In today’s rapidly evolving commerce landscape, omnichannel payments have emerged as a cornerstone for businesses striving to meet the demands of modern consumers. Omnichannel payments refer to a unified system that enables seamless transactions across multiple channels, including in-store, online, and mobile platforms. By integrating these channels into a cohesive payment ecosystem, businesses can deliver a consistent and frictionless experience for their customers, ensuring that every interaction aligns with their expectations.

The importance of omnichannel payments lies in their ability to harmonize diverse payment methods, making the customer journey more convenient and streamlined. Consumers no longer see separate touchpoints—they expect the same level of ease and efficiency, whether they’re purchasing on a mobile app, picking up in-store, or buying directly from a social media platform. Businesses that adopt omnichannel payments not only meet these expectations but also enhance customer satisfaction and build stronger brand loyalty.

The growing relevance of omnichannel payments is closely tied to the transformation in consumer behavior and technological advancements. With the rise of mobile wallets, contactless payments, and buy-now-pay-later options, customers demand greater flexibility and security in their payment experiences. Meanwhile, businesses are recognizing the potential of omnichannel payments to drive growth by reducing friction at checkout and enabling seamless cross-channel shopping experiences. As digital and physical commerce continue to merge, implementing omnichannel payments has become essential for businesses to stay competitive, foster customer trust, and adapt to the ever-changing retail landscape.

This blog post explores the intricacies of omnichannel payments, from their definition and key features to their benefits, challenges, and real-world applications. Whether you’re a business looking to implement an omnichannel payment strategy or simply curious about its transformative potential, this comprehensive guide will provide valuable insights into one of the most critical aspects of modern commerce.

Table of Contents

Key Features of Omnichannel Payment Systems

Omnichannel payments are at the forefront of modern commerce, providing a seamless and unified experience that benefits both businesses and consumers. At their core, omnichannel payments integrate multiple payment channels—whether online, in-store, or mobile—into a single, cohesive system. This approach eliminates silos between payment methods, ensuring a consistent experience regardless of where or how a transaction occurs.

For businesses, omnichannel payments are a strategic solution to meet the ever-growing demand for flexibility, convenience, and security in today’s dynamic market. Consumers now expect to interact with brands across multiple touchpoints, often switching between them during a single transaction. Omnichannel payments enable businesses to adapt to these behaviors, offering a streamlined and consistent process across all channels. This not only enhances customer satisfaction but also strengthens brand loyalty by delivering a frictionless shopping experience.

From simplifying payment reconciliation for businesses to offering customers the ability to pay using their preferred methods, omnichannel payments drive operational efficiency while elevating the consumer journey. By unifying disparate payment systems, businesses can leverage insights from transactional data, optimize operations, and provide a level of personalization that was previously unattainable. As we explore the key features of omnichannel payment systems, it becomes clear how they are transforming the way businesses and customers interact, setting a new standard for modern commerce.

Cross-Channel Payment Consistency

One of the defining characteristics of omnichannel payments is the ability to provide cross-channel payment consistency. In today’s interconnected world, customers expect seamless transitions between shopping channels, whether they are browsing products online, checking inventory in a mobile app, or completing a purchase in a physical store. Omnichannel payments enable businesses to meet these expectations by unifying payment experiences across all platforms.

Enabling Customers to Start a Transaction on One Channel and Complete It on Another

Omnichannel payments empower customers with unparalleled flexibility. Shoppers can begin a transaction on one channel—such as adding items to their cart through a mobile app—and complete the purchase on another, such as paying in-store. This fluidity is made possible through centralized data synchronization, which ensures that customer information, cart details, and payment preferences are seamlessly carried over from one touchpoint to the next. For example:

- A customer shopping for electronics might add a laptop to their cart on an eCommerce site but decide to visit a physical store for a hands-on experience before completing the purchase. With omnichannel payments, they can pay in-store without restarting the transaction.

- Buy online, pick up in-store (BOPIS) is another popular example where omnichannel payments play a crucial role. Customers can pay securely online and collect their orders at a convenient location without any additional payment steps.

This flexibility not only enhances customer convenience but also reduces cart abandonment rates, a common challenge for businesses operating across multiple channels.

Unified Experiences for In-Store, Online, and Mobile Platforms

Omnichannel payments ensure that the payment process feels consistent and familiar regardless of the channel being used. A unified experience means that customers encounter the same payment methods, user interface, and branding whether they are shopping on a website, using a mobile app, or standing at a checkout counter in a brick-and-mortar store.

For instance:

- Payment methods like credit cards, digital wallets, and loyalty rewards are integrated across platforms, allowing customers to choose their preferred option every time.

- Digital receipts can be accessed from any channel, whether they originate from an in-store purchase or an online transaction, ensuring a cohesive customer journey.

- Consistent branding, such as logos, color schemes, and messaging, reassures customers that they are interacting with the same trusted business across all touchpoints.

Unified experiences eliminate confusion and frustration, fostering a sense of trust and reliability in the brand. For businesses, this cohesion simplifies the management of payment systems and enhances operational efficiency.

Ensuring Brand Consistency in Payment Processes

Brand consistency extends beyond aesthetics—it encompasses every aspect of the customer experience, including payments. Omnichannel payments allow businesses to maintain their brand identity across all channels, reinforcing their values and image during every transaction.

- Payment pages, whether online or in-store, can be customized to reflect the brand’s tone and visual style, ensuring a familiar environment for customers.

- Integrated loyalty programs tied to omnichannel payments can further promote brand consistency by rewarding customers for their interactions, regardless of the channel.

- Personalized experiences are made possible by centralized payment data, allowing businesses to tailor recommendations, discounts, or rewards based on a customer’s purchase history and preferences.

By ensuring brand consistency in payment processes, businesses can build stronger relationships with their customers. A seamless, unified, and recognizable payment experience not only encourages repeat transactions but also differentiates the brand in a competitive market.

Cross-channel payment consistency is more than a feature—it is a necessity in an age where customer journeys span multiple touchpoints. Omnichannel payments empower businesses to break down the barriers between channels, delivering the seamless and cohesive experiences that modern consumers expect. This capability is foundational to the success of any omnichannel strategy, driving both customer satisfaction and business growth.

Centralized Data Management

Centralized data management is one of the most powerful features of omnichannel payments, serving as the backbone that connects all payment channels into a cohesive system. By consolidating transaction data from in-store, online, and mobile platforms, businesses can operate with a single source of truth, ensuring accuracy, efficiency, and strategic insight. This feature enables businesses to provide seamless payment experiences for customers while gaining valuable data to optimize their operations.

Real-Time Updates and Synchronization of Transaction Data Across Platforms

Omnichannel payments rely on real-time updates and data synchronization to ensure consistency and accuracy across all customer touchpoints. When a customer makes a payment, the transaction data is immediately updated and reflected across the business’s entire ecosystem, whether it involves inventory, customer profiles, or sales records.

- For example, if a customer purchases an item online for in-store pickup, the omnichannel payment system instantly updates the inventory across both the eCommerce platform and the physical location. This ensures that the item is reserved for the customer and prevents overselling.

- Real-time updates enable businesses to provide dynamic features such as live stock availability, price adjustments, and location-specific promotions, creating a more personalized shopping experience.

- Synchronization across platforms also ensures that loyalty points or rewards are applied seamlessly, regardless of where the transaction occurs.

This level of integration reduces errors and improves customer satisfaction by offering accurate, up-to-date information at every step of the purchasing journey.

Simplified Reconciliation Processes for Businesses

Centralized data management in omnichannel payments streamlines the traditionally complex process of payment reconciliation. By consolidating all transaction data into a unified system, businesses can avoid the inefficiencies and inaccuracies associated with managing multiple disparate systems.

- Businesses can reconcile payments across channels with greater ease, reducing the time spent on manual data entry and cross-checking. For example, transactions made in-store and online can be reviewed in a single report, ensuring that all sales are accounted for accurately.

- Automated reconciliation processes minimize the risk of errors, such as duplicate entries or missing transactions, which are common in fragmented systems.

- Streamlined reconciliation frees up resources, allowing businesses to focus on strategic initiatives rather than administrative tasks.

For businesses with a high volume of transactions, such as retail chains or eCommerce platforms, the ability to simplify reconciliation processes through omnichannel payments can lead to significant cost savings and operational efficiency.

Enabling Detailed Analytics for Customer Behavior and Preferences

The centralized nature of omnichannel payments provides businesses with a treasure trove of data that can be used to understand customer behavior and preferences. By aggregating payment information across channels, businesses can gain a holistic view of their customers, enabling them to make data-driven decisions.

- Businesses can track customer purchasing patterns, such as preferred payment methods, peak buying times, and average transaction values, across all channels. These insights help businesses tailor their offerings and marketing strategies to better align with customer needs.

- Payment data can also reveal trends in regional or demographic preferences, allowing businesses to create targeted promotions or adjust inventory accordingly.

- Advanced analytics tools integrated with omnichannel payment systems enable predictive modeling, helping businesses anticipate future customer behavior and prepare for upcoming trends.

For example, a business might notice that customers frequently use mobile wallets for smaller purchases but prefer credit cards for higher-value transactions. Armed with this knowledge, the business can optimize its payment options to meet these preferences, enhancing the overall customer experience.

By offering real-time updates, simplifying reconciliation, and enabling deep analytics, centralized data management elevates omnichannel payments from a transactional tool to a strategic asset. It allows businesses to operate more efficiently, gain valuable insights into their customers, and deliver personalized, seamless payment experiences across all channels. In an era where data drives decision-making, centralized data management is not just a feature of omnichannel payments—it is a competitive necessity.

Enhanced Security Measures

Security is a cornerstone of omnichannel payments, ensuring that transactions remain safe and trustworthy across all channels. In a world where cyber threats and data breaches are constant risks, businesses must prioritize robust security measures to protect customer data and maintain their reputation. Omnichannel payments incorporate cutting-edge technologies and industry standards to deliver a secure, seamless payment experience. Below are the key security features that define omnichannel payments.

Adoption of PCI DSS Standards to Ensure Safe Transactions

The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized framework designed to protect sensitive payment information. Businesses leveraging omnichannel payments must comply with these standards to provide a secure environment for transactions across all platforms.

- PCI DSS compliance mandates stringent security protocols, including encryption of cardholder data, secure storage of payment information, and regular system monitoring. These measures are crucial in preventing unauthorized access and data breaches.

- Omnichannel payments simplify compliance by unifying security processes across all channels. For instance, a business with both online and in-store operations can maintain consistent security practices rather than managing separate systems.

- Businesses can assure customers that their payment information is handled in a secure and standardized manner, fostering trust and encouraging repeat transactions.

By adhering to PCI DSS standards, omnichannel payments create a foundation of security that benefits both businesses and consumers.

Tokenization to Replace Sensitive Payment Data with Unique Tokens

Tokenization is a powerful security mechanism that plays a pivotal role in omnichannel payments. It replaces sensitive payment information, such as credit card numbers, with unique, non-sensitive tokens that are meaningless to hackers.

- When a customer makes a payment, the system generates a token that represents their card details. This token is used for transaction processing, while the actual card information is securely stored in a token vault.

- Tokenization ensures that even if a breach occurs, the stolen data is useless to cybercriminals, as tokens cannot be reverse-engineered.

- Omnichannel payments leverage tokenization to enable secure, cross-channel transactions. For example, a customer can use the same token for payments on a website, mobile app, or physical store, ensuring a seamless and secure experience.

Tokenization not only enhances security but also simplifies compliance with data protection regulations, making it a critical component of omnichannel payments.

Fraud Prevention Through AI-Driven Monitoring

Fraud prevention is a major concern for businesses operating across multiple channels, as fraudulent activities can significantly impact revenue and customer trust. Omnichannel payments integrate advanced AI-driven monitoring tools to detect and prevent fraudulent transactions in real time.

- AI-powered systems analyze vast amounts of transaction data across all channels, identifying patterns and anomalies that may indicate fraud. For example, if a customer’s account shows simultaneous transactions from different locations, the system can flag it as suspicious.

- Machine learning algorithms continuously improve their ability to detect fraudulent behavior by learning from new data, ensuring that the system stays ahead of evolving threats.

- Omnichannel payments benefit from centralized fraud detection, as the unified system enables businesses to monitor transactions holistically rather than managing separate security measures for each channel.

These AI-driven tools not only enhance security but also minimize false positives, ensuring that legitimate transactions are not disrupted.

Enhanced security measures are integral to the success of omnichannel payments. By adopting PCI DSS standards, implementing tokenization, and utilizing AI-driven fraud prevention, businesses can protect their customers and operations from the growing threat of cybercrime. Security is no longer just a backend requirement; it is a key feature that builds trust and drives customer loyalty, making it indispensable in today’s competitive marketplace. Omnichannel payments offer businesses the tools they need to provide safe, reliable, and seamless payment experiences that customers can count on.

Support for Multiple Payment Methods

One of the standout features of omnichannel payments is their ability to support a diverse range of payment methods. Modern consumers expect flexibility and convenience when completing transactions, and businesses that fail to meet these expectations risk losing customers to competitors. Omnichannel payments enable businesses to accept traditional payment methods like credit cards while embracing newer technologies such as digital wallets, Buy Now, Pay Later (BNPL) options, and loyalty rewards. By accommodating multiple payment methods, omnichannel payments cater to the preferences of a diverse customer base and create seamless experiences across all channels.

Acceptance of Traditional and Modern Payment Modes

Omnichannel payments bridge the gap between legacy payment methods and cutting-edge innovations, ensuring that customers have access to the payment options they trust and prefer.

- Traditional payment methods like credit and debit cards remain a staple for many customers, and omnichannel payments integrate these options seamlessly across all platforms. Whether a customer is shopping online, in-store, or via a mobile app, they can use their card without any disruptions.

- Modern payment solutions such as digital wallets, including Apple Pay, Google Pay, and Samsung Pay, are growing in popularity due to their convenience and security. Omnichannel payments incorporate these technologies to meet the demand for faster, contactless transactions.

- BNPL services like Klarna and Afterpay are becoming increasingly popular among younger shoppers. Omnichannel payments support these options, allowing customers to split payments into manageable installments without impacting their shopping experience.

By offering both traditional and modern payment modes, omnichannel payments ensure that businesses remain relevant and accessible to all demographics.

Catering to Regional Preferences

The global nature of commerce means that businesses must adapt to the payment preferences of customers in different regions. Omnichannel payments are designed to accommodate these variations, enabling businesses to expand their reach while respecting local payment norms.

- In China, digital wallets like Alipay and WeChat Pay dominate the market. Omnichannel payments integrate these platforms, allowing businesses to cater to Chinese consumers both domestically and internationally.

- In India, the Unified Payments Interface (UPI) has revolutionized cashless transactions. Omnichannel payment systems that support UPI give businesses a competitive edge in this rapidly growing market.

- Regional payment methods such as iDEAL in the Netherlands or Paytm in India can also be integrated into omnichannel payments, ensuring that local customers feel valued and supported.

By catering to regional preferences, omnichannel payments enable businesses to establish trust and build stronger connections with their international audience.

Integration of Loyalty Points and Gift Card Payments

Loyalty programs and gift cards are powerful tools for driving customer engagement and repeat purchases. Omnichannel payments seamlessly integrate these features, enhancing the customer experience while providing businesses with additional opportunities to build loyalty.

- Customers can earn and redeem loyalty points across all channels, whether they are shopping online, in-store, or through a mobile app. This consistency reinforces the value of loyalty programs and encourages continued engagement.

- Gift card payments are fully integrated into omnichannel payment systems, allowing customers to purchase, reload, and use gift cards without limitations. For instance, a customer could buy a gift card online and redeem it in a physical store, or vice versa.

- Omnichannel payments also enable businesses to personalize rewards based on customer behavior, offering targeted discounts or bonus points to enhance loyalty.

The integration of loyalty points and gift cards not only enhances the payment process but also strengthens the relationship between businesses and their customers.

Support for multiple payment methods is a cornerstone of omnichannel payments, reflecting their commitment to flexibility and customer satisfaction. By accepting traditional and modern payment options, catering to regional preferences, and integrating loyalty rewards and gift cards, omnichannel payments ensure that businesses can meet the needs of their diverse customer base. This adaptability not only enhances the shopping experience but also drives customer retention and loyalty, making it an indispensable feature in today’s competitive marketplace.

Scalability and Customization

Scalability and customization are critical features of omnichannel payments, enabling businesses to adapt their payment systems to evolving needs and market demands. As businesses grow and diversify, their payment infrastructures must keep pace, ensuring seamless customer experiences and operational efficiency. Omnichannel payments provide the flexibility and modularity needed to scale alongside businesses while offering tailored solutions that cater to specific industries and technological requirements.

Modular Designs to Adapt to Business Growth and Changes

Omnichannel payments are designed with modularity at their core, allowing businesses to expand or adjust their payment capabilities as they grow.

- Modular designs enable businesses to add new payment methods, channels, or features without overhauling their entire payment system. For example, a small retailer can start with basic card payment integration and later include digital wallets, Buy Now, Pay Later options, or cryptocurrency as their customer base diversifies.

- As businesses expand into new markets or regions, omnichannel payments facilitate the addition of localized payment methods, such as Alipay in China or UPI in India, without disrupting existing operations.

- Seasonal businesses or those experiencing rapid growth can easily scale their payment infrastructure to handle increased transaction volumes, ensuring smooth operations during peak periods.

This adaptability ensures that businesses remain agile, capable of meeting customer expectations and market trends without incurring unnecessary costs or complexities.

Custom Features Tailored for Specific Industries or Markets

Omnichannel payments recognize that no two businesses are the same. Different industries have unique needs, and omnichannel payment systems provide the customization required to meet these demands effectively.

- In retail, omnichannel payments can integrate loyalty programs and in-store POS systems to create a unified customer experience. For example, customers can earn and redeem loyalty points across online and offline channels, fostering engagement and retention.

- Hospitality businesses, such as hotels or restaurants, benefit from features like split billing, tipping options, and reservation-linked payments. These tailored functionalities enhance customer satisfaction by addressing specific service expectations.

- For subscription-based services or SaaS platforms, omnichannel payments can include recurring billing and subscription management tools, simplifying payment processes for both businesses and customers.

- By offering industry-specific customizations, omnichannel payments empower businesses to deliver personalized, efficient payment experiences that resonate with their target audiences.

Ability to Integrate with Legacy Systems and Emerging Technologies

Integration is a key strength of omnichannel payments, allowing businesses to connect their payment infrastructure with both existing systems and cutting-edge technologies.

- Many businesses operate with legacy systems that are deeply embedded in their operations. Omnichannel payments provide seamless integration with these systems, ensuring continuity while introducing modern capabilities. For instance, an established retailer with an older ERP system can integrate omnichannel payments to enable real-time inventory updates and cross-channel transaction tracking.

- Omnichannel payments are also future-proof, designed to work with emerging technologies such as blockchain, artificial intelligence, and the Internet of Things (IoT). This compatibility ensures that businesses can stay ahead of technological advancements without needing frequent system overhauls.

- APIs and middleware play a crucial role in enabling omnichannel payments to connect with diverse software ecosystems, from CRM tools to analytics platforms, enhancing overall operational efficiency.

By bridging the gap between old and new technologies, omnichannel payments provide businesses with a comprehensive solution that supports innovation while maintaining stability.

Scalability and customization are essential features of omnichannel payments, reflecting their ability to grow and evolve alongside businesses. Modular designs allow for seamless adaptation to changing demands, while industry-specific customizations ensure that payment solutions align with unique operational needs. Moreover, the integration capabilities of omnichannel payments make them a future-ready choice, empowering businesses to leverage both legacy systems and emerging technologies. In an era where flexibility and personalization are paramount, omnichannel payments provide businesses with the tools they need to succeed in a dynamic and competitive marketplace.

Benefits of Omnichannel Payments

In today’s dynamic and competitive commerce environment, omnichannel payments have emerged as a transformative solution for businesses seeking to meet evolving consumer demands. As customer journeys increasingly span multiple touchpoints—such as mobile apps, eCommerce platforms, physical stores, and social media marketplaces—traditional payment systems often fall short in delivering the unified experiences that consumers now expect. Omnichannel payments address this challenge by integrating diverse payment channels into a seamless and cohesive system.

This integration allows businesses to go beyond mere transaction processing, enabling them to offer personalized, convenient, and consistent payment experiences that build customer trust and loyalty. Omnichannel payments not only enhance how businesses interact with their customers but also streamline back-end operations, improve data management, and drive strategic growth. From simplifying complex payment infrastructures to fostering engagement through loyalty programs, omnichannel payments empower businesses to thrive in an interconnected world.

The benefits of adopting omnichannel payments extend far and wide, impacting every aspect of the customer journey and business operation. Businesses can offer flexible payment options, ensure real-time data synchronization across platforms, and provide insights for better decision-making—all while reducing operational inefficiencies. As commerce continues to evolve, businesses leveraging omnichannel payments are well-positioned to deliver exceptional value to their customers and achieve long-term success.

Improved Customer Experience

One of the most significant benefits of omnichannel payments is their ability to transform the customer experience. In a marketplace where convenience and personalization are paramount, omnichannel payments enable businesses to deliver the seamless, flexible, and efficient payment options that modern customers demand. By integrating payment channels and unifying the shopping journey, businesses can create interactions that leave a lasting impression and encourage customer loyalty.

Personalized Payment Options Catering to Customer Preferences

Omnichannel payments empower businesses to offer personalized payment experiences tailored to individual customer preferences. Modern shoppers expect flexibility in how they pay, and businesses must accommodate a wide variety of options to stay competitive.

- Customers can choose from a range of payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, Buy Now, Pay Later (BNPL) solutions, and even loyalty points. This variety ensures that customers can pay in the way that suits them best, whether they are shopping online, in-store, or through a mobile app.

- Omnichannel payments enable businesses to save customer payment preferences securely, allowing returning customers to enjoy faster and more convenient checkouts. For example, a frequent shopper might prefer using a specific digital wallet, and the system can automatically prioritize that option during future transactions.

- By analyzing payment behavior, businesses can offer targeted promotions or discounts based on customer preferences. For instance, a business might provide exclusive cashback offers for customers who use a particular payment method, creating a sense of personalization and fostering engagement.

These personalized options not only meet customer expectations but also strengthen relationships by demonstrating that the business understands and values their preferences.

Faster Checkout Processes Through Contactless and One-Click Payments

Speed and efficiency are critical components of a positive customer experience, especially in today’s fast-paced world. Omnichannel payments streamline the checkout process by offering contactless and one-click payment options, reducing friction and enhancing convenience.

- Contactless payment methods, such as tap-to-pay cards and digital wallets, allow customers to complete transactions quickly without the need to enter PINs or handle cash. This feature is particularly valuable in physical stores, where long checkout lines can deter potential buyers.

- Online, one-click payments eliminate the need for customers to repeatedly enter their payment details. Instead, stored payment information enables customers to finalize purchases with a single click, speeding up the process and reducing cart abandonment rates.

- Omnichannel payments also facilitate features like buy online, pick up in-store (BOPIS), where customers can prepay for their orders online and collect them without waiting in line, further improving the shopping experience.

By simplifying and accelerating the checkout process, omnichannel payments not only enhance customer satisfaction but also encourage repeat purchases by making transactions as effortless as possible.

Consistent Branding Across Payment Platforms

A cohesive and consistent brand identity is crucial for building trust and loyalty, and omnichannel payments ensure that this consistency extends to every aspect of the payment process. Whether customers are shopping in-store, online, or through a mobile app, they encounter the same recognizable branding that reinforces the business’s image.

- Payment interfaces, such as checkout pages and POS systems, can be customized to reflect the business’s branding, including logos, colors, and messaging. This consistency reassures customers that they are interacting with the same trusted brand across all channels.

- Loyalty programs integrated into omnichannel payments further enhance brand consistency. Customers can seamlessly earn and redeem rewards regardless of where they shop, reinforcing the connection between their purchases and the business’s brand.

- Personalized receipts, both digital and printed, can include branded elements such as thank-you messages, promotional offers, or social media links, creating additional touchpoints that strengthen customer relationships.

Consistent branding across payment platforms ensures that customers have a unified experience, fostering trust and encouraging them to engage with the brand more frequently.

Improved customer experience is a cornerstone of the benefits provided by omnichannel payments. By offering personalized payment options, streamlining checkout processes, and maintaining consistent branding, businesses can create seamless and enjoyable interactions that meet and exceed customer expectations. This enhanced experience not only drives customer satisfaction but also builds loyalty, setting the foundation for long-term success in an increasingly competitive marketplace. Omnichannel payments empower businesses to connect with their customers on a deeper level, ensuring that every transaction contributes to a positive and lasting impression.

Increased Sales and Conversions

One of the most compelling benefits of omnichannel payments is their ability to directly impact a business’s bottom line by increasing sales and driving conversions. In an era where customers demand convenience, flexibility, and personalization, omnichannel payments empower businesses to meet these expectations while optimizing the checkout process. By offering diverse payment options, enhancing affordability, and fostering loyalty, businesses can create a seamless shopping experience that encourages more purchases and builds long-term customer relationships.

Reducing Cart Abandonment Rates by Offering Flexible Payment Options

Cart abandonment is a persistent challenge for businesses, especially in eCommerce. Customers often leave items in their carts due to frustration with limited payment options or overly complex checkout processes. Omnichannel payments address this issue by providing flexibility and convenience, reducing barriers that discourage customers from completing their purchases.

- By integrating a wide range of payment methods, such as credit and debit cards, digital wallets like Apple Pay and Google Pay, and Buy Now, Pay Later (BNPL) services, businesses can cater to diverse customer preferences. This inclusivity ensures that customers are never limited by the lack of their preferred payment option.

- Omnichannel payments simplify checkout processes by enabling features like one-click payments and auto-filling saved payment details. These streamlined experiences significantly reduce the effort required to complete a purchase, minimizing cart abandonment.

- Businesses can also incorporate regional payment methods, such as Alipay, WeChat Pay, or UPI, to appeal to international customers. This adaptability not only makes payments easier for global shoppers but also demonstrates the brand’s commitment to meeting customer needs.

By eliminating common pain points in the payment journey, omnichannel payments encourage customers to follow through with their purchases, resulting in higher conversion rates.

Increasing Impulse Purchases with Instant Credit or BNPL

Impulse purchases are a significant driver of revenue, and omnichannel payments enhance their likelihood by offering instant credit and BNPL options. These payment methods lower the financial barrier to immediate purchasing, enabling customers to buy what they want, when they want, without upfront financial strain.

- BNPL solutions, such as Klarna, Afterpay, or Affirm, allow customers to split their payments into manageable installments. By spreading the cost over time, these services make higher-value items more accessible and appealing, encouraging customers to proceed with purchases they might otherwise delay or abandon.

- Instant credit options integrated into omnichannel payments provide customers with near-instant access to financing at the point of purchase, removing the need for lengthy application processes. This convenience is particularly effective in increasing impulse purchases during limited-time sales or promotions.

- Omnichannel payments ensure that these financing options are available across all shopping channels. Whether a customer is shopping online, in a physical store, or via a mobile app, they can easily access credit or BNPL services, maintaining a seamless experience.

By leveraging these payment methods, businesses can boost revenue by capturing sales that might have been lost due to financial hesitations.

Encouraging Repeat Purchases with Loyalty Integration

Customer loyalty is a cornerstone of sustained business growth, and omnichannel payments play a pivotal role in nurturing it. By integrating loyalty programs into the payment process, businesses can incentivize repeat purchases while strengthening customer relationships.

- Customers can earn and redeem loyalty points seamlessly across all channels. For instance, a customer who earns points for an in-store purchase can use them for a discount on their next online order, creating a unified and rewarding experience.

- Omnichannel payments enable businesses to personalize loyalty rewards based on customer behavior. For example, frequent shoppers might receive exclusive offers or bonus points for using specific payment methods, encouraging them to stay engaged with the brand.

- Gift cards, another form of loyalty integration, are seamlessly supported by omnichannel payments. Customers can purchase, reload, and redeem gift cards across various platforms, further enhancing their convenience and utility.

This integration not only fosters repeat purchases but also reinforces the emotional connection between customers and the brand, increasing lifetime customer value.

Omnichannel payments are a powerful tool for driving increased sales and conversions by addressing key pain points in the customer journey. By reducing cart abandonment with flexible payment options, facilitating impulse purchases through instant credit or BNPL, and encouraging repeat transactions with loyalty integration, businesses can create a seamless and satisfying shopping experience. These benefits not only contribute to immediate revenue growth but also build the foundation for long-term customer loyalty, positioning businesses for sustained success in a competitive marketplace. Through omnichannel payments, businesses can align their payment strategies with customer expectations, ensuring that every transaction contributes to their growth and profitability.

Operational Efficiency

Omnichannel payments do more than enhance customer experiences; they revolutionize back-end operations, creating a more streamlined and efficient workflow for businesses. By unifying payment systems and centralizing data, omnichannel payments reduce errors, save time, and improve the overall accuracy of financial processes. These operational efficiencies translate into cost savings, better resource allocation, and smoother transaction management, making omnichannel payments a valuable asset for any business.

Reduced Manual Errors in Payment Reconciliation

Payment reconciliation, the process of matching transactions with corresponding bank statements, can be a labor-intensive and error-prone task—especially for businesses operating across multiple channels. Omnichannel payments alleviate these challenges by automating and consolidating reconciliation processes.

- Unified systems ensure that all payment data, whether from online platforms, mobile apps, or physical stores, is recorded in a single, centralized database. This reduces the need for manual cross-checking, minimizing the risk of errors such as duplicate entries or missed transactions.

- Automated reconciliation tools integrated into omnichannel payments can instantly match payments to invoices or orders, saving businesses hours of tedious manual work.

- By reducing discrepancies in financial records, businesses can improve the accuracy of their accounting, ensuring compliance with financial regulations and maintaining the trust of stakeholders.

This reduction in manual errors not only enhances operational efficiency but also prevents costly mistakes that could impact a business’s bottom line.

Streamlined Back-End Operations with Unified Payment Systems

One of the greatest advantages of omnichannel payments is their ability to unify disparate payment systems into a cohesive infrastructure. This integration simplifies back-end operations, allowing businesses to manage transactions, inventory, and customer data more effectively.

- A unified payment system ensures that transactions from all channels are processed through a single platform, eliminating the need to maintain multiple, siloed systems. This consolidation reduces administrative overhead and streamlines workflows.

- Businesses can synchronize payment data with other operational tools, such as inventory management, CRM systems, and analytics platforms. For example, a completed sale can automatically update inventory levels, trigger a loyalty reward, and generate a receipt without requiring additional manual input.

- Omnichannel payments also facilitate better resource management. With streamlined operations, staff can focus on higher-value tasks, such as improving customer service or analyzing sales trends, rather than being bogged down by repetitive administrative work.

The result is a more agile and efficient operation that can adapt to changing business needs while delivering consistent service quality.

Faster Dispute Resolution with Centralized Data

Disputes are an inevitable part of payment processing, whether they stem from chargebacks, billing errors, or customer complaints. Omnichannel payments simplify dispute resolution by providing centralized access to all transaction data, making it easier to identify and address issues.

- With all payment data stored in a unified system, businesses can quickly locate transaction records, verify details, and respond to disputes. This centralized approach significantly reduces the time and effort required to resolve issues.

- Omnichannel payments often include advanced reporting tools that allow businesses to generate detailed transaction histories with just a few clicks. These reports can be shared with customers or financial institutions as part of the dispute resolution process.

- Faster dispute resolution not only improves operational efficiency but also enhances customer satisfaction. When businesses can address concerns promptly and transparently, they build trust and loyalty among their customers.

By enabling faster and more accurate dispute resolution, omnichannel payments protect both businesses and customers, ensuring smoother financial interactions.

Operational efficiency is a cornerstone of the benefits provided by omnichannel payments. By reducing manual errors in payment reconciliation, streamlining back-end operations, and enabling faster dispute resolution, businesses can optimize their workflows and allocate resources more effectively. These efficiencies lead to cost savings, improved accuracy, and enhanced customer satisfaction, creating a win-win scenario for businesses and their clients. In a competitive marketplace, the ability to operate efficiently and respond quickly to challenges is essential, and omnichannel payments provide the tools needed to achieve these goals. As businesses continue to evolve, the operational advantages of omnichannel payments will remain a critical driver of success.

Enhanced Data Analytics

Omnichannel payments are not just about facilitating transactions; they are also a powerful tool for collecting and analyzing data. By consolidating payment data from various channels into a unified system, omnichannel payments provide businesses with unparalleled insights into consumer behavior and operational performance. These insights enable businesses to make informed decisions, optimize strategies, and stay ahead in a competitive market. From understanding spending patterns to leveraging predictive analytics, the data-driven capabilities of omnichannel payments are transforming how businesses operate.

Providing Actionable Insights into Consumer Spending Patterns

One of the most valuable benefits of omnichannel payments is their ability to provide businesses with a comprehensive view of customer spending habits across all channels.

- Omnichannel payments centralize data from in-store, online, and mobile transactions, allowing businesses to track and analyze consumer behavior holistically. For example, a retailer can identify which products are popular in physical stores versus those trending online, enabling tailored marketing strategies for each channel.

- Businesses can segment their customers based on spending patterns, such as frequency of purchases, average transaction value, and preferred payment methods. This segmentation allows for more personalized marketing campaigns, loyalty rewards, and promotions.

- These insights also reveal shifts in consumer preferences, such as increased adoption of digital wallets or BNPL options, enabling businesses to adapt their payment offerings proactively.

By leveraging these insights, businesses can deepen their understanding of their customers, improve engagement, and drive revenue growth.

Enabling Predictive Analytics for Better Inventory and Marketing Decisions

The data collected through omnichannel payments goes beyond historical analysis; it can also be used for predictive analytics to forecast future trends and demands.

- Predictive analytics tools integrated with omnichannel payments can analyze transaction data to anticipate customer needs. For instance, a business might identify seasonal purchasing patterns, such as increased demand for certain products during holidays, and adjust inventory levels accordingly.

- Marketing teams can use these predictions to create targeted campaigns, such as promoting items that are likely to be popular in the near future or offering personalized recommendations based on past purchases.

- Predictive analytics also helps businesses optimize pricing strategies, identify upselling and cross-selling opportunities, and reduce waste by stocking inventory more efficiently.

With predictive analytics powered by omnichannel payments, businesses can shift from reactive to proactive decision-making, giving them a competitive edge.

Real-Time Monitoring of Payment Trends and Performance

Omnichannel payments enable real-time monitoring of payment activities, providing businesses with up-to-the-minute data on transaction performance and customer behavior.

- Real-time dashboards offer insights into payment trends, such as peak transaction times, popular payment methods, and geographic variations in sales. This immediate access to data allows businesses to respond quickly to changing market conditions.

- Businesses can identify and address issues in real time, such as failed transactions or unexpected spikes in chargebacks, minimizing disruptions and ensuring a seamless customer experience.

- Monitoring payment trends also helps businesses evaluate the performance of new initiatives, such as introducing a new payment method or launching a promotion. Real-time data provides immediate feedback, enabling rapid adjustments for optimal results.

This real-time visibility ensures that businesses can stay agile and responsive, maintaining smooth operations and maximizing revenue opportunities.

Enhanced data analytics is one of the most transformative benefits of omnichannel payments, providing businesses with the insights they need to make data-driven decisions. By offering a unified view of consumer spending patterns, enabling predictive analytics, and supporting real-time monitoring of payment trends, omnichannel payments empower businesses to optimize every aspect of their operations. These capabilities not only improve efficiency but also enable businesses to deliver more personalized and engaging customer experiences, driving loyalty and long-term success. In an increasingly data-driven world, the analytical advantages of omnichannel payments are indispensable for businesses looking to thrive.

Global Expansion Readiness

As businesses aim to expand their reach into international markets, the ability to handle cross-border transactions effectively becomes a critical factor for success. Omnichannel payments empower businesses to scale globally by providing robust features that address the unique challenges of international commerce. With support for multi-currency transactions, compliance with local regulations, and seamless integration with global payment processors, omnichannel payments offer a comprehensive solution for businesses ready to go global.

Supporting Multi-Currency Transactions for International Customers

In the global marketplace, accommodating customers who transact in different currencies is essential for building trust and enhancing their shopping experience. Omnichannel payments provide businesses with the tools to support multi-currency transactions seamlessly.

- Omnichannel payment systems automatically convert prices and process payments in the customer’s preferred currency, eliminating the need for manual calculations and reducing friction at checkout. For instance, an eCommerce site can display product prices in USD, EUR, or JPY depending on the customer’s location, making the shopping experience more accessible and transparent.

- Multi-currency support fosters trust by enabling customers to see and pay in their local currency without worrying about exchange rate fluctuations or hidden fees. This transparency is especially important in building confidence with international shoppers.

- For businesses with physical locations in multiple countries, omnichannel payments ensure that in-store transactions are processed in the local currency, creating consistency across all sales channels.

By enabling smooth multi-currency transactions, omnichannel payments help businesses attract and retain international customers, driving sales and expanding their global footprint.

Compliance with Local Regulations and Tax Systems

Navigating the complexities of international commerce requires adherence to varying local regulations, tax laws, and financial standards. Omnichannel payments simplify this process by providing built-in compliance tools that help businesses operate smoothly across borders.

- Omnichannel payment systems are designed to comply with region-specific regulations such as the General Data Protection Regulation (GDPR) in Europe or the Payment Services Directive 2 (PSD2). This ensures that businesses meet legal requirements while maintaining secure and transparent payment processes.

- Integrated tax management features help businesses calculate and apply the correct taxes based on the customer’s location. For example, a business selling products in Europe can automatically add value-added tax (VAT) to transactions, while a customer in the United States might see sales tax based on their state.

- Local payment regulations, such as those governing data storage or anti-money laundering (AML) practices, are addressed through partnerships with compliant payment providers, reducing the administrative burden on businesses.

By ensuring compliance with local laws and tax systems, omnichannel payments enable businesses to focus on growth without the risk of regulatory setbacks or penalties.

Partnering with Global Payment Processors for Seamless Operations

Collaborating with established global payment processors is crucial for businesses entering new markets, and omnichannel payments make this integration seamless.

- Omnichannel payment systems partner with leading payment processors like PayPal, Stripe, or Adyen to facilitate cross-border transactions. These processors provide access to a wide range of payment methods preferred by customers in different regions, including Alipay in China, UPI in India, and iDEAL in the Netherlands.

- By leveraging the expertise and infrastructure of global payment processors, businesses can provide a reliable and secure payment experience regardless of the customer’s location. For example, a customer in Japan can pay using a local bank transfer, while a customer in Canada might use a digital wallet, all within the same unified payment system.

- Global payment processors also handle currency conversion, fraud detection, and dispute resolution, ensuring that businesses can focus on delivering great customer experiences without worrying about operational complexities.

This seamless collaboration enhances operational efficiency and ensures that businesses can offer consistent, high-quality payment experiences to customers around the world.

Global expansion readiness is a key advantage of omnichannel payments, providing businesses with the tools they need to succeed in international markets. By supporting multi-currency transactions, ensuring compliance with local regulations, and partnering with global payment processors, omnichannel payments enable businesses to overcome the challenges of cross-border commerce. These features not only simplify operations but also create trust and confidence among international customers, laying the foundation for sustained global growth. As businesses look to expand their reach, omnichannel payments offer the scalability, flexibility, and reliability needed to thrive in a competitive global economy.

Omnichannel Payment Solutions

Omnichannel payment solutions are at the core of creating seamless, efficient, and customer-centric payment experiences. These solutions integrate various payment channels into a unified system, enabling businesses to meet customer expectations while improving operational efficiency. Whether it’s through payment gateways, point-of-sale systems, mobile payment technologies, or unified commerce platforms, omnichannel payment solutions offer businesses the flexibility and scalability they need to succeed in an increasingly complex marketplace.

Payment Gateways

Payment gateways form the backbone of omnichannel payments by enabling secure, efficient, and seamless transaction processing across multiple channels. These gateways act as intermediaries, connecting customers, merchants, and financial institutions to facilitate payments. With advanced features tailored for businesses of all sizes, payment gateways not only simplify payment processing but also enhance the customer experience. Below, we explore three leading payment gateways—PayPal, Stripe, and Square—and their contributions to omnichannel payments.

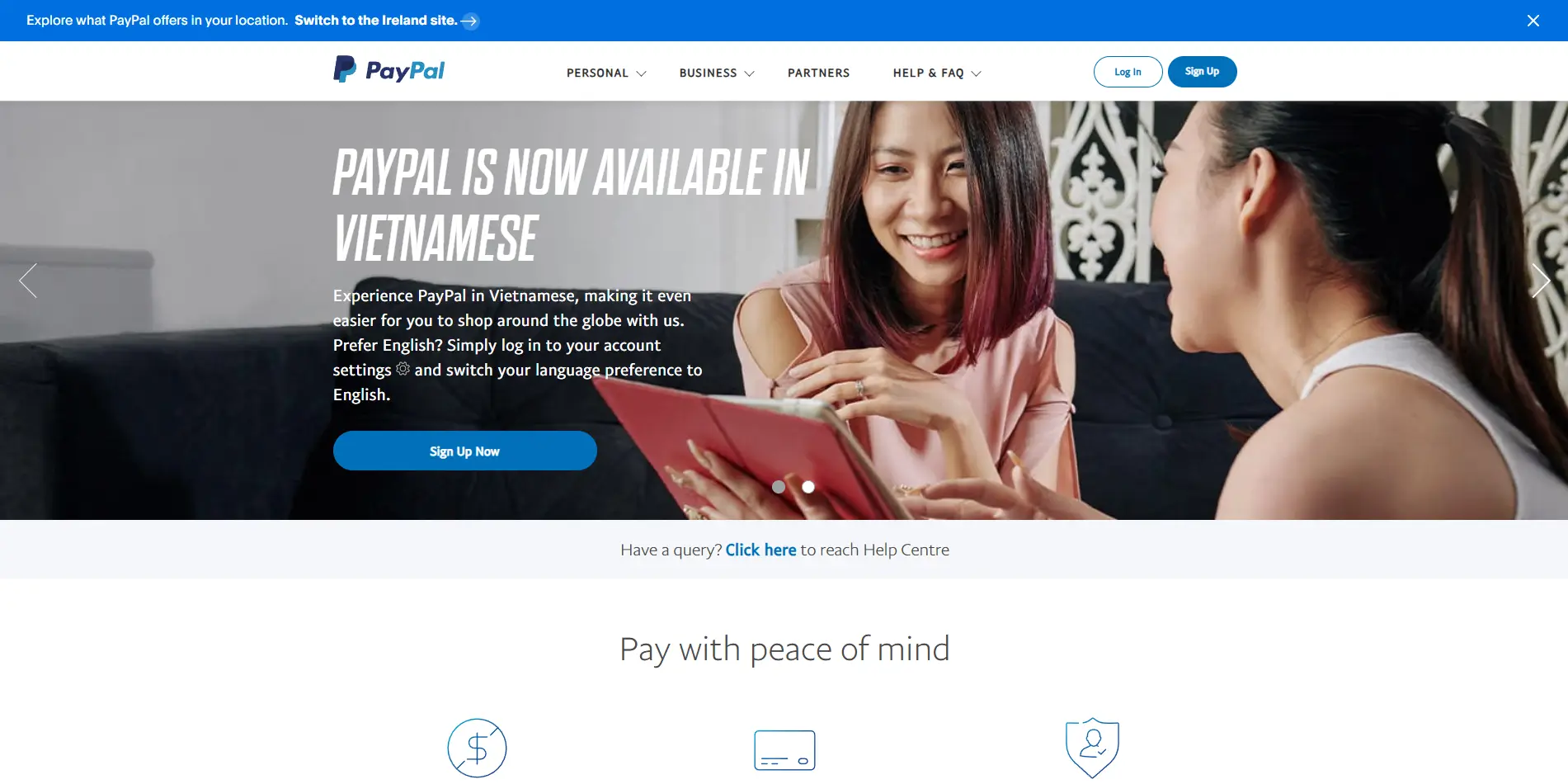

PayPal

PayPal is a global leader in payment processing, renowned for its seamless integration with eCommerce platforms and its focus on secure transactions. Its widespread adoption makes it a cornerstone of omnichannel payments, offering businesses and customers alike the flexibility and trust required in modern commerce.

- Seamless Integration with eCommerce Platforms: PayPal integrates effortlessly with leading eCommerce platforms such as Shopify, WooCommerce, and Magento, making it easy for businesses to incorporate it into their payment systems. Customers can pay with their PayPal account, linked credit or debit cards, or even their bank accounts, ensuring a hassle-free checkout experience.

- Support for Multiple Currencies and Payment Methods: As a global payment gateway, PayPal supports transactions in over 100 currencies, allowing businesses to cater to international customers. In addition to traditional payment methods, PayPal enables customers to use options like PayPal Credit, Pay in 4 (a BNPL solution), and digital wallets, aligning with diverse customer preferences.

- Advanced Fraud Protection and Buyer/Seller Protection Policies: PayPal prioritizes security with advanced fraud detection tools and encryption. Its buyer and seller protection policies ensure that both parties are safeguarded against fraudulent activities, unauthorized payments, and disputes, making it a trusted choice for global transactions.

PayPal’s versatility and focus on security make it an essential component of omnichannel payments for businesses targeting a global audience.

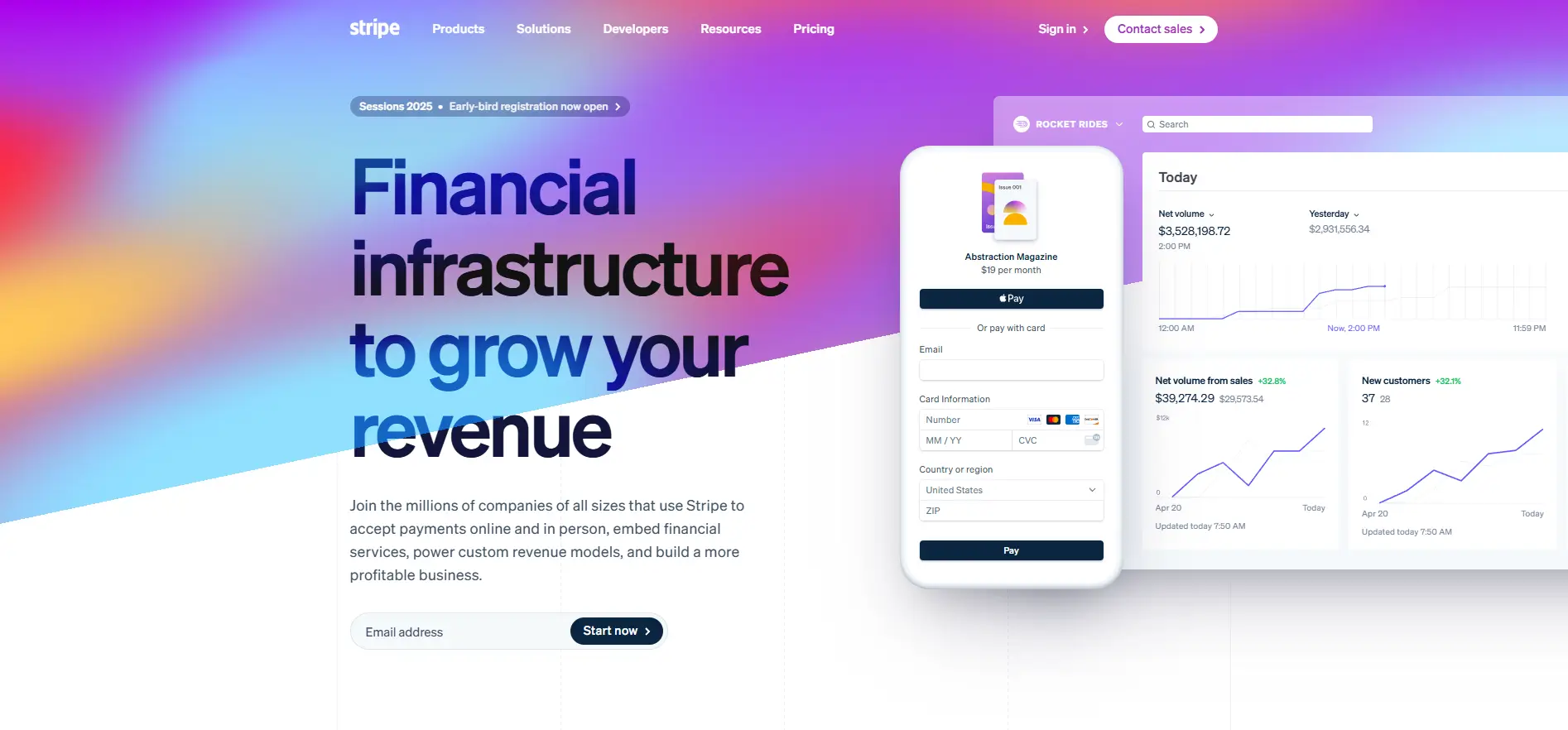

Stripe

Stripe has gained prominence as a developer-friendly payment gateway, offering extensive customization capabilities and advanced features that cater to businesses of all sizes. Its innovative approach to payment processing aligns perfectly with the demands of omnichannel payments.

- Developer-Friendly APIs for Custom Integrations: Stripe’s robust APIs allow businesses to build custom payment solutions tailored to their unique needs. Whether it’s integrating with a proprietary eCommerce platform or developing a subscription-based billing system, Stripe offers the tools to create a seamless experience.

- Support for Recurring Billing, Subscriptions, and Multi-Party Payments: Stripe excels in handling complex payment models, such as recurring billing for subscription services and multi-party payments for marketplaces. These features are critical for businesses operating across diverse channels, ensuring flexibility and scalability.

- Advanced Analytics and Machine Learning Fraud Prevention: Stripe provides businesses with detailed analytics to monitor payment trends, revenue performance, and customer behavior. Its machine learning-powered fraud prevention system, Radar, proactively identifies and blocks suspicious transactions, safeguarding businesses and their customers.

Stripe’s focus on flexibility, innovation, and security positions it as a leading choice for businesses implementing omnichannel payments.

Square

Square is a versatile payment gateway that combines robust payment processing with advanced tools for managing in-store and online operations. Its all-in-one approach makes it a valuable addition to omnichannel payments, particularly for small and medium-sized businesses.

- Integration of Payment Processing with POS Systems: Square seamlessly integrates its payment gateway with its point-of-sale systems, providing businesses with a unified solution for in-store and online sales. This integration ensures that all transactions are recorded in a single platform, simplifying operations and enhancing efficiency.

- Tools for Invoicing, Inventory Management, and Payroll Integration: Beyond payment processing, Square offers a suite of tools to streamline business operations. Its invoicing feature allows businesses to send and track invoices easily, while its inventory management system keeps stock levels updated in real time. Payroll integration ensures that employees are paid accurately and on time, reducing administrative burdens.

- Competitive Rates and Robust Reporting Features: Square is known for its transparent and competitive pricing, making it an attractive choice for small businesses. Additionally, its reporting features provide actionable insights into sales performance, customer behavior, and operational efficiency, helping businesses make informed decisions.

Square’s comprehensive feature set and user-friendly design make it a cornerstone of omnichannel payments, particularly for businesses looking to unify their payment and operational systems.

Payment gateways are indispensable for the success of omnichannel payments, providing businesses with the tools to process transactions securely, efficiently, and flexibly across multiple channels. PayPal excels in global reach and customer trust, Stripe leads in customization and advanced features, and Square offers an all-in-one solution for in-store and online operations. Together, these gateways empower businesses to meet the diverse needs of their customers while optimizing operational efficiency, making them essential components of a robust omnichannel payment strategy.

Point-of-Sale Systems

Point-of-sale systems are integral to the success of omnichannel payments, providing a bridge between physical retail operations and digital commerce. Modern POS systems go beyond simple payment terminals, offering comprehensive features that unify in-store, online, and mobile transactions. By integrating advanced functionalities such as inventory management, employee tracking, and loyalty programs, POS systems help businesses streamline operations and create consistent customer experiences. Here, we explore three leading POS systems—Clover POS, Shopify POS, and Lightspeed POS—and their contributions to omnichannel payments.

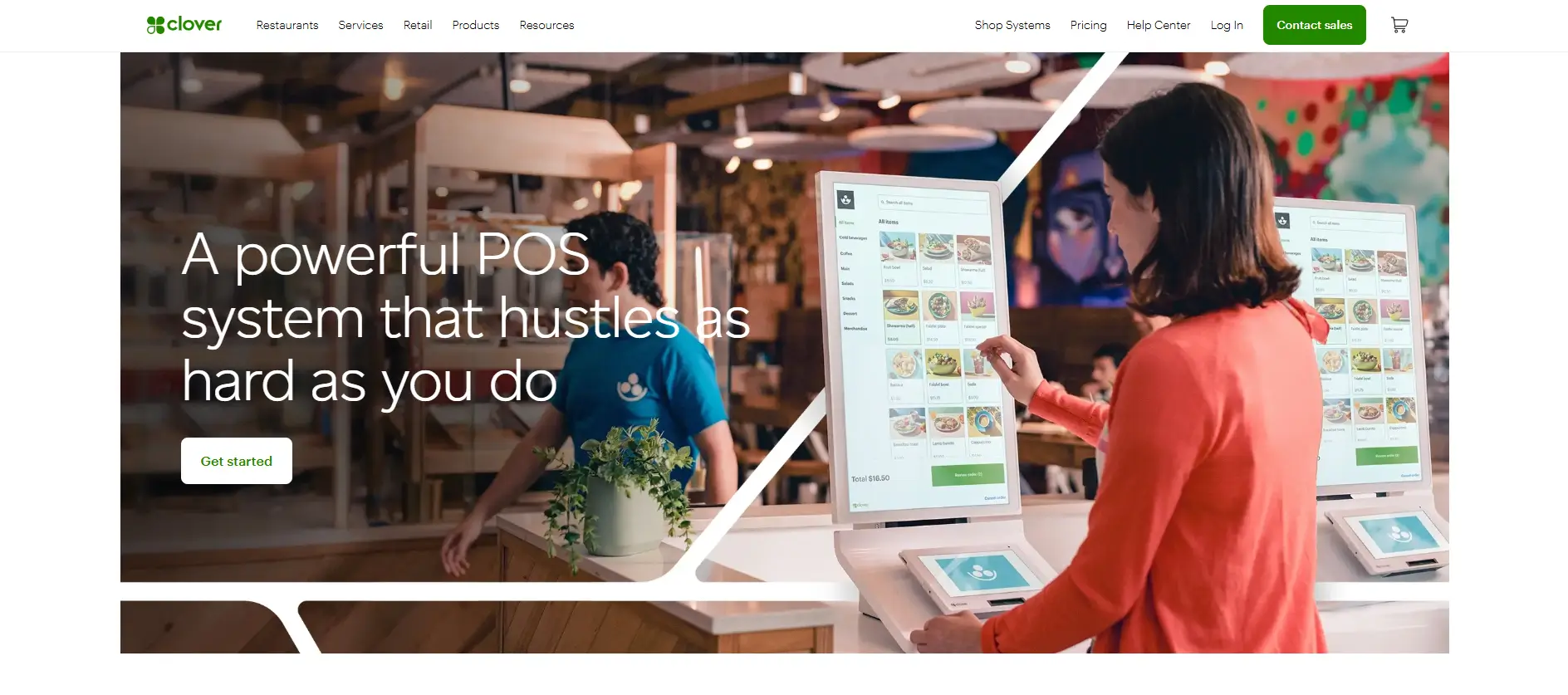

Clover POS

Clover POS is a versatile and highly customizable point-of-sale system designed to meet the diverse needs of businesses. Its integrated payment processing and advanced features make it an excellent choice for businesses looking to optimize their omnichannel payments strategy.

- Highly Customizable System with Integrated Payment Processing: Clover POS offers a flexible platform that businesses can tailor to their specific requirements. From small retailers to larger establishments, Clover POS supports various industries with features that integrate seamlessly into existing payment systems. Its built-in payment processing ensures secure and efficient transactions, enhancing the customer experience.

- Inventory Management, Employee Tracking, and Loyalty Programs: Clover POS provides robust tools for managing inventory, tracking employee performance, and running customer loyalty programs. Businesses can monitor stock levels in real time, set alerts for low inventory, and analyze sales trends. Loyalty programs encourage repeat customers by enabling rewards, discounts, and personalized offers.

- Mobile POS Functionality for Flexible Checkout Options: With mobile POS capabilities, Clover POS allows businesses to accept payments anywhere within their store or even at pop-up locations. This flexibility enhances customer convenience by reducing wait times and creating a seamless checkout process.

Clover POS is a comprehensive solution for businesses seeking a customizable and efficient POS system that integrates seamlessly into their omnichannel payments ecosystem.

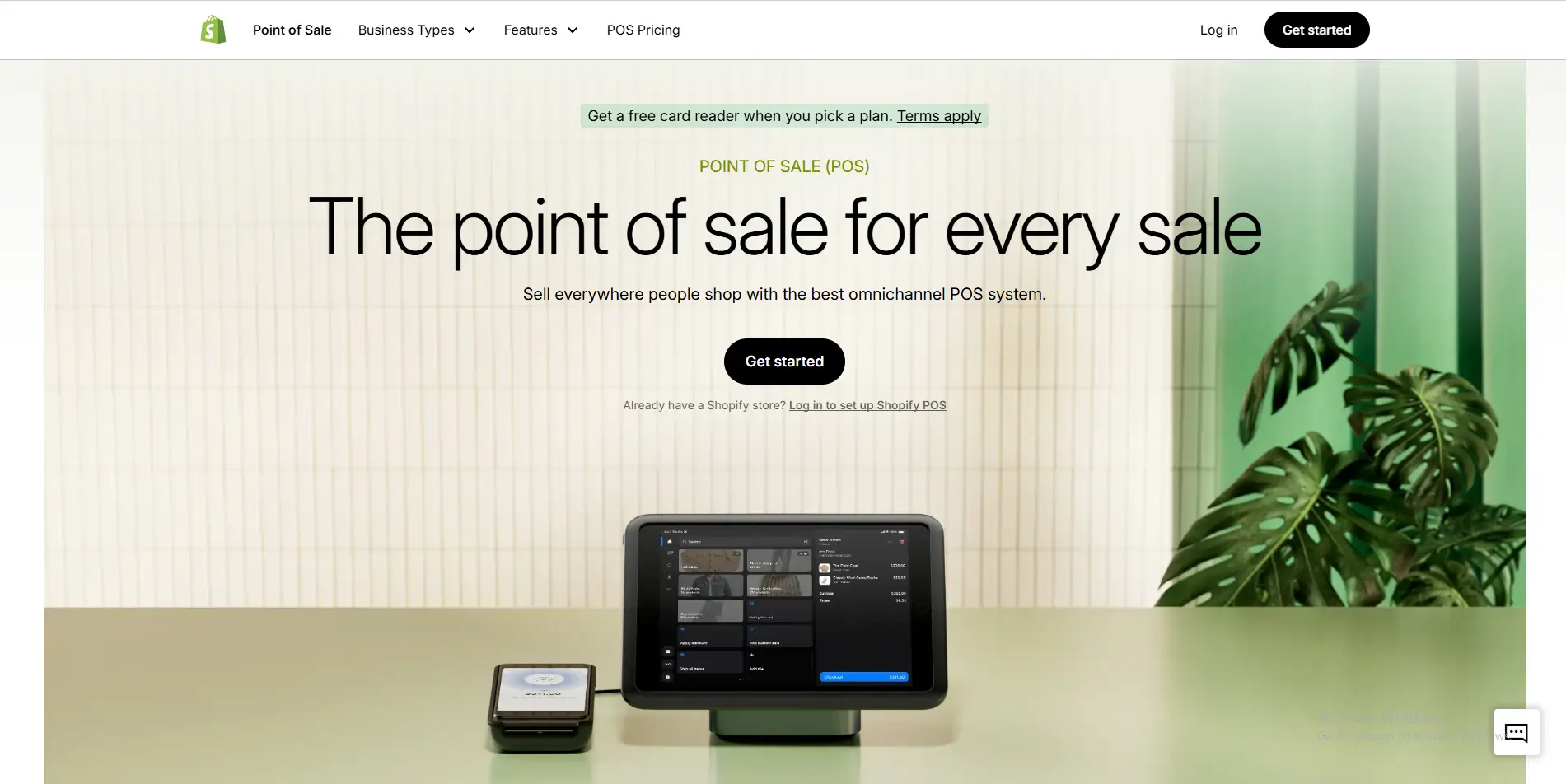

Shopify POS

Shopify POS is a powerful point-of-sale system that fully integrates with Shopify’s eCommerce platform, making it a perfect choice for businesses that operate both online and in-store. Its robust features ensure consistency and flexibility in managing inventory, sales, and customer experiences.

- Full Integration with Shopify’s eCommerce Platform: Shopify POS provides seamless synchronization between online and in-store operations, ensuring that inventory and sales data are updated in real time. This integration simplifies inventory tracking, enabling businesses to avoid stockouts or overselling while maintaining a unified view of sales performance.

- Seamless In-Store and Online Shopping Experiences: Shopify POS allows businesses to offer customers the flexibility to shop across channels. For instance, customers can browse products online, check availability in a nearby store, and complete the purchase in-store. Similarly, in-store purchases can be linked to customer accounts for online loyalty rewards or order tracking.

- Hardware Options for Various Retail Needs: Shopify POS offers a range of hardware solutions to meet the needs of different businesses. From card readers and barcode scanners to cash drawers and receipt printers, these options ensure that businesses can create a professional and efficient checkout experience tailored to their operations.

Shopify POS stands out as a unified solution for businesses aiming to provide seamless and consistent experiences across digital and physical channels.

Lightspeed POS

Lightspeed POS is designed specifically for retail and hospitality businesses, offering industry-specific features that support omnichannel payments and enhance operational efficiency. Its advanced tools cater to the unique needs of these sectors, making it an ideal choice for businesses that require specialized solutions.

- Industry-Specific Features for Retail and Hospitality: Lightspeed POS tailors its features to suit the needs of various industries. Retailers benefit from tools for managing large inventories, while hospitality businesses enjoy functionalities like table management, menu customization, and split billing. This industry focus ensures that Lightspeed POS meets the specific demands of its users.

- Advanced Inventory Management, Reporting, and Customer Insights: Lightspeed POS includes robust inventory management tools that allow businesses to track stock levels, monitor performance, and generate detailed reports. These insights help businesses identify trends, forecast demand, and make informed decisions about inventory and marketing strategies.

- Mobile POS Solutions for On-the-Go Sales: Lightspeed POS offers mobile capabilities, enabling businesses to accept payments and manage transactions from anywhere. This flexibility is particularly useful for businesses operating in dynamic environments, such as food trucks, pop-up shops, or outdoor events.

Lightspeed POS is a feature-rich system that empowers retail and hospitality businesses to enhance their omnichannel payments and streamline operations.

Point-of-sale systems are essential to the success of omnichannel payments, acting as a bridge between physical and digital transactions. Clover POS offers customization and mobile functionality, making it ideal for businesses seeking flexibility. Shopify POS provides seamless integration with eCommerce platforms, ensuring consistency across online and in-store operations. Lightspeed POS delivers industry-specific features tailored to retail and hospitality businesses, enhancing efficiency and customer satisfaction. Together, these POS systems highlight the versatility and power of omnichannel payments, enabling businesses to thrive in a competitive marketplace.

Mobile Payment Solutions

Mobile payment solutions are a vital component of omnichannel payments, catering to the growing demand for convenience, speed, and security in modern commerce. By leveraging smartphones and other mobile devices, these solutions enable seamless transactions across online, in-app, and in-store environments. Among the leading players in the mobile payment space are Apple Pay, Google Pay, and Samsung Pay, each offering unique features that enhance the customer experience and empower businesses to provide flexible payment options.

Apple Pay

Apple Pay has established itself as a leader in mobile payment solutions, offering customers a secure, convenient, and fast way to complete transactions. Designed exclusively for Apple devices, it seamlessly integrates with the iOS ecosystem, making it an essential element of omnichannel payments for businesses targeting Apple users.

- Enables Contactless Payments with Biometric Authentication: Apple Pay allows users to make contactless payments with a simple tap of their device, whether it’s an iPhone, iPad, or Apple Watch. Biometric authentication through Face ID or Touch ID adds an extra layer of security, ensuring that transactions are both fast and safe.

- Seamless Integration with iOS Devices and Apps: Apple Pay integrates effortlessly with Apple’s ecosystem, supporting in-app purchases, online transactions, and point-of-sale payments. Businesses can incorporate Apple Pay into their apps and websites, creating a smooth and consistent experience for customers who prefer mobile-first strategies.

- Supported by Merchants Globally: Apple Pay’s widespread adoption ensures compatibility with a vast network of merchants, from online retailers to brick-and-mortar stores. This global support makes it a reliable option for businesses looking to expand their omnichannel payments strategy to a broad audience.

Apple Pay’s emphasis on security, convenience, and integration makes it a valuable tool for businesses seeking to provide frictionless payment experiences in their omnichannel systems.

Google Pay

Google Pay has become a popular mobile payment solution for Android users, combining simplicity, security, and functionality into a unified platform. With features that cater to both customers and businesses, Google Pay is an integral part of omnichannel payments, enabling seamless transactions across multiple channels.

- Unified Wallet for Payment Methods, Loyalty Cards, and Passes: Google Pay acts as a digital wallet, storing credit and debit cards, loyalty rewards, gift cards, and even boarding passes. This all-in-one approach simplifies the customer experience, ensuring that everything they need for a transaction is in one convenient location.

- Easy Integration with Android Apps and Websites: Google Pay is designed to integrate seamlessly with Android apps and websites, allowing businesses to offer a smooth and efficient payment experience. For example, customers can make one-click payments on eCommerce sites or in mobile apps without needing to re-enter their payment details.

- Advanced Security Through Tokenization and Multi-Factor Authentication: Google Pay prioritizes security by replacing sensitive card details with unique tokens during transactions, ensuring that actual card information is never shared with merchants. Multi-factor authentication adds an additional layer of protection, providing peace of mind for both customers and businesses.

Google Pay’s user-friendly features and robust security measures make it an indispensable part of any omnichannel payment strategy, particularly for businesses targeting Android users.

Samsung Pay

Samsung Pay distinguishes itself from other mobile payment solutions with its unique technology and rewards-based approach, making it a versatile option in omnichannel payments. Designed for Samsung devices, it offers broad compatibility and innovative features that enhance customer convenience.

- Unique MST Technology for NFC and Magnetic Card Readers: Samsung Pay’s Magnetic Secure Transmission (MST) technology allows it to work with both NFC-enabled terminals and traditional magnetic card readers. This capability ensures that customers can use Samsung Pay almost anywhere, making it one of the most universally accepted mobile payment solutions.

- Rewards Program to Incentivize Users: Samsung Pay includes a built-in rewards program that encourages customer adoption and engagement. Users earn points for every purchase made through the platform, which can be redeemed for discounts, gift cards, or other perks, creating additional value for customers.

- Wide Compatibility with Banks and Card Networks: Samsung Pay supports a broad range of banks and card networks globally, ensuring that customers can link their preferred payment methods and use them seamlessly across online and in-store transactions.

Samsung Pay’s focus on compatibility, incentives, and technological innovation makes it a valuable addition to any omnichannel payments ecosystem, particularly for businesses seeking to cater to a diverse customer base.

Mobile payment solutions are a cornerstone of omnichannel payments, enabling businesses to deliver fast, secure, and convenient transactions across multiple channels. Apple Pay excels in its seamless integration with the iOS ecosystem, Google Pay offers a comprehensive and secure digital wallet for Android users, and Samsung Pay stands out with its versatile MST technology and customer rewards program. Together, these solutions empower businesses to meet customer expectations, streamline payment processes, and enhance the overall shopping experience. As mobile payments continue to grow in popularity, integrating these solutions into an omnichannel payment strategy is essential for businesses looking to stay competitive and customer-focused.

Unified Commerce Platforms

Unified commerce platforms are the ultimate solution for businesses aiming to deliver seamless and consistent omnichannel payments. These platforms integrate critical aspects of eCommerce, such as inventory, shipping, customer engagement, and payment processing, into a single, cohesive system. By breaking down silos and centralizing operations, unified commerce platforms empower businesses to provide streamlined customer experiences while enhancing operational efficiency. Below, we explore three leading unified commerce platforms—Shopify, BigCommerce, and Magento (Adobe Commerce)—and their contributions to omnichannel payments.

Shopify

Shopify is a widely popular unified commerce platform that integrates eCommerce, payment processing, and back-end operations into a user-friendly solution. Its flexibility and scalability make it an ideal choice for businesses of all sizes implementing omnichannel payments.

- Integration of Inventory, Shipping, and Payment Solutions: Shopify’s platform ensures that inventory, shipping, and payment processes are fully integrated, enabling businesses to manage these functions from a single dashboard. For instance, when a customer makes a purchase, Shopify automatically updates inventory levels, processes the payment, and generates a shipping label, saving businesses time and effort.

- Built-In Tools for Analytics, Marketing, and Customer Engagement: Shopify provides robust tools for monitoring sales performance, analyzing customer behavior, and managing marketing campaigns. Features such as abandoned cart recovery and email marketing help businesses engage customers effectively, increasing conversions and revenue.

- Support for Multiple Sales Channels: Shopify supports omnichannel payments across online stores, social media platforms, and marketplaces like Amazon and eBay. This multi-channel functionality allows businesses to reach a broader audience and provide a consistent shopping experience across all touchpoints.

Shopify’s all-in-one approach makes it a powerful platform for businesses seeking to streamline operations and enhance their omnichannel payments strategy.

BigCommerce

BigCommerce is a robust unified commerce platform designed for scalability and customization, making it particularly suited for businesses managing large inventories or operating multiple stores. Its advanced tools and integrations are ideal for supporting comprehensive omnichannel payments.

- Robust Tools for Managing Large Inventories and Multi-Store Setups: BigCommerce is equipped to handle complex inventory systems and multi-store operations, ensuring that businesses can manage products efficiently across various locations and channels. Real-time updates and centralized control prevent stockouts and overselling, providing a smooth shopping experience for customers.

- Integrations with Popular Payment Gateways: BigCommerce supports integrations with leading payment gateways like PayPal, Stripe, and Square, ensuring flexibility in omnichannel payments. This compatibility allows businesses to offer a wide range of payment options to customers, enhancing satisfaction and reducing cart abandonment.

- Headless Commerce Capabilities for Custom Solutions: BigCommerce’s headless commerce architecture enables businesses to decouple the front-end customer experience from the back-end systems. This flexibility allows for highly customized and branded shopping experiences while maintaining seamless integration with omnichannel payments.

BigCommerce’s scalability and customization options make it an excellent choice for businesses looking to expand their omnichannel presence and enhance payment flexibility.

Magento (Adobe Commerce)

Magento, now known as Adobe Commerce, is a leading unified commerce platform designed for enterprise-grade eCommerce operations. Its highly customizable features and advanced integrations make it a top choice for businesses with complex omnichannel payment needs.

- Highly Customizable Platform for Enterprise Operations: Magento provides unmatched flexibility, allowing businesses to tailor every aspect of their eCommerce operations, from payment processes to website design. This customization is particularly beneficial for businesses with unique requirements or those operating in niche markets.

- Seamless Integration with CRM, ERP, and Third-Party Applications: Magento supports integrations with customer relationship management (CRM) tools, enterprise resource planning (ERP) systems, and other third-party applications. These integrations ensure that payment data and customer interactions are synchronized across all platforms, creating a unified omnichannel experience.

- Advanced Analytics and AI-Driven Personalization Tools: Magento leverages artificial intelligence and machine learning to deliver personalized shopping experiences. By analyzing payment and customer behavior data, businesses can offer tailored product recommendations, dynamic pricing, and targeted promotions that drive engagement and loyalty.

Magento’s enterprise-grade capabilities and focus on personalization make it an indispensable platform for businesses seeking to optimize their omnichannel payments.