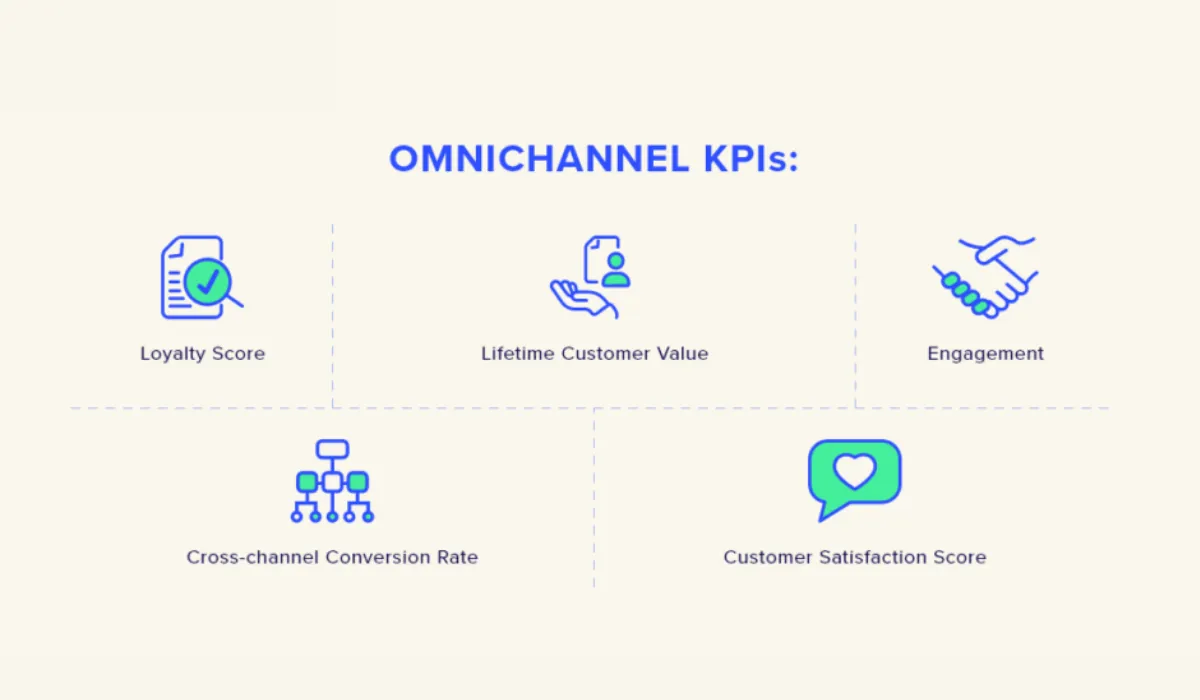

Omnichannel retail KPIs (Key Performance Indicators) are essential tools for measuring the success of this integration. They help retailers understand where they excel and where there is room for improvement. From tracking sales and inventory to gauging customer satisfaction across different platforms, KPIs provide valuable insights that can drive strategic decisions and foster growth.

In this comprehensive guide, we explore the various metrics that can help retailers thrive in a marketplace that is increasingly interconnected. By understanding these indicators, businesses can refine their operations, enhance customer interactions, and achieve a competitive edge in the fast-paced world of retail. This blog post aims not only to outline the essential omnichannel retail KPIs but also to offer actionable insights on how to leverage this data effectively in the quest for omnichannel excellence.

Table of Contents

Core Omnichannel Retail KPIs

This section delves into the core omnichannel retail KPIs that are essential for a comprehensive analysis of performance as we explore Sales Metrics; assess the efficiency of marketing efforts through Customer Acquisition Costs (CAC); evaluate loyalty and engagement via Customer Retention Rates; analyze purchasing behavior through Average Order Value (AOV); and finally, gauge long-term profitability with Customer Lifetime Value (CLTV).

Each of these metrics offers valuable insights, guiding retailers towards informed decision-making and strategic planning in a multi-channel retail environment.

Sales Metrics

When considering omnichannel retail KPIs, understanding and measuring sales metrics forms the foundation of strategic decision-making. By tracking various sales metrics, businesses can assess their performance across different channels, adjust strategies in real time, and optimize customer experiences. This section will delve into the core sales metrics that are pivotal in managing and evaluating the success of omnichannel retail strategies.

Total Sales

Total sales are the most direct indicator of a retail operation’s financial performance. In an omnichannel context, this metric encompasses sales from all channels — online, offline, mobile, and any other customer touchpoints. Monitoring total sales helps retailers gauge overall market performance and understand long-term trends. To effectively analyze total sales within omnichannel retail KPIs, it is essential to segment these figures by channel, campaign, or even specific time periods to identify what drives the most revenue and why.

For a more nuanced analysis within the framework of omnichannel retail KPIs, breaking down total sales by specific channels is crucial. This segmentation allows retailers to evaluate the effectiveness of each channel independently and in correlation with others.

Further, segmenting total sales by individual marketing campaigns can reveal which promotional activities are most effective at driving revenue. This could help identify whether a recent online marketing push or an in-store discount event had a greater impact on short-term sales spikes. It also helps in understanding consumer response to different sales tactics, which is invaluable for planning future promotions.

Additionally, analyzing total sales over specific time periods can highlight seasonal trends, consumer buying patterns, and the impact of external factors such as economic shifts or changes in consumer behavior. For instance, a retailer might notice that sales peak during the holiday season and drop in the first quarter. Understanding these patterns is essential for inventory planning, staffing, and budget allocation.

Online vs. Offline Sales

This analysis is not only about counting transactions but also about understanding the deeper narrative of consumer behavior and the role of each channel in the customer journey.

- Channel Effectiveness: Analyzing the performance of sales channels in terms of revenue generation and customer engagement offers direct feedback on where investments are paying off. If online sales are accelerating more rapidly than offline sales, this could indicate a shift in consumer habits towards digital shopping, possibly driven by enhanced online user experiences or more effective digital marketing strategies. Conversely, if offline sales remain strong or experience growth, this might suggest that customers still value the tactile and personal experience offered by physical stores. This insight can be critical for deciding where to allocate resources to maximize sales and customer satisfaction.

- Customer Behavior Insights: Delving into where and how customers choose to make their purchases allows businesses to fine-tune their marketing and operational strategies. For instance, a high volume of online sales might suggest convenience is a key driver for many customers, whereas substantial in-store traffic might indicate that the sensory experience or immediate product access is highly valued. Recognizing these preferences supports strategic decisions like implementing or enhancing omnichannel services such as BOPIS (buy online, pick up in-store), which bridges the gap between online convenience and offline immediacy, potentially increasing overall sales and improving customer experience.

- Seasonal and Promotional Impact: Understanding how sales fluctuate between online and offline channels during different seasons or promotional periods can provide valuable insights for planning marketing activities and stock management. For example, if online sales typically surge during exclusive online promotions or specific eCommerce events like Cyber Monday, retailers can maximize their online marketing efforts and stock availability to capitalize on these peaks. Conversely, if offline sales increase significantly during particular times, such as the back-to-school season, it would be wise to enhance in-store promotions, staffing, and inventory to attract and manage increased foot traffic.

By meticulously analyzing online versus offline sales as one of the omnichannel retail KPIs, retailers can optimize their strategies to cater to evolving consumer preferences and maximize the effectiveness of each sales channel. This approach not only boosts sales but also enhances the overall shopping experience, encouraging customer loyalty and supporting long-term business growth in the competitive landscape of omnichannel retail.

Sales Growth Across Channels

Tracking sales growth across different channels is another critical aspect of omnichannel retail KPIs. It helps businesses understand which channels are expanding and at what rate. This metric acts as a barometer for the health and direction of each channel’s contribution to the overall business strategy.

- Strategic Resource Allocation: Sales growth metrics offer a clear perspective on where a business should focus its energies. For example, if a significant upsurge in online sales is observed, it could signal the need for enhanced IT infrastructure or more robust customer service for digital platforms. Conversely, if traditional brick-and-mortar stores are showing steady growth, it might justify further investment in physical retail space or localized marketing strategies. This strategic allocation based on channel performance ensures that resources are not just spent but invested where they can generate the highest returns.

- Scalability and Expansion Decisions: Tracking how new and existing channels grow in response to omnichannel strategies helps businesses decide when to scale operations or expand into new market areas. For instance, a consistent increase in sales from an eCommerce platform might prompt a business to expand its online inventory or explore advanced logistical solutions like automated warehousing. Additionally, if a new channel such as a mobile shopping app is attracting a growing number of users, it may be advantageous to increase functionality or integrate augmented reality features to enhance user engagement.

- New Market Penetration: Understanding sales growth in various demographics and markets is crucial for tapping into new customer segments. If data reveals that a particular channel is popular among a specific demographic — such as increased activity on social media shopping features among millennials — retailers can tailor their marketing campaigns to resonate with this group, possibly adjusting product lines to meet the unique tastes and preferences of these consumers..

- Effectiveness of Omnichannel Strategies: Observing sales growth across channels also serves as a litmus test for the effectiveness of integrated retail strategies. For instance, if the introduction of an omnichannel loyalty program correlates with higher sales volumes across both online and offline channels, it provides empirical evidence that customers value and respond to a unified shopping experience. Such insights not only validate existing strategies but also guide future enhancements and innovations in customer service and engagement.

By continuously monitoring and analyzing sales growth across different channels, retailers can fine-tune their omnichannel approaches, ensuring that they remain competitive and responsive to consumer needs and market changes. This proactive analysis helps in crafting a customer-centric, resilient, and adaptive business model that leverages strengths across all retail channels.

Customer Acquisition Costs (CAC)

CAC is a key performance indicator that measures the cost associated with acquiring a new customer through a specific channel or combination of channels. This metric is particularly significant in the context of omnichannel retail KPIs because it helps retailers evaluate the efficiency and effectiveness of their marketing efforts across various channels.

Definition and Importance of CAC in Omnichannel Retail

Customer Acquisition Cost (CAC) in the context of omnichannel retail is a critical metric that quantifies the total expenses incurred in marketing and promotional activities aimed at acquiring new customers. This includes a comprehensive range of costs such as online advertising (e.g., PPC campaigns, social media ads), offline advertising (e.g., print, billboards, TV commercials), content production (e.g., blogs, videos, podcasts), staff salaries associated with marketing and sales teams, and investments in technology to enhance digital marketing efforts (e.g., CRM software, marketing automation tools). Calculating CAC in such a diverse ecosystem requires attributing these costs accurately across various channels to determine the efficiency of each in contributing to new customer acquisitions.

The significance of CAC as one of the omnichannel retail KPIs cannot be overstated. It serves not just as a measure of cost effectiveness but also as a strategic lens through which retailers can assess and refine their marketing strategies. By understanding CAC, businesses gain insight into which channels deliver the best return on investment (ROI), allowing them to allocate resources more effectively and potentially shift strategies to capitalize on the most lucrative channels. Additionally, a lower CAC typically indicates a higher efficiency of the marketing spend, which is particularly valuable in competitive retail environments where cost efficiency can significantly impact overall profitability.

Moreover, CAC is instrumental in evaluating the long-term sustainability of customer acquisition strategies in an omnichannel framework. High acquisition costs may be sustainable in the short term if the lifetime value (LTV) of customers is high, but if not, they could lead to diminishing returns. Therefore, analyzing CAC helps retailers not only to identify more cost-effective methods for customer acquisition but also to optimize their marketing mix across channels to reduce costs while maintaining or improving customer engagement and conversion rates. This strategic approach enables retailers to adapt and thrive in the evolving retail landscape, where understanding and controlling costs across multiple channels is key to maintaining a competitive edge.

Calculating CAC in an Omnichannel Environment

The calculation of Customer Acquisition Cost (CAC) in an omnichannel environment poses unique challenges due to the complexity of customer interactions across multiple channels. To achieve an accurate calculation, it’s crucial to attribute customer acquisitions accurately to the specific channels that influenced or directly led to their conversion. This process typically involves a couple of key methodologies:

- Tracking Multi-Channel Interactions: In an omnichannel setting, a customer might interact with a brand in several ways before making a purchase. For example, they might see an advertisement on social media, read an email newsletter, and visit a physical store before finally making a purchase online. Advanced analytics tools are essential for tracing this multifaceted journey. These tools track and compile data from various channels, helping to map a complete picture of the customer journey. This tracking enables marketers to understand which interactions were most influential in converting browsers into buyers. It’s not just about recognizing the final touchpoint but understanding all the effective touch points along the customer journey that contribute to the decision to purchase.

- Allocation of Costs: After mapping out the customer journey, the next step is the accurate allocation of marketing costs to these various touchpoints. This can be complex, as it involves determining the influence of each interaction in the journey towards conversion. Marketers often use attribution models to assign value to each channel. These models can range from simple (such as last-click attribution, which gives all credit to the final touchpoint before purchase) to more complex (such as multi-touch attribution, which assigns a weighted value to each touchpoint based on its perceived influence on the customer’s decision). By applying these models, retailers can more accurately divide their marketing budget across channels, reflecting the true role and influence of each channel in acquiring new customers.

Effective CAC calculation in an omnichannel environment enables retailers to gauge the efficiency of their marketing efforts more accurately. It highlights which channels are most cost-effective and which may require optimization or re-evaluation in terms of strategy.

Moreover, this insight allows retailers to refine their marketing approaches continuously, ensuring resources are invested in channels that provide the best returns, enhancing overall marketing ROI and reducing wasteful spending. Through meticulous tracking and smart allocation of costs, retailers can turn the complexity of omnichannel marketing into a strategic advantage, driving more informed decisions and ultimately, more successful outcomes.

Strategies to Optimize CAC in Omnichannel Retail

Optimizing Customer Acquisition Cost in omnichannel retail involves strategic adjustments across various marketing and sales channels to enhance efficiency and effectiveness. Here, we delve deeper into the strategies that can help minimize CAC while maximizing customer engagement and conversion rates:

- Enhanced Channel Integration: The goal of enhanced channel integration is to create a seamless customer journey across all platforms, thereby increasing the likelihood of conversion at lower costs. For instance, by linking online advertisements directly to in-store promotions, retailers can bridge the gap between digital engagement and physical shopping experiences. This integration can encourage customers who engage with a brand online to visit a physical store to complete their purchase, which can lead to higher conversion rates. Additionally, integrating customer service channels so that inquiries handled via one channel (like social media) are seamlessly connected to others (such as in-store support) can enhance customer satisfaction and increase the chances of conversion without additional acquisition costs.

- Targeted Marketing Campaigns: Utilizing advanced data analytics to decipher customer preferences and behaviors allows retailers to craft highly targeted marketing campaigns. By analyzing data from various channels, retailers can identify the most effective messages and promotions for specific customer segments. This precision marketing means that resources are not wasted on broad, ineffective campaigns. Instead, by concentrating on targeted strategies where they are most likely to resonate — whether through personalized email marketing, tailored social media ads, or localized content — retailers can significantly improve conversion rates and, consequently, lower the CAC.

- Leveraging Organic Channels: Organic channels typically require lower ongoing investment compared to paid media and can be highly effective in customer acquisition. Strategies such as search engine optimization (SEO), content marketing, and leveraging social media platforms can attract customers at a lower cost than traditional paid advertising. Additionally, focusing on building a strong brand presence that encourages customer referrals and word-of-mouth can also significantly reduce CAC. For instance, creating shareable content or engaging directly with customers on social platforms can turn satisfied customers into brand advocates, who then help spread the word organically.

- Customer Retention Focus: Reducing churn by improving customer satisfaction is a strategic way to lower CAC indirectly. When customers are satisfied and engaged, they are more likely to repeat purchases and less likely to switch to competitors. Improving customer retention rates can be achieved through loyalty programs, exceptional customer service, personalized experiences, and regular engagement. By investing in customer retention strategies, the lifespan value of each customer increases, thereby spreading the acquisition cost over a longer period and more transactions, which effectively reduces the CAC.

By implementing these strategies, retailers can not only reduce their CAC but also enhance customer loyalty and brand strength in a competitive omnichannel marketplace. These efforts lead to more sustainable growth and a better return on investment from marketing expenditures.

The Impact of CAC on Omnichannel Success

CAC is one of the most important omnichannel retail KPIs because it directly impacts the profitability and scalability of marketing efforts. By regularly assessing CAC, retailers can gauge the financial efficiency of their strategies to attract new customers across various channels. This metric isn’t just a number; it’s a reflection of how well a retailer utilizes its budget and whether the allocation of resources aligns with effective customer acquisition.

A high CAC typically signals that a retailer’s marketing efforts might be costing more than they should, which can eat into profit margins and limit growth potential. This situation can arise from several factors, such as inefficient use of advertising funds, poor conversion rates, or targeting the wrong customer segments. High CAC can act as a red flag for businesses, prompting them to reevaluate their marketing strategies. It might indicate the need for optimization in areas like ad spending, channel selection, or campaign targeting. For instance, if a particular advertising channel consistently shows a high CAC, it may be beneficial to either improve the campaigns on that channel or reallocate the budget towards more effective channels.

On the other hand, a low CAC indicates that a retailer is acquiring customers cost-effectively, which is a sign of efficient marketing strategy and execution. This situation offers numerous advantages, such as increased profitability and the opportunity for scalability. Retailers with a low CAC have the potential to reinvest the savings from their acquisition costs into other areas of their business, such as enhancing customer service, expanding into new markets, or further developing omnichannel capabilities. This reinvestment can help improve the overall customer experience, foster customer loyalty, and create a more robust omnichannel presence.

Moreover, maintaining a low CAC in an omnichannel environment suggests that a retailer is successfully leveraging the strengths of various channels to complement each other, enhancing the overall efficiency of marketing efforts. For example, a retailer might use data gathered from online interactions to refine targeting in offline marketing campaigns, or vice versa, leading to more personalized and effective customer interactions that drive conversions without excessive spending.

Ultimately, the impact of CAC on omnichannel success is profound. It not only measures the cost effectiveness of customer acquisition strategies but also serves as a critical lever in managing profitability and growth. Retailers that excel in optimizing their CAC can achieve a competitive advantage by maximizing the return on their marketing investments and continuously enhancing their omnichannel strategies to meet evolving consumer demands.

Customer Retention Rates

Customer retention rates are crucial amongst omnichannel retail KPIs, serving as a barometer for measuring the success of a retailer’s ability to keep customers engaged and committed over time. They not only reflect the health of customer relationships but also directly impact the financial stability and growth potential of a retail business.

In an environment where multiple channels interact to provide a cohesive customer experience, understanding and optimizing these rates becomes essential for sustainable growth and profitability. By focusing on personalized experiences, consistency across channels, active engagement, and responsiveness to customer feedback, retailers can significantly enhance their customer retention rates and, by extension, their omnichannel success.

Importance of Customer Retention in Omnichannel Retail

Customer retention rates serve as one of the critical omnichannel retail KPIs regarding a brand’s effectiveness in sustaining and enriching its relationships with customers across multiple channels of interaction. These rates are a significant measure, often directly correlating with key aspects of business health such as customer satisfaction, loyalty, and the overall value that customers bring over their lifetime with the brand. High retention rates typically suggest that a business is successful in meeting or exceeding customer expectations in a consistent manner, which in turn fosters a strong sense of brand loyalty.

The strategic focus on customer retention, as opposed to solely acquiring new customers, involves deepening existing relationships and ensuring ongoing satisfaction and engagement. This approach is generally more cost-effective than acquisition strategies because it leverages existing relationships rather than spending resources to establish new ones. Retained customers are more likely to make repeated purchases and often at higher values, which boosts the overall profitability and stability of the business.

Moreover, a robust customer retention strategy supports the development of a loyal customer base that acts as an advocate for the brand. Satisfied, loyal customers are more inclined to share their positive experiences with others, effectively driving new customer acquisitions through powerful, organic channels such as word-of-mouth recommendations and social proof. This organic advocacy is invaluable as it comes with a high level of trust and credibility, often influencing new customers in a more profound and lasting way than traditional advertising methods.

Thus, high customer retention rates not only ensure a steady and predictable revenue stream but also play a crucial role in the organic growth of the business. They reflect a harmonious balance between meeting customer needs and successfully managing customer relationships across all channels, which is essential for long-term success in today’s competitive retail landscape.

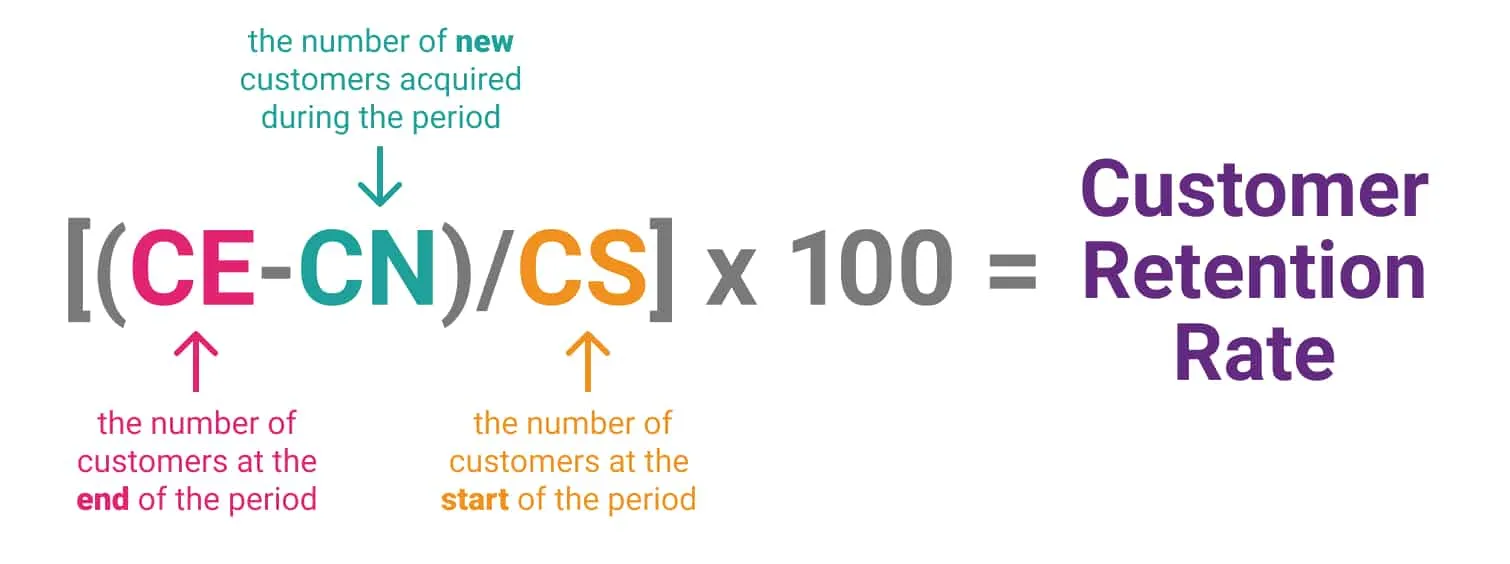

Calculating Customer Retention Rates

Effectively measuring customer retention rates in an omnichannel environment involves a nuanced approach to data collection and analysis, as it requires a comprehensive understanding of customer interactions across various channels. Retailers must track and analyze not only the number of repeat purchases but also the ongoing engagement activities of customers over a designated period. This is compared against the total number of active customers at the beginning of the period to calculate retention rates accurately.

The inherent challenge of this measurement in an omnichannel setting is the precise attribution of customer retention to specific channels and touchpoints. This complexity arises because modern consumers often engage with a brand through multiple channels before making a repeat purchase.

For example, a customer might initially discover a product through an online ad, research it on a mobile app, and finally purchase it in a physical store. Each of these touchpoints contributes to retaining that customer, yet attributing retention to just one touchpoint would provide a skewed view of what is truly driving customer loyalty.

To address this challenge, retailers require sophisticated tracking systems capable of capturing and integrating data across all platforms. This includes CRM systems, marketing automation tools, and advanced analytics platforms that can track customer behaviors and preferences in real time. With these systems, it becomes possible to create a unified view of the customer journey, tracing all the interactions a customer has with a brand from initial contact through to repeat purchases.

For example, if a customer browses products on a mobile app, this interaction should be recorded and linked to their customer profile. If the same customer later makes a purchase online, this too is tracked, and the data is integrated to show a continuous timeline of engagement. Finally, if the customer chooses to BOPIS, this interaction is also logged, providing a full spectrum view of how omnichannel strategies are contributing to customer retention.

By recognizing and recording each of these interactions, retailers can gain a more detailed understanding of what influences customer loyalty and retention. This depth of insight allows them to refine their omnichannel strategies, ensuring they deliver personalized and cohesive experiences that encourage customers to remain engaged over time. Thus, a robust system for tracking and analyzing customer data across multiple touchpoints is crucial for measuring and enhancing customer retention rates in omnichannel retail.

Strategies to Improve Customer Retention Rates

Improving customer retention rates in an omnichannel retail environment requires a multi-faceted approach that focuses on creating personalized, consistent, and engaging customer experiences across all channels. Here’s a deeper exploration of the strategies that can significantly enhance customer retention:

- Personalized Customer Experiences: Enhancing customer retention in omnichannel retail starts with personalized experiences tailored to the customer’s preferences and previous interactions with the brand. Utilizing data analytics to understand customer behavior across channels allows retailers to deliver targeted messages, recommendations, and offers that resonate with individual customers. Personalization can manifest in various forms, from personalized emails and customized shopping recommendations to tailored in-store experiences facilitated by mobile apps or loyalty programs.

- Consistent Quality of Service Across Channels: Consistency is key in omnichannel retail. Customers expect a seamless experience, whether they are shopping online, via mobile, or in a physical store. Ensuring that service quality, brand messaging, and customer support are consistent across all platforms can significantly enhance customer satisfaction and retention. For example, a customer’s ability to return an online purchase in-store without hassle, or to receive customer support through their preferred channel at any time, can greatly influence their decision to remain with a brand.

- Engagement and Community Building: Building a community around a brand can foster a sense of belonging among customers, which is crucial for retention. Engagement can be driven through social media, exclusive members-only events, or loyalty programs that offer more than just transactional rewards. For example, offering special access to new products, or creating a platform for customers to share experiences, can strengthen the emotional connection customers feel towards the brand.

- Regular Feedback and Responsive Adjustments: Continuously gathering customer feedback across all channels and being responsive to their needs and preferences is vital for improving retention rates. This feedback should inform business decisions and prompt adjustments to products, services, or experiences. Implementing changes based on customer feedback not only improves the customer experience but also shows customers that their opinions are valued, enhancing their loyalty to the brand.

By implementing these strategies, retailers can create a holistic and attractive customer experience that spans various channels, thus significantly improving their customer retention rates. Each strategy not only strengthens the individual touchpoints but also ensures that the entire omnichannel system works effectively to keep customers returning.

Impact of High Customer Retention on Omnichannel Success

High customer retention rates are vital in omnichannel retail, serving as a robust indicator of a brand’s success across various customer interaction points. When customers return repeatedly, it demonstrates that the brand consistently meets or surpasses their expectations, whether they engage through physical stores, online platforms, or mobile apps. This consistency in fulfilling customer needs and preferences across all channels is critical in building trust and loyalty.

High retention rates contribute to lower marketing costs. It is generally more cost-effective to retain existing customers than to acquire new ones, as the former does not require the extensive use of costly acquisition tactics such as paid advertising or promotional discounts. Instead, retailers can focus on more cost-effective engagement and retention strategies like email marketing, loyalty programs, and customer appreciation events, which offer a better return on investment. This shift in focus from acquisition to retention can significantly decrease the overall marketing spend while maintaining revenue growth.

With reduced marketing expenses, overall profitability improves. Retailers can reallocate resources saved from acquisition to other areas such as product development, service enhancements, or even expansion into new markets. Furthermore, retained customers typically have better conversion rates; they are easier to sell to because they already understand and appreciate the brand value. This ease of conversion often results in a more streamlined sales process, reducing operational costs associated with sales efforts and enhancing the efficiency of the business operations.

A well-established customer base provides fertile ground for organic growth strategies such as upselling and cross-selling. These strategies are more effective with customers who have a proven interest in the brand’s offerings and a history of repeated purchases. Additionally, loyal customers often provide valuable feedback that can be instrumental in refining existing products and services or creating new ones. This continual input from loyal customers acts as a compass guiding the brand towards market trends and customer desires, fostering innovation that can keep the brand competitive and relevant. High retention rates also enable retailers to harness their customer base for insights that drive innovation and adaptation. Understanding why customers stay loyal and what they value most about the brand can help in tailoring offerings more precisely to market demands, ultimately leading to better product offerings and service improvements.

In short, high customer retention rates are more than just a metric amongst omnichannel retail KPIs; they are a comprehensive reflection of a brand’s ability to operate successfully across multiple channels in an integrated manner. This success not only boosts immediate financial performance but also establishes a foundation for sustainable growth and innovation, crucial for long-term competitiveness in the dynamic landscape of omnichannel retail.

Average Order Value (AOV)

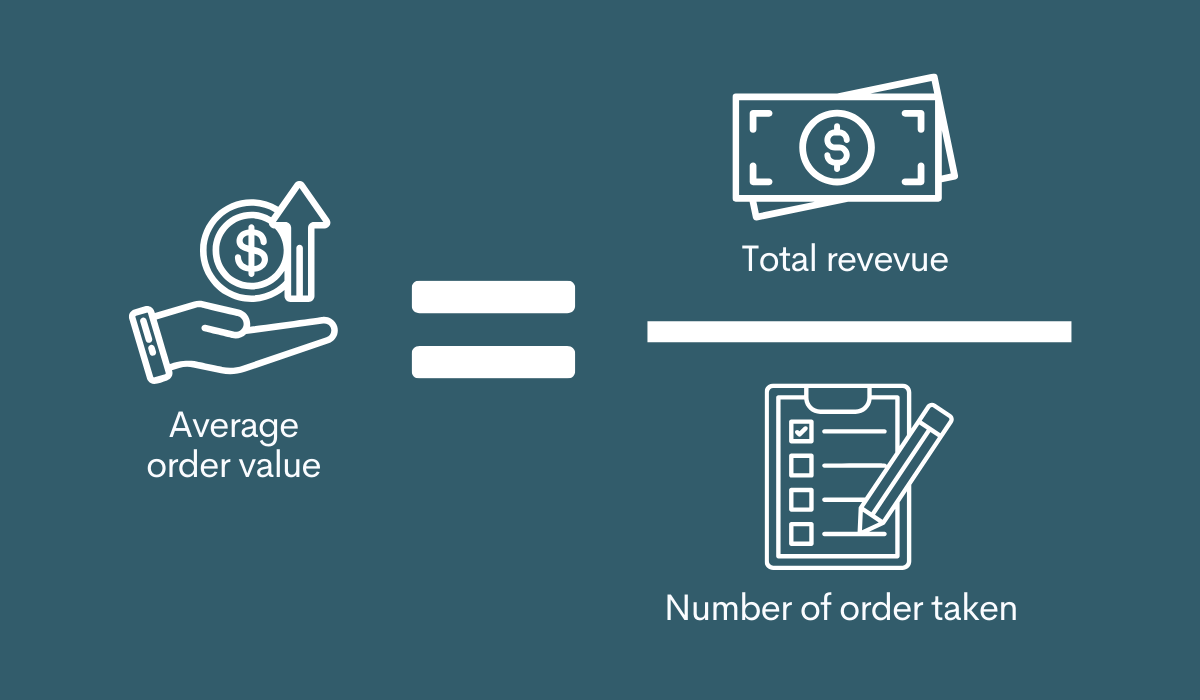

Average Order Value (AOV) stands out as one of the critical omnichannel retail KPIs that offers insights into consumer purchasing behavior across multiple sales channels. AOV measures the average total of every order placed with a retailer over a defined period, providing key data points that help to assess the effectiveness of marketing strategies and the overall customer spending patterns. This metric is particularly valuable in an omnichannel strategy, as it helps retailers understand how different channels contribute to sales and customer engagement.

Average Order Value is calculated by dividing the total revenue by the number of orders over a specific time frame. In an omnichannel context, it’s important to segment AOV by each channel — online, in-store, mobile app, etc. — to pinpoint how each channel performs and influences shopper spending. This detailed analysis helps retailers tailor their marketing and sales strategies to boost AOV across all channels, enhancing the overall profitability of the business.

The Significance of AOV for Omnichannel Retailers

Average Order Value (AOV) is instrumental in assessing the effectiveness of various pricing strategies and promotional efforts across different sales channels. By closely analyzing changes in AOV in response to different pricing tactics and promotional activities, retailers can discern which strategies encourage higher spending.

For instance, a promotional campaign that requires a minimum spend to unlock a discount may lead to an increase in AOV. This suggests that customers are willing to add more items to their carts to meet the threshold for the discount. Understanding this behavior allows retailers to fine-tune their promotions. For example, they might increase the minimum spend threshold slightly to test if the AOV rises correspondingly, or they could apply similar promotional strategies to other product lines or channels and monitor the impact on AOV. This kind of strategic experimentation helps identify the most effective ways to boost revenue and can be a guide for deploying successful promotions across multiple retail channels.

Understanding AOV also plays a crucial role in customer segmentation and targeting. By analyzing AOV, retailers can classify their customers into segments based on their purchasing power and buying behavior. This segmentation enables more precise marketing strategies that cater to the distinct needs and preferences of each group.

For high-AOV customers, retailers might tailor their approach by offering premium products, exclusive early-access promotions, or personalized services that cater to their propensity for higher spending. Conversely, for customers with a lower AOV, retailers might focus on different incentives that encourage a higher spend per transaction, such as bundle deals, volume discounts, or loyalty points that accrue benefits over time. This targeted approach not only enhances the customer experience by aligning it with individual expectations and value perceptions but also increases the effectiveness of marketing spend by focusing efforts where they are most likely to increase AOV and overall profitability.

Further, AOV provides valuable insights into which products or categories are contributing to higher order values. This information is critical for inventory management and marketing focus. If certain products consistently contribute to a higher AOV, a retailer might decide to increase stock levels of these items or highlight them in marketing campaigns. Additionally, understanding product performance in terms of AOV can guide decisions regarding product bundling or cross-selling strategies.

For example, if high-end electronics have a high AOV, pairing them with complementary accessories in a bundled offer could further increase the AOV. Retailers can also use this data to optimize the layout of both their physical stores and online platforms, positioning high-value items in prominent locations to maximize visibility and accessibility. This strategic placement can significantly influence buying patterns, encouraging customers to purchase more or higher-value items during their shopping journey.

By leveraging AOV in these comprehensive ways—through strategic pricing and promotions, targeted customer segmentation, and optimized product mix—retailers can significantly enhance their sales effectiveness and overall financial performance in an omnichannel retail environment. Each strategy not only aims to increase AOV but also to create a more personalized and satisfying shopping experience, which in turn can drive loyalty and repeat business, key components of long-term retail success.

Strategies to Increase AOV in Omnichannel Retail

- Cross-Selling and Upselling: Effective cross-selling and upselling strategies can significantly boost AOV by encouraging customers to add additional items or upgrade to more expensive options. For instance, showing related products or accessories at checkout online, or training in-store staff to suggest complementary products, can enhance the customer’s shopping experience and increase the order value.

- Loyalty Programs: Implementing or enhancing loyalty programs to reward higher spending can also drive up AOV. These programs can offer points, discounts, or special services that incentivize higher spending, such as free shipping or a free gift with a minimum purchase amount.

- Tiered Pricing Strategies: Using tiered pricing can encourage customers to buy more to achieve a better deal, effectively increasing the AOV. For example, offering a small discount on buying two items and a larger discount for three can encourage customers to purchase more items at once.

- Technology-Driven Personalization: Leveraging data analytics and AI to offer personalized product recommendations based on customer browsing and purchase history can significantly impact AOV. By presenting customers with products that align with their interests and previous shopping behavior, retailers can increase the likelihood of a larger basket size.

In-Depth Analysis of AOV’s Impact on Omnichannel Success

The significance of Average Order Value (AOV) in shaping the success of omnichannel retail strategies is profound. A higher AOV not only reflects the economic value of transactions but also suggests that customers perceive high value in the offerings, which is crucial for sustaining long-term business growth. Here’s a deeper exploration into how AOV impacts various facets of omnichannel retailing:

- Indication of Customer Value Perception: A higher AOV typically indicates that customers perceive the products or the shopping experience as valuable enough to warrant higher spending. This is a direct reflection of customer satisfaction and the effectiveness of a retailer’s marketing and pricing strategies. In an omnichannel context, where customers interact with a brand through multiple touchpoints, a consistent or increasing AOV across these channels suggests that the brand is successfully delivering value at every point of interaction. For example, if both the online and physical store channels show a growing AOV, it implies that the integration of these channels is effectively enhancing the customer experience, leading customers to spend more.

- Strategic Decision Making: Monitoring AOV helps omnichannel retailers make informed decisions about product placement, marketing strategies, and customer engagement tactics. By analyzing AOV trends, retailers can identify which channels, products, or promotional strategies are driving higher value sales. This insight allows them to allocate resources more efficiently and focus on strategies that are likely to boost AOV further. For instance, if data shows that online promotions significantly increase AOV, retailers might invest more in digital advertising and promotional campaigns to capitalize on this trend.

- Resource Allocation and Inventory Management: Understanding AOV dynamics helps in better inventory management and resource allocation. Products that consistently contribute to a higher AOV can be stocked more aggressively, ensuring that demand is met without overstocking less popular items. Similarly, insights from AOV can guide retailers in optimizing their supply chain and logistics for maximum efficiency, ensuring that high-value products are always available across all channels without significant holding costs.

- Customer Loyalty and Retention: Efforts to increase AOV often go hand-in-hand with improving the overall customer experience, which in turn can enhance customer loyalty and retention. For instance, initiatives aimed at personalizing the shopping experience, such as tailored product recommendations or loyalty rewards, not only encourage higher spending per transaction but also enhance the overall customer relationship with the brand. Satisfied customers are more likely to return, and a focus on increasing AOV can indirectly boost retention rates by elevating the perceived value and quality of the service provided.

- Enhanced Profitability: Ultimately, the goal of increasing AOV is to enhance profitability. Higher order values mean more revenue from each transaction, which can significantly improve the financial health of a business. In an omnichannel setup, where customer acquisition can be costly and complex due to the need to maintain multiple channels, maximizing the revenue from each customer interaction becomes crucial. A higher AOV reduces the pressure on acquiring large numbers of customers by increasing the revenue generated from existing customers, thus allowing for more sustainable growth and profitability.

In summary, AOV is a critical metric in omnichannel retail KPIs, influencing not just immediate sales figures but also broader strategic decisions that dictate resource allocation, customer relationship management, and long-term business sustainability. By focusing on strategies to enhance AOV, omnichannel retailers can ensure they not only meet but exceed customer expectations, driving both revenue and loyalty in a competitive retail landscape.

Customer Lifetime Value (CLV)

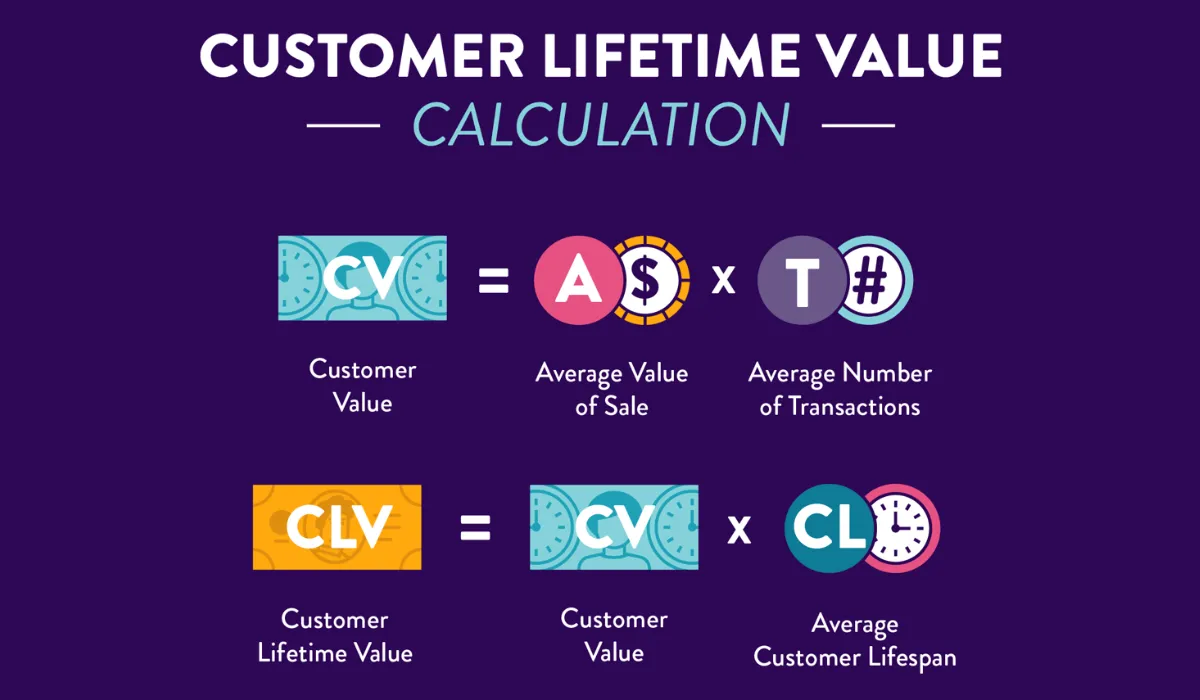

In the landscape of omnichannel retail, Customer Lifetime Value (CLV) is one of the most important omnichannel retail KPIs that provides deep insights into the long-term value of customers across multiple channels. CLV measures the total revenue a business can reasonably expect from a single customer account throughout the duration of their relationship with the company. This metric is especially critical for omnichannel retailers because it encapsulates the results of customer interactions that span digital and physical touchpoints, offering a holistic view of customer profitability over time.

CLV is integral for understanding how different customer segments contribute to the overall financial health of a retail business. In omnichannel retail, where customers engage through various channels — from online shopping to in-store purchases — the ability to track and analyze CLV across these channels helps retailers allocate marketing resources more effectively and tailor customer experiences to maximize long-term revenue. The essence of CLV in an omnichannel strategy lies in its ability to highlight the value of creating cohesive customer experiences that encourage repeat business and increase the duration of the customer relationship.

Calculating CLV in Omnichannel Environments

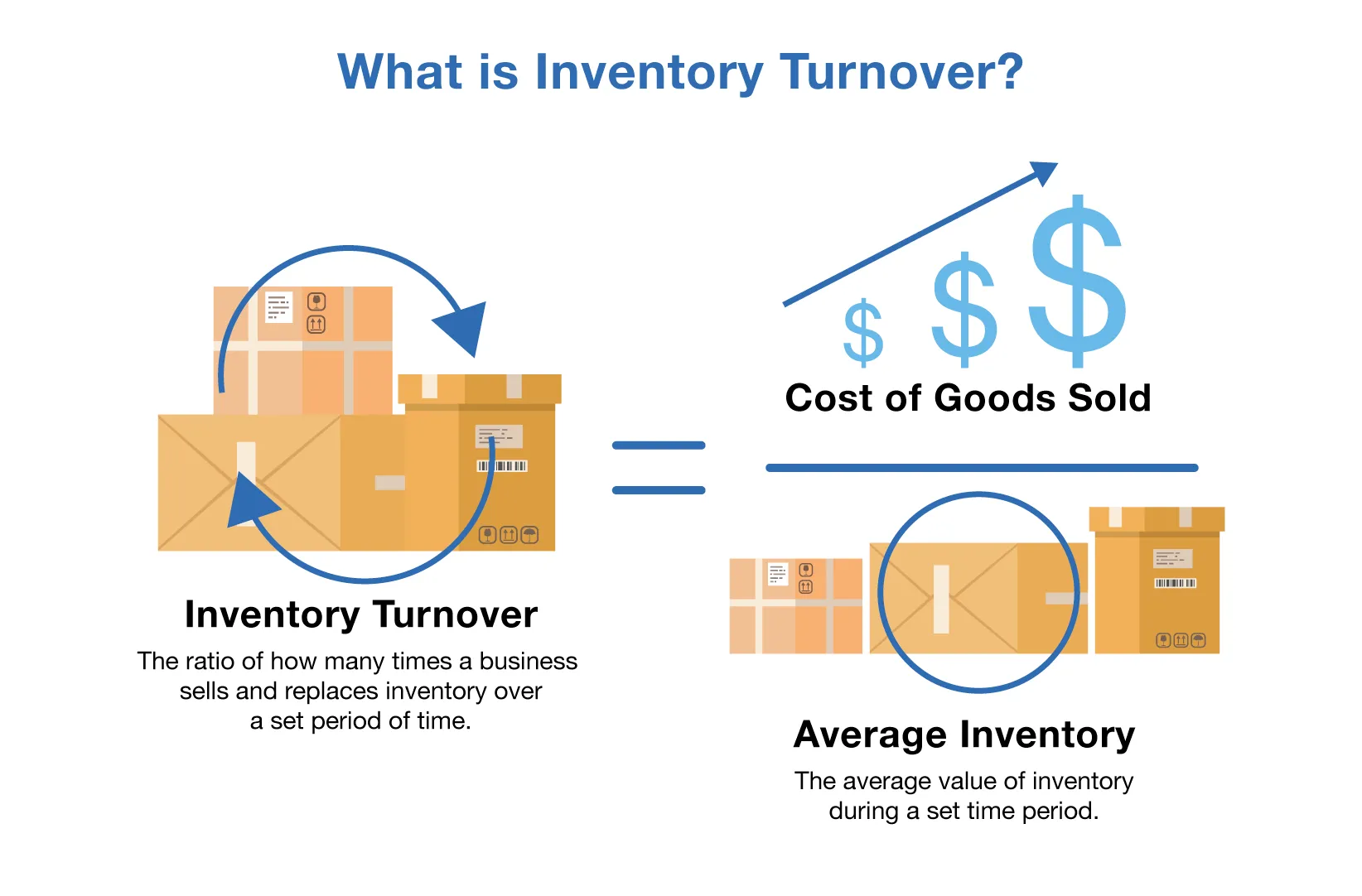

Calculating Customer Lifetime Value in an omnichannel setting is a critical process that integrates data across multiple customer touchpoints to predict the total value a customer will bring to a business over the entirety of their relationship. This calculation not only reflects the financial contribution of each customer but also guides strategic decision-making across the organization. Here’s a more detailed exploration of each step involved in calculating CLV in an omnichannel context:

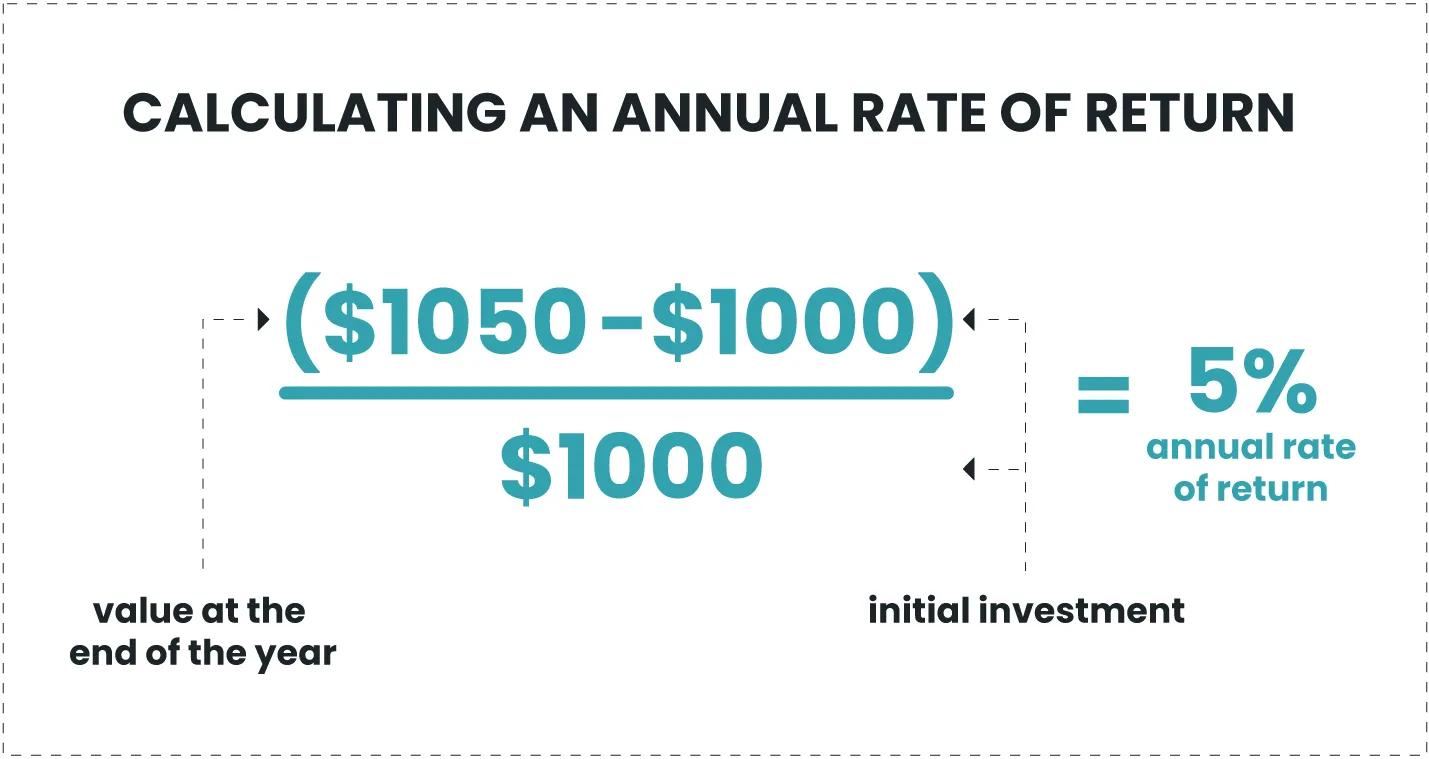

- Average Order Value (AOV): As mentioned above, to determine the Average Order Value, divide the total revenue generated from all customer purchases by the number of purchases within a specific period. This metric should be calculated separately for each channel — online, in-store, via mobile apps, etc. — to understand channel-specific spending behaviors. For omnichannel retailers, integrating data from various channels to get a unified view of AOV is crucial. For example, if a customer typically spends more in-store than online, this insight can inform personalized marketing strategies that encourage more frequent or higher-value online purchases.

- Purchase Frequency: Purchase Frequency measures how often an average customer makes a purchase within a given time frame. This calculation helps retailers understand customer engagement levels across different channels. Tracking frequency requires robust data analytics to accurately attribute purchases to individual customers across multiple platforms. Higher purchase frequency indicates stronger customer engagement, which is a positive sign for overall business health.

- Customer Value: By multiplying the Average Purchase Value by Purchase Frequency, retailers can estimate the total value a customer typically contributes within a defined period. This Customer Value is a snapshot of the immediate worth of the customer to the business, not taking into account the entire projected lifecycle. For omnichannel retailers, understanding customer value on a per-channel basis can reveal which channels are most valuable and deserve more strategic focus.

- Average Customer Lifespan: Estimating the Average Customer Lifespan involves analyzing historical data to determine how long customers typically continue to make purchases from the brand. This step is crucial and can vary significantly based on the business model, industry, and customer engagement strategies. In an omnichannel environment, it’s important to consider how different customer touchpoints contribute to retaining customers over time, potentially extending their lifespan with the brand.

- CLV: Finally, multiplying the Customer Value by the Average Customer Lifespan gives the Customer Lifetime Value. This figure represents the total revenue a retailer can expect from a typical customer throughout their relationship with the brand. In an omnichannel context, calculating CLV helps retailers gauge the long-term value of investments in customer relationship management and marketing across multiple channels.

Understanding CLV in an omnichannel environment allows retailers to refine their strategies for customer engagement and retention, ensuring that resources are allocated efficiently to maximize long-term returns. This metric not only helps in identifying the most profitable customer segments but also in tailoring communications, promotions, and product offerings to meet the unique needs of different customer groups, enhancing their experiences and increasing their lifetime value.

Impact of CLV on Omnichannel Success

Understanding and effectively monitoring Customer Lifetime Value as an omnichannel retail KPIs plays a pivotal role in shaping a retailer’s strategic direction. Here’s a deeper dive into how a robust CLV influences omnichannel success and supports sustainable business growth:

- Indicator of Customer Retention and Engagement: High CLV is a direct indicator of successful customer retention and engagement strategies. It suggests that customers consistently receive value from the brand’s offerings, which motivates them to maintain their relationship with the brand over time. In an omnichannel context, this implies that the integration of services and channels — from online platforms to physical stores and mobile apps — is effectively meeting or exceeding customer expectations. Customers who experience seamless interactions across multiple channels are more likely to increase their engagement, leading to higher transaction frequencies and, subsequently, greater lifetime value.

- Reduction in Acquisition Costs: By focusing on increasing the CLV, retailers can reduce their dependence on new customer acquisition strategies, which are often more costly and yield lower immediate returns compared to strategies aimed at retaining existing customers. High CLV reflects a strong base of loyal customers who contribute to a stable and predictable revenue stream. This stability allows retailers to allocate resources more effectively, not only sustaining the business with recurrent revenues but also investing in innovations and improvements that further enhance customer satisfaction and retention.

- Enhanced Profitability Through Up-Selling and Cross-Selling: A customer with a high CLV is generally more receptive to up-selling and cross-selling opportunities because of their established trust and familiarity with the brand. In an omnichannel setup, where customer data from various channels can be integrated and analyzed, personalized marketing becomes more precise and effective. Retailers can tailor their offers based on the specific buying patterns and preferences of individual customers, encouraging them to explore higher-value products or additional services that align with their interests. This strategic approach not only boosts the AOV but also reinforces the customer’s relationship with the brand, leading to sustained increases in CLV.

- Strategic Allocation of Marketing Resources:With clear insights from CLV metrics, retailers can more strategically allocate their marketing efforts and budgets across channels. Understanding which channels generate higher CLV allows businesses to optimize their spending, focusing more on these high-return channels while refining or reducing expenditure in less profitable areas. This targeted allocation helps in maximizing overall marketing ROI and ensures that each channel is leveraged to its full potential in contributing to customer value and retention.

- Long-Term Business Sustainability: Retailers that excel in maintaining high CLV are better positioned for long-term sustainability. They can rely on a loyal customer base that not only supports the business through repeated purchases but also acts as a brand advocate, attracting new customers through word-of-mouth. This organic growth is invaluable as it comes with high trust and lower cost. Furthermore, high CLV allows retailers to plan with greater confidence, investing in long-term growth initiatives such as technological advancements, market expansion, and product development with the assurance that their customer base will support these endeavors over time.

In essence, CLV is more than just a measure of customer value; it is a comprehensive indicator of how well a retailer is performing in the omnichannel landscape and a critical driver of strategic decision-making. By prioritizing the improvement of CLV, retailers not only enhance their customer relationships but also secure a robust foundation for future growth and success in the competitive retail market.

Customer Experience KPIs

Understanding customer experience is paramount for omnichannel retailers who aim to integrate and optimize interactions across multiple touchpoints. To effectively measure and enhance the customer experience, several omnichannel retail KPIs are utilized, each offering unique insights into different facets of the customer journey. This section will explore the critical customer experience KPIs, including Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), Customer Effort Score (CES), Return Rate, and Cart Abandonment Rate, and how they collectively inform omnichannel strategies.

Net Promoter Score (NPS)

The Net Promoter Score (NPS) serves as a critical gauge of customer loyalty and brand advocacy in omnichannel retail. This straightforward metric is profoundly insightful, reflecting not just customer satisfaction but their willingness to act as brand ambassadors. Here’s a deeper exploration into how NPS functions and its strategic value in an omnichannel setting.

Calculating and Interpreting NPS

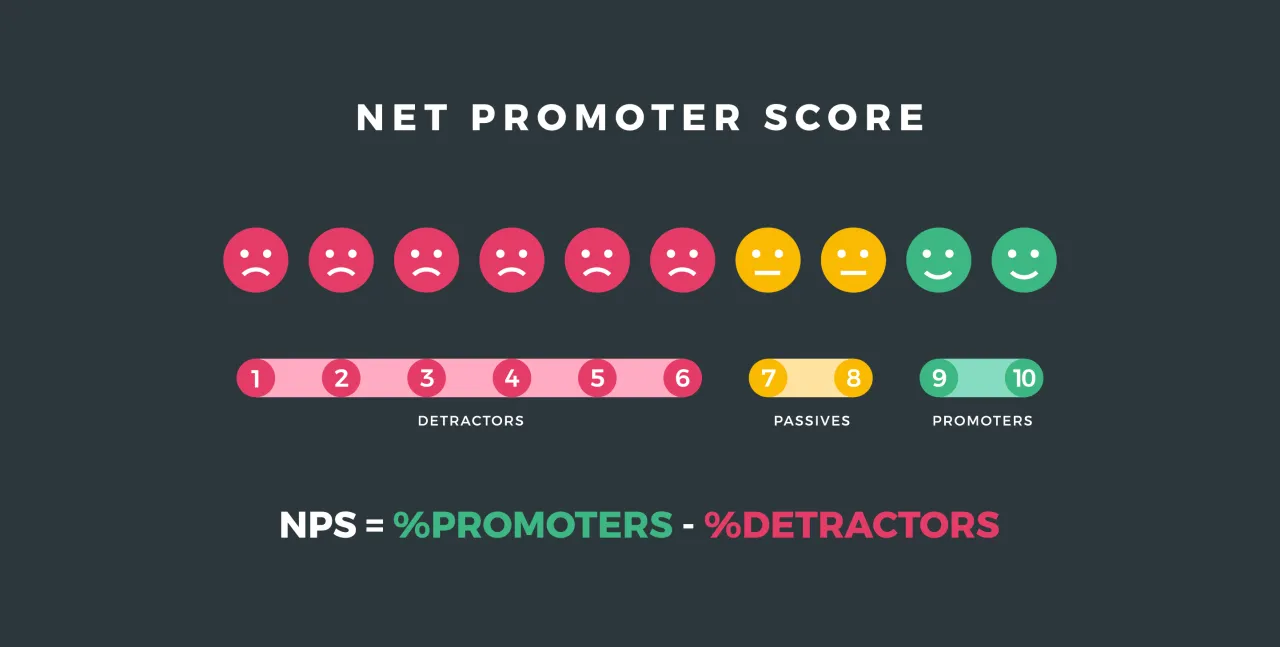

NPS is derived from customer responses to a singular, pivotal question about their likelihood to recommend the brand to others, scored on a scale from 0 to 10. Customers responding with a score of 9 or 10 are labeled as Promoters — these are highly satisfied customers who are likely to create the most value, not only through repeat business but also by attracting new customers through word-of-mouth. Those who score 7 or 8 are Passives — satisfied but unenthusiastic customers who are vulnerable to competitive offerings. Scores from 0 to 6 categorize Detractors, who are dissatisfied customers potentially detrimental to the brand through negative word-of-mouth.

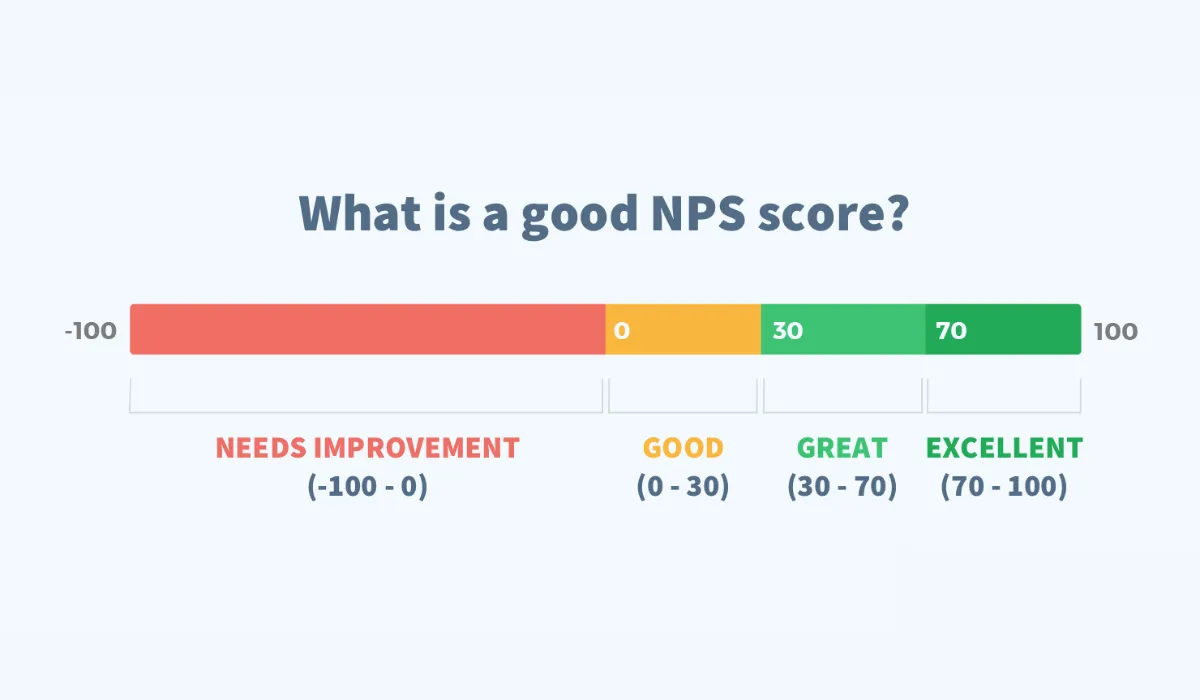

The NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters. A positive NPS (higher than zero) is generally favorable and indicates that a brand has more Promoters than Detractors. A very high NPS is a strong indicator of customer loyalty and product or service excellence.

Strategic Uses of NPS

NPS is not just a measure; it’s a tool for continuous improvement. High NPS scores across channels can reinforce a retailer’s confidence in their customer service policies and product quality, while low scores provide a clear signal that changes are needed. Omnichannel retailers can use NPS data to:

- Enhance Customer Service: Tailor training programs to address specific weaknesses in customer interactions that may be causing low NPS scores.

- Refine Product Offerings: Adjust product lines and services based on the feedback from Detractors and Passives to convert them into Promoters.

- Optimize User Experience: Improve website interfaces, mobile app usability, and in-store technology to create seamless shopping experiences that could elevate NPS.

Long-term Benefits of High NPS

In an omnichannel approach, understanding the NPS across various channels helps pinpoint strengths and weaknesses in different areas of customer interaction. For instance, an omnichannel retailer might discover that while their online platform achieves an exceptionally high NPS due to ease of use and excellent customer support, their in-store experience lags due to poor service or long wait times. This discrepancy can guide targeted improvements in customer service training, store layout adjustments, or the implementation of technology to streamline in-store processes.

Sustaining a high NPS can lead to significant long-term benefits for omnichannel retailers. These include increased customer retention, lower marketing costs due to organic growth through recommendations, and higher overall profitability. Furthermore, a strong NPS indicates successful customer engagement strategies that can become a key competitive advantage in the retail market.

Customer Satisfaction Score (CSAT)

The Customer Satisfaction Score (CSAT) is a vital KPI for measuring the immediate satisfaction levels of customers within an omnichannel retail environment. As a direct reflection of how customers perceive their latest interaction or transaction, CSAT provides actionable insights that can be used to optimize customer experiences across multiple platforms and touchpoints.

Calculation and Utilization of CSAT

CSAT is calculated by soliciting customer feedback through surveys typically administered after a purchase or interaction. The survey usually asks a straightforward question such as, “How satisfied were you with your experience or purchase?” with customers providing ratings on a scale (often from 1 to 5 or 1 to 10). The responses are then converted into a percentage of customers who answered with the top-tier ratings, providing a clear measure of satisfaction levels.

To truly harness the power of CSAT in an omnichannel context, retailers should gather and analyze these scores separately for each channel—be it online, in-store, or via mobile apps. This segmented data allows retailers to identify which channels are delivering the best customer experiences and which may require immediate intervention to address specific issues.

Strategic Implications of CSAT in Omnichannel Retail

High CSAT scores generally indicate that customers are pleased with their shopping experiences and the products or services provided. In contrast, lower scores can alert retailers to problems in specific areas.

For example, low CSAT scores in an online store could indicate issues with website navigation, checkout processes, or even the quality of online customer support. Understanding these nuances allows omnichannel retailers to:

- Pinpoint Specific Areas for Improvement: Low CSAT scores can direct attention to aspects of the service or product experience that are not meeting customer expectations. Retailers can then focus on refining these areas, whether it involves streamlining a cumbersome checkout process, enhancing product quality, or improving post-purchase customer support.

- Customize Training and Development: Insights from CSAT can inform staff training programs, especially for in-store employees, to enhance direct customer interactions and ensure consistency across all physical locations.

- Adjust Product and Service Offerings: CSAT feedback can lead to adjustments in product ranges or service offerings to better align with customer expectations and demands.

Impact of CSAT

In the competitive landscape of omnichannel retail, CSAT is directly linked to customer retention and loyalty. Satisfied customers are more likely to return, make repeat purchases, and become brand advocates. Each positive experience reinforces their loyalty to the brand, which in turn contributes to a sustainable business model through repeat business and reduced customer acquisition costs.

While CSAT provides immediate insights into customer satisfaction, it is most powerful when combined with other omnichannel retail KPIs such as NPS and CES. Together, these metrics offer a comprehensive view of customer experience, from satisfaction with specific interactions (CSAT) to overall loyalty and advocacy (NPS) and the ease of interactions (CES). This integrated approach enables omnichannel retailers to develop a holistic strategy that not only addresses short-term satisfaction but also builds long-term customer relationships.

By strategically leveraging CSAT data, omnichannel retailers can make informed decisions that enhance the customer experience across all channels, driving higher levels of satisfaction and fostering a loyal customer base. The ability to quickly respond to customer feedback and make necessary adjustments ensures that the brand remains responsive and competitive in a rapidly evolving retail landscape.

Return Rate

The Return Rate is a pivotal omnichannel retail KPIs to monitor and manage, as it provides crucial insights into the reasons behind product returns and helps identify opportunities for improving customer satisfaction and operational efficiencies. Here’s an in-depth exploration of the Return Rate, its implications, and strategies for management in an omnichannel retail context.

Understanding Return Rate

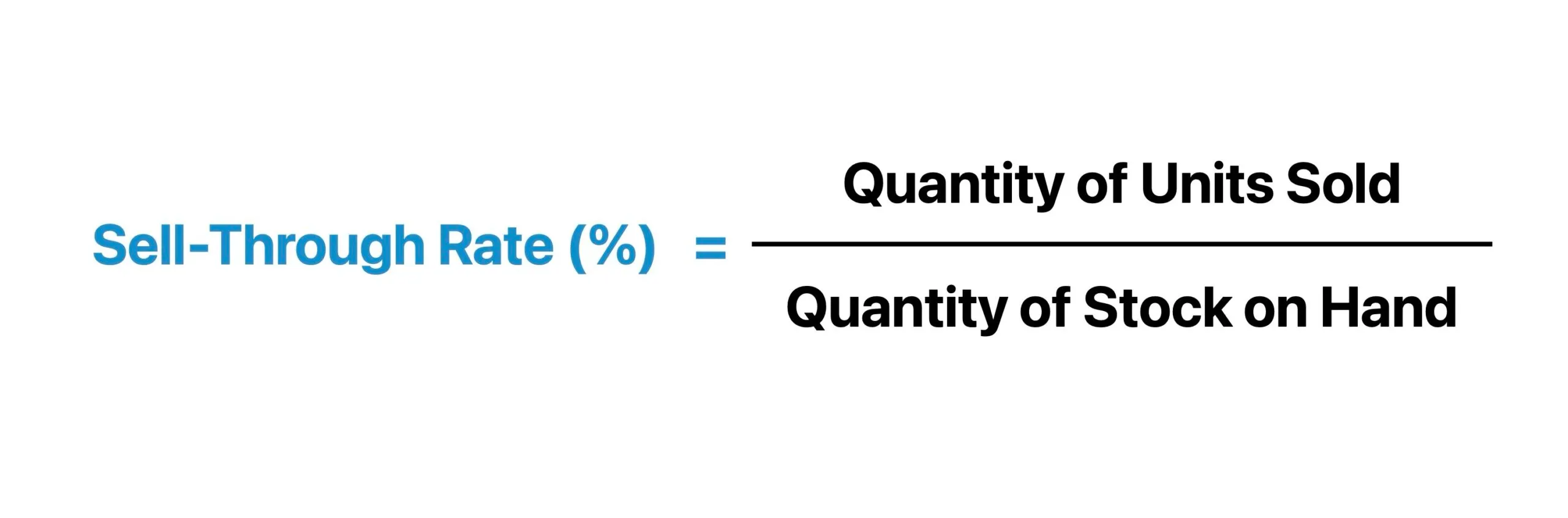

Return Rate is calculated by dividing the number of returned items by the total number of items sold, typically expressed as a percentage. This metric is essential for assessing the health of product offerings and the accuracy of product descriptions across various sales channels. In an omnichannel setting, where customers may interact with products differently (e.g., seeing an item in-store vs. viewing it online), discrepancies in how products are presented can lead to higher return rates.

A high Return Rate can be symptomatic of several underlying issues:

- Product Quality Concerns: Frequent returns might indicate problems with product durability or functionality, suggesting a need for quality improvements or better quality control processes.

- Inaccurate or Misleading Product Information: If product descriptions and images are not consistent across channels or fail to accurately represent the product, customers may feel misled, leading to dissatisfaction and returns.

- Customer Expectations Not Met: Returns can also signal a mismatch between what customers expect based on the marketing materials and what the product actually offers.

By examining return rates specifically for each channel—online, in-store, mobile app, etc. — retailers can pinpoint where customers may be encountering issues.

For instance, higher return rates from online purchases could suggest that product images or descriptions may not be clear or detailed enough, causing a gap between customer expectations and the actual product. Conversely, returns in physical stores might highlight issues with the in-store experience or sales staff interactions.

Strategies to Reduce Return Rates

Minimizing the return rate involves several strategic actions that can significantly enhance customer satisfaction and reduce operational costs:

- Enhance Product Information Accuracy: Ensuring that all product information is consistent and thorough across all channels can help manage customer expectations more effectively. This includes high-quality images, detailed descriptions, and accurate sizing information for items like clothing or furniture.

- Improve Quality Control: Strengthening quality control processes to ensure that products meet the advertised standards can reduce returns due to quality issues.

- Customer Feedback Integration: Regularly collecting and analyzing customer feedback related to returns can provide insights into why returns are happening and how product offerings or descriptions can be improved.

- Flexible and Clear Return Policies: Clearly communicating return policies and making the return process as easy as possible can enhance customer satisfaction, even in situations where a return is necessary.

If you want to better your returns management, consider implementing advanced analytics and AI. It can help predict potential return patterns and identify products that might have higher return risks before they become a significant issue. Additionally, technology can streamline the returns process, making it more efficient and less costly by automating aspects like return label generation and refunds processing.

By meticulously managing and reducing the Return Rate, omnichannel retailers can not only enhance customer satisfaction but also improve their overall operational efficiency and product strategy. This focus ensures that products meet customer expectations and are presented accurately across all channels, ultimately contributing to a more successful omnichannel strategy and healthier bottom-line performance.

Cart Abandonment Rate

The Cart Abandonment Rate is a crucial omnichannel retail KPIs, reflecting the percentage of shopping carts that are initiated but not completed with a purchase. This metric is particularly important in eCommerce and can provide valuable insights into the online purchasing process and customer behavior. Below is a detailed exploration of Cart Abandonment Rate, its implications for omnichannel retail, and effective strategies to mitigate it.

Understanding Cart Abandonment Rate

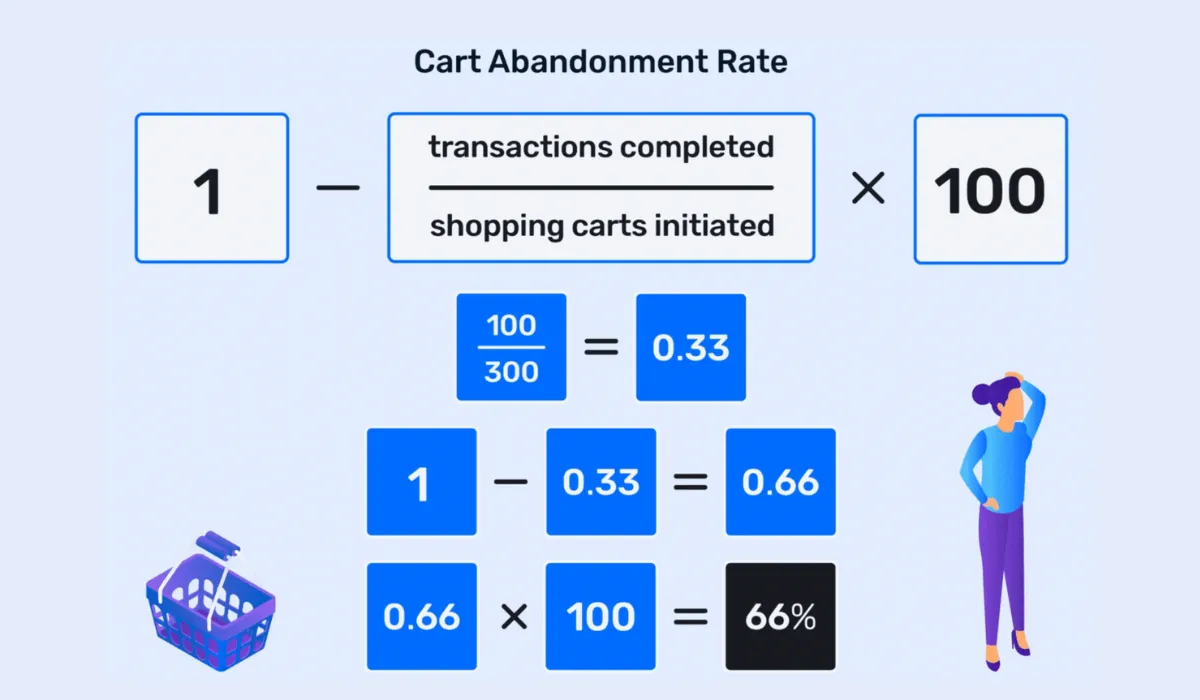

The Cart Abandonment Rate is calculated by dividing the number of completed purchases by the number of shopping carts created, subtracting this from one, and then multiplying by 100 to get a percentage. This rate is indicative of how well an eCommerce platform facilitates the journey from interest to purchase. A high abandonment rate often points to friction within the checkout process that discourages customers from completing their transactions.

High Cart Abandonment Rates can signal several potential issues within the online shopping experience:

- Complex Checkout Processes: A lengthy or complicated checkout process can deter customers. This might include having to enter excessive information, confusing navigation, or lack of guidance on the next steps.

- Unexpected Costs: High shipping costs, taxes, or additional fees added at checkout can lead to cart abandonment. Customers prefer transparent pricing from the onset of their shopping journey.

- Limited Payment Options: Today’s consumers expect a variety of payment options, including digital wallets and alternative payment methods. A lack of these options can cause customers to abandon their carts.

- Website Performance Issues: Slow load times, crashes, or errors during the checkout process can frustrate customers and lead them to abandon their purchases.

Strategies to Reduce Cart Abandonment

Addressing cart abandonment requires a multifaceted approach to streamline the purchasing process and enhance the customer experience:

- Simplify the Checkout Process: Minimize the number of steps and amount of information required to complete a purchase. Consider features like auto-fill and guest checkout options to facilitate a quicker and smoother transaction.

- Transparent Pricing: Ensure that all costs, including shipping and taxes, are clearly disclosed early in the shopping process. Surprises at checkout can lead to distrust and lost sales.

- Diverse Payment Options: Incorporate multiple payment methods, including popular digital wallets and financing options, to accommodate a broader range of customer preferences.

- Optimize Website Performance: Regularly test and update the e-commerce platform to ensure it is fast, secure, and user-friendly. Address any bugs or glitches promptly to prevent disruptions during the checkout process.

- Retargeting Abandoned Carts: Implement strategies such as sending reminder emails or targeted ads that encourage customers to revisit their abandoned carts. Personalize these communications with details of the abandoned items and possibly include a special offer or discount to incentivize completion of the purchase.

Advanced analytics tools and AI can also help identify patterns and trends in cart abandonment, providing insights into which products are most frequently abandoned or at what stage of the checkout process customers are dropping off. This data can be instrumental in continuously refining the shopping experience to reduce abandonment rates.

By actively addressing the factors contributing to high Cart Abandonment Rates, omnichannel retailers can enhance the efficiency of their eCommerce operations and improve overall customer satisfaction. These efforts not only help convert more browsers into buyers but also build trust and loyalty among customers, encouraging repeat business and positive word-of-mouth recommendations.

Channel-Specific KPIs

To effectively manage and optimize an omnichannel retail strategy, retailers must dive deep into channel-specific KPIs. These omnichannel retail KPIs serve as metrics to provide crucial insights into how each channel contributes to the overall business and customer experience. This section explores the vital KPIs for different channels, including website traffic and conversion rates, social media engagement metrics, email marketing performance, mobile app usage and engagement, and in-store foot traffic and conversion.

Website Traffic and Conversion Rates

Website traffic and conversion rates are crucial channel-specific KPIs in omnichannel retail, offering critical insights into how effectively an online store attracts and converts potential customers into paying customers.

Understanding Website Traffic and Conversion Rates

Website traffic measures the number of users who visit the website over a specific period. It serves as a primary indicator of online presence effectiveness and initial customer interest. High traffic volumes suggest strong brand visibility and reach, potentially driven by successful marketing campaigns or strong organic search presence. However, high traffic alone doesn’t guarantee business success unless it translates into actual sales, which is where conversion rates come into play.

Conversion rates measure the percentage of website visitors who complete a desired action, such as making a purchase. It is a direct indicator of the effectiveness of the website’s design, functionality, and overall user experience. Conversion rates help identify how well the website capitalizes on its traffic, turning visitors into customers. A low conversion rate, despite high traffic, may indicate issues with the website’s navigation, content, product offerings, pricing strategy, or checkout process.

Optimization Strategies for Website Traffic and Conversion Rates

To optimize your web traffic and conversion rate, here are the few things you can do:

Enhancing User Experience (UX):

- Simplify Navigation: Ensure that the website’s layout is intuitive and user-friendly. Simplify the navigation process to help users find products quickly and efficiently. A well-organized site structure significantly enhances the ability to browse and find information, directly impacting user satisfaction and conversion rates.

- Mobile Optimization: With a significant portion of web traffic coming from mobile devices, it’s crucial to ensure that the website is optimized for mobile. This includes fast loading times, responsive design, and accessible navigation tailored for smaller screens.

- Loading Speed: Improve site speed as delays can deter potential purchases. Faster websites provide a better user experience, encouraging visitors to stay longer and explore more products, thereby increasing the likelihood of conversion.

A/B Testing:

- Experiment with Different Elements: Regularly test different aspects of the website, such as product images, CTA buttons, layout designs, and content placements. For example, testing the color and placement of a Buy Now button may reveal preferences that lead to more conversions.

- Landing Pages: Test different versions of landing pages to determine which elements perform best in terms of visitor engagement and conversions. This could involve variations in headline text, images, or the amount of text on the page.

SEO and Retargeting Ads:

- Search Engine Optimization (SEO): Utilize SEO strategies to increase organic traffic. This includes optimizing website content for relevant keywords, improving meta descriptions and titles for better click-through rates, and ensuring website architecture supports search engine indexing.

- Content Marketing: Develop and distribute valuable content that attracts and engages visitors, such as blogs, videos, and infographics. This not only helps improve SEO but also establishes the brand as a thought leader in its niche.

- Retargeting Campaigns: Implement retargeting strategies to bring back visitors who didn’t make a purchase on their first visit. By displaying ads to these visitors while they browse other sites, you remind them of their interest and encourage them to return, potentially increasing conversion rates.

Social Media Engagement Metrics

Social media platforms play an integral role in the omnichannel retail landscape, serving as dynamic venues for customer interaction and brand promotion. The effectiveness of a brand’s social media presence is often measured through engagement metrics, which include likes, shares, comments, and the growth of followers. These metrics are critical as they provide a quantitative look at how engaging and appealing a brand’s content is to its audience.

Engagement Metrics Explained

- Likes: This metric serves as a basic indicator of content’s immediate appeal.

- Shares: Shares and reposts indicate that the content resonates well enough that users are willing to associate it with their own profiles, expanding the content’s reach.

- Comments: Comments often provide deeper insight into how users perceive the brand or content, including constructive feedback or direct customer engagement.

- Followers: Growth in followers can signal improving brand visibility and audience interest over time.

High engagement rates typically suggest successful content strategies and effective communication channels that capture and hold the audience’s attention. Conversely, low engagement might suggest that content is not resonant or that the strategies are not effectively aligned with the audience’s preferences.

Strategies to Enhance Social Media Engagement

- Content Relevance and Value: Crafting content that is both relevant and valuable to the target audience is crucial. This involves understanding audience preferences and pain points to tailor content that speaks directly to their interests or needs. For instance, a brand can use insights from customer data to create informational content, how-to guides, or lifestyle posts that align with the audience’s interactions with the brand.

- Active Community Engagement: Brands should strive to create a community around their products or services by actively engaging with their audience. Responding to comments, participating in discussions, and even acknowledging user-generated content can foster a loyal community. This active engagement helps humanize the brand and build stronger, more personal connections with customers.

- Targeted Promotions and Contests: Social media-specific promotions, such as giveaways or contests, are excellent strategies for boosting engagement. These activities not only encourage existing followers to engage but also attract new followers. Brands can leverage these promotions to increase brand exposure and incentivize interactions by offering rewards that align with the audience’s interests.

- Regular Interaction and Consistency: Consistency in posting and interaction helps maintain brand presence and keeps the audience engaged. Setting a regular posting schedule and maintaining a consistent voice and style across all posts reinforce brand identity and help in building a dependable image.

- Utilizing Social Media Insights: Most social media platforms provide analytics tools that allow brands to track engagement metrics and audience demographics. By regularly reviewing these insights, brands can continuously refine their strategies to better meet the needs of their audience, adapting content types, posting times, and engagement tactics based on what has proven most effective.

Email Marketing Performance

Email marketing continues to be an indispensable component of omnichannel retail strategies, with open rates and click-through rates (CTR) serving as primary indicators of its effectiveness. Understanding these metrics allows retailers to gauge the impact of their email communications and refine their approaches to enhance customer engagement and drive conversions.

Understanding Email Marketing Performance

Open Rates provide insight into the percentage of recipients who open an email, which reflects the initial appeal of the email content, particularly the effectiveness of the subject line. A high open rate generally indicates that the subject line was compelling enough to catch the recipient’s attention, possibly due to effective personalization, relevance to the recipient, or timely delivery.

Click-Through Rates (CTR) measure the percentage of recipients who click on a link within the email after opening it. This metric is crucial as it reflects the effectiveness of the email content in motivating recipients to take a desired action, such as visiting a product page, reading an article, or taking advantage of a promotion. High CTRs are indicative of content that is relevant and offers perceived value to the audience, encouraging deeper engagement with the brand.

Strategies to Enhance Email Marketing Performance

In order to enhance your email marketing performance, here are a few things you can do:

- Advanced Segmentation: Going beyond basic demographic segmentation, retailers can utilize behavioral data, purchase history, and customer preferences to create highly targeted email campaigns. This advanced segmentation ensures that the content is extremely relevant to each recipient, which can significantly improve both open rates and CTRs. For example, sending a special offer on a product category that a customer has shown interest in can result in higher engagement rates compared to a generic promotional email.

- Optimizing Email Subject Lines: Crafting subject lines that resonate with the target audience is key to boosting open rates. This involves using action-oriented language, posing questions, or including intriguing teasers that pique curiosity without giving away too much. Personalizing subject lines with the recipient’s name or references to past interactions can also increase the likelihood of the email being opened. Retailers should continuously A/B test different subject lines to determine which styles and formats generate the best response.

- Compelling and Clear CTAs: Each email should include a clear and compelling call to action that guides recipients towards what they should do next. Whether it’s inviting them to learn more about a product, take advantage of a limited-time offer, or participate in a loyalty program, the CTA should be easy to find and visually distinct. Using buttons instead of hyperlinks, employing action-driven text, and placing CTAs strategically within the email can enhance visibility and improve click-through rates.

- Consistent Testing and Analytics: Continuous testing and analysis are essential to refine email strategies. This includes not only A/B testing of subject lines and CTAs but also testing different email formats, layouts, and content types. Analyzing the performance of each email campaign helps identify what resonates best with the audience and which areas might need adjustment. Metrics such as open rates, CTRs, conversion rates, and even unsubscribe rates provide a comprehensive view of campaign effectiveness.