The eCommerce landscape is highly competitive, and having the best accounting software for Shopify can give you a significant edge. From automated bookkeeping to real-time financial reporting, these tools are designed to enhance efficiency and accuracy in managing your finances. By integrating seamlessly with your Shopify store, the right accounting software can handle everything from sales and expenses to taxes and payroll, allowing you to focus more on growing your business.

Whether you’re a small startup or a well-established enterprise, finding the best accounting software for Shopify can make a significant difference in your financial management. Keep reading to discover the top solutions tailored for Shopify businesses, and learn how they can support your journey towards financial success and business growth.

Table of Contents

Best 10 Accounting Software for Shopify

With a plethora of options available, it’s essential to choose an accounting solution that aligns perfectly with your specific needs. In this section, we will explore the best eight accounting software for Shopify, each offering unique features and benefits tailored to eCommerce. Whether you’re looking for seamless integration, advanced reporting capabilities, or user-friendly interfaces, these top-rated accounting tools are designed to help you manage your finances with precision and ease.

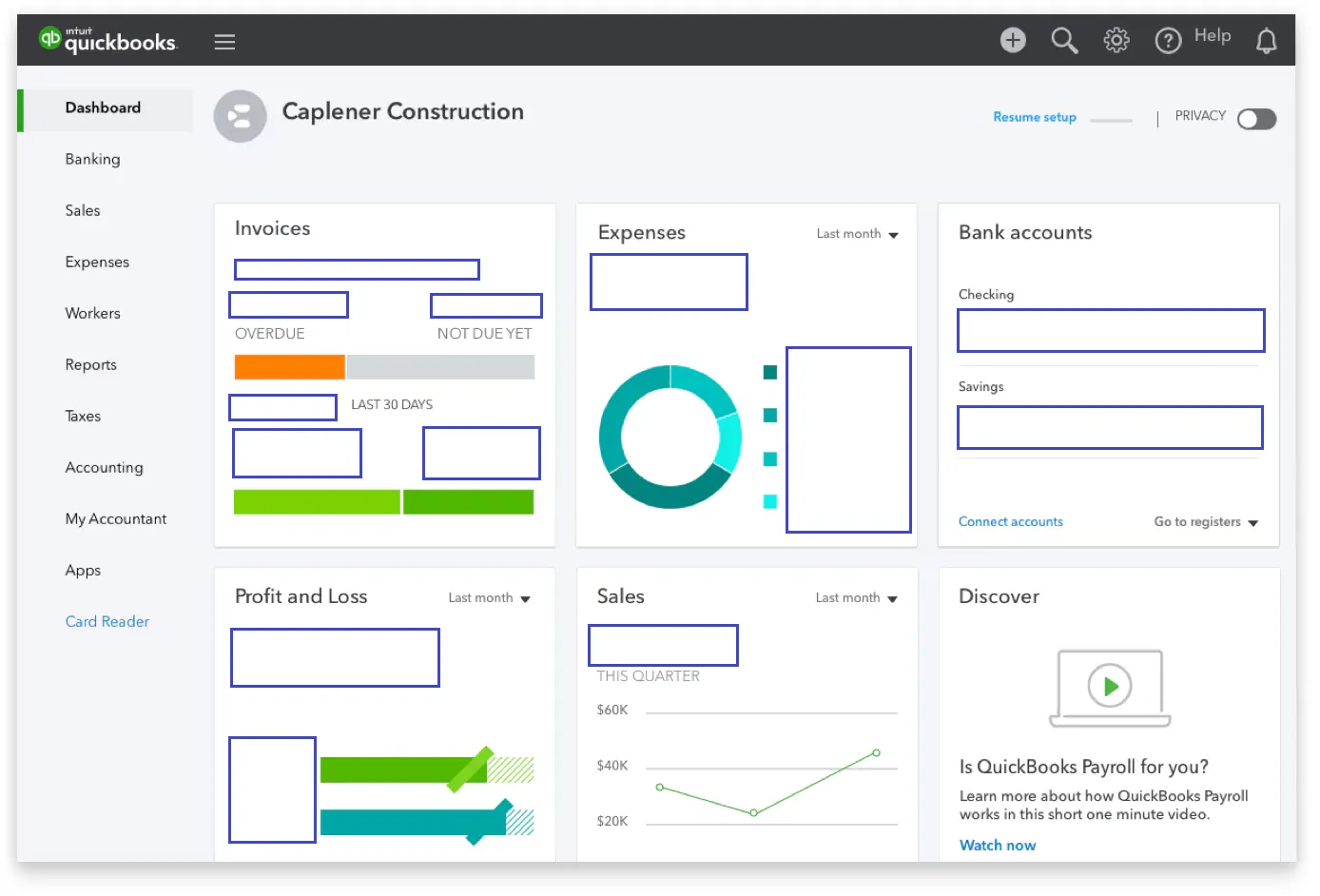

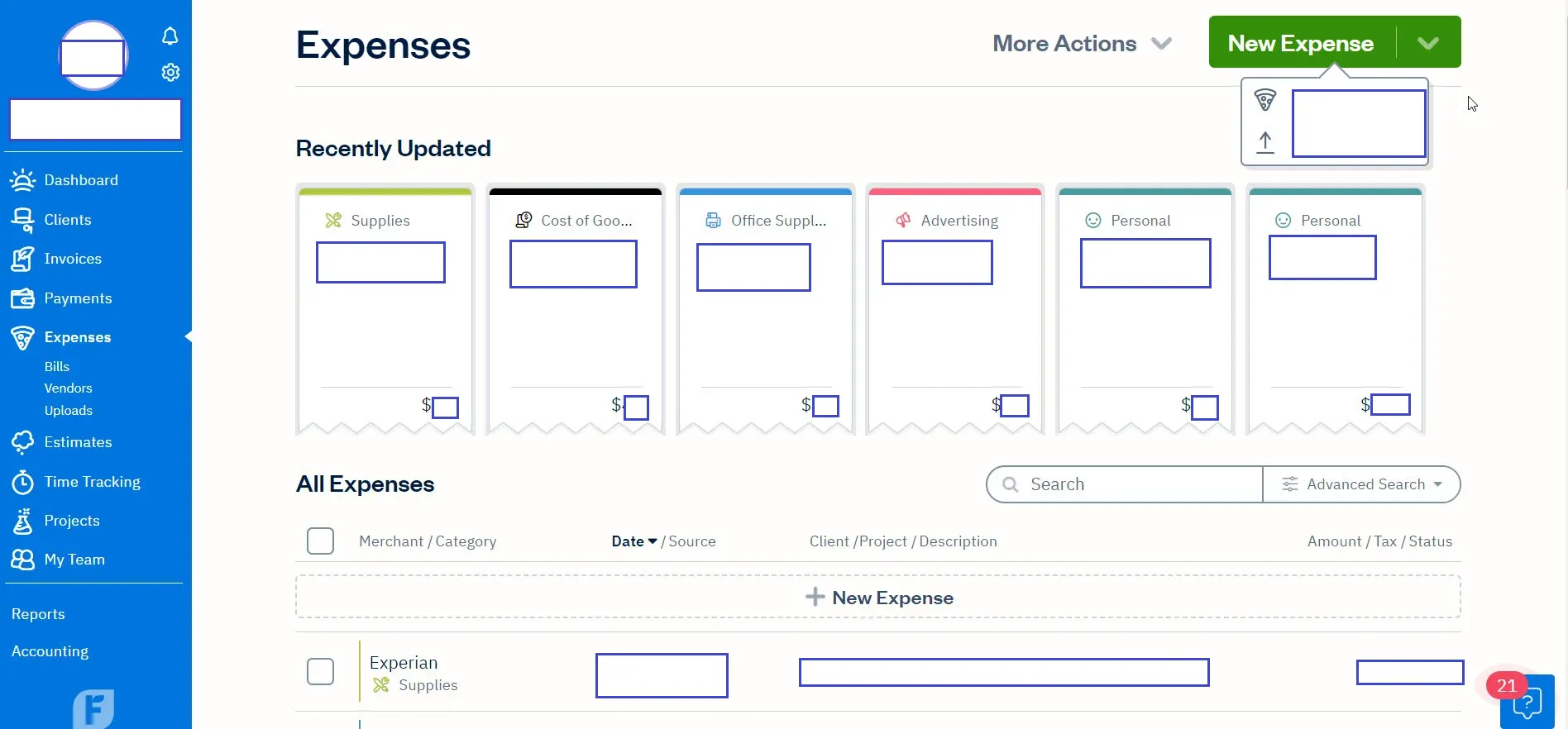

QuickBooks Online

QuickBooks has significantly expanded to lead the industry as the most cutting-edge accounting system for both offline and online retailers in the last three decades . If you are searching for the best accounting software for Shopify stores, QuickBooks is one of the well-known options out there.

Due to its extensive feature set, which includes more than 200 connectors, many currencies, payroll support, inventory management options, flexible invoicing, etc,… QuickBooks Online continues to be in the spotlight for best accounting software for Shopify. As an integrated Shopify accounting system, it has drawn 2.2 million users, including owners of Shopify stores.

Key features

- Sync QuickBooks Online with Shopify’s inventory management system — Keep an eye on your orders and the supply of raw materials. This will enable smooth data synchronization between your manufacturing and financial operations.

- Invoice customers intuitively – you can create personalized templates, send invoices, and automatically send reminders to them. Sending payment links to consumers will streamline the procedure all around.

- Track diverse revenue and expenses excellently – you can connect your numerous payment methods to QuickBooks Online, such as credit cards, bank transfers, and PayPal. Your earnings, losses, and outlays are shown on a single platform with attractive charts on top.

- Advanced reporting – It’s simple to browse, print, and alter profit/loss, expense, and balance sheets to produce interactive reports. The capacity to monitor cash flow and avert any undesirable occurrences is even more essential to the business’s day-to-day operations.

Pros and Cons

Pros

- Ease of Use: Features an intuitive interface and straightforward navigation, making it accessible for users with varying levels of accounting experience.

- Automated Tasks: Enhances workflows by automating the import of bank transactions, categorizing expenses, creating invoices, and sending payment reminders.

- Real-Time Insights: Delivers up-to-date financial information through customizable dashboards and reports, facilitating informed decision-making.

- Mobile Accessibility: Allows users to access and manage their finances anytime, anywhere with a convenient mobile app.

- Scalability: Adapts to the growth of your business with various plans and features that meet evolving needs.

- Integrations: Seamlessly connects with numerous business tools, including bank accounts, payment gateways, and eCommerce platforms, to streamline operations.

Cons

- Limited Customization: Offers less flexibility in customizing features such as reports and the chart of accounts compared to some other accounting software.

- Costly Add-Ons: Essential features like payroll and advanced reporting often come with additional fees, which can increase the overall cost of ownership.

- Customer Support: Receives mixed reviews regarding the quality and availability of customer support, with some users experiencing delays or difficulty in reaching knowledgeable representatives.

- Reporting Restrictions: Certain financial reports and data exports have limitations, potentially necessitating workarounds or manual adjustments.

- Learning Curve: While the software is generally user-friendly, some features and functionalities may have a learning curve for users new to accounting software.

- Occasional Glitches: Users have reported occasional bugs or glitches that can disrupt workflows, requiring troubleshooting or waiting for fixes.

Additional information and overall evaluation

Deployment | Cloud-based |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Early: $15/month - Growing: $42/month - Established: $78/month |

Free Trial | 30 days |

Shopify Integration | Yes |

Suitable for | Small-sized eCommerce businesses |

QuickBooks Online has proven itself to be one of the best accounting software for Shopify, offering a comprehensive and robust solution for managing financial operations in small-sized eCommerce businesses. Its cloud-based deployment ensures accessibility across multiple platforms, including MacOS, Windows, ChromeOS, and Android, with mobile app support for both Android and iOS. This flexibility allows business owners to manage their finances anytime, anywhere, which is surely very much appreciated. The integration with Shopify’s inventory management system further enhances its appeal, enabling smooth data synchronization between manufacturing and financial processes.

One of the standout features of QuickBooks Online is its extensive set of functionalities. With over 200 integrations, support for multiple currencies, payroll capabilities, and advanced reporting tools, it provides everything a Shopify store owner needs to streamline their financial operations. Automated tasks, such as importing bank transactions, categorizing expenses, creating invoices, and sending payment reminders, save time and reduce the likelihood of errors. Real-time insights through customizable dashboards and reports facilitate informed decision-making, helping businesses stay on top of their financial health.

Despite a few drawbacks, such as the additional costs for essential features like payroll and advanced reporting, limited customization options, and occasional customer support issues, QuickBooks Online remains a top choice for Shopify merchants. Its ease of use, scalability, and seamless integration capabilities make it one of the best accounting software for Shopify. The ability to track diverse revenue streams, manage expenses efficiently, and generate detailed financial reports ensures that Shopify store owners can focus on growing their business while maintaining accurate and up-to-date financial records. Overall, QuickBooks Online stands out as a powerful tool that enhances productivity and operational efficiency for eCommerce businesses.

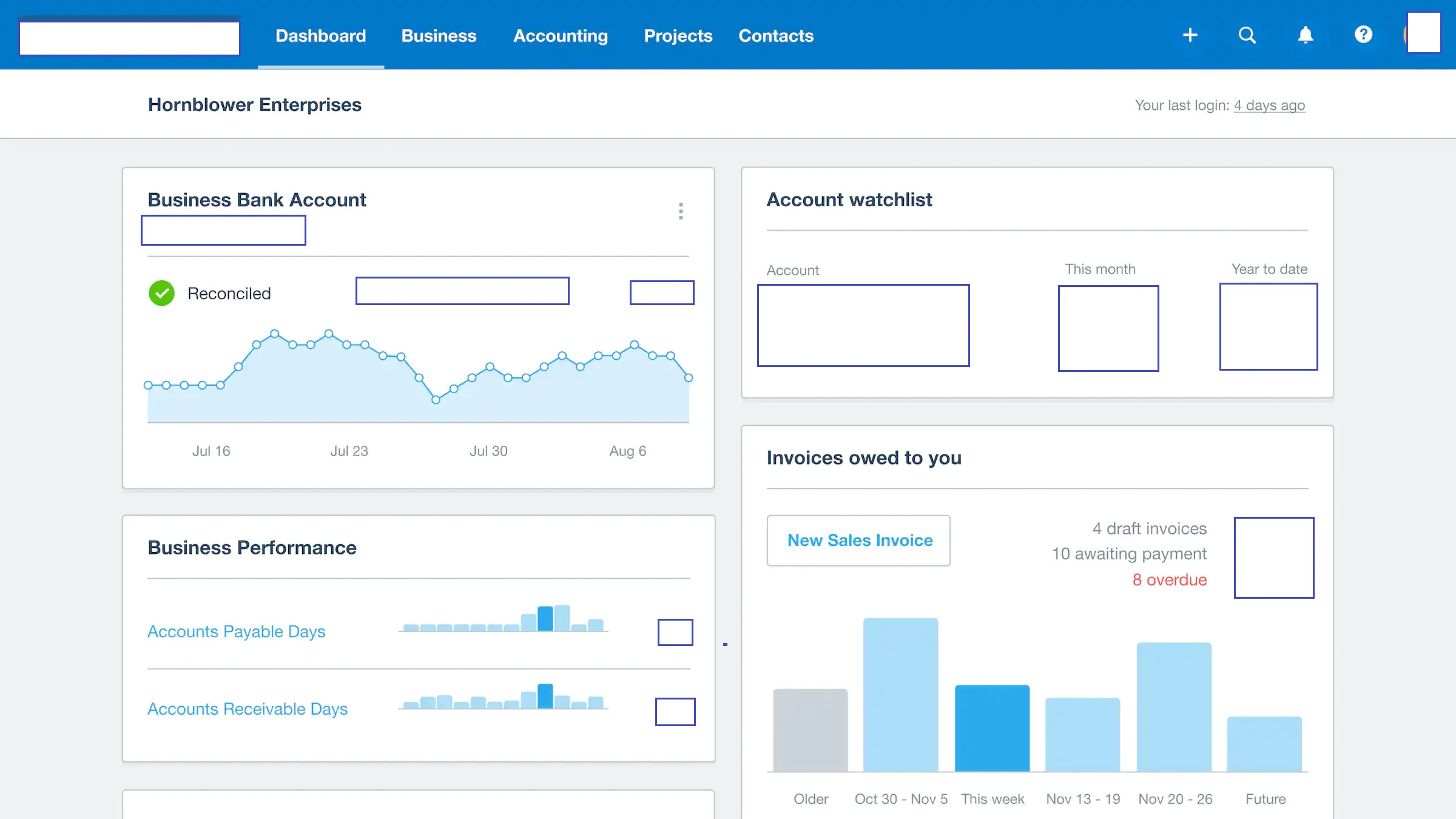

Xero

Xero is a highly regarded accounting software program that has earned a solid reputation not only among Shopify store owners but also across the broader eCommerce retail industry. This acclaim is largely due to its extensive collection of accounting tools, all integrated into a single suite to form a full-stack accounting system. Business owners and accountants appreciate the comprehensive nature of Xero, which simplifies financial management by bringing together various essential functions under one roof. This integration makes Xero particularly effective for managing the multifaceted financial operations of eCommerce businesses, positioning it as one of the best accounting software options for Shopify stores.

Xero excels in managing all aspects of payment processing, supporting transactions in over 160 different currencies, and providing seamless connections with multiple payment gateways and POS software. This capability is crucial for Shopify store owners who often deal with international customers and need reliable multi-currency support. Additionally, Xero’s features include paperless expense management and efficient bookkeeping, which help streamline operations and reduce manual workload. The software’s ability to integrate with various financial and business tools further enhances its utility, making it a powerful ally for Shopify merchants. By offering a robust, all-encompassing financial management solution, Xero stands out as one of the best accounting software for Shopify, helping businesses maintain accurate financial records and make informed decisions.

Key features

- Payroll Processing: Supports payroll across all 50 states, allowing users to see when payments are due, track them, and ensure timely payment. It also enables the analysis of accounts payable with a quick view, scheduling of advanced payments, and making batch payments.

- Banking: Connects directly to your bank to track and facilitate daily transactions securely. Monitors the flow of money through a secure connection that integrates seamlessly into the solution.

- Expense Management: Tracks and manages expense claims effortlessly. Provides real-time data and reports to gain insights into spending patterns and trends. Users can record costs, see and approve claims, view overall spending, and manage reimbursements. The feature also includes receipt capture to monitor employee spending and verify costs.

- Project Management: Integrates with other workflows to enhance financial project management. Allows users to provide quotes for client work before starting, and track time, costs, profitability, and other variables to create accurate invoices.

- Customer History: Utilizes smart lists and contacts to manage detailed customer information, including contact details, emails, past sales, invoices, and past payments. This feature helps maintain comprehensive records when working with partners or clients.

- Detailed reporting: the system can produce 65 reports based on the fundamentals of payrolls, profit/losses, and balance sheets. But it offers an equity report that lists the owner’s investments and equity withdrawals, something that the majority of competitors don’t. Even though it might not apply to everyone, it is a strong feature for the firms it does.

Pros and Cons

Pros

- Simple and Intuitive Interface: Xero’s clean layout and straightforward navigation make it easy for users of all skill levels to manage their finances.

- Automated Tasks: Xero automates repetitive tasks such as invoicing, expense tracking, and bank reconciliation, saving users time and reducing errors.

- Mobile App for On-the-Go Access: Xero’s mobile app allows users to manage finances and stay updated on business performance anytime, anywhere.

- Customizable Reports and Dashboards: Users can gain valuable insights into cash flow, profitability, and other key financial metrics through Xero’s customizable reports and dashboards.

- Multi-User Access and Permissions: Xero provides secure multi-user access and permission controls, enabling seamless collaboration with team members and advisors.

Cons

- Limited Inventory Management: Xero lacks advanced inventory tracking features, making it less suitable for businesses with complex inventory needs.

- Learning Curve for Complex Features: While basic tasks are straightforward, advanced features like multi-currency accounting can be challenging for non-accountants to navigate.

- Higher Cost for Advanced Features: Access to advanced features such as payroll processing and multi-currency accounting comes at a higher price, which may exceed the budget for smaller businesses.

- Limited Phone Support: Xero primarily relies on email and live chat for support, which may not be ideal for users needing immediate assistance with critical issues.

- Integration Limitations: Although Xero offers many integrations, some key business tools may not integrate seamlessly, necessitating workarounds or data duplication.

Additional information and overall evaluation

Deployment | Cloud-based |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Early: $15/month - Growing: $42/month - Established: $78/month |

Free Trial | 30 days |

Shopify Integration | Yes |

Suitable for | Small-sized eCommerce businesses |

Xero has emerged as one of the best accounting software for Shopify due to its cloud-based deployment, extensive platform support, and robust feature set tailored for small-sized eCommerce businesses. Available on Linux, MacOS, Windows, ChromeOS, and Android, Xero ensures comprehensive accessibility across various devices, complemented by its mobile app for Android and iOS. This versatility allows Shopify store owners to manage their finances anytime and anywhere, aligning perfectly with the dynamic nature of eCommerce operations.

Xero’s strengths lie in its intuitive interface, automated tasks, and real-time insights. Automated features such as invoicing, expense tracking, and bank reconciliation save valuable time and reduce errors, streamlining financial workflows. Additionally, Xero provides customizable reports and dashboards that offer real-time data, enabling informed decision-making. The ability to integrate seamlessly with Shopify and other business tools further enhances its utility, ensuring smooth operations and comprehensive financial management.

Despite some limitations, such as higher costs for advanced features and limited phone support, Xero remains a top contender for Shopify users seeking reliable and efficient accounting software. Its affordability, good customer service, and excellent functionality make it a strong choice for small-sized eCommerce businesses. By providing a scalable and adaptable accounting solution, Xero helps Shopify store owners manage their finances effectively, supporting business growth and operational efficiency. Overall, Xero’s combination of features, user-friendly design, and integration capabilities solidify its position as one of the best accounting software for Shopify.

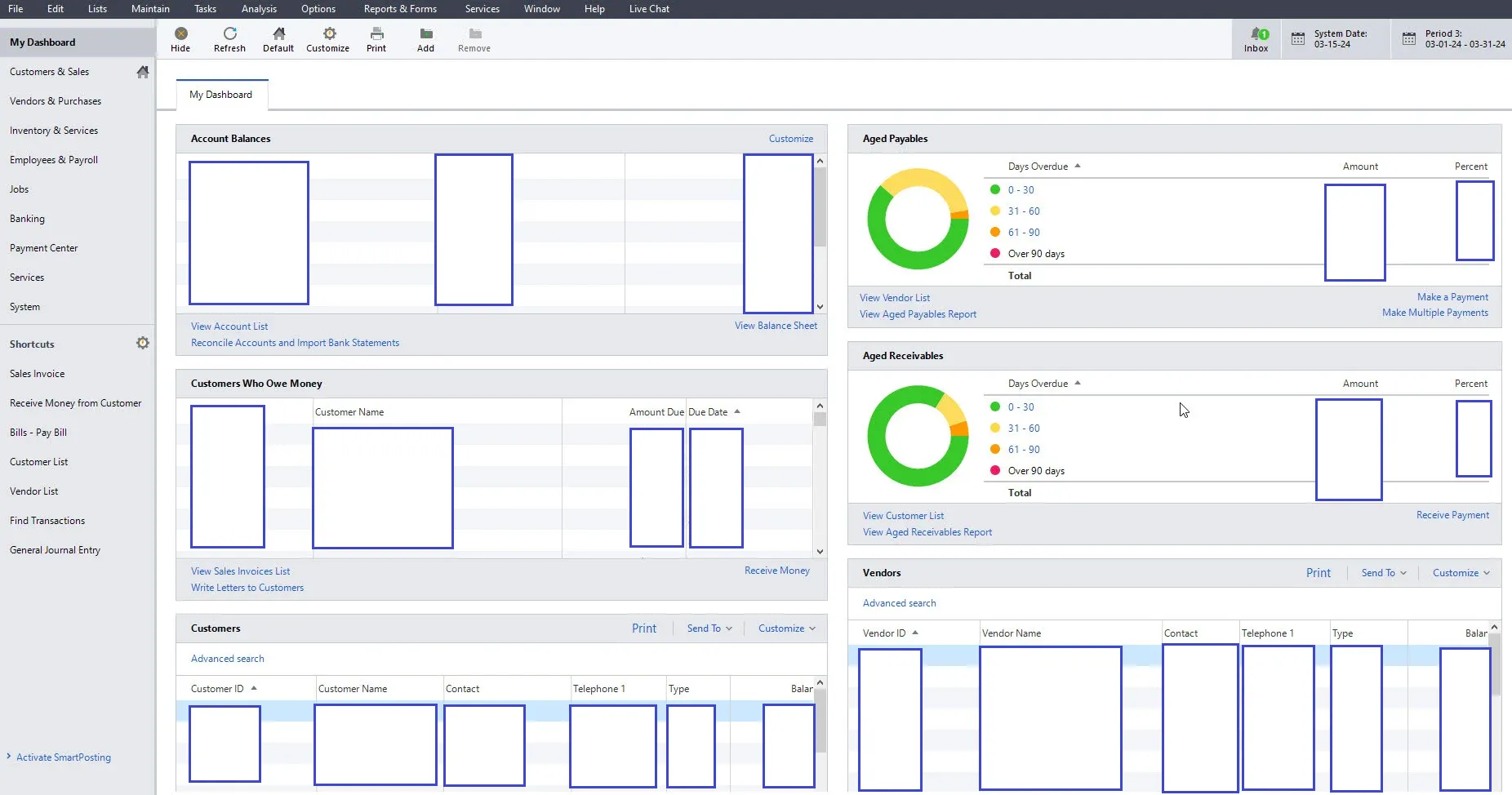

Sage 50cloud Accounting

Sage 50cloud Accounting is a robust accounting software solution that combines the reliability and power of desktop software with the convenience and flexibility of cloud-based access. Designed for small to medium-sized businesses, Sage 50cloud Accounting offers comprehensive tools for managing finances, including invoicing, payroll, inventory, and reporting. With its seamless integration with other platforms, Sage 50cloud Accounting provides users with enhanced productivity and collaboration capabilities, making it easier to manage business operations from anywhere, at any time.

Sage 50cloud Accounting stands out as one of the best accounting software for Shopify; a versatile and powerful accounting solution tailored to meet the diverse needs of growing businesses. Its feature-rich platform includes automated bank reconciliation, advanced inventory management, and customizable financial reports that provide deep insights into business performance. The software’s integration with cloud services ensures that users can securely access their data and collaborate in real-time, whether they’re in the office or on the go. Additionally, Sage 50cloud Accounting offers robust security features, regular updates, and dedicated customer support, ensuring that businesses can rely on it to manage their finances efficiently and effectively. By leveraging the strengths of both desktop and cloud environments, Sage 50cloud Accounting delivers a comprehensive accounting solution that enhances operational efficiency and supports business growth.

Key features

- Cash Flow and Invoicing: Offers a clear view of finances with customizable cash flow settings tailored to the business’s specific needs.

- Payment and Banking: Automates accounts payable, purchase orders, invoices, payments, and bank feeds, including reconciliation. Automatic reconciliation reduces manual data entry and simplifies the acceptance of payments.

- Advanced Inventory Management: Monitors cost and quantity, ensuring that everything is kept in stock and staying ahead of purchase orders.

- Job Costing: Provides estimates on project durations and profitability, giving insight into how much time and money are being spent on each job.

- Payroll: Tracks employee tips, vacations, and hours worked, making payroll processing straightforward with options for direct deposit and pay cards.

- Reporting: Supports one-click generation of reports for payables, sales tax, expenses, receivables, inventory, payroll, and more. Allows for the design and customization of reports to meet business requirements.

- Security Shield: Ensures financial security with advanced protection features for customers, safeguarding their financial data.

Pros and Cons

Pros

- Ease of Use: Features an intuitive interface and simple navigation for everyday accounting tasks.

- Mobile App: Enables you to manage your finances on the go with the Sage 50cloud mobile app.

- Automation: Automates repetitive tasks such as bank reconciliations and invoicing, saving time and reducing errors.

- Reporting and Analytics: Offers customizable reports and dashboards to gain insights into your business performance.

- Integrations: Connects with other business applications like CRM and eCommerce platforms for a streamlined workflow.

- Scalability: Grows with your business, accommodating increasing data volumes and user needs.

- Security: Provides robust security features to protect your financial data

Cons

- Pricing: Can be expensive for small businesses compared to some competitors.

- Limited Features: May lack some advanced features needed by larger businesses.

- Learning Curve: Interface can be complex for new users, necessitating training or investment in onboarding.

- Integrations: Not all third-party applications integrate seamlessly, sometimes requiring workarounds or additional costs.

- Performance: Occasional lag or slowness, especially on older hardware or with large dataset

Additional information and overall evaluation

Deployment | Cloud-based |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Lite: $9.50/month - Plus: $16.50/month - Premium: $30.00/month |

Free Trial | 30 days |

Shopify Integration | Requires OneSaaS |

Suitable for | Small-sized eCommerce businesses and startups |

Sage 50cloud Accounting is recognized as one of the best accounting software for Shopify, particularly suited for medium-sized eCommerce businesses. Its cloud-based deployment combined with the reliability of desktop software offers a robust solution that meets diverse financial management needs. Sage 50cloud’s integration with Shopify ensures that users can efficiently manage their online store’s finances, providing a seamless experience across both platforms. The software supports various essential functions, including invoicing, payroll, inventory management, and detailed financial reporting, which are crucial for maintaining accurate financial records and making informed business decisions.

One of the key strengths of Sage 50cloud Accounting is its user-friendly interface and automation capabilities, which simplify complex accounting tasks. By automating repetitive processes such as bank reconciliations and invoicing, Sage 50cloud helps save time and reduce the likelihood of errors. Additionally, the software’s mobile app allows users to access their financial data on the go, enhancing flexibility and productivity. With robust security features, Sage 50cloud ensures that financial data is protected, giving users peace of mind. Despite its higher cost compared to some competitors and a learning curve for new users, its comprehensive feature set and scalability make it a valuable investment for growing businesses.

Overall, Sage 50cloud Accounting stands out as one of the best accounting software for Shopify due to its powerful features, ease of integration, and ability to support business growth. The software’s advanced reporting and analytics capabilities provide valuable insights into business performance, helping eCommerce businesses optimize their operations and achieve their financial goals. While it may require a higher upfront investment and some initial training, the long-term benefits and enhanced efficiency it offers make Sage 50cloud Accounting an excellent choice for medium-sized eCommerce businesses using Shopify.

Freshbooks

Freshbooks is a cloud-based accounting software designed for freelancers and small businesses. Freshbooks makes up for its lack of advanced functionality with a user-friendly and quick-to-navigate layout. It has one of the greatest customer assistance systems, and its accounting and billing processes are easy to understand. Freshbooks also encourages consumers to contact them for human assistance rather than just relying on publications; because while the initial learning curves are not overly challenging, having some guidance can significantly enhance your overall experience and benefit you greatly.

A minor drawback is that connecting Freshbooks to Shopify requires the OneSaas app. However, the fact that it streamlines tax payments with its pre-defined classifications more than makes up for it. Additionally, every item from your Shopify store will be automatically transferred, allowing you to start properly determining selling prices.

Key features

- Invoicing: Customize invoices and thank-you emails with your company logo. Users can request deposits on invoices at the start of a project, ensuring they have the necessary funds to support the project during its preliminary stages.

- Expense Management: Link bank accounts and credit cards directly to FreshBooks, eliminating the need for manual data entry. Real-time data display allows users to instantly track where their money is going.

- Time Tracking: Manage project and task durations with the time tracking feature, which includes a timer that accurately records task durations. These time logs can easily be added to invoices. Users can also monitor how employees spend their time, addressing issues before they become major problems.

- Project Management: Store files and vital attachments in the centralized project management tool, enabling teams to efficiently locate necessary documents and continue their high-caliber tasks. Users can also set project deadlines, share images and files through FreshBooks, and designate rates or hours to specific projects.

- Accounting: Obtain precise profit and loss calculations and easily share financial data and reports with accountants. This module streamlines bank reconciliations by importing and organizing financial transactions, validating or revising automated matching recommendations, and drafting and exporting Excel-friendly summary reports.

- Reports: Color-code spending breakdowns and generate profit and loss reports with the reporting feature. Users can save, export, and print financial reports for their accountants. This tool also simplifies tax season by storing valuable data such as money earned and taxes already paid.

Pros and Cons

Pros

- Simple and Intuitive Interface: FreshBooks features a clean layout and straightforward navigation, making it easy for even non-accountants to manage their finances.

- Time-Saving Features: Automated invoicing, expense categorization, and online payments help users save time and effort on routine accounting tasks.

- Mobile App for On-the-Go Management: Access invoices, track expenses, and manage clients from smartphones or tablets, ensuring flexibility and productivity.

- Seamless Integrations with Popular Tools: FreshBooks streamlines workflows by connecting with tools like Stripe, PayPal, and Google Workspace, centralizing financial data.

Cons

- Limited Features for Complex Accounting: FreshBooks may not handle advanced accounting needs such as inventory management, double-entry bookkeeping, or fixed asset management.

- Not Ideal for Large Businesses: As businesses grow, FreshBooks’ scalability and feature set might become insufficient for complex financial operations.

- Price Increases with Client Base: The cost of FreshBooks can rise significantly as you add more clients, potentially exceeding initial budget expectations.

- Basic Reporting and Analytics: FreshBooks’ reporting capabilities may be insufficient for businesses requiring in-depth financial analysis and data insights.

- Limited Customer Support for Free Plans: Free trial and Lite plan users might have limited access to customer support, potentially hindering troubleshooting and issue resolution.

Additional information and overall evaluation

Deployment | Cloud-based |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Lite: $9.50/month - Plus: $16.50/month - Premium: $30.00/month |

Free Trial | 30 days |

Shopify Integration | Requires OneSaaS |

Suitable for | Small-sized eCommerce businesses and startups |

FreshBooks stands out as one of the best accounting software for Shopify, especially for small-sized eCommerce businesses and startups. Its cloud-based deployment ensures accessibility across various platforms, including Linux, MacOS, Windows, ChromeOS, and Android, with mobile apps available for both Android and iOS. FreshBooks is known for its user-friendly interface and straightforward navigation, making it easy for even non-accountants to manage their finances effectively.

One of the key reasons FreshBooks is considered one of the best accounting software for Shopify is its seamless integration with popular tools such as Stripe, PayPal, and Google Workspace, which centralizes financial data and streamlines workflows. Although it requires OneSaaS for Shopify integration, FreshBooks’ comprehensive feature set, including automated invoicing, expense management, time tracking, project management, and reporting, makes it a powerful tool for managing eCommerce finances. The software’s ability to link bank accounts and credit cards for real-time expense tracking, along with its intuitive project management capabilities, enhances productivity and efficiency for Shopify store owners.

Despite some limitations, such as basic reporting and analytics, and the need for additional costs for advanced features, FreshBooks remains a top contender for eCommerce businesses using Shopify. Its simple and intuitive interface, combined with time-saving features and robust mobile accessibility, ensures flexibility and productivity on the go. While it may not be ideal for large businesses with complex financial operations, FreshBooks provides excellent value and functionality for small to medium-sized Shopify stores. Overall, FreshBooks’ ability to integrate seamlessly with essential business tools and its focus on user-friendly financial management make it one of the best accounting software for Shopify store.

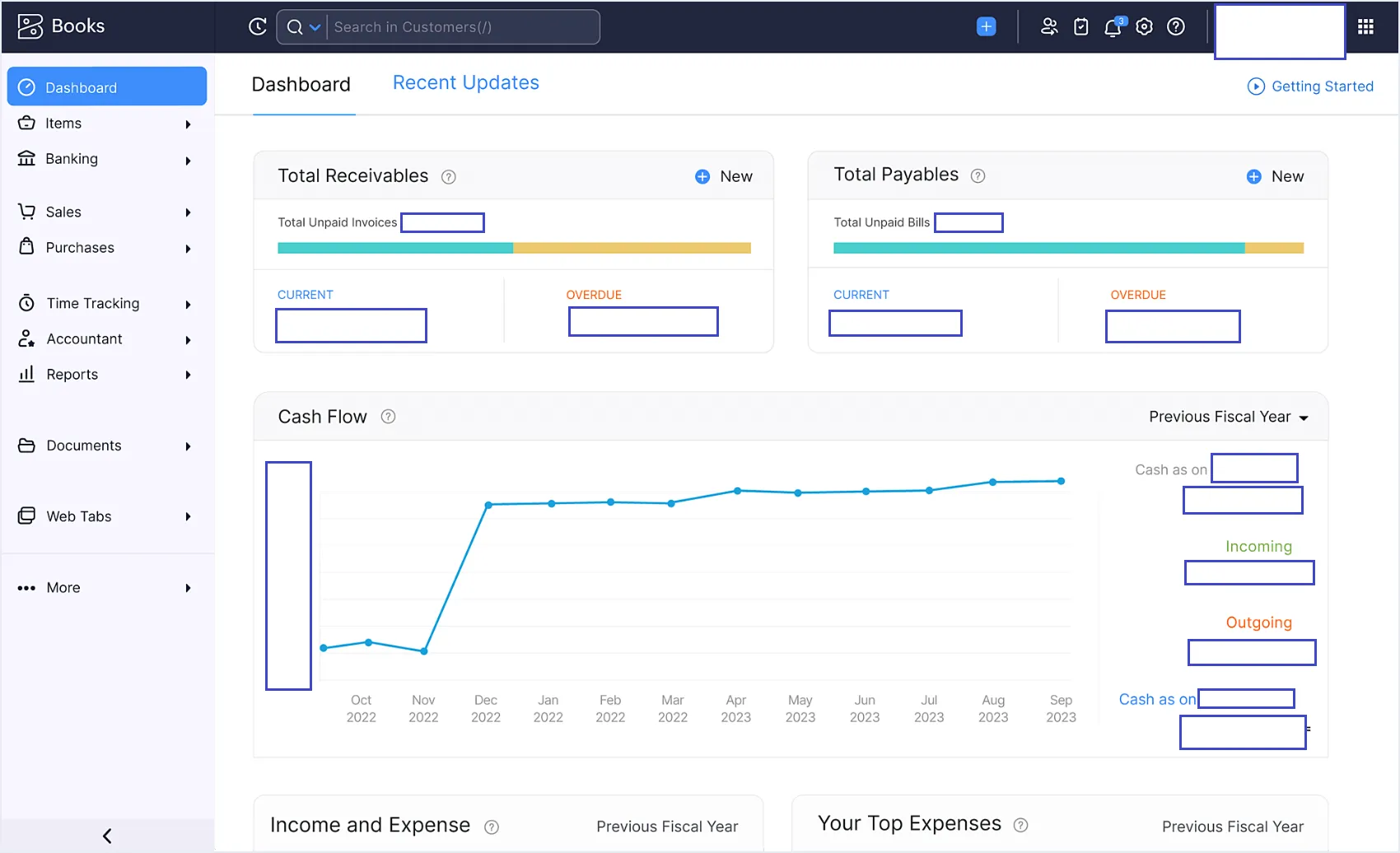

Zoho Books

Zoho Books is known for being one of the best accounting software for Shopify store. It offers comprehensive accounting features and integrates with Shopify. It also allows you to manage invoices, track expenses, and reconcile bank transactions, streamlining your eCommerce accounting processes.

Zoho Books is a cloud-based accounting software designed to simplify and streamline financial management for businesses of all sizes. It offers a comprehensive suite of features that help you handle your accounting, invoicing, expense tracking, and reporting needs. Whether you’re a small business owner, a freelancer, or a growing enterprise, Zoho Books aims to provide user-friendly tools to manage your finances effectively.

Key features

- Sales Orders: Customize sales orders with your company’s logo, fonts, and colors to reflect your brand identity. Easily convert approved estimates into sales orders and invoices with just a few clicks. Identify your top clients and products using real-time reports generated from transaction histories.

- Purchase Orders: Track all purchased items and negotiated prices with vendors using the purchase order management tool. Print, copy, and share purchase orders via email to collaborate efficiently with clients, partners, and internal stakeholders, ensuring swift task completion.

- Online Payments: Choose from a variety of payment gateways, including Stripe, PayPal, Worldpay, and more, to collect customer payments promptly. Enable recurring transactions to automatically receive payments at weekly, monthly, or yearly intervals.

- Reporting: Monitor key performance indicators such as total receivables, sales, and top expenses through the reporting module’s dashboard. Access detailed reports like profit and loss statements, balance sheets, and cash flow statements to analyze data and make informed decisions.

- Automation: Utilize automation tools to send instant payment reminders, save client information for future automatic billing, and manage recurring invoices. Automatically dispatch transactions, streamlining your accounting processes with Zoho Books.

Pros and Cons

Pros

- Intuitive Interface: Features a simple and easy-to-navigate interface, making it accessible even for users without prior accounting experience.

- Automation Superpowers: Automates tasks such as invoicing, payment reminders, bank reconciliation, and financial reporting, saving users significant time and effort.

- Seamless Integrations: Integrates smoothly with other Zoho apps like CRM and Projects, as well as popular third-party tools, streamlining workflows and eliminating data silos.

Cons

- Transaction Limits: The highest plan caps the number of monthly transactions at 5,000, which may hinder high-volume businesses.

- Inventory Management Constraints: While Zoho Books offers inventory tracking, it lacks advanced features like sales analytics and in-depth item breakdowns, making it less suitable for businesses with complex inventory needs.

- Coding Requirements for Automation: Unlocking the full potential of automation features often requires knowledge of coding (Deluge script), posing a challenge for non-technical users.

- Occasional Reporting Issues: Users may encounter occasional glitches or inconsistencies in financial reports, necessitating careful review and potential manual adjustments.

- Multiple Subscriptions for Multiple Businesses: Managing multiple businesses requires separate subscriptions, which can become cost-prohibitive for users with several entities.

Additional information and overall evaluation

Deployment | Cloud-based |

Platforms | MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Free - Standard: $20/month - Professional: $50/month - Premium: $70/month |

Free Trial | 14 days |

Shopify Integration | Yes |

Suitable for | All-sized eCommerce Business |

Zoho Books is a versatile and comprehensive accounting software solution, making it one of the best accounting software for Shopify users across businesses of all sizes. Its intuitive interface ensures that even those without prior accounting experience can navigate and manage their finances effortlessly. Zoho Books stands out with its robust automation features, which simplify and streamline tasks such as invoicing, payment reminders, bank reconciliation, and financial reporting. These capabilities save users significant time and effort, allowing them to focus more on growing their eCommerce business.

One of the key strengths of Zoho Books is its seamless integration with other Zoho apps, such as CRM and Projects, as well as popular third-party tools. This integration eliminates data silos and ensures smooth workflows, making it easier for Shopify store owners to manage various aspects of their business from a single platform. Although Zoho Books does impose transaction limits and has some inventory management constraints, its overall feature set is highly beneficial for eCommerce operations. The software’s ability to automate complex accounting tasks and provide real-time financial insights makes it a powerful tool for Shopify businesses looking to optimize their financial management.

Despite some minor drawbacks, such as the need for coding knowledge to unlock advanced automation features and occasional reporting issues, Zoho Books remains a top choice for Shopify store owners. Its flexibility, comprehensive integration capabilities, and user-friendly design position it as one of the best accounting software for Shopify. Whether you’re a small startup or a large eCommerce enterprise, Zoho Books can scale with your business needs, providing reliable and efficient financial management to support your growth.

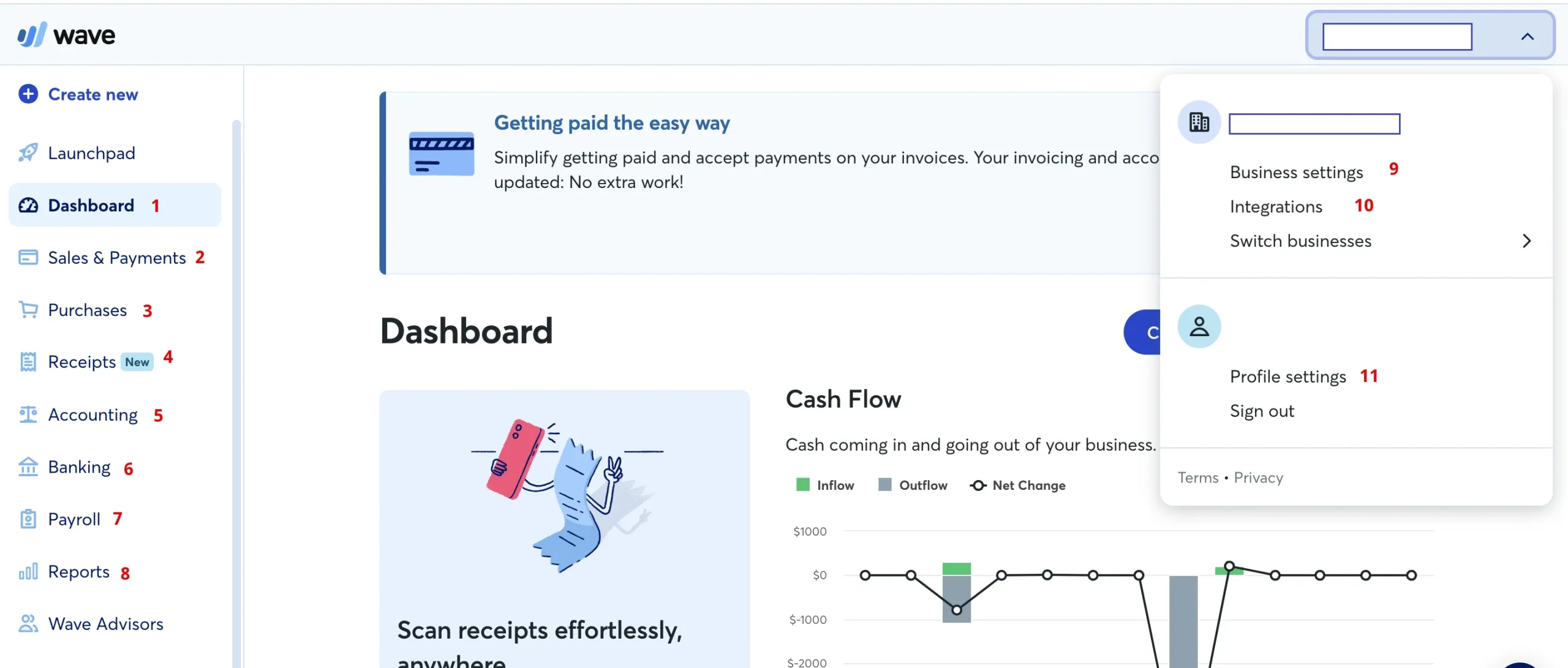

Wave

Wave Accounting is a highly accessible and user-friendly accounting software designed specifically for small businesses and freelancers. As a cloud-based solution, Wave offers a comprehensive suite of financial tools that include invoicing, expense tracking, payroll, and receipt scanning, all available for free. Its intuitive interface and seamless integration capabilities make it an ideal choice for those who are new to accounting software. Wave’s features are tailored to meet the needs of small business owners, allowing them to manage their finances with ease and confidence.

Wave stands out as one of the best accounting software for Shopify due to its simplicity, cost-effectiveness, and robust feature set. The software integrates effortlessly with Shopify, enabling store owners to track sales, manage expenses, and handle payroll without hassle. Wave’s ability to provide real-time financial insights through customizable reports and dashboards empowers Shopify merchants to make informed business decisions. Additionally, the software’s strong security measures ensure that all financial data is protected. Despite being free, Wave offers a professional level of service, making it a top choice for small eCommerce businesses looking to streamline their financial operations without incurring high costs.

Key features

- Smooth Integrations: Seamlessly integrate Shopify transactions and link with PayPal, Shoeboxed, and Etsy accounts, ensuring all your financial data is connected and easily accessible.

- Intricate Dashboards: Access detailed dashboards that display cash balances, invoice statuses, incomes, expenses, and payments. This feature also provides reminders for bills and invoices, helping you stay on top of your financial obligations.

- Export Various Reports: Export a wide variety of accounting reports, including profit and loss statements, sales tax reports, cash flow analyses, comparative reports, and more, to gain deeper insights into your financial health.

- Automatic Updates: Receive prompt updates and reminders on invoices, payments, and payroll details, ensuring you always have the most current information at your fingertips.

- Evaluate High Volumes of Transactions: Efficiently process large volumes of transactions to maintain rapid bookkeeping practices. Users can also perform and accept transactions in foreign currencies and search for transactions based on descriptions.

- Top-Notch Security: Protect your financial information with robust security features, including bank connections with 256-bit encryption in read-only formats and PCI Level-1 security for managing credit card and bank account information.

Pros and Cons

Pros

- Easy Setup: Quickly get started with easy account setup and installation, allowing users to begin managing their finances immediately.

- Available Anywhere: Access Wave on both computers and mobile devices, enabling users to make changes from virtually any location. All updates are automatically saved and synced, ensuring that everyone always has the most current information.

- Instant Transactions: Connect bank accounts for instant transaction recording, eliminating the need for manual receipt entry.

- Modules: Benefit from a variety of capabilities, including an assortment of reports, bank account syncing, and invoice reminders.

Cons

- Frustrating Reconciliation Process: Matching transactions can be difficult and time-consuming, leading to delayed reconciliations and potential errors.

- Limited Reporting Options: Wave lacks robust and flexible reporting features, including preset date options for generating customized reports.

- Lack of Phone Support: Wave primarily relies on email and online resources for support, which can be frustrating for users who prefer immediate assistance or have complex issues to resolve.

- Occasional Glitches and Errors: Users have reported occasional software glitches, such as duplicated transactions or difficulties with bank syncing, which can disrupt workflows and create data inconsistencies.

Additional information and overall evaluation

Deployment | Cloud-based |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Standard: Free - Pro plan: $16/month |

Free Trial | No |

Shopify Integration | Yes |

Suitable for | Small to medium-sized eCommerce Business |

Wave Accounting stands out as one of the best accounting software for Shopify, particularly for small to medium-sized eCommerce businesses. Its cloud-based platform offers an intuitive and user-friendly interface that makes it easy for users, even those without prior accounting experience, to manage their finances effectively. The ease of setup and installation allows Shopify store owners to quickly get started and take advantage of its robust features. Wave’s ability to seamlessly integrate with Shopify and other platforms like PayPal, Shoeboxed, and Etsy ensures that all financial data is connected and easily accessible, which is crucial for maintaining accurate financial records and making informed business decisions.

One of the key reasons Wave is considered one of the best accounting software for Shopify is its comprehensive feature set that includes automated invoicing, expense management, and real-time transaction recording. The software’s intricate dashboards provide a clear overview of cash balances, invoice statuses, incomes, expenses, and payments, helping business owners stay on top of their financial health. Wave also supports the export of various accounting reports, such as profit and loss statements and cash flow analyses, offering valuable insights into business performance. Furthermore, Wave’s strong security measures, including 256-bit encryption and PCI Level-1 security, ensure that all financial data is protected.

Despite some limitations, such as a challenging reconciliation process and limited reporting options, Wave remains a top choice for Shopify store owners due to its affordability and accessibility. The lack of phone support and occasional software glitches are minor drawbacks compared to the overall benefits it provides. By offering essential accounting features without the high cost, Wave empowers small to medium-sized eCommerce businesses to streamline their financial operations and focus on growth. Overall, Wave’s combination of user-friendly design, powerful integrations, and robust security features make it one of the best accounting software solutions for Shopify.

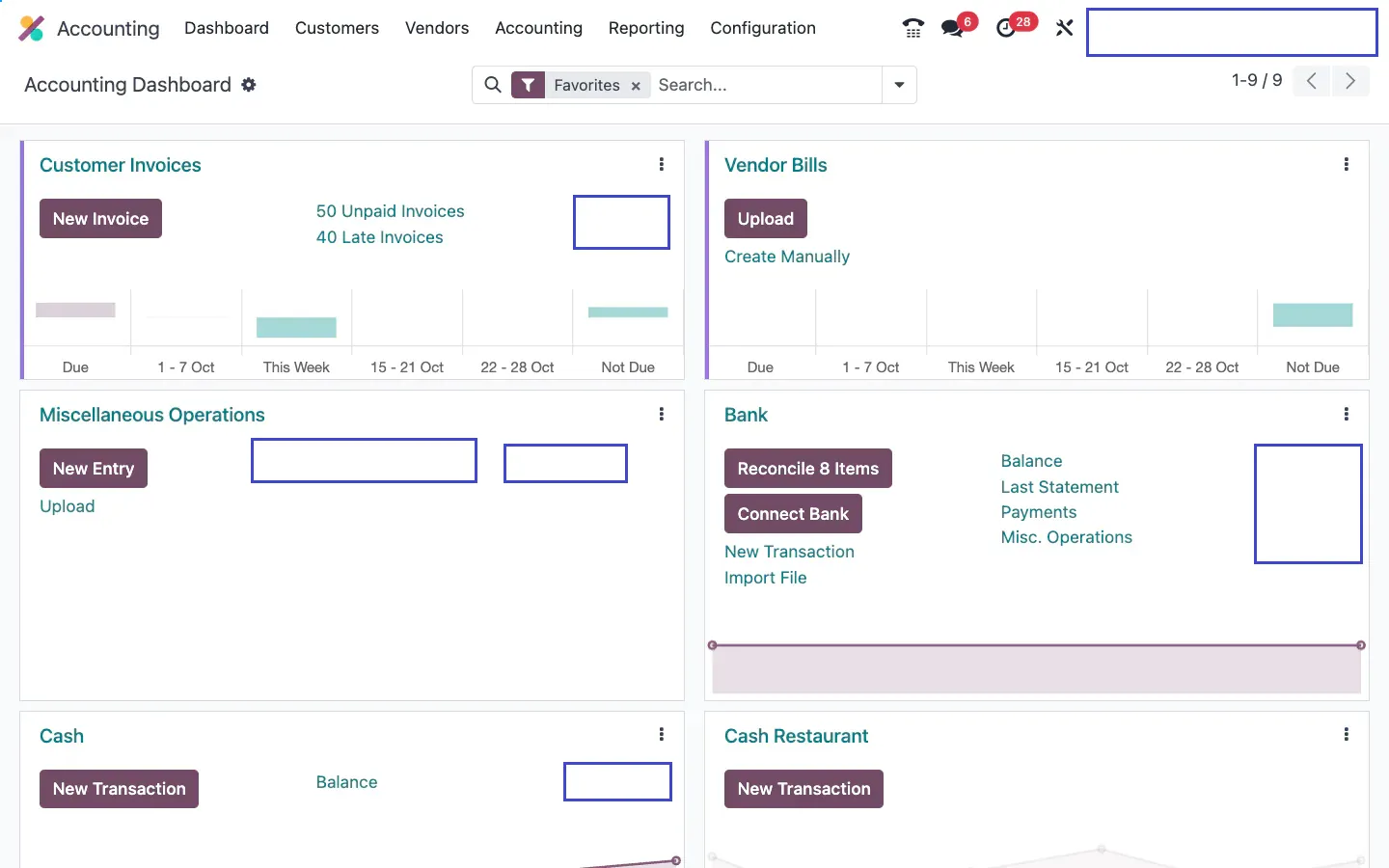

Odoo Accounting

Odoo Accounting is a robust and versatile web-based accounting software that is part of the extensive Odoo suite of business applications. This software is tailored to meet the needs of small and medium-sized businesses, offering a comprehensive range of features designed to manage financial operations with ease and precision. Known for its affordability, ease of use, and high customizability, Odoo Accounting is an ideal solution for businesses seeking to streamline their processes in invoicing, bookkeeping, reporting, and tax management. Its user-friendly interface and seamless integration within the Odoo ecosystem make it a powerful tool for managing various financial tasks efficiently.

One of the core strengths of Odoo Accounting is its ability to create and send professional invoices using customizable templates, which can be automated for follow-ups and payment reminders to ensure timely collections. The software excels in bookkeeping, managing all financial transactions such as expenses, income, and bank reconciliations with automated journal entries that maintain accuracy and efficiency. Odoo Accounting stands out as one of the best accounting software for Shopify store owners due to its powerful and integrated solution that handles various financial tasks seamlessly. By offering a comprehensive suite of features, Odoo Accounting helps businesses maintain accurate financial records, enhance operational efficiency, and support growth in the competitive eCommerce landscape.

Key features

- Automated Invoicing: Generate professional invoices, monitor payments, manage recurring invoices, and automate reminders for overdue payments to streamline the invoicing process.

- Expense Tracking: Effortlessly record and categorize expenses, attach receipts, and generate expense reports for reimbursement and tax purposes, ensuring accurate expense management.

- Financial Reporting: Access real-time dashboards and generate customizable reports, including profit and loss statements, balance sheets, cash flow statements, and tax reports, to track key financial metrics.

- Payroll Integration: Integrate with Odoo’s Payroll module to streamline payroll processing and expense management.

- Project Accounting: Track project costs and revenues, manage budgets, and generate project-specific financial reports to keep project finances under control.

- Customizable Workflows: Define approval processes for invoices, expenses, and other financial transactions to ensure control and compliance with customizable workflows.

- User Roles and Permissions: Assign different access levels to users based on their roles and responsibilities, ensuring data security and confidentiality through robust user roles and permissions management.

Pros and Cons

Pros

- Intuitive Interface: Users consistently praise Odoo Accounting’s user-friendly design, making it easy to navigate and learn, even for those without extensive accounting experience.

- Automation: Odoo streamlines numerous accounting tasks, such as invoice creation, bill payment, bank reconciliation, and financial reporting, saving time and reducing errors.

- Integration: Seamless integration with other Odoo modules, such as Sales, CRM, and Inventory, provides a unified view of business data and eliminates the need for manual data entry across multiple systems.

- Customization: Odoo Accounting can be customized to fit the specific needs of businesses in various industries and sizes, ensuring it aligns with unique accounting workflows and requirements.

- Accessibility: Odoo’s cloud-based nature allows access from any device with an internet connection, enabling work from anywhere and anytime, enhancing flexibility and collaboration.

Cons

- Learning Curve: While the interface is generally intuitive, mastering all of Odoo Accounting’s features and functionalities can involve a learning curve, especially for those new to accounting software.

- Reporting Flexibility: Although Odoo offers a variety of financial reports, some users desire more flexibility in customizing reports to meet their exact needs and preferences, which may require potential workarounds.

- Integration Challenges: Although Odoo Accounting integrates well with other Odoo apps, users have reported occasional challenges when integrating with third-party software, necessitating additional setup or workarounds.

Additional information and overall evaluation

Deployment | Cloud-based, On Premise |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | - Free - Standard: $9.10/user/month - Custom: $13.60/user/month |

Free Trial | 1 module |

Shopify Integration | Yes |

Suitable for | Small to medium-sized eCommerce businesses |

Odoo Accounting is a standout choice for small to medium-sized eCommerce businesses, making it one of the best accounting software for Shopify. Its intuitive interface, praised by users for its user-friendly design, ensures that even those without extensive accounting experience can navigate and manage their finances effectively. Odoo’s powerful automation capabilities streamline essential accounting tasks such as invoice creation, bill payment, bank reconciliation, and financial reporting, which significantly reduces manual effort and minimizes errors. This efficiency is critical for Shopify store owners who need to focus on growing their business rather than getting bogged down by financial management.

One of Odoo Accounting’s greatest strengths is its seamless integration with other Odoo modules, such as Sales, CRM, and Inventory. This integration provides a unified view of business data, eliminating the need for manual data entry across multiple systems and enhancing overall operational efficiency. Additionally, the software’s high degree of customization allows it to meet the specific needs of various industries and business sizes, ensuring it aligns perfectly with unique accounting workflows and requirements. Odoo’s cloud-based accessibility further adds to its appeal, enabling business owners and their teams to access and manage financial data from any device with an internet connection, facilitating flexibility and collaboration.

Despite a learning curve associated with mastering all of its features and some reported integration challenges with third-party software, Odoo Accounting remains a top contender among the best accounting software for Shopify. Its robust feature set, including comprehensive financial reporting, automated processes, and seamless integration within the Odoo ecosystem, makes it a powerful tool for eCommerce businesses looking to streamline their financial operations. By providing a scalable and adaptable accounting solution, Odoo Accounting helps Shopify store owners maintain accurate financial records, improve operational efficiency, and support business growth in a competitive market.

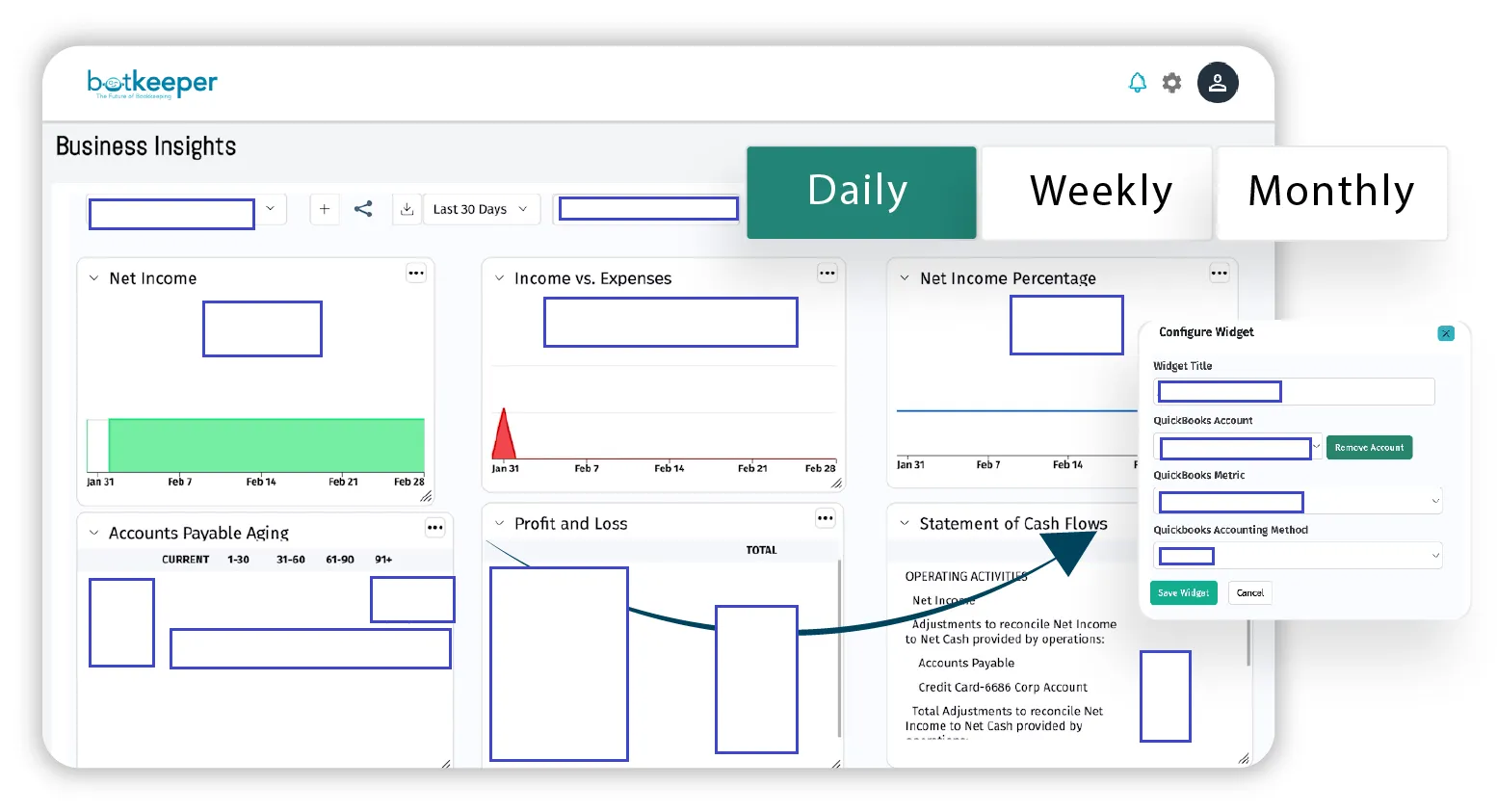

Botkeeper

Botkeeper is a cutting-edge AI-based accounting solution designed to streamline financial management for businesses by leveraging artificial intelligence and machine learning. Created in 2015, Botkeeper allows companies to automate routine bookkeeping tasks without requiring extensive manual setup. This innovative software combines the power of AI with the expertise of remote accounting specialists to automate and validate revenue and expenses, making it a comprehensive full-stack accounting system. By utilizing Botkeeper, businesses can focus more on their core operations while ensuring their financial processes are handled efficiently and accurately.

Botkeeper stands out as one of the best accounting software for Shopify due to its seamless integration capabilities and advanced automation features. The software is designed to work within the Shopify POS payment processor and includes specific Shopify app connectors, enabling it to capture all necessary financial data effortlessly. Botkeeper’s ability to learn and adapt to your business operations means it can handle everything from routine bookkeeping to complex financial tasks, supported by a team of qualified accountants. This integration ensures that Shopify store owners can maintain accurate financial records and streamline their accounting processes, freeing up valuable time to focus on growing their business. Botkeeper’s combination of AI-driven automation and expert support makes it an ideal choice for Shopify users seeking a reliable and efficient accounting solution.

Key features

- Bank Authorization: Gain real-time access to bank feeds, ensuring complete transparency into bank and credit accounts without needing to repeatedly request client authentication.

- Invoice Management: Streamline invoice management with ScanBot, which automates the process of scanning and uploading receipts, invoices, expenses, and sales contracts, syncing them directly with the client’s books.

- Automated Transaction Categorization: Utilize machine learning to automatically categorize transactions based on the client’s historical data, reducing manual input and increasing accuracy.

- Spend Management: Enhance visibility into cash flows, reduce procurement costs, ensure compliance, and boost operational efficiency through effective spend management.

- Expense Tracking: Efficiently manage and report business expenses, including travel requests and reimbursements, for better financial oversight.

- Cash Management: Optimize the utilization of the organization’s liquid resources by effectively collecting, handling, and controlling cash inflows, ensuring sound cash management practices.

Pros and Cons

Pros

- Ease of Use: Botkeeper features an intuitive design and straightforward interface, making it easy to navigate and manage financial tasks, even for those without a strong accounting background.

- Reliability: The software consistently performs accurately in handling financial data, ensuring that users’ books are up-to-date and reliable.

- Security: Botkeeper’s robust security measures provide users with peace of mind, knowing that their sensitive financial information is protected from unauthorized access and cyber threats.

- Scalability: Botkeeper can adapt to the changing needs of businesses as they grow, allowing users to scale their accounting processes without outgrowing the platform.

Cons

- Limited Functionality for Accounting: Botkeeper’s features are not as comprehensive as those of other accounting software, particularly for tasks like managing accounts payable and receivable.

- Setup Time: Setting up Botkeeper can be a time-consuming and laborious process.

- Updates and Transitions: Users may experience issues with the smoothness of updates and transitions.

- Customization: The dashboard can be difficult to customize to meet specific needs.

- Response Time: Users have reported slow response times, which can be frustrating when immediate support is needed.

Additional information and overall evaluation

Deployment | Cloud-based, On Premise | |

Platforms | Linux - Windows | |

Mobile app | Android, iOS | |

Price | Professional Licenses | - Perpetual: $3,213/user + 20% annual fee - Subscription: $108/user/month |

Limited Licenses | - Perpetual: $1666/user + 20% annual fee - Subscription: $56/user/month | |

Free Trial | 30 days | |

Shopify Integration | Yes | |

Suitable for | Small to medium-sized eCommerce businesses | |

Botkeeper is a powerful AI-based accounting solution that provides an innovative approach to managing financial operations, making it one of the best accounting software for Shopify. Its ease of use and intuitive design make it accessible to users without extensive accounting experience, while its reliable performance ensures that financial data is always accurate and up-to-date. Botkeeper’s robust security measures offer peace of mind, protecting sensitive financial information from potential cyber threats. Additionally, its scalability allows it to grow alongside businesses, accommodating increasing accounting needs without requiring a change in platform.

Despite some limitations, such as less comprehensive features compared to other accounting software and a potentially laborious setup process, Botkeeper remains a strong choice for small to medium-sized Shopify businesses. Its ability to integrate seamlessly with the Shopify POS payment processor and specific Shopify app connectors ensures that all necessary financial data is captured efficiently. While users may encounter challenges with updates, transitions, and dashboard customization, the overall benefits of using Botkeeper for automated bookkeeping and financial management are significant. By leveraging AI and expert support, Botkeeper helps Shopify store owners streamline their accounting processes, making it one of the best accounting software for Shopify store owners.

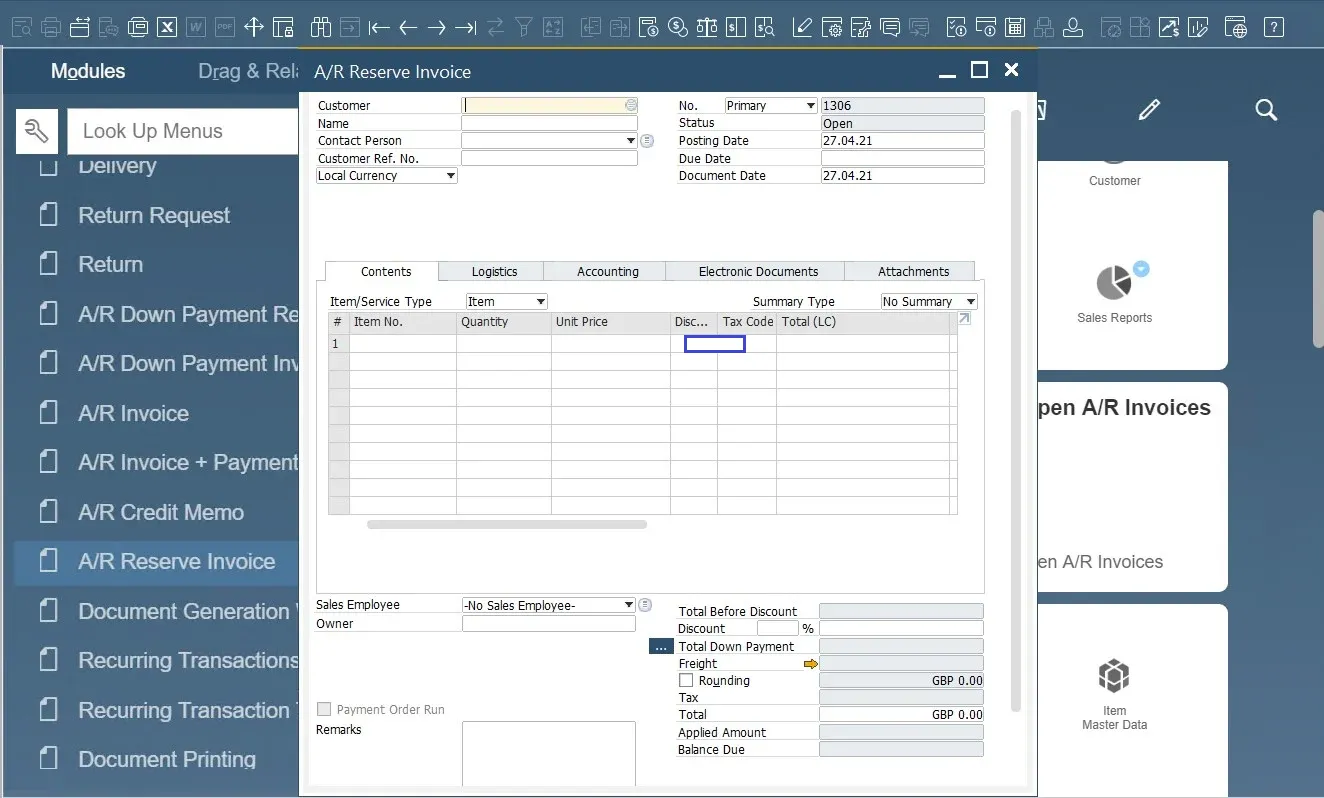

SAP Business One

SAP Business One is an integrated enterprise resource planning solution specifically designed for small and medium-sized enterprises. This comprehensive software offers a wide range of functionalities, including financial management, sales, customer relationship management, inventory control, and production planning. SAP Business One aims to streamline business operations by providing a single, unified platform that enhances efficiency, visibility, and decision-making capabilities. Its user-friendly interface and customizable features empower businesses to manage their processes effectively and adapt to changing market conditions, making it an ideal choice for Shopify store owners seeking a robust accounting solution.

SAP Business One stands out as one of the best accounting software for Shopify due to its ability to provide real-time insights and robust analytics. This software helps businesses gain a clear understanding of their operations and financial performance. Its seamless integration with other SAP solutions and third-party applications ensures a flexible and scalable approach to business management. Additionally, SAP Business One supports multi-currency transactions and compliance with local regulations, making it suitable for businesses operating in multiple regions. By centralizing critical business functions and offering extensive customization options, SAP Business One helps SMEs improve productivity, reduce costs, and drive sustainable growth. This comprehensive ERP solution is particularly valuable for Shopify store owners who need an integrated, efficient, and scalable accounting system to support their eCommerce operations.

Key features

- Accounting: Automates essential accounting tasks, including accounts receivable, journal entries, and accounts payable, to streamline financial operations.

- Controlling: Efficiently manage budgets, track fixed assets, monitor cash flow, and oversee project costs with precision and accuracy.

- Fixed Asset Management: Virtually manage fixed assets, eliminating the need for manual data entry and reducing errors.

- Banking and Reconciliation: Quickly process payments, perform reconciliations, and manage bank statements using various methods such as cash, checks, and bank transfers.

- Financial Analysis and Reporting: Enhance audit reviews and planning processes by generating customized and standard reports, supported by real-time data for improved financial insights.

Pros and Cons

Pros

- Functionality: SAP Business One offers a robust suite of successful business management tools, making it a comprehensive solution for managing various business functions.

- Customizations: The software is easy to customize to meet specific business needs, allowing users to tailor it to their unique requirements.

- Integrations: The available integrations add significant value to the base product

- Scalable: The platform is scalable, supporting business growth and evolving needs over time.

Cons

- Implementation: The physical implementation process is often time-consuming and not up to the mark

- Customization Needs Coding: Customizing the software often requires coding knowledge, which can be a barrier for some users.

- Lack of Advanced Features: Some users feel that SAP Business One lacks certain advanced features needed for complex business operations.

- Complex Migration Path: The migration path to SAP Business One can be complex and challenging, posing difficulties during the transition period.

Additional information and overall evaluation

Deployment | Cloud-based, On Premise | |

Platforms | Linux - Windows | |

Mobile app | Android, iOS | |

Price | Professional Licenses | - Perpetual: $3,213/user + 20% annual fee - Subscription: $108/user/month |

Limited Licenses | - Perpetual: $1666/user + 20% annual fee - Subscription: $56/user/month | |

Free Trial | 30 days | |

Shopify Integration | Yes | |

Suitable for | Small to medium-sized eCommerce businesses | |

SAP Business One is a powerful ERP solution that stands out as one of the best accounting software for Shopify, particularly for small and medium-sized enterprises. Its robust suite of business management tools includes financial management, sales, CRM, inventory control, and production planning, all integrated into a single, unified platform. This comprehensive functionality, combined with its ease of customization, allows businesses to tailor the software to their specific needs and streamline operations effectively. The seamless integration with other SAP solutions and third-party applications further enhances its value, making it a flexible and scalable solution that grows with your business.

Despite some challenges, such as the time-consuming implementation process and the need for coding knowledge to customize the software, SAP Business One remains a top choice for Shopify store owners. Its ability to provide real-time insights and robust analytics helps businesses gain a clear understanding of their operations and financial performance. Additionally, the support for multi-currency transactions and compliance with local regulations makes it suitable for businesses operating in multiple regions. By centralizing critical business functions and offering extensive customization options, SAP Business One empowers SMEs to improve productivity, reduce costs, and drive sustainable growth, making it one of the best accounting software for Shopify.

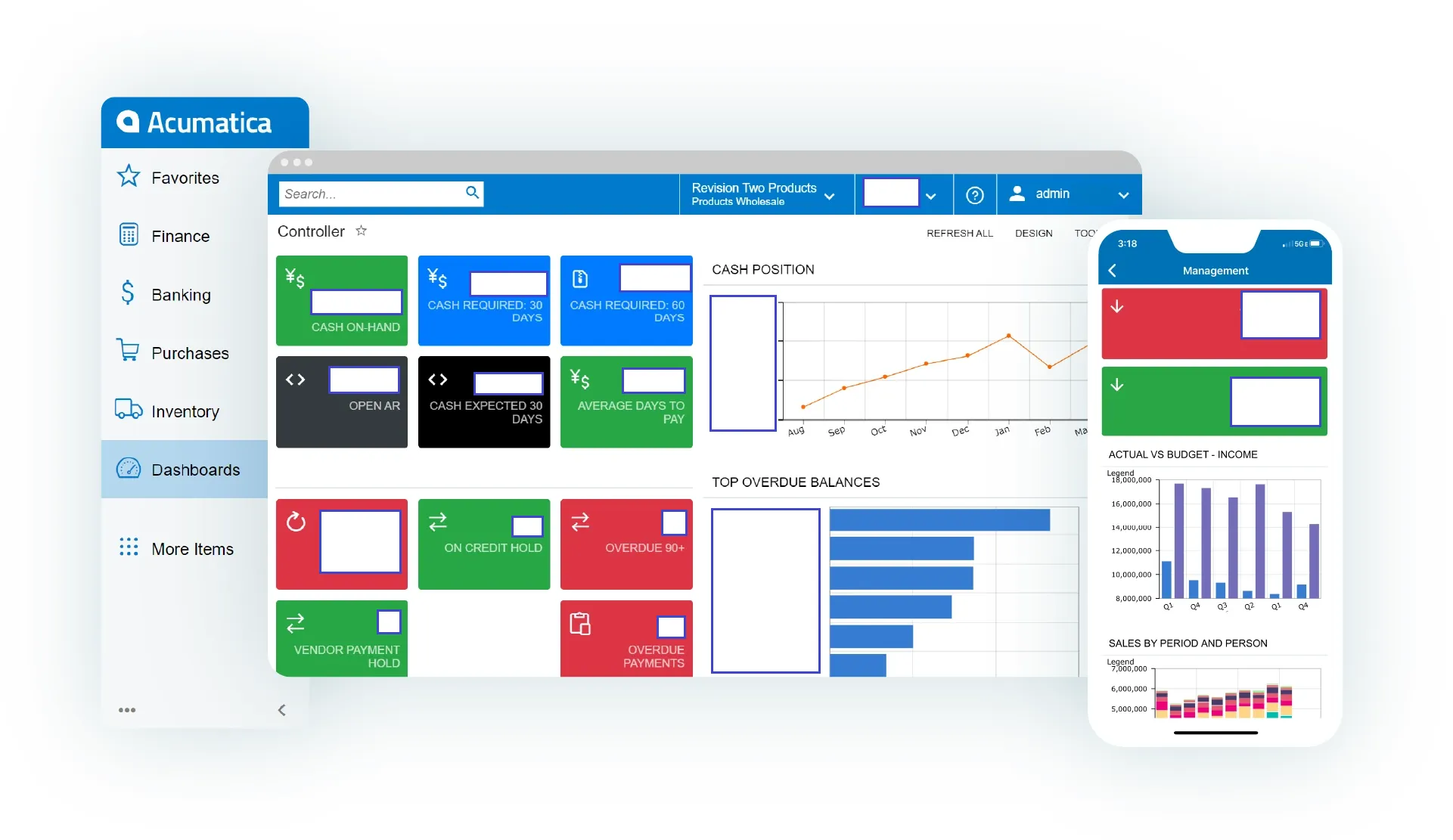

Acumatica

Acumatica is a comprehensive cloud-based enterprise resource planning software that provides a robust accounting solution designed for growing businesses, including small to medium-sized eCommerce enterprises. Known for its flexibility and scalability, Acumatica offers a wide range of functionalities, such as financial management, customer relationship management, project accounting, and inventory management. This software is tailored to meet the unique needs of Shopify store owners by providing seamless integration with Shopify, ensuring that all financial and operational data is connected and easily accessible. Acumatica’s user-friendly interface and advanced automation capabilities make it an ideal choice for businesses looking to streamline their financial processes and support growth.

Acumatica stands out as one of the best accounting software for Shopify due to its powerful features and seamless integration capabilities. The software provides real-time financial insights through customizable dashboards and reports, enabling Shopify store owners to make informed business decisions. Acumatica’s cloud-based nature allows users to access and manage their financial data from any device with an internet connection, ensuring flexibility and efficiency in their operations. Additionally, Acumatica supports multi-currency transactions and compliance with various tax regulations, making it suitable for businesses operating in multiple regions. The software’s scalability ensures that it can grow alongside your business, adapting to increasing data volumes and user needs, suitable for medium and large business. By centralizing critical business functions and offering extensive customization options, Acumatica helps Shopify store owners enhance productivity, reduce costs, and drive sustainable growth, making it one of the best accounting software solutions for Shopify.

Key features

- General Ledger: Track all financial transactions within a business and generate financial statements like the income statement and balance sheet. Users can structure the general ledger by accounts and subaccounts, and segment financial reporting by departments or products for more specialized insights.

- Accounts Receivable: Create and send invoices for outstanding payments in various formats, including print, PDF, or HTML. The feature supports PCI-compliant credit card transactions, handling refunds, voided transactions, and manual charges. It also connects to bank processing centers via built-in plugins or custom integrations using Acumatica’s SDK.

- Accounts Payable: Manage prepayments with tools that allow for request handling, applying prepayments to incoming invoices, and issuing prepayments. The system can automatically calculate use and VAT taxes and generate tax filing reports. Align payments with cash flows to minimize late charges.

- Cash Management: Integrates with General Ledger, Accounts Receivable, and Accounts Payable functionalities to update balances and store transactions linked to vendors and customers. It also facilitates fund transfers between accounts and supports multiple currencies.

- Currency Management: Automatically calculate realized and unrealized gains and losses from foreign currency transactions. Prepare auto-reversing entries for open documents recorded in foreign currencies, adhering to FASB-52 standards for currency translation.

- Tax Management: Supports use, sales, withholding, VAT, and reverse VAT taxes. Automatically calculate taxes based on assigned tax zones or categories, or manually adjust them within the system. Taxes are posted to a tax liability account in the general ledger.

- Deferred Revenue Accounting: Automatically calculate deferred revenue using user-established schedules. Develop these schedules using templates or from scratch and post deferred revenue automatically to various financial statements.

Pros and Cons

Pros

- Functionality: Acumatica provides robust functionality with regular yearly updates, ensuring continuous improvement and added features.

- Cloud-Based Scalability: Easily adapt to business growth by adding modules or users without data disruption or complex upgrades.

- Seamless Integrations: Connect with various third-party tools and platforms through open APIs and connectors, streamlining data flow and operations.

- Centralized Data: Consolidate all business information in one system, improving data accuracy, accessibility, and reporting capabilities.

- Mobile App Access: Manage key tasks and access data on the go with the mobile app, boosting productivity and flexibility.

Cons

- Support: Requires users to partner with a third party for support, which may complicate issue resolution.

- Implementation: Long implementation cycles and the need for a Value-Added Reseller (VAR) to implement the system can be time-consuming and costly.

- Steeper Learning Curve for Complex Needs: Extensive customization and advanced features may require dedicated IT resources or consultant support, increasing implementation costs.

- Limited Industry-Specific Features: May lack specialized modules or functionalities for highly regulated or niche industries.

- Occasional System Bugs & Glitches: Users report occasional bugs and glitches, requiring troubleshooting and potential downtime.

Additional information and overall evaluation

Deployment | Cloud-based, On Premise |

Platforms | Linux - MacOS - Windows - ChromeOS - Android |

Mobile app | Android, iOS |

Price | No fixed price, based on the number of applications |

Free Trial | Yes, request from provider |

Shopify Integration | Yes |

Suitable for | Medium to large-sized eCommerce business |

Acumatica is a comprehensive cloud-based ERP solution that ranks among the best accounting software for Shopify, particularly for growing businesses seeking scalability and robust functionality. The software’s flexibility allows it to adapt to business growth seamlessly, whether by adding new modules or increasing the number of users without disrupting data or requiring complex upgrades. Acumatica’s robust functionality is continually enhanced through yearly updates, ensuring that users always have access to the latest features and improvements. Additionally, its open APIs and connectors facilitate seamless integration with various third-party tools and platforms, streamlining data flow and improving overall operational efficiency.

One of the key reasons Acumatica is considered one of the best accounting software for Shopify is its ability to centralize all business information in one system. This consolidation enhances data accuracy, accessibility, and reporting capabilities, providing Shopify store owners with valuable insights into their business performance. The mobile app access further boosts productivity and flexibility, allowing users to manage key tasks and access critical data on the go. While the implementation process may be lengthy and require external support, and some users may encounter occasional system bugs, the overall benefits of using Acumatica for comprehensive financial management and seamless integration with Shopify make it a top choice for eCommerce businesses. By leveraging Acumatica, Shopify store owners can streamline their financial operations, support business growth, and maintain a competitive edge in the market.

Criteria for Selecting the Best Accounting Software for Shopify

The best accounting software for Shopify encompasses several essential features that make these tools invaluable for any eCommerce business. When choosing the best accounting software for your Shopify store, several key criteria should guide your decision. These criteria ensure that the software will effectively meet your business needs and enhance your overall eCommerce operations.

- Integration with Shopify: One of the most critical factors is how well the accounting software integrates with Shopify. Seamless integration ensures that all sales, expenses, and inventory data from your Shopify store are automatically synchronized with your accounting software. This eliminates the need for manual data entry, reducing the risk of errors and saving valuable time. Look for software that offers direct integration with Shopify or has robust third-party connectors that facilitate this process. In addition to working well with Shopify, your software should get along with the other eCommerce solutions you use, such as order shipping apps and payment processors.

- User-Friendliness: The ease of use of accounting software can significantly impact its effectiveness. User-friendly software features an intuitive interface and straightforward navigation, allowing users of all experience levels to manage their finances efficiently. Look for software that provides a clean and organized dashboard, easy access to essential functions, and helpful tutorials or customer support to assist with any challenges that may arise.

- Automation Capabilities: Automation is a game-changer in accounting, helping to streamline repetitive tasks and reduce manual workload. The best accounting software for Shopify should offer robust automation capabilities, such as automated invoicing, expense tracking, bank reconciliation, and payment reminders. Automation not only saves time but also increases accuracy, ensuring that your financial data is always up-to-date and reliable.

- Reporting and Analytics Features: Comprehensive reporting and analytics are essential for making informed business decisions. The software should provide customizable reports and real-time analytics that give insights into your financial performance. Key reports to look for include profit and loss statements, balance sheets, cash flow statements, and sales tax reports. Advanced analytics features can help identify trends, monitor key performance indicators (KPIs), and forecast future financial scenarios.

- Scalability: As your business grows, your accounting needs will evolve. It is crucial to choose software that can scale with your business, accommodating increasing data volumes, additional users, and more complex financial operations. Scalable software allows you to add new features or modules as needed without disrupting your existing data or requiring a complete system overhaul. This flexibility ensures that your accounting solution remains effective as your business expands.

- Security: Protecting your financial data is paramount. The best accounting software for Shopify should offer robust security features to safeguard your sensitive information. Look for software that includes data encryption, secure user access controls, regular security updates, and compliance with industry standards such as PCI DSS for payment processing. Ensuring that your financial data is secure helps prevent unauthorized access and potential breaches, giving you peace of mind.

- Cloud-based: Cloud-based solutions give you simple access to your current data across devices and prevent issues that could occasionally arise when attempting to manually sync information.

- Simple to use across all platforms: The options listed below all have at the very least a web application as well as mobile apps for iOS and Android devices.

- Sales tax configuration: Figuring out the sales tax can be challenging for internet firms. Select accounting software that streamlines the process of computing, collecting, and paying sales tax.

- High-quality support: The best Shopify accounting software provides dependable help choices, ideally around-the-clock assistance. Reading reviews of such apps on Shopify from other business owners is a fantastic starting point.

By considering these criteria, you can select an accounting software solution that not only integrates seamlessly with your Shopify store but also supports your business’s growth and operational efficiency.

In conclusion,

When selecting the best accounting software for your Shopify store, it’s important to consider factors such as integration with Shopify, user-friendliness, automation capabilities, reporting and analytics features, scalability, and security. Each of the software options discussed in this post excels in these areas to varying degrees, making them strong contenders for enhancing your eCommerce business’s financial management.

Ultimately, the best accounting software for Shopify will depend on your specific business needs and goals. We encourage you to take advantage of free trials and demos offered by these software providers to get a firsthand experience of their features and capabilities. By thoroughly evaluating your options, you can choose an accounting solution that not only meets your current needs but also supports your business as it grows and evolves.

In conclusion, integrating the right accounting software into your Shopify store can significantly improve your financial operations, save you time, and provide you with the insights needed to make strategic business decisions. Whether you’re a small startup or a growing medium-sized business, there’s an accounting solution out there that’s perfect for your needs. Choose wisely, and watch your business thrive with the support of a robust and efficient accounting system.