillion visits to U.S. retail websites, 100 million SKUs, and 18 different product categories. This comprehensive approach allows Adobe to provide detailed insights into the dynamics of the U.S. online retail sector during this critical shopping period.

The Overview of the Market during the Black Friday Period

The Black Friday period, as detailed in Adobe’s report, witnessed a remarkable surge in consumer spending, with a total of $12.4 billion expended on Cyber Monday alone, marking a 9.6% year-over-year increase and exceeding Adobe’s initial forecasts.

Notably, during the peak hour between 10:00 to 11:00 pm Eastern, spending reached a staggering $15.7 million per minute. Cyber Monday solidified its status as the largest online shopping day ever, with shoppers eagerly capitalizing on substantial discounts across various categories. Electronics discounts peaked at 31% off the listed price, followed by toys at 27%, apparel at 23%, furniture at 21%, and appliances at 18%.

Vivek Pandya, lead analyst at Adobe Digital Insights, has said: We’ve seen a very strategic consumer emerge over the past year where they’re really trying to take advantage of these marquee days so that they can maximize on discounts.

Apparel emerged as the top category on Cyber Monday, with online sales skyrocketing by 189% compared to an average day in October 2023. Other categories witnessing robust demand included appliances (up 166%), toys (up 140%), furniture (up 129%), electronics (up 103%), jewelry (up 99%), and sporting goods (up 95%).

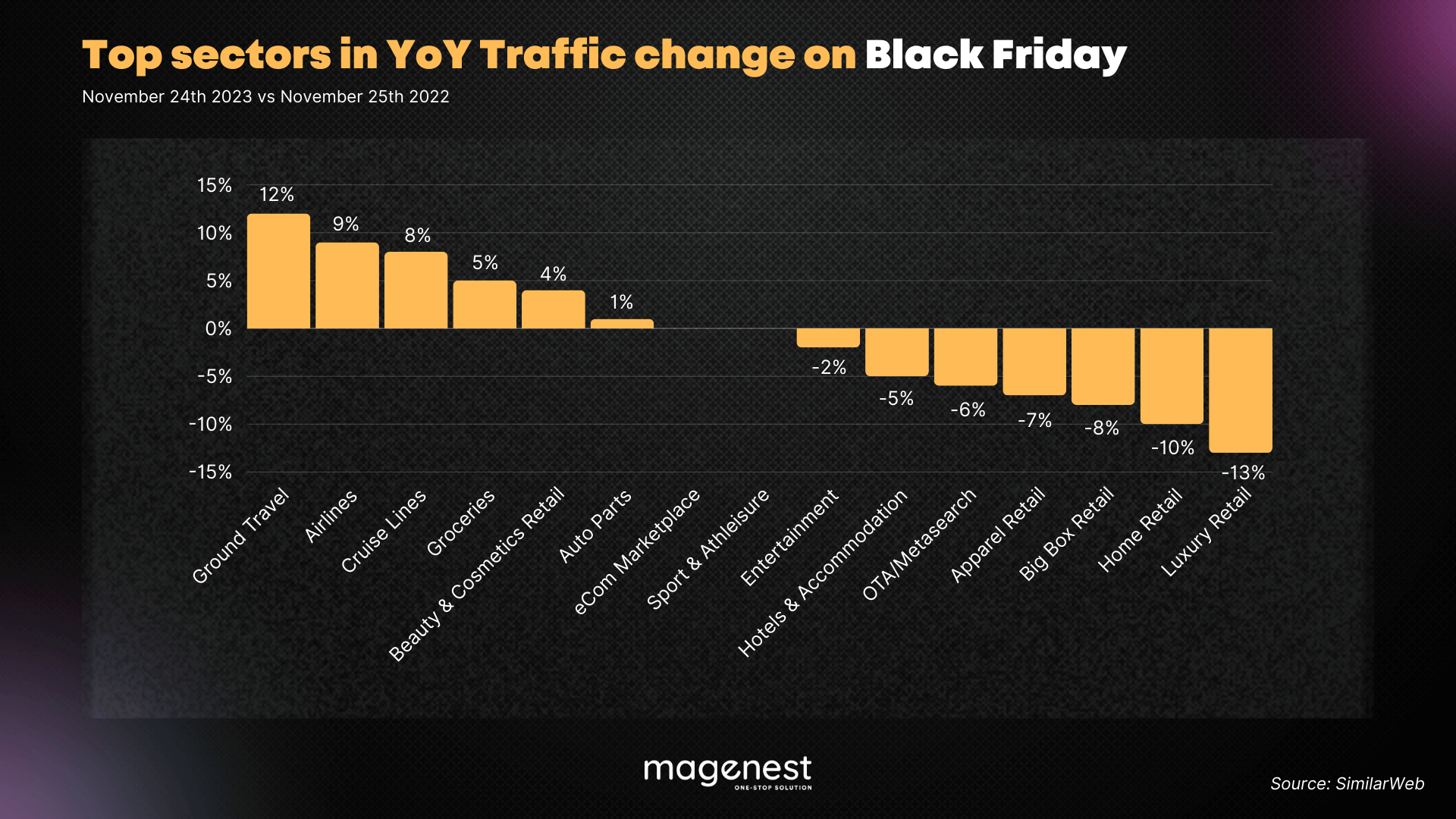

In contrast, according to SimilarWeb, the first two days of Black Friday saw a unique consumer trend with a marked preference for travel, particularly transportation, overshadowing other large-ticket items such as home furnishings or luxury goods. This shift indicates a significant consumer interest in experiences and mobility, potentially reflecting broader changes in consumer priorities and spending habits.

Following closely with the Ground Travel sector, airlines experienced a 9% rise, which suggests that many consumers are looking to secure discounted flights, possibly in response to easing travel restrictions or in anticipation of planned trips.

Entertainment and Hotels and Accommodation sectors experienced a slight decline, with 2% and 5% decreases in traffic. This could reflect a shift in consumer spending towards tangible goods over experiences or accommodations. A similar trend can be applied to the Apparel and Luxury Retail sector.

Additionally, a notable 5% increase in traffic to grocery sites on Black Friday. This trend suggests that shoppers are increasingly utilizing Black Friday discounts not just for traditional shopping but also to replenish their grocery supplies.

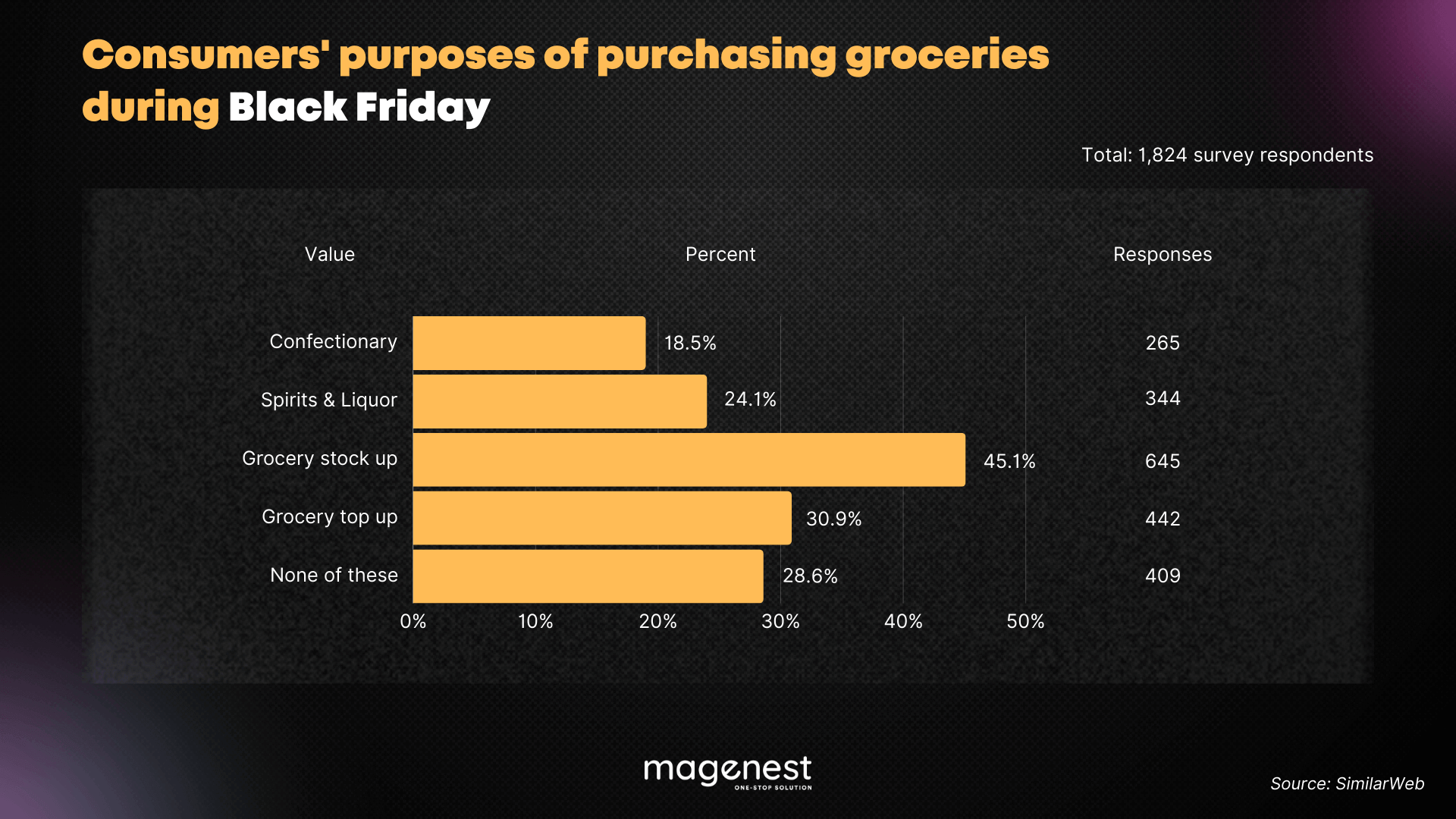

Similarweb’s Market Research Panel, which surveyed 1,824 respondents, found that a significant 45% of consumers intended to purchase groceries during Black Friday specifically for stocking up. This inclination towards buying groceries in bulk during sales events like Black Friday eCommerce highlights a strategic shift in consumer behavior, where shoppers are keen to maximize savings for everyday essentials, not just luxury or electronic items.

A Robust Beginning for the Holiday Season Sales

The commencement of the 2023 holiday shopping season was enveloped in unpredictability. Consumers were adjusting their expenditures more towards services amidst the escalation of living costs, as outlined by Vivek Pandya: The 2023 holiday shopping season began with a lot of uncertainty, as consumers shifted their spending to services while dealing with rising costs across different facets of their lives.

Nonetheless, the surge in online purchases during Cyber Week underscores how significant discounting strategies can influence purchasing behavior. Pandya added: The record online spending across Cyber Week, however, shows the impact that discounts can have on consumer demand, especially with quality products that drove a lot of impulse shopping.

The Black Friday period, encapsulating Cyber Week, saw a notable surge in consumer spending, reflecting the success and continued expansion of the digital economy. The span from Thanksgiving to Cyber Monday alone generated a remarkable $38 billion in sales, marking a 7.8% YoY increase. This uptick was supported by unprecedented online spending during Thanksgiving, which reached $5.6 billion (up 5.5% YoY), Black Friday at $9.8 billion (up 7.5% YoY), and the subsequent weekend, which saw $10.3 billion in sales (up 7.7% YoY).

Expanding the view to the season-to-date, from November 1 to November 27, there has been a significant influx of online spending, with consumers shelling out $109.3 billion, a 7.3% rise compared to the same period last year. A substantial portion of this spending, 60%, was concentrated in five key sectors: electronics, which drew $21.7 billion, apparel at $19.2 billion, furniture at $14.7 billion, grocery with $6.8 billion, and toys at $3.1 billion. These categories have proven to be the primary growth drivers within the digital marketplace.

Adobe’s forecast for the full holiday season, with an anticipated total spend of $221.8 billion, growing at 4.8% year-over-year, suggests a continued consumer preference for online shopping. This forecast, coupled with the projection that one-fifth of all holiday spending will be conducted online, showcases the ongoing shift in consumer behavior towards eCommerce, which is progressively outperforming traditional in-store shopping. The data indicates a strong consumer confidence in online shopping, likely driven by the convenience and competitive pricing that eCommerce platforms offer.

The Rise of Buy Now – Pay Late Payment Method

During this Black Friday season, the Buy Now – Pay Later (BNPL) payment option has surfaced as a significant trend, reflecting the current economic landscape where shoppers are more price-sensitive. This sensitivity is attributed to the ripple effects of last year’s record inflation and rising interest rates, which have led to tighter consumer budgets.

Despite these economic pressures, the desire to engage in online shopping remains strong. On Cyber Monday alone, BNPL transactions reached an unprecedented high, contributing $940 million to online spending, a remarkable 42.5% increase year-over-year. This spike in BNPL usage suggests that while consumers continue to participate in online retail, they are also looking for payment structures that allow for more immediate fiscal maneuverability.

The statistics also show an 11% YoY rise in the number of items per order during this period, indicating that shoppers are not only buying more but are also leaning towards BNPL services to manage the cost of larger shopping carts. From November 1 to November 27, BNPL has facilitated a substantial $8.3 billion in sales, marking a 17% increase from the previous year.

Additionally, a Mastercard analysis of this year’s Black Friday sales highlighted a modest increase of just over 1% in in-store sales, while online sales saw a robust growth of over 8% compared to the previous year. This disparity underscores the continuing consumer shift towards online shopping, which is perhaps fueled by the convenience and flexibility offered by digital platforms, including the option to use BNPL services.

Adobe’s Vivek Pandya remarked on the changing dynamics of the Black Friday experience: I do think the paradigm has changed around the in-store Black Friday experience, the long lines and things like that.

This change can be linked to consumers’ preference for the control and ease provided by online shopping. When shopping online, consumers are “more in the driver’s seat,” as Pandya observed, because they can easily compare prices side-by-side and secure better deals.

Amazon Achieves Greater Success in the Initial Two Days of Cyber 5

Amazon’s performance during the initial days of the Black Friday season was notably successful, exceeding expectations with an influx of site visits and remarkable growth in several pivotal categories. The eCommerce giant recorded a 6% YoY increase in site traffic on Thanksgiving Day, surpassing the growth observed on Black Friday itself, which stood at a 3% YoY increase.

The spike in visits peaked at around 10 pm on Thanksgiving, suggesting that shoppers were keen to kick off their deal-hunting post the festive dinner. Conversely, on Black Friday, the highest traffic was noted at around 3 pm.

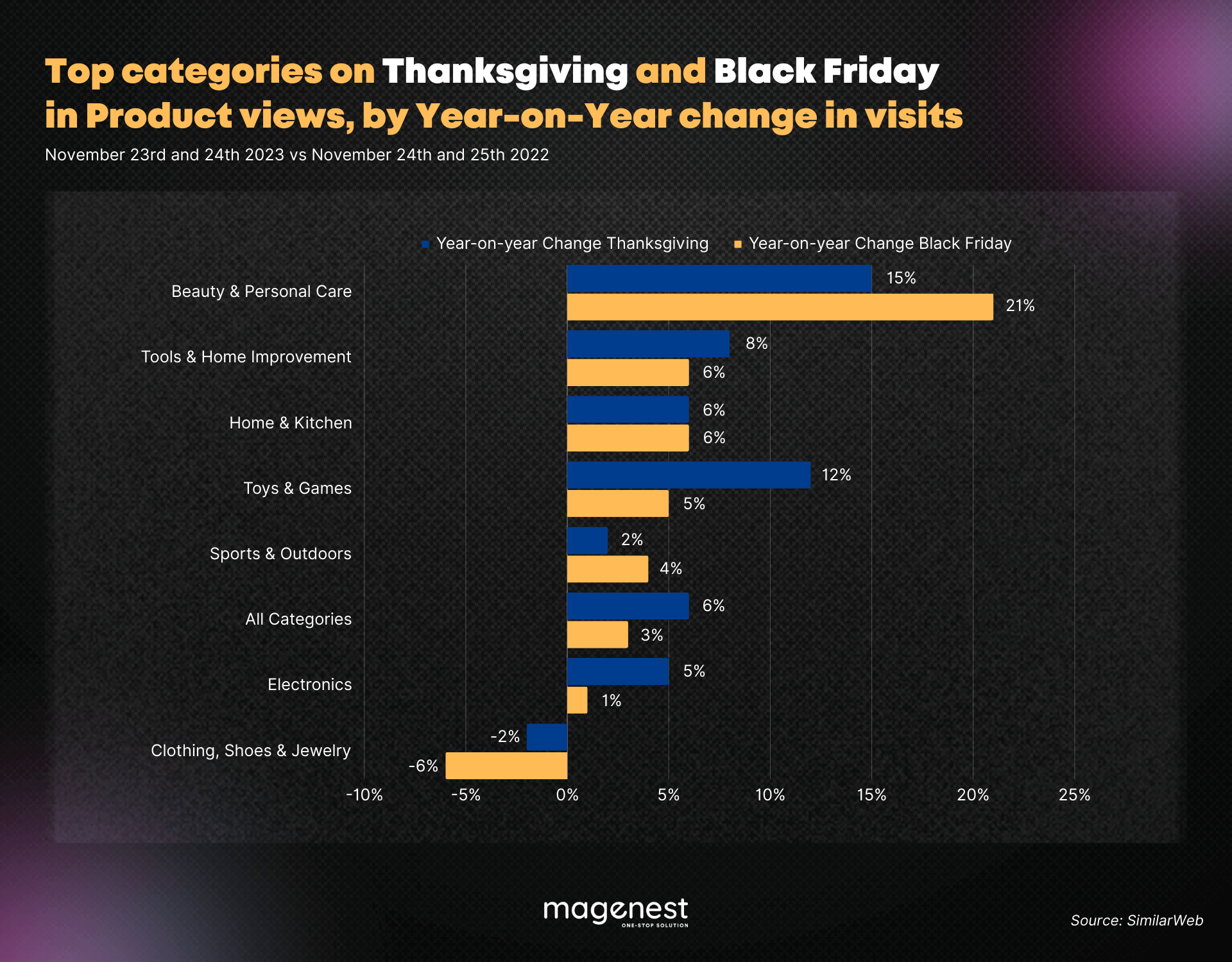

According to the Top categories on Thanksgiving and Black Friday in Product views, by Year-on-Year change in visits to Amazon above, we can observe that the Toys and Games category, with a 12% increase in product views on Thanksgiving, reflects a robust consumer interest in holiday gifts, suggesting that shoppers are keen on taking advantage of deals during this festive season for their gifting needs.

However, the Clothing, Shoes, and Jewelry categories displayed a downturn in demand, with a 6% decrease on Thanksgiving and an even steeper drop of 2% on Black Friday, aligning with the global slowdown in fashion demand.

On the other hand, the Beauty and Personal Care category clearly stands out with a remarkable 15% rise in visits on Thanksgiving and an impressive 21% on Black Friday, indicating a burgeoning consumer interest in beauty products. This is further evidenced by the strong sales figures, particularly for products that received heavy discounts and those popularized on social media platforms like TikTok, underscoring the influence of digital trends on consumer purchasing behavior.

Apple Maintains Its Status as a Consumer Favorite

The list of popular searches for Black Friday 2023 features several Apple products, indicating a strong consumer preference for the brand. The brand’s flagship products, including the iPad, Apple Watch, and AirPods, not only featured prominently but also ranked among the top 10 most searched items on Amazon. This clearly reflects the sustained allure that Apple holds for consumers.

Popular Searches Black Friday 2022 | Popular Searches Black Friday 2023 |

laptop | lego |

air fryer | ipad |

monitor | airpods |

airpods | apple watch |

ps5 | ps5 |

ssd | kindle |

lego | tv |

nintendo switch | monitor |

kindle | headphones |

headphones | laptop |

The consistent preference for these Apple products underscores the brand’s successful innovation and its ability to maintain a loyal customer base year after year, even amid a market crowded with alternatives.

Some Black Friday Highlights from the Shopify Merchants

Shopify merchants experienced a momentous Black Friday-Cyber Monday (BFCM) weekend, shattering records with an impressive $9.3 billion in sales, marking a significant 24% increase from the previous year. The global reach of Shopify was on full display as over 61 million consumers from New Zealand to California chose to purchase from Shopify-powered brands.

The shopping fervor reached its zenith at 12:01 p.m. EST on Black Friday, with sales hitting a peak rate of $4.2 million per minute. The hottest product categories driving this surge were apparel and accessories, health and beauty, and home and garden, highlighting diverse consumer interests and spending power, with the average cart price standing at $108.12.

Additionally, the payment facilitation through Shop Pay saw a substantial 60% YoY increase in sales, indicating a growing consumer preference for convenient and secure payment solutions.

A particularly heartening metric is the 17,500+ entrepreneurs who made their first sale on Shopify during the Black Friday season, reflecting the platform’s role in fostering new business growth. Moreover, more than 55,000 merchants celebrated their highest-selling day ever, highlighting the massive success of individual businesses.

The robustness of the Shopify platform was further validated by its ability to handle an astonishing 967K requests per second at peak times during the Black Friday period, equivalent to 58 million requests per minute. This performance is a testament to the reliability, scalability, and resilience of the Shopify commerce platform, ensuring that merchants can confidently drive sales without the fear of technical issues, even during the most demanding shopping periods.

Additional Insights That You Should Know

Black Friday eCommerce in 2023 has revealed several additional insights that shed light on evolving consumer behavior and the shifting retail landscape. Here are some key takeaways that you should know.

Mobile Shopping Ascends to New Heights

Mobile shopping reached unprecedented levels during the 2023 Black Friday eCommerce period, setting a new standard for consumer purchasing behavior. Thanksgiving day saw a surge in mobile transactions, with smartphones accounting for 59% of online sales, a 4% increase from the 55% recorded in 2022. This trend persisted throughout Cyber Week, with mobile sales constituting 51.8% of the total, marking a rise from the previous year’s 49.9%.

This shift indicates a significant trend: mobile platforms have become a central driver of growth in the digital economy. The convenience of shopping on a smartphone has reached a point where it is often preferred over traditional desktop shopping. The seamless user experience, the optimization of eCommerce sites for mobile devices, and the ubiquitous nature of smartphones have contributed to their ascent as the preferred shopping channel for a majority of consumers.

Extended Deal Season

The period following Cyber Week traditionally sees a cooling-off from the dizzying heights of peak discounts, yet it remains a ripe time for consumers to snag substantial deals across various product categories. The savvy shopper can still find enticing discounts, with appliances being offered at a notable 20% off listed prices, and appealing reductions continue across toys, computers, apparel, and furniture, with discounts ranging from 11% to 16%.

Notably, for those with an eye on sporting goods, marking the calendar for Monday, December 4th would be wise, as it is anticipated to offer the most competitive pricing in this category with discounts expected to reach 21% off listed prices. This extended deal season allows consumers to continue their holiday shopping while still capitalizing on considerable savings, catering especially to those who may have missed out on Cyber Week’s whirlwind of deals or who are looking to make thoughtful, cost-effective purchases in the lead-up to the holidays.

Marketing Channels and Their Impact

During Cyber Week, the influence of various marketing channels on retail sales was evident, with paid search leading as the most significant sales driver, accounting for 27% of online sales. Other channels also played substantial roles; direct traffic contributed to 21%, organic search to 17%, email marketing accounted for 15%, and affiliates or partners brought in 12%.

Despite social media’s less dominant direct revenue contribution at under 5% of total sales, it’s noteworthy that this channel experienced a year-over-year growth of 6%, indicating its rising importance in the digital marketing mix. This diversified channel performance highlights the need for retailers to maintain a balanced and multi-faceted digital marketing strategy.

Growth in Average Order Value

The Average Order Value (AOV) during this holiday season has seen a modest uptick. From November 1st to the 27th, AOV rose by 2.7% compared to last year, translating to an increase in shopping cart values from $100 to approximately $102 on average.

Furthermore, during the Cyber Weekend, the AOV growth was even more pronounced at 3.2%. This rise in AOV, alongside the record spending reported this season, indicates an expanding adoption of eCommerce by a broader consumer base, contributing to the overall growth in market expenditures.

As you can observe, headless commerce has become increasingly significant as businesses seek more flexible and customizable eCommerce solutions. Alongside this, our article eCommerce Statistics 2023 also reveals a fascinating trend of growth and evolution in the digital marketplace. These statistics offer valuable insights into consumer behaviors and emerging technologies, shaping strategies for businesses aiming to thrive in the competitive eCommerce landscape.

In Conclusion,

As you can observe, Black Friday eCommerce highlights of 2023 have painted a picture of a rapidly evolving retail landscape, one where technological convenience intersects with consumer savvy. The surge in mobile shopping, record-breaking discounts, and the extension of deal seasons underscore a clear trend: consumers are increasingly turning to digital solutions to fulfill their shopping needs.

As we reflect on the successes and trends of this pivotal shopping period, it becomes evident that eCommerce platforms are not just facilitators of transactions but are also shaping the future of retail and consumer expectations. Don’t hesitate to subscribe to our newsletter to receive the latest insights and news from the market through the analysis of our experts!