Choosing the right payment platform – whether it be the integrated approach of Shopify or the extensive, flexible options offered by PayPal – can dramatically affect your operational efficiency, customer satisfaction, and ultimately, your bottom line. In the forthcoming sections, we will delve deeper into Shopify vs PayPal, helping you understand which platform aligns best with your business objectives in the dynamic digital marketplace. This comparison aims not only to highlight the strengths and limitations of each but also to equip you with the knowledge to make an informed decision tailored to your specific needs.

Detailed Comparison: Shopify vs PayPal

The decision between Shopify and PayPal influences not only how businesses manage transactions but also how they are perceived by consumers, how they scale, and how they integrate various online sales tools and analytics. This part of the blog post aims to dissect these platforms through various lenses such as features, user experience, pricing, security, and more, to provide you with comprehensive insights.

Core Features and Services

Understanding the core features and offerings of eCommerce and payment platforms is essential for assessing how they can bolster your business operations. This section focuses on the distinct functionalities and services of Shopify Payments and PayPal, exploring their unique capabilities. By detailing what each platform has to offer, we aim to provide you with the necessary insights to decide which platform aligns best with your business needs and growth objectives.

Shopify

Shopify is not just a payment processor; it’s an all-encompassing eCommerce platform that allows merchants to set up an online store and sell products globally. Shopify Payments is the platform’s own payment gateway, integrated directly within the user’s Shopify environment, streamlining the setup and daily operations. Shopify Payments represents Shopify’s integrated payment processing system, designed to streamline operations for merchants using the Shopify platform. It eliminates the need for third-party gateways, providing a seamless integration directly into the Shopify admin. This system is crucial when discussing Shopify vs PayPal as it directly contrasts with PayPal’s external payment gateway model.

eCommerce Platform Functionalities

Shopify provides a robust platform for online store creation, including website hosting, a customizable store builder, a vast app marketplace, and detailed analytics. The platform supports various sales channels, including online, mobile, social media, and physical locations, making it a versatile choice for omnichannel retailing.

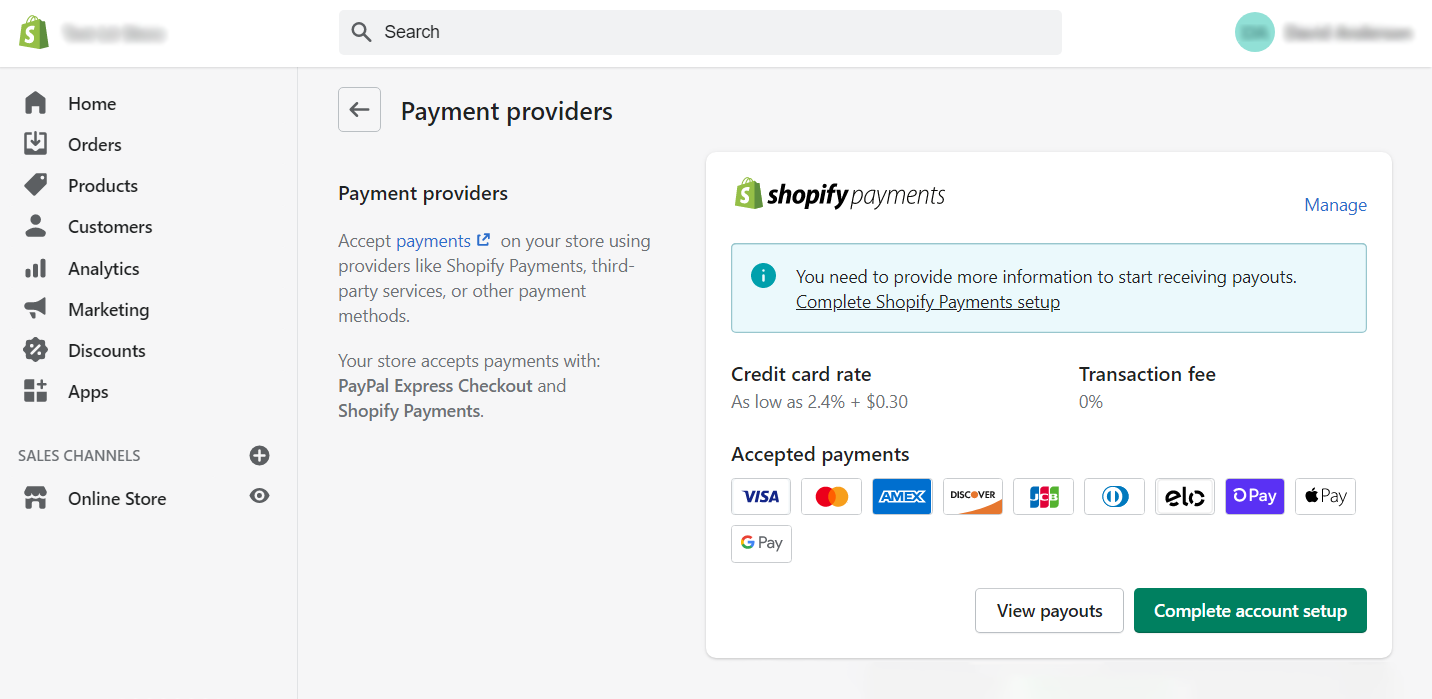

Shopify Payments is deeply integrated with the Shopify eCommerce platform, which is a significant advantage for users of Shopify. This integration means that Shopify merchants can manage everything from inventory to payments in one centralized location, enhancing the simplicity and efficiency of their operations.

In the Shopify vs PayPal comparison, while PayPal can be used across various platforms, Shopify Payments is exclusive to Shopify users, offering tailored functionalities that enhance the Shopify experience. These functionalities include:

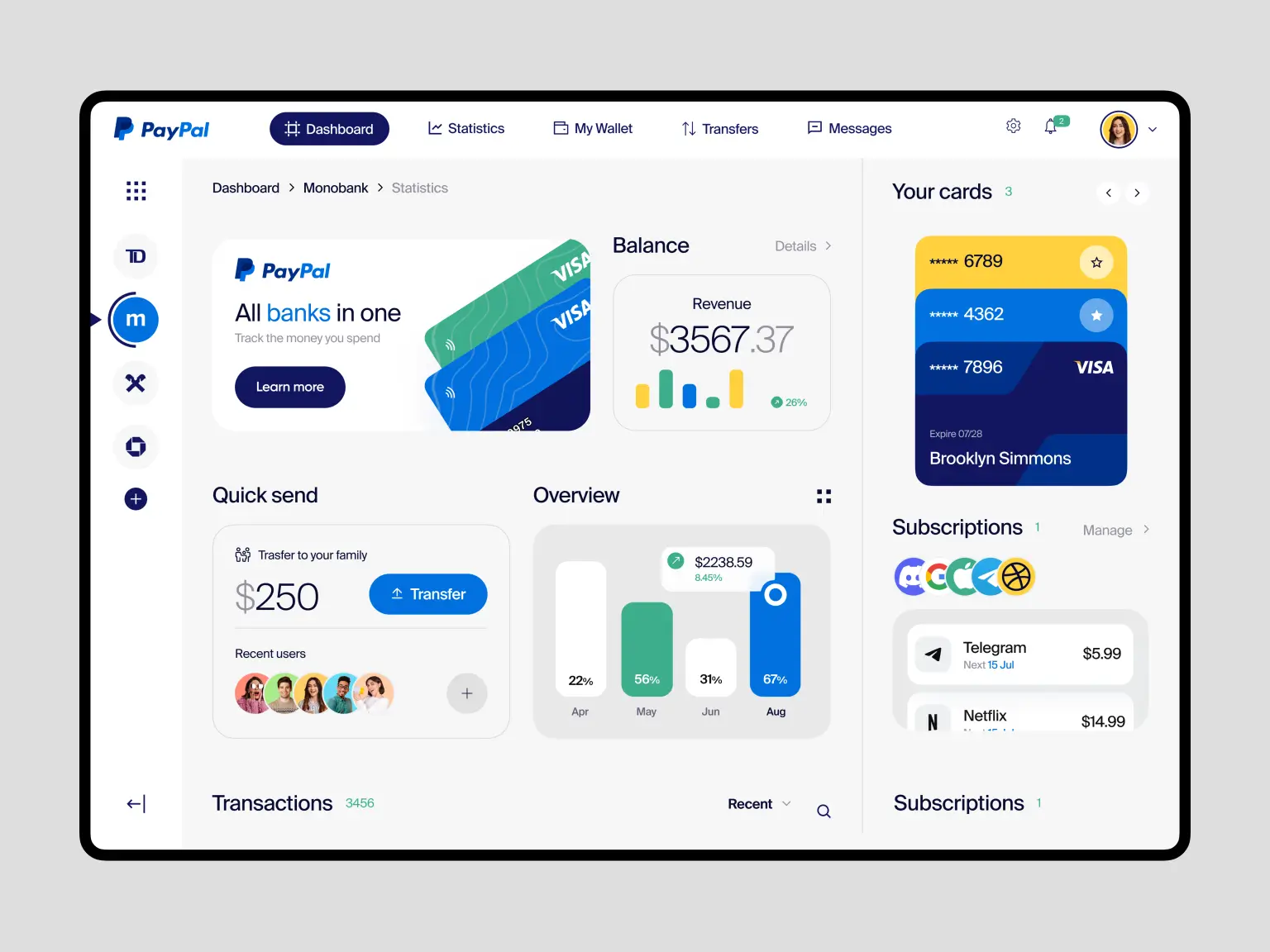

- Unified Dashboard: Merchants can view their payments, orders, and payouts directly in the Shopify admin panel. This centralization is crucial for quick decision-making and effective store management.

- Streamlined Checkout Process: Shopify Payments provides a smoother checkout experience for customers, which is optimized to increase conversion rates by reducing the number of steps to complete a purchase.

- Currency Handling: Shopify Payments supports multiple currencies, allowing merchants to sell and accept payments in various local currencies, thus expanding their global reach.

Payment Processing Capabilities

Shopify Payments allows merchants to accept a wide range of payment methods including credit cards, Apple Pay, and Google Pay directly in their stores. This eliminates the need for third-party gateways, reducing fees and simplifying reconciliation. Shopify Payments is fully integrated into the merchant’s dashboard, providing seamless management of transactions, chargebacks, and refunds.

Shopify Payments excels in its payment processing capabilities, making it a strong competitor in the Shopify vs PayPal debate. It supports a wide range of payment methods including major credit cards, Google Pay, and Apple Pay, directly within the merchant’s store. Key features include:

- Direct Integration: Since Shopify Payments is built into the Shopify platform, merchants don’t need to integrate additional payment gateways, simplifying the setup process and reducing compatibility issues.

- Fraud Analysis and Prevention: Shopify Payments includes built-in fraud analysis tools that help merchants identify and mitigate fraudulent transactions, a critical service that protects both merchants and consumers.

- Chargeback Management: Shopify also offers support in handling chargebacks, providing tools and guidance to help merchants resolve disputes and recover funds.

Additional Services:

In addition to standard payment processing, Shopify Payments integrates additional services that enrich the Shopify ecosystem, setting it apart in the Shopify vs PayPal comparison:

- Shopify POS: This service integrates physical sales with the merchant’s online inventory, allowing for the seamless management of sales and inventory across multiple channels. This is ideal for merchants who operate both online and brick-and-mortar stores.

- Shopify Capital: Shopify offers funding options to help merchants grow their business. Shopify Capital provides eligible merchants with loans, which are then repaid through a percentage of their sales made via Shopify Payments. This service highlights the ecosystem’s support for merchant growth and scalability.

- Shopify Balance: This is a business account specifically designed for merchants to manage their business finances directly within Shopify, including tracking expenses and making payments.

Paypal

PayPal stands out as a global leader in digital payment solutions, offering a broad array of services that cater to both individual consumers and businesses. In the context of Shopify vs PayPal, PayPal distinguishes itself with its versatility and widespread acceptance, operating independently of any single eCommerce platform. Unlike Shopify Payments, which is specific to the Shopify ecosystem, PayPal operates independently, allowing merchants and consumers alike a high degree of flexibility and security in transactions across numerous online and physical venues.

This flexibility allows merchants to use PayPal across various platforms, not just Shopify, providing a universal solution that can handle transactions worldwide. PayPal is a global leader in online payment solutions, known for its secure and flexible payment options for both consumers and merchants. It operates as a standalone payment processor that can integrate with numerous eCommerce platforms, including Shopify.

Payment Processing Capabilities

PayPal’s payment processing capabilities are designed to accommodate a wide array of needs and are a central component of the Shopify vs PayPal comparison. Here’s how PayPal equips businesses:

- Wide Range of Accepted Payment Methods: PayPal accepts a diverse range of payment methods including credit cards, bank transfers, and PayPal balances. This flexibility ensures that almost any customer can make purchases using the platform.

- Global Reach: With the capability to process payments in over 100 currencies and withdraw them to bank accounts in 56 currencies, PayPal offers an extensive network, making it an indispensable tool for international sellers.

- Seamless Integration: PayPal integrates smoothly with countless eCommerce platforms, including Shopify. This makes it an attractive option for merchants looking for versatility beyond what Shopify Payments might offer.

- Enhanced Checkout Solutions: PayPal offers several streamlined checkout solutions like PayPal Express Checkout, which facilitates faster payments by allowing customers to skip entering their shipping and billing information.

- Mobile Optimization: Recognizing the shift towards mobile commerce, PayPal has optimized its processing capabilities for mobile devices, ensuring a seamless checkout experience on smartphones and tablets.

Buyer and Seller Protection

One of PayPal’s most compelling features in the Shopify vs PayPal debate is its comprehensive buyer and seller protection programs. These protections are designed to foster trust and safety, fundamental in eCommerce transactions.

- Buyer Protection: PayPal offers a Buyer Protection program that covers consumers for the full purchase price plus shipping costs on eligible purchases if they do not receive their item or the item is significantly not as described.

- Seller Protection: For sellers, PayPal provides a Seller Protection program that protects against unjust chargebacks for unauthorized transactions and items that the buyer claims they didn’t receive, as long as the seller meets the program’s requirements.

Additional Services

Beyond basic payment processing, PayPal provides a suite of additional services that enhance its value proposition in the Shopify vs PayPal comparison:

- PayPal Working Capital: Tailored for businesses looking for accessible funding to grow, PayPal Working Capital offers loans based on a merchant’s PayPal sales history. Payments are flexible, and adjusted as a percentage of the merchant’s sales, which can be less burdensome than fixed payment loans.

- PayPal Here: Addressing the needs of physical store owners, PayPal Here allows merchants to accept credit card payments with a mobile card reader. This service bridges the gap between online and offline sales, making PayPal a comprehensive payment solution.

- PayPal Business Debit Mastercard: This card enables instant access to funds in a PayPal account, offering 1% cash back on eligible purchases, thereby enhancing liquidity for business operations.

- Shipping Tools: PayPal simplifies logistics with integrated tools that allow sellers to print shipping labels, track packages, and receive discounts on postage, directly from their PayPal account.

- PayPal Marketing Solutions: This service provides insights into shopper behaviors and preferences, helping businesses optimize their marketing strategies and improve conversion rates.

Comparative Analysis

When comparing Shopify Payments and PayPal, several key differences emerge:

- Integration vs. Versatility: Shopify Payments offers a more integrated experience for users of the Shopify platform, simplifying many operational aspects of running an online store. In contrast, PayPal offers greater versatility, functioning across different platforms and providing services beyond just payment processing, such as working capital loans and in-person payment solutions.

- User Base: Shopify Payments is an ideal solution for Shopify users, as it is tailor-made for the Shopify environment, potentially offering lower fees and smoother operations within that ecosystem. PayPal’s user base is broader, appealing to a wide range of consumers and businesses beyond those using Shopify, thanks to its brand recognition and trust built over decades.

- Global Reach: While both platforms support global businesses, PayPal’s established network across over 200 countries and support for 25 currencies makes it a more accessible option for businesses looking to reach an international market immediately.

- Cost Structure: Shopify Payments generally offers a clear cost structure tied to the merchant’s Shopify plan, which can be advantageous for transparency. PayPal’s fee structure is also transparent but varies more significantly between domestic and international transactions, which may affect businesses depending on their customer base’s location.

User Experience and Interface

Examining the user experience and interface of payment gateways is crucial for a merchant’s efficient transaction management and can greatly influence customer satisfaction. In this section, we compare Shopify Payments and PayPal, focusing on their user interfaces and the overall user experience they offer. This comparison aims to highlight the nuances of each platform, helping you understand which may better suit your operational needs and enhance customer interactions.

Shopify

Shopify Payments offers a user experience and interface that is highly optimized for Shopify merchants, focusing on ease of use, effective management tools, and excellent support.

This makes Shopify Payments a strong contender in the Shopify vs PayPal debate, particularly for merchants who value a seamless, integrated payment processing solution within their Shopify ecosystem.

Ease of Setup and Use

When evaluating Shopify vs PayPal from a setup and usability standpoint, Shopify Payments scores highly for its integration and a streamlined approach tailored specifically for Shopify users. Here’s a detailed look at its ease of setup and use:

- Integrated Setup: For Shopify store owners, integrating Shopify Payments is a seamless process. Once a merchant sets up their Shopify store, enabling Shopify Payments is mostly a matter of filling out a few forms and providing basic business details. This integration eliminates the need for configuring third-party payment gateways, which can often involve complex steps and technical adjustments.

- User-Friendly Interface: Shopify Payments is designed with the user experience in mind. The interface aligns with the rest of the Shopify dashboard, maintaining a consistent look and feel that reduces the learning curve for new merchants.

- Automatic Synchronization: Transactions processed through Shopify Payments are automatically synced with the user’s Shopify account, simplifying accounting and inventory management processes. This feature is particularly beneficial for merchants who require a unified system for managing their sales, inventory, and finances.

Dashboard and Management Tools

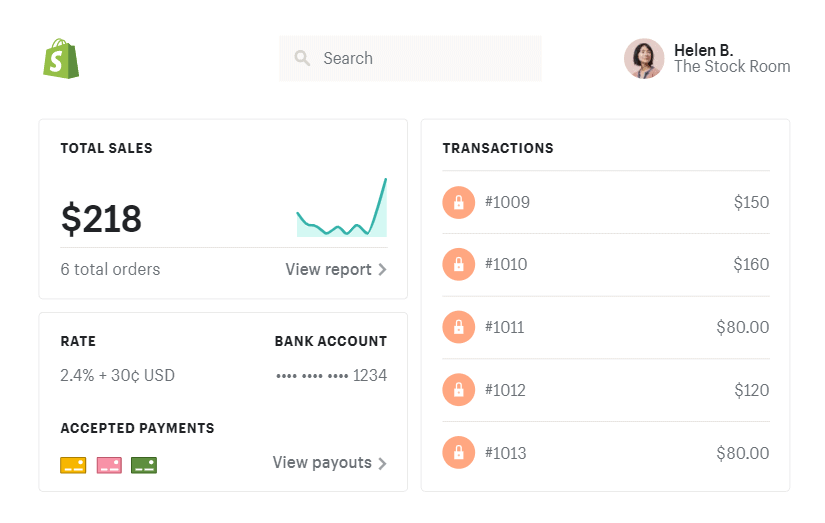

A significant aspect of the Shopify vs PayPal comparison is the effectiveness of each platform’s management tools. Shopify Payments offers a comprehensive dashboard that allows merchants to monitor their business at a glance:

- Centralized Dashboard: The Shopify dashboard presents a holistic view of a merchant’s business, including sales, orders, and payment activities. This central hub ensures that all critical business metrics are easily accessible, which aids in quick decision-making and effective management.

- Detailed Reporting: Shopify Payments provides detailed reports that help merchants track everything from payment methods used to chargeback rates. These insights are invaluable for optimizing sales strategies and financial planning.

- Real-Time Analytics: Merchants can access real-time data regarding their sales and payments, which is crucial for adapting to market changes promptly.

Mobile Usability

In today’s mobile-first world, the usability of payment systems on smartphones and tablets is crucial. In the Shopify vs PayPal discussion, Shopify Payments stands out with its mobile-friendly design:

- Shopify App: The Shopify mobile app allows merchants to manage their store and handle payments directly from their mobile devices. This app is particularly useful for small business owners who need to operate on-the-go, enabling them to process payments, update inventory, and communicate with customers from anywhere.

- Responsive Design: The Shopify dashboard is fully responsive, meaning it adapts to the screen size of various devices, including smartphones and tablets. This responsiveness ensures that merchants can effectively manage their stores without dealing with interface limitations.

Customer Support and Resources

Strong customer support and comprehensive resources are essential for any payment service. Shopify Payments excels in providing support tailored to its users’ needs:

- 24/7 Support: Shopify offers 24/7 customer support via email, phone, and live chat, ensuring that Shopify Payments users can get help whenever they need it. This round-the-clock support is crucial for dealing with payment issues that might arise during non-business hours.

- Extensive Documentation: Shopify provides an extensive library of tutorials, guides, and FAQs on its website, covering topics ranging from setting up Shopify Payments to resolving disputes. This repository is a valuable resource for both new and experienced merchants.

- Community Forums: Shopify’s community forums allow merchants to connect with other users, share experiences, and seek advice. These forums are a great resource for troubleshooting common issues and learning best practices from other merchants.

- Dedicated Account Management: For higher-volume merchants, Shopify offers dedicated account managers who provide personalized support and guidance. This service helps large businesses optimize their payment processes and resolve issues quickly.

Paypal

PayPal’s user experience and interface are designed to accommodate the diverse needs of its user base, offering powerful tools and support that make it a compelling option in the Shopify vs PayPal debate.

With its ease of use, comprehensive management tools, and strong mobile and support offerings, PayPal continues to be a favorite choice for merchants globally.

Ease of setup and use

When discussing Shopify vs PayPal in terms of setup and usability, PayPal demonstrates its strengths as a versatile and user-friendly payment solution. Here’s how PayPal excels in ease of setup and use:

- Simplified Setup: Setting up a PayPal account is straightforward. Users can start accepting payments within a few minutes of account creation, by simply linking their bank accounts and setting up the necessary personal or business details. This ease of setup is advantageous for both new merchants and established businesses looking to integrate PayPal into their online stores.

- Plugin Integration: PayPal is renowned for its extensive compatibility with numerous eCommerce platforms, including Shopify. Integrating PayPal into these platforms typically involves adding a PayPal plugin or widget, a process that can often be completed with minimal technical expertise.

- Flexible Integration Options: PayPal offers various integration options, from simple button additions on websites to more sophisticated API integrations for custom-built eCommerce sites. This flexibility ensures that PayPal can meet the specific needs of a wide range of merchants.

Dashboard and management tools

PayPal’s dashboard and management tools are key components of its user experience, providing valuable insights and management capabilities that are crucial in the Shopify vs PayPal analysis:

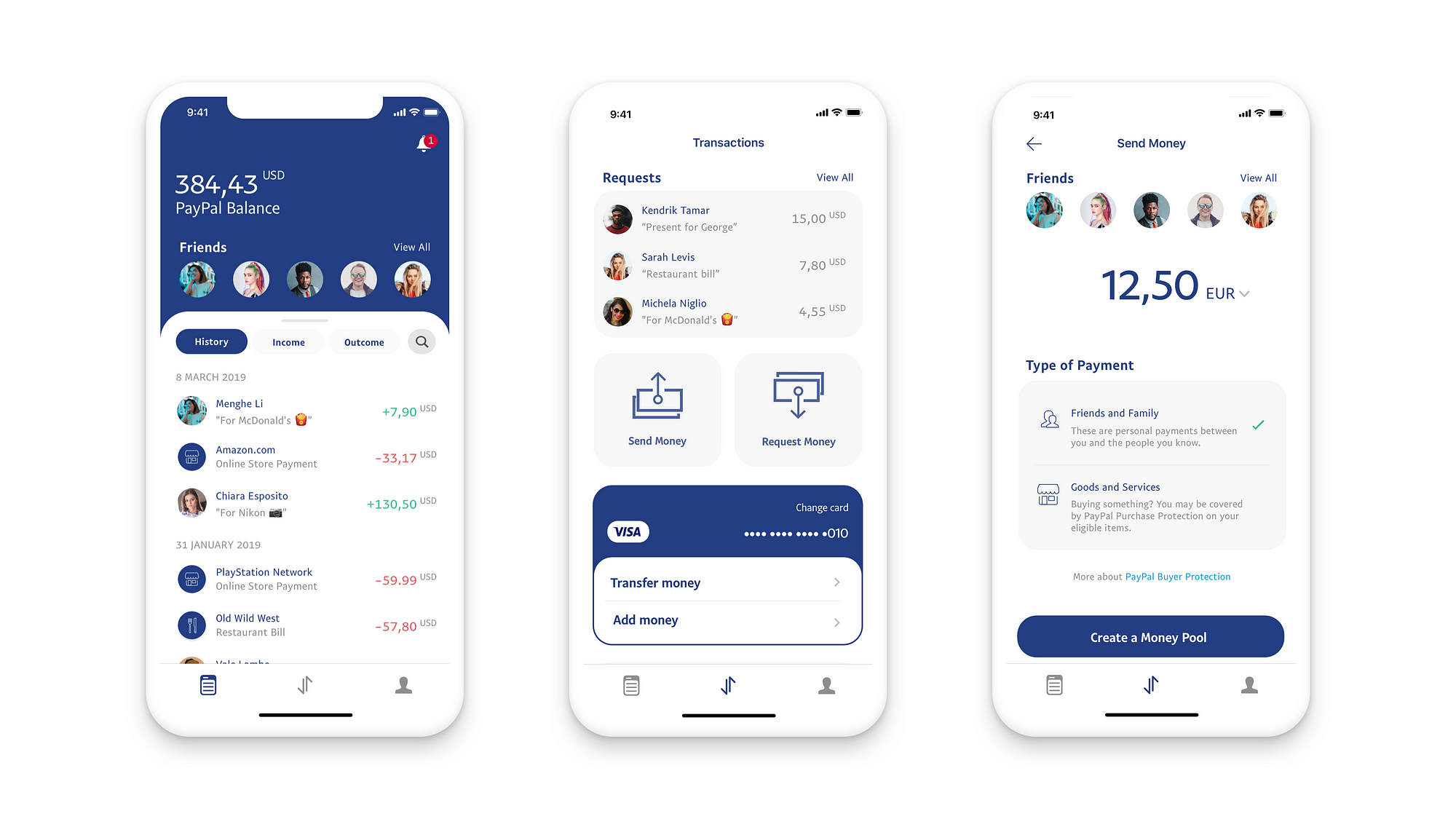

- Comprehensive Dashboard: PayPal’s user dashboard offers an intuitive interface where users can view transaction histories, manage payments, check balances, and withdraw funds. The dashboard is designed to give users a complete overview of their financial activities at a glance.

- Advanced Reporting Tools: PayPal provides detailed reporting tools that help merchants track and analyze their sales data. These tools are invaluable for understanding customer behavior, tracking sales trends, and making informed business decisions.

- Customizable Views: Merchants can customize their dashboard to highlight the information that matters most to them, whether it’s recent transactions, monthly sales figures, or pending withdrawals. This customization enhances the user experience by making the interface more relevant to each merchant’s needs.

Mobile usability

In the Shopify vs PayPal comparison, mobile usability is increasingly important as eCommerce transactions shift towards mobile devices. PayPal’s mobile experience is robust:

- PayPal Mobile App: The PayPal app is a powerful tool for managing transactions on the go. It allows users to send and receive money, check balances, and review transactions from their mobile devices, making it incredibly convenient for merchants who need to manage their finances outside of traditional business settings.

- Mobile-Optimized Website: PayPal’s website is fully optimized for mobile use, ensuring that users can easily navigate the site on their smartphones and tablets without losing functionality.

- One Touch™ Mobile Payments: PayPal offers One Touch™, an innovative feature that enables users to make purchases across various websites and apps without having to enter their login and payment details each time. This feature significantly enhances the mobile shopping experience by making it faster and more secure.

Customer support and resources

PayPal’s customer support and educational resources play a critical role in its user experience, providing essential support and guidance to users:

- 24/7 Customer Service: PayPal provides round-the-clock customer service via phone, email, and live chat, ensuring that users can access support whenever they need it. This is particularly important for resolving urgent payment issues that could affect business operations.

- Comprehensive Help Center: PayPal offers an extensive Help Center that includes articles, tutorials, and FAQs. These resources cover a wide range of topics, from account setup and troubleshooting to security and fraud prevention.

- Community Forums: PayPal’s community forums are a valuable resource for users seeking advice and information from other experienced PayPal users. The forums provide a platform for discussions about best practices, solutions to common problems, and tips for optimizing PayPal use.

- Educational Resources: PayPal also provides a variety of educational materials, such as webinars and guides, designed to help merchants maximize their use of PayPal’s features and services. These resources are particularly useful for new merchants looking to expand their knowledge of eCommerce and payment processing.

Comparative analysis

Shopify Payments is notable for its seamless integration within the Shopify platform, providing a smooth setup process that is directly embedded into the Shopify dashboard. This integration is particularly beneficial for merchants already on the Shopify platform, as it eliminates the need for additional payment gateway configurations and aligns with the existing store setup. PayPal, on the other hand, offers a broader usability scope as it integrates with a variety of eCommerce platforms, including Shopify. The setup process is straightforward, involving simple steps to create an account and integrate it across multiple platforms using plugins or APIs. PayPal’s flexibility makes it a versatile choice for merchants who operate across different platforms beyond Shopify.

Shopify Payments provides a unified dashboard experience that aligns with the Shopify environment, offering merchants an integrated view of their sales, payments, and overall business analytics. This centralized approach is particularly useful for Shopify users who benefit from having all their operational tools in one place. PayPal offers a robust dashboard that is not specific to any single platform but is universally accessible and feature-rich, suitable for managing multiple sales channels. It includes advanced reporting tools and customizable views that help users track and analyze their transaction data effectively, regardless of their eCommerce platform.

Both services offer strong mobile capabilities but with different focal points. Shopify Payments benefits from the Shopify app’s overall efficiency, which allows users to manage their entire online store and payment system on the go. This app is especially effective for merchants who need to handle eCommerce activities from their mobile devices seamlessly.PayPal shines with its dedicated mobile app, which is designed not just for payment management but also for facilitating easy transfers and funds management on a mobile interface. The PayPal mobile app and its One Touch™ feature enhance the mobile user experience across various websites and apps, emphasizing speed and security.

Shopify Payments benefits from Shopify’s overarching support infrastructure, which includes 24/7 access via phone, email, and live chat, alongside a wealth of online resources tailored to the Shopify ecosystem. This makes it highly effective for users who require consistent support and resources that are specifically geared toward maximizing their Shopify operations. PayPal excels with its extensive customer support options, accessible globally 24/7, and a comprehensive Help Center that covers a wide array of topics. PayPal also offers community forums and educational resources that provide additional support and learning opportunities for a diverse range of users.

In the Shopify vs PayPal debate regarding user experience and interface, the choice largely depends on the merchant’s specific needs and business model. Shopify Payments is ideal for merchants who are looking for a streamlined, integrated solution that fits neatly into the Shopify ecosystem, providing simplicity and ease of use within a single platform. PayPal, however, offers greater flexibility and is suitable for merchants who operate across multiple platforms or need a payment solution that is recognized and trusted globally, independent of their eCommerce platform choice.

Ultimately, both Shopify Payments and PayPal offer robust user experiences and interfaces, each with its strengths catering to different segments of the online merchant community.

Pricing and Fees

Pricing structures and associated fees play a critical role for businesses in choosing a payment gateway. This section examines the pricing models of Shopify Payments and PayPal, two prominent options in the market. We will explore their fee structures, including transaction fees, monthly charges, and any additional costs, such as chargebacks and international payments. Understanding these financial aspects is vital for merchants striving to balance cost-efficiency with comprehensive payment processing features.

Shopify

When comparing Shopify vs PayPal in terms of pricing and fees, Shopify Payments emerges as a potentially more cost-effective solution for merchants already embedded within the Shopify ecosystem, particularly due to its integrated nature and the waiver of additional transaction fees. However, the overall cost can increase with the addition of premium themes, apps, and higher-tier subscription plans. This makes Shopify Payments an excellent choice for merchants who anticipate leveraging the full range of Shopify’s platform capabilities alongside their payment processing needs.

Subscription tiers

When considering Shopify vs PayPal from a pricing perspective, it’s crucial to begin by understanding Shopify’s subscription model, as it directly influences the cost of using Shopify Payments. Shopify offers several subscription tiers, each designed to cater to different business sizes and needs, impacting the overall cost structure of using their payment gateway.

- Basic Shopify: This plan is ideal for small businesses or new merchants just starting out. It includes all the basic features needed to start a new online store. The plan typically costs around $29 per month, with Shopify Payments’ credit card rates being higher than those of the more advanced plans.

- Shopify: This mid-tier plan is priced at approximately $79 per month. It offers lower credit card fees than the Basic Shopify plan and includes additional features like professional reports and greater staff accounts, which can be beneficial for growing businesses.

- Advanced Shopify: Targeting larger businesses, this plan costs about $299 per month and offers the lowest credit card fees available on Shopify Payments. It includes advanced features such as an advanced report builder and third-party calculated shipping rates, which are valuable for high-volume merchants.

Each tier not only impacts the monthly fee but also affects the transaction fees imposed on each sale, making it a significant factor in the overall cost of using Shopify Payments.

Transaction fees

Transaction fees are a critical component of the Shopify vs PayPal discussion, as these can significantly affect a merchant’s profitability. Shopify Payments offers a distinct advantage by waiving transaction fees on all plans if it is used as the primary payment processor. This can lead to substantial savings, especially for merchants with high sales volumes. Here are the specifics:

- Credit Card Rates: These rates vary by plan. For instance, in the U.S., rates start at about 2.9% + 30¢ per transaction for the Basic Shopify plan and decrease to around 2.4% + 30¢ for the Advanced Shopify plan. These fees are competitive and tend to be lower than standard PayPal fees, especially for merchants on higher-tier Shopify plans.

- No Additional Transaction Fees: Unlike many other eCommerce platforms that charge additional fees for using a payment provider other than their own, Shopify does not charge additional transaction fees if Shopify Payments is used. This contrasts with the standard practice on Shopify where using an external payment gateway (like PayPal) incurs additional fees up to 2% per transaction, depending on the Shopify plan.

Additional costs

Beyond subscription and transaction fees, merchants using Shopify Payments must also consider additional costs that can influence the overall expense of operating a Shopify store. These include:

- Themes: Shopify offers a range of free and premium themes to customize the store’s appearance. Premium themes can cost between $140 and $180, a one-time fee that may enhance the user experience but adds to the startup costs.

- Apps: The Shopify App Store contains thousands of apps that extend the functionality of Shopify stores. Costs for these apps vary widely, from free to premium apps that can cost upwards of $50 per month or more, depending on the app’s functionality.

- Other Potential Costs: Other costs can include domain purchase (if not using the Shopify domain), SSL certificates for custom domains, and potential third-party integration fees for specific operational or marketing functionalities.

Paypal

PayPal’s fee structure in the Shopify vs PayPal comparison is characterized by its flexibility and no mandatory monthly fees, making it appealing to a wide range of businesses from startups to established enterprises. However, international sales, currency conversions, and potential additional charges like chargebacks and optional service fees can increase the overall cost for merchants, particularly those with a global customer base or those in industries with higher rates of chargebacks or refunds.

Transaction fees

When analyzing Shopify vs PayPal, a crucial aspect to consider is the transaction fee structure of each service. PayPal is known for its straightforward, no-subscription-needed approach, appealing to businesses of various sizes and sectors. Here’s how PayPal structures its transaction fees:

- Standard Transaction Fees: PayPal typically charges a fee of 2.9% + $0.30 per transaction for payments processed within the United States. This rate applies to sales made on websites, invoices, and through other digital channels. The fee is automatically deducted from the payment received, ensuring simplicity and predictability in transaction processing.

- Discounted Rates for Eligible Merchants: For merchants with higher sales volumes, PayPal offers discounted rates which can decrease transaction fees slightly below the standard rates. These volume discounts can make PayPal increasingly economical for larger businesses.

- Micropayments Plan: Recognizing the needs of businesses that frequently handle small transaction amounts, PayPal provides a micropayments pricing structure where the fee is 5% + $0.05 per transaction. This option is ideal for businesses that sell low-cost items such as digital downloads or accessories.

International payments and currency conversion fees

In the Shopify vs PayPal comparison, international sales and operations play a significant role. PayPal’s capabilities in handling international payments are robust, making it a popular choice for global eCommerce:

- Higher Fees for International Transactions: For international transactions, PayPal’s fees are generally higher than domestic rates, starting at 3.9% plus a fixed fee based on the currency received. These fees reflect the additional costs and risks associated with cross-border payments.

- Currency Conversion Fees: If a transaction involves a currency conversion, PayPal charges an additional fee. This currency conversion fee is typically added to the exchange rate, about 3% to 4% over the base exchange rate provided by PayPal’s bank. This fee compensates for the risk and service of converting currencies, which can be significant in international trade.

- Cross-Border Fees: Specific fees are also applicable when receiving payments from another country, known as cross-border fees. These fees vary depending on the countries involved and the type of account the recipient has with PayPal.

Additional costs

While PayPal is praised for its simplicity and broad usability, certain additional costs can affect a merchant’s overall expense calculations in the Shopify vs PayPal debate:

- Chargeback Fees: If a customer disputes a transaction and it results in a chargeback, PayPal may charge a fee to manage the dispute process. This fee is typically $20 per transaction in the U.S., which could vary by country. This fee is charged regardless of the dispute’s outcome and is intended to cover the administrative costs of handling the dispute.

- Refund Fees: In the event of a refund, PayPal keeps the fixed fee of the original transaction (e.g., the $0.30 of the 2.9% + $0.30 rate). While the percentage fee is returned to the merchant, the fixed fee is not, which could add up in businesses with high return rates.

- Monthly Fees for Optional Services: PayPal offers several additional services such as PayPal Here for accepting in-person payments, and Virtual Terminal for processing credit card payments over the phone or by mail. These services require additional monthly fees and transaction fees, which can increase overall costs for merchants who need these capabilities.

Comparative analysis

Shopify Payments provides a straightforward pricing structure closely tied to the merchant’s chosen Shopify subscription plan. It eliminates transaction fees if Shopify Payments is used as the primary payment processor, which can result in substantial savings for merchants with high sales volumes. Credit card rates vary by plan but are generally competitive, decreasing with higher-tier Shopify plans. PayPal, on the other hand, charges a standard fee for domestic payments, with reduced rates available for merchants who qualify for volume discounts. For micropayments, PayPal offers a specialized rate, which is advantageous for businesses dealing with small transaction values. Unlike Shopify Payments, PayPal’s fees are consistent across all types of businesses and do not require a subscription plan.

PayPal stands out for its global reach, supporting international payments with additional fees that include higher transaction rates and currency conversion charges. These fees cater to PayPal’s extensive international capabilities, offering services in multiple currencies and across numerous countries. Shopify Payments also supports international sales but does so within the confines of the Shopify platform, making it simpler for merchants who already operate internationally under Shopify’s ecosystem. Shopify’s currency conversion fees are typically lower than PayPal’s, providing an integrated solution without the need for additional setups.

Shopify Payments involves additional costs that can affect the overall finances of operating a Shopify store. These include the costs of Shopify plans themselves, which range from basic to advanced, and fees for additional services like apps and premium themes that enhance store functionality and aesthetics. PayPal imposes additional fees for services like PayPal Here and Virtual Terminal, as well as chargeback fees which are not uncommon in the industry. PayPal does not require a monthly subscription, making it accessible with minimal upfront costs, but merchants may face chargeback fees and costs for optional services that add to the total expense of using PayPal.

The choice between Shopify Payments and PayPal often depends on the specific needs of the business, including the scale of operations, international reach, and preferred eCommerce platform.

- Shopify Payments is most cost-effective for merchants who are fully integrated into the Shopify ecosystem and can benefit from waived transaction fees and lower credit card rates offered at higher subscription tiers. It’s particularly beneficial for merchants who prefer an all-in-one solution where their eCommerce platform and payment processor are tightly integrated.

- PayPal offers more flexibility with its pay-as-you-go approach, which can be more appealing to businesses not wanting to commit to monthly fees or those operating on multiple platforms. PayPal’s strength lies in its robust support for international transactions and its ability to handle a wide range of payment scenarios without the need for a monthly subscription.

In summarizing Shopify vs PayPal, merchants must consider their operational scale, international transaction needs, and specific financial strategies to determine which payment solution offers the best value according to their unique business requirements.

Integration and Compatibility

The ability of a payment gateway to integrate seamlessly with existing platforms and tools is essential for creating a cohesive digital ecosystem. This section compares Shopify Payments and PayPal regarding their integration capabilities and compatibility with other software. Whether you’re a small business owner seeking an all-in-one solution or a developer aiming to craft a highly customized shopping experience, understanding these integration aspects can greatly influence your decision between Shopify Payments and PayPal.

Shopify

In the comparison of Shopify vs PayPal, Shopify Payments is notably advantageous for merchants who are already utilizing the Shopify platform or considering it. The native integration of Shopify Payments with the broader Shopify functionalities—from inventory management to marketing automation—provides a cohesive user experience that can significantly enhance operational efficiency and marketing effectiveness. This level of integration is especially beneficial for merchants who value the convenience of managing all their eCommerce operations under one roof, with streamlined processes and consolidated data analytics driving business growth.

Overview of Shopify Integrations

Shopify Payments is certainly a seamlessly integrated solution within the Shopify ecosystem. This integration provides a substantial benefit in the Shopify vs PayPal comparison, particularly for merchants who prioritize a streamlined workflow and centralized management.

- Direct Integration with Shopify: Shopify Payments is inherently integrated into the Shopify platform, meaning it’s designed to work flawlessly with all the core features of Shopify stores. This integration eliminates the need for setting up third-party payment gateways, reducing complexity and potential integration issues. Merchants can activate Shopify Payments directly from their Shopify admin panel, which simplifies the setup process and aligns all payment processing activities with their store operations.

- Unified Account Management: With Shopify Payments, merchants can manage their payments, orders, and payouts all within the same admin dashboard used for their online store management. This unification helps in maintaining consistency and accuracy in financial reporting and simplifies the reconciliation process, as all transaction data are automatically synchronized and recorded.

eCommerce, Marketing, and Analytics Integrations

Shopify Payments does not only streamline payment processing but also enhances the capabilities of Shopify users through extensive integrations with eCommerce, marketing, and analytics tools. These integrations are pivotal in maximizing operational efficiency and optimizing the merchant’s return on investment.

eCommerce Integrations:

- Inventory Management: Shopify Payments integrates seamlessly with Shopify’s inventory management system, ensuring that all transactions are instantly reflected in inventory levels. This real-time updating helps prevent overselling and stock discrepancies, which are crucial for maintaining customer satisfaction and operational reliability.

- Shipping and Fulfillment: Shopify Payments works in tandem with Shopify’s shipping settings to streamline the calculation of shipping costs and the printing of shipping labels directly from the dashboard. This integration facilitates a smoother fulfillment process, from payment to delivery.

Marketing Integrations:

- Shopify Email: Shopify Payments aligns with Shopify’s marketing tools like Shopify Email, enabling merchants to create and send targeted email campaigns based on customer purchase history and behavior. This integration ensures that marketing efforts are directly tied to transaction data, allowing for more personalized and effective campaigns.

- Social Media and Ad Campaigns: Integration with platforms such as Facebook, Instagram, and Google makes it easy for merchants to manage their social media marketing and paid ad campaigns from within Shopify. Shopify Payments records the results of these campaigns in terms of sales conversions, thus providing a comprehensive overview of marketing effectiveness.

Analytics Integrations:

- Shopify Analytics and Reports: Merchants using Shopify Payments benefit from integrated analytics tools that provide detailed insights into their sales performance, customer behavior, and overall business health. These tools help merchants understand payment processing trends, track conversion rates, and make data-driven decisions.

- Third-party Analytics Tools: Shopify Payments also supports integration with advanced analytics platforms like Google Analytics. This compatibility allows for deeper data analysis and a broader understanding of customer journeys and attribution, which are critical for optimizing the sales funnel and improving checkout experiences.

Paypal

PayPal’s strength lies in its extensive integration capabilities and compatibility with a wide array of platforms and software. This makes PayPal an excellent option for businesses looking for a payment solution that can grow with them, adapting to various platforms and business needs without requiring significant changes to existing setups. PayPal’s universal acceptance and ability to integrate with almost any system enhance its appeal as a versatile and reliable choice for merchants worldwide.

Overview of PayPal integrations

PayPal’s integrations and compatibility with a broad range of platforms play a pivotal role. Known for its flexibility and universal acceptance, PayPal maintains a robust framework for integration that supports a wide variety of systems across different industries and technologies.

- Broad Platform Support: PayPal’s primary advantage in the Shopify vs PayPal debate is its ability to integrate seamlessly with not just Shopify but also hundreds of other eCommerce platforms, including big names like WooCommerce, Magento, and BigCommerce. This universal compatibility makes PayPal an incredibly versatile choice for merchants who operate across multiple platforms or who might consider platform migration in the future without wanting to change their payment processor.

- Plug-and-Play Convenience: PayPal offers easy integration options, including APIs and plugins for most major eCommerce platforms, which simplifies the setup process. Merchants can typically integrate PayPal into their existing website with just a few clicks, allowing them to start accepting payments almost immediately. This ease of integration is complemented by PayPal’s extensive documentation and developer resources that guide users through the integration process.

eCommerce platforms and accounting software

eCommerce Platform Integration:

- Shopify: PayPal integrates directly with Shopify, allowing merchants to offer it as an additional payment method alongside Shopify Payments. This integration helps shop owners cater to customers who prefer PayPal over other payment methods due to its brand recognition and security features.

- WooCommerce and Other Platforms: For platforms like WooCommerce, PayPal offers customized solutions that include PayPal Checkout, which can increase conversion rates by streamlining the checkout process. PayPal’s smart payment buttons also automatically present the most relevant payment types to customers, enhancing user experience.

Accounting Software Compatibility:

- QuickBooks: PayPal integrates directly with accounting software like QuickBooks, simplifying the reconciliation process by automatically syncing sales and payment data. This integration is crucial for maintaining accurate financial records and efficient bookkeeping.

- Xero and Others: Similarly, PayPal’s integration with Xero and other financial management software allows for smooth data transfer that supports comprehensive financial analysis and reporting. This connectivity ensures that all transaction details are captured and categorized correctly in the merchant’s accounting records.

Advanced Developer Tools and APIs:

- PayPal’s Developer Tools: PayPal provides developers with robust APIs and SDKs that allow for further customization and deeper integration into a merchant’s infrastructure. These tools are designed to handle everything from simple payment processing to complex marketplace needs and risk management.

- Custom Integrations: Beyond standard eCommerce and accounting integrations, PayPal’s flexible APIs allow businesses to develop custom solutions that can integrate PayPal’s capabilities into mobile apps, POS systems, and other bespoke applications. This level of adaptability makes PayPal especially attractive for businesses looking to innovate or provide a unique user experience.

Comparative analysis

Shopify Payments is inherently integrated within the Shopify platform, providing a seamless setup and user experience for Shopify merchants. This native integration is a significant advantage for users who are looking for a unified solution where their eCommerce platform and payment processing are tightly linked. Key benefits include:

- Direct Setup: Merchants can activate and manage Shopify Payments directly through the Shopify admin panel without needing to integrate or configure a separate payment gateway.

- Unified Management: Shopify Payments allows for centralized management of transactions, inventory, and customer data, all within the Shopify dashboard, streamlining operations and reducing the complexity of managing separate systems.

- Cohesive Ecosystem: The integration extends to other Shopify features, including marketing and analytics tools, providing a cohesive experience that leverages data across the entire platform to improve business operations and customer insights.

PayPal, on the other hand, excels in its flexibility and wide compatibility across numerous platforms, not just Shopify. This makes it a robust choice for businesses that operate across multiple platforms or that might change their eCommerce environment in the future. PayPal’s integration features include:

- Broad Compatibility: PayPal is compatible with a vast array of eCommerce platforms beyond Shopify, including WooCommerce, Magento, and BigCommerce, making it versatile for merchants not limited to a single platform.

- Ease of Integration: Through APIs and plugins, PayPal integrates easily with websites and platforms, allowing businesses to add PayPal as a payment option quickly and with minimal technical effort.

- Extended Functionalities: PayPal’s integration capabilities are not just limited to payment processing; they extend to accounting software like QuickBooks and Xero, enhancing financial management and reporting capabilities for businesses.

In the Shopify vs PayPal comparison, the choice between Shopify Payments and PayPal hinges on the specific needs and operational contexts of the merchant. Shopify Payments offers deep integration and optimized functionality within the Shopify platform, ideal for merchants who prefer a streamlined and centralized approach to managing their online store. PayPal offers broader flexibility and extensive third-party integration options, suited for businesses that require a versatile payment solution that can adapt to various selling environments and backend systems.

Both payment solutions provide robust integrations that can significantly benefit a business’s operational efficiency and customer experience, but the best choice depends on the merchant’s platform preference, business scale, and specific needs for integration complexity and versatility.

Security and Trustworthiness

Security and trustworthiness are critical in choosing a payment processing service, as they directly impact the safety of financial transactions and the protection of sensitive customer data. In this section, we explore and compare the security measures and trustworthiness of Shopify Payments and PayPal, two leading payment gateways. This comparison aims to highlight how each platform safeguards its users’ data and transactions, assisting merchants in making an informed decision based on the level of trust and security offered by Shopify Payments and PayPal.

Shopify

When discussing eCommerce and payment processing platforms, security and trustworthiness are paramount. In the comparison of Shopify vs PayPal, Shopify Payments stands out with its robust security measures designed to protect merchants and customers alike. Below, we delve into the security features that Shopify Payments offers, including SSL certification, PCI compliance, and fraud analysis tools.

SSL certification

Secure Sockets Layer (SSL) certification is critical for any online business, as it encrypts data transferred between a user’s browser and the server, ensuring that sensitive information such as credit card numbers and personal details remain secure from interception. In the Shopify vs PayPal context, Shopify Payments offers the following SSL features:

- Automatic SSL: All Shopify stores automatically receive a free 256-bit SSL certificate, which covers all pages, content, and data. This automatic inclusion eliminates the need for merchants to set up their own SSL, simplifying the process and ensuring that every Shopify store has a basic level of security from the outset.

- Checkout Security: Shopify Payments ensures that the checkout process is fully secured with SSL, providing customers with a safe environment for completing transactions. This security measure not only protects data but also helps to build trust with customers, reassuring them that their transactions are secure.

- Constant Updates: Shopify continuously updates its SSL technology to adhere to the latest security standards, helping to protect against emerging threats and vulnerabilities. This proactive approach ensures that merchants and customers benefit from strong security at all times.

PCI compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is another cornerstone of payment security that Shopify Payments adheres to rigorously. PCI compliance is required for any business that accepts credit card payments, ensuring that their payment systems are secure and that cardholder data is protected throughout the transaction process.

- Level 1 PCI DSS Compliant: Shopify Payments is certified as a Level 1 PCI DSS compliant service provider, the highest level of compliance available. This certification involves rigorous audits and ensures that Shopify Payments meets stringent security standards.

- Secure Card Data Handling: By being PCI compliant, Shopify Payments helps ensure that all cardholder data handled by Shopify merchants is secure from fraud and breaches. This includes data encryption and secure data storage practices.

- Risk Management: Compliance with PCI DSS also means that Shopify continually assesses its payment environment to manage risks effectively. This ongoing process helps to identify potential security weaknesses and implement necessary safeguards promptly.

Fraud analysis tools

In addition to basic security certifications, Shopify Payments offers advanced fraud analysis tools to help merchants detect and prevent fraudulent transactions. These tools are essential in maintaining the integrity of transactions and protecting both merchants and customers.

- Automated Fraud Analysis: Shopify Payments provides automated fraud analysis with every order, using machine learning and other advanced technologies to flag potentially fraudulent transactions based on patterns and indicators.

- Customizable Risk Settings: Merchants have the ability to adjust their fraud settings according to their risk tolerance. This flexibility allows merchants to be more or less stringent in their fraud controls, depending on their specific business needs and customer profiles.

- Fraud Prevention Recommendations: Shopify also offers recommendations and best practices for fraud prevention. These are integrated into the Shopify admin and can alert merchants of suspicious activities, helping them to take preventive actions swiftly.

Paypal

In the ongoing comparison of Shopify vs PayPal, PayPal’s security features play a critical role in its global reputation as a trusted leader in payment processing. Understanding PayPal’s commitment to security can help merchants and consumers make informed decisions about which platform to use. Here, we explore PayPal’s security measures, including buyer and seller protection, data encryption, and fraud prevention capabilities.

Buyer and seller protection

PayPal’s Buyer and Seller Protection Programs are key components of its security and trustworthiness. These programs are designed to safeguard the interests of both parties in a transaction, providing peace of mind and promoting a secure trading environment.

- Buyer Protection: PayPal’s Buyer Protection program covers consumers if they do not receive the item they purchased or if the item they receive is significantly different from the described condition. If eligible, buyers can receive a full refund, including shipping costs, which ensures that consumers can shop with confidence on any platform that accepts PayPal.

- Seller Protection: PayPal’s Seller Protection program defends merchants against chargebacks, reversals, and their associated fees when fraudulent transactions or unauthorized payments occur. This protection is vital for maintaining the financial stability of businesses and helps mitigate the risks associated with online sales.

- Dispute Resolution: Both protection programs are supported by PayPal’s robust dispute resolution process. This process provides a platform for buyers and sellers to resolve their issues concerning transactions, which is overseen by PayPal to ensure fairness and the proper handling of each case.

Data encryption

PayPal’s approach to data security includes state-of-the-art data encryption techniques, ensuring that all transaction and user information is protected from unauthorized access.

- End-to-end Encryption: PayPal employs strong end-to-end encryption to secure data as it travels between devices and PayPal’s servers. This encryption protects sensitive personal and financial information from being intercepted by malicious entities.

- Secure Network Architecture: PayPal’s network architecture is designed to safeguard user data by utilizing advanced security technologies and protocols. Firewalls, intrusion detection systems, and anti-malware tools are all integral parts of PayPal’s defense strategy.

- Data Storage Security: For data at rest, PayPal uses multiple layers of encryption and security protocols to ensure that stored data is protected against breaches and unauthorized access. These measures comply with international standards and best practices in data security.

Fraud prevention

PayPal is renowned for its comprehensive fraud prevention measures that utilize sophisticated technologies and constant vigilance to detect and prevent fraudulent activities.

- Real-Time Monitoring: PayPal’s systems monitor transactions in real-time to identify unusual patterns or suspicious activities. This proactive approach allows PayPal to respond quickly to potential fraud, minimizing the risk to users.

- Advanced Machine Learning: Utilizing machine learning algorithms, PayPal analyzes vast amounts of transaction data to improve its fraud detection over time. These algorithms help identify new fraud tactics and refine existing parameters to catch fraud more effectively.

- User Verification and Risk Models: PayPal implements rigorous verification processes for new and existing users, which helps prevent identity theft and unauthorized account use. Additionally, personalized risk models are applied to each transaction, assessing the risk level based on historical data and user behavior patterns.

- Secure Tokenization: For added security, PayPal uses tokenization to replace sensitive card and bank details with unique identifiers in transactions. This method ensures that actual bank details are never exposed during transactions, further securing user data.

Comparative analysis

Shopify Payments excels in providing a seamless and secure integration within the Shopify ecosystem. This payment platform comes with automatic SSL certification for all Shopify sites, ensuring that data transmitted during transactions is encrypted. Additionally, it adheres to PCI compliance at the highest level, which is essential for any business handling credit card information. Shopify also offers built-in fraud analysis tools, which are integrated into the Shopify dashboard, allowing for a streamlined approach to managing transaction risks. This makes Shopify Payments particularly appealing for merchants who use Shopify exclusively and benefit from a unified operational and security experience.

On the other hand, PayPal stands out for its flexibility and extensive protective measures that apply across various eCommerce platforms. PayPal’s buyer and seller protection programs provide an additional layer of security by covering eligible transactions against fraud, chargebacks, and disputes. This is complemented by state-of-the-art data encryption and sophisticated fraud prevention strategies, including real-time monitoring and machine learning algorithms. These features make PayPal highly reliable for merchants operating across multiple platforms and looking for a payment solution with broad acceptance and a strong emphasis on security.

In summary, while Shopify Payments is ideal for those embedded within the Shopify platform looking for tightly integrated security features, PayPal offers a more versatile solution that extends robust security measures across a wider range of eCommerce environments. Both platforms provide high levels of protection, making them excellent choices for ensuring the security of online transactions, but the decision between them may hinge on the specific business model and operational scope of the merchant.

Market Presence and Reputation

The market presence and reputation of a payment gateway can significantly influence a merchant’s choice, impacting trust and perceived reliability. In this section, we compare Shopify Payments and PayPal, two giants in the payment processing arena, examining their standing in the global market and their reputations among users.

Shopify

In the ongoing comparison of Shopify vs PayPal, understanding the market presence and reputation of each platform provides crucial insight into their strengths and how they are perceived within the eCommerce industry. Shopify Payments, deeply integrated with the Shopify platform, has carved out a significant niche in the market. Here’s an analysis of Shopify Payments’ user base, geographical reach, and notable clients.

User base

Shopify Payments is directly linked to the broader Shopify ecosystem, benefiting from Shopify’s expansive and growing user base. With over 1.7 million merchants actively using Shopify platforms around the globe, Shopify Payments has a large and diverse user base, which continues to expand as Shopify attracts more businesses to its platform.

- Diverse Merchant Profiles: Shopify’s platform services a wide range of businesses from small startups to large enterprises, spanning across various industries including fashion, electronics, home goods, and more. This diversity not only strengthens Shopify Payments’ position in the market but also enhances its reliability and adaptability as a payment solution.

- High Adoption Rate: Given its seamless integration with Shopify, many Shopify merchants opt to use Shopify Payments for its simplicity and the cohesive management experience it offers. This high adoption rate is bolstered by the elimination of transaction fees within Shopify’s platform when using Shopify Payments, making it an economically attractive option for merchants.

Geographical reach

Shopify Payments has a broad geographical reach, supporting merchants in multiple countries and territories. This international presence is crucial for its growth and the scalability of businesses using the Shopify platform.

- Supported Countries: As of now, Shopify Payments is available in many countries including the United States, Canada, United Kingdom, Australia, and several European and Asian countries. This wide reach enables Shopify merchants from different parts of the world to process payments in their local currencies and manage their stores efficiently.

- Currency Support: Shopify Payments allows transactions in numerous currencies, enabling businesses to sell globally and accept payments in their customers’ local currency. This capability not only simplifies the payment process for international customers but also helps improve conversion rates, as customers are more likely to purchase when they can pay in their currency.

Notable clients

Shopify Payments is used by a range of well-known brands and high-profile clients, underscoring its reputation and reliability in handling high-volume transactions and supporting significant eCommerce operations.

- Large Brand Adoption: Notable clients include big names such as Gymshark, KKW Beauty, and Fitbit. These brands require a reliable and scalable payment solution that can handle a significant number of transactions efficiently and securely, which Shopify Payments provides.

- Success Stories: Many Shopify users have grown from small startups to major eCommerce successes. For instance, Gymshark started as a garage-based business and has grown into a global brand within just a few years, utilizing Shopify’s platform and Shopify Payments to streamline their sales and manage international transactions.

Paypal

In the dynamic landscape of eCommerce payment solutions, PayPal stands as a venerable giant. When we talk about Shopify vs PayPal, it’s crucial to delve into PayPal’s extensive market presence and solid reputation which underline its long-standing dominance and trustworthiness in the online payment industry.

User base

PayPal’s expansive user base is one of its most formidable assets, reflective of its widespread acceptance and trust among consumers and businesses alike. Here’s a closer look:

- Extensive Consumer Adoption: PayPal boasts over 400 million active account holders worldwide, a testament to its widespread use and acceptance. This vast user base includes both individual consumers and businesses, making it one of the most popular payment methods online.

- Merchant Acceptance: A significant number of online merchants accept PayPal, further proof of its pervasive use. From small independent stores to large multinational corporations, PayPal’s versatility and security make it a preferred payment option across diverse industries.

- High Transaction Volume: PayPal processes billions of transactions annually, handling vast sums of money. This level of activity not only showcases its capacity to manage high volumes efficiently but also builds user confidence in its reliability and security.

Geographical reach

PayPal’s geographical reach is unparalleled, strengthening its position in the global market and enhancing its capability to serve a diverse clientele.

- Global Operations: PayPal operates in over 200 markets around the world, allowing users to send, receive, and hold funds in 25 currencies. This global reach is crucial for businesses looking to expand internationally, offering them a reliable payment solution across borders.

- Currency Flexibility: The ability to deal with multiple currencies and convert them seamlessly is a significant advantage for international sellers and buyers. This flexibility helps PayPal users engage in cross-border transactions more efficiently, fostering global trade.

- Local Adaptations: In many regions, PayPal has adapted its services to meet local regulations and preferences, which enhances user experience and compliance. For example, PayPal offers localized payment options in countries like China and India, aligning with local payment habits and regulatory requirements.

Notable clients

PayPal’s roster of notable clients includes many high-profile companies and brands, further illustrating its robust capabilities and trustworthiness as a payment processor.

- eCommerce Giants: Companies like eBay (which owned PayPal until 2015) have been using PayPal extensively. Although eBay has started to move away from PayPal as its main payment processor, the long history between the two companies helped PayPal cement its reputation in eCommerce.

- Tech Companies: Large tech companies, including Google and Microsoft, integrate PayPal for transactions on their platforms, ranging from app stores to subscription services.

- Retail Chains: Major retailers and fast-food chains like Walmart and McDonald’s accept PayPal, demonstrating its utility in a variety of commercial settings, from online shopping to physical retail locations.

Comparative analysis

Shopify Payments benefits significantly from its integration with the Shopify platform, which has cultivated a vast and diverse user base. With Shopify’s backing, Shopify Payments has become the go-to solution for over 1.7 million merchants globally, ranging from small startups to large enterprises. This integration not only streamlines the eCommerce process for Shopify users but also reinforces Shopify Payments’ reputation as a reliable and secure option within the Shopify ecosystem. Its reach, although broad, is tied to Shopify’s platform, which gives it deep penetration in the markets where Shopify is prevalent, particularly in North America, Europe, and parts of Asia.

PayPal, on the other hand, stands out for its massive independent user base and extensive geographical reach. With over 400 million active accounts and operations in more than 200 markets, PayPal commands a significant presence in the global payments landscape. This is complemented by its flexibility to handle transactions in 25 different currencies, making it a preferred choice for international transactions and users outside the Shopify ecosystem. PayPal’s client list includes big names from various industries, underscoring its capability to handle complex, high-volume transactions securely and efficiently.

Both platforms are distinguished by their ability to foster trust among their users—Shopify Payments through its seamless integration and native functionality within Shopify, and PayPal through its longstanding reliability, security features, and universal acceptance. While Shopify Payments is ideal for those fully committed to the Shopify platform, PayPal offers versatility and a broader reach, appealing to a wide array of users across different platforms and industries.

Ultimately, the choice between Shopify Payments and PayPal may hinge on specific business needs—Shopify Payments for those seeking an all-in-one solution within Shopify, and PayPal for those requiring a versatile payment solution with a strong track record across various global markets. Each holds a strong position in their respective niches, making them leaders in the eCommerce payment processing space.

Pros and Cons of Shopify Payment vs Paypal

In the realm of eCommerce, choosing the right payment processor is crucial. The decision between Shopify Payments and PayPal involves careful consideration of each platform’s strengths and weaknesses. This section of the blog post provides a detailed examination of the advantages and limitations of both payment systems, aiding businesses in making an informed choice.

Summary of Shopify’s advantages and limitations

Advantages

- Seamless Integration with Shopify: Shopify Payments is fully integrated into the Shopify platform, providing a smooth and cohesive experience for users. This integration eliminates the need for third-party payment gateways, simplifying the setup and reducing potential compatibility issues.

- Streamlined User Experience: Since Shopify Payments is embedded within Shopify, merchants benefit from a unified dashboard for managing both their eCommerce and payment processing needs. This centralization can lead to more efficient management and a clearer overview of business operations.

- Elimination of Additional Transaction Fees: One of the most significant advantages in the Shopify vs PayPal debate is that Shopify Payments does not charge additional transaction fees if it’s used as the primary payment method. This can result in substantial savings, particularly for businesses with high sales volumes.

- Direct Payouts: Shopify Payments simplifies the financial aspects of running an eCommerce business by providing direct payouts to the bank, enhancing cash flow management.

Limitations

- Geographical Availability: Shopify Payments is not available in all countries. This geographical limitation can be a significant drawback for international businesses or those located outside of Shopify Payments’ supported regions.

- Dependency on Shopify: Shopify Payments can only be used within the Shopify platform. If a merchant decides to move to another platform, they cannot take Shopify Payments with them, which could necessitate a costly and complex transition to a new payment processor.

- Limited Customization Options: Compared to PayPal, Shopify Payments offers fewer customization options for the checkout experience. This could be a drawback for merchants who wish to have more control over their transaction processes.

Summary of PayPal’s advantages and limitations

Advantages

- Widespread Acceptance: PayPal is accepted globally and is one of the most widely recognized and trusted payment solutions. Its brand recognition alone can increase consumer confidence and potentially improve conversion rates.

- Flexibility Across Platforms: Unlike Shopify Payments, PayPal can be integrated with a multitude of eCommerce platforms. This flexibility makes it an excellent option for businesses that operate across different platforms or might consider changing their eCommerce solution in the future.

- Robust Security Features: PayPal offers comprehensive security measures, including end-to-end encryption and advanced fraud protection. Their buyer and seller protection programs also add an extra layer of security, making transactions safer.

- Strong International Capabilities: PayPal supports payments in over 100 currencies and operates in over 200 markets, making it ideal for international sales. The ability to handle cross-border transactions seamlessly is a significant advantage for businesses looking to expand globally.

Limitations

- Fees: PayPal’s fee structure can be relatively high, especially for international transactions and small transactions. These fees can accumulate, potentially affecting the profitability of small to medium-sized businesses.

- Account Holds and Freezes: PayPal is known for its stringent security measures, which can sometimes result in sudden account holds or freezes if its system detects any unusual activity. This can disrupt business operations and affect cash flow.

- Customer Service Issues: Some users report challenges with PayPal’s customer service, including delays in resolving disputes and issues with account management.

Contextual Considerations for Businesses Choosing Between Shopify and PayPal

- Business Model and Scale: Businesses fully integrated into the Shopify ecosystem and those looking for a streamlined, all-in-one solution may find Shopify Payments more advantageous. Conversely, businesses that prioritize flexibility, operate on multiple platforms or engage in significant international sales might prefer PayPal for its broad compatibility and strong global presence.

- Geographical Presence: If a business operates in a region not supported by Shopify Payments, PayPal emerges as the clear choice due to its extensive international support.

- Cost Considerations: Cost-sensitive businesses should closely evaluate transaction fees, international charges, and other associated costs. Shopify Payments might offer savings for Shopify users through waived transaction fees, whereas PayPal might be more costly in terms of transaction fees but offers more robust services that could justify the extra cost.

In conclusion, the choice between Shopify Payments and PayPal depends heavily on specific business needs, operational scope, and future growth plans. Each platform has its strengths and weaknesses, and the decision should align with the company’s strategic objectives and operational requirements.

Conclusion

When deciding between Shopify Payments and PayPal, businesses should consider their current eCommerce platform, their geographical reach, and their growth ambitions.

- For merchants who are already using Shopify and plan to continue doing so, Shopify Payments offers a convenient and cost-efficient solution that is perfectly integrated with their store’s operations.

- For those who value platform independence or require a payment processor with a strong international presence, PayPal provides the necessary tools and flexibility, along with enhanced security that protects both the buyer and seller across diverse transaction scenarios.

Both Shopify Payments and PayPal offer compelling features, but they serve slightly different merchant needs. The decision between Shopify vs PayPal should be guided by a clear understanding of each platform’s offerings and how they match up with the specific requirements of your business. Consider your operational scope, where your customers are located, and how you plan to grow your business in the future. By aligning your payment processing strategy with these factors, you can choose a solution that not only meets your current needs but also supports your business’s long-term success.

Love our content? Subscribe to our newsletter now so you will not miss out on our updates.