In the dynamic world of eCommerce, selecting the right payment gateway for your Magento 2 store is a decision of paramount importance. The payment gateway not only acts as the bridge between your online store and the financial network but also plays a crucial role in ensuring a secure, efficient, and seamless transaction experience for your customers. With a myriad of options available, each offering unique features and services, choosing the best fit for your business needs careful consideration.

This article aims to guide you through the best Magento payment gateways, highlighting their key features, benefits, and potential drawbacks. Whether you’re targeting a local market aiming for a global presence, prioritizing security, or focusing on user experience, the right payment gateway can significantly influence your store’s success.

From well-known industry leaders to emerging innovators, we delve into what makes each of these gateways stand out, helping you make an informed decision that aligns with your business strategy and customer expectations. Let’s explore the top best of Magento 2 payment gateways to find the perfect match for your eCommerce venture.

Table of Contents

- Top Best Magento 2 Payment Gateways

- Factors to Consider When Choosing a Payment Gateway for Magento 2

- The Market You Currently Operating

- Security and Compliance (PCI DSS Standards, SSL Encryption)

- Integrating Easily with Magento 2

- Supporting Apple Pay – Google Pay

- Transaction Fees and Payment Structures

- Supported Currencies and Countries

- User Experience and Interface

- Customer Support and Service Reliability

Top Best Magento 2 Payment Gateways

PayPal

PayPal is a globally recognized payment gateway and an essential addition to the list of the top best payment gateway for Magento 2. Renowned for its extensive user base of over 400 million, PayPal offers a robust and reliable solution for eCommerce businesses. PayPal’s widespread popularity and trustworthiness stem from its consistent performance and comprehensive features that cater to a broad spectrum of payment needs.

Key Features

- Variety of Payment Methods: PayPal allows Magento 2 stores to offer diverse payment options, including credit/debit cards, PayPal balance, and bank transfers, catering to a wide range of customer preferences.

- Buy Now, Pay Later: This feature enables customers to make purchases and defer payments, increasing buying power and flexibility.

- Recurring Payments and Subscriptions: Ideal for businesses that operate on a subscription model or require regular payment schedules.

- Global Payment Acceptance: PayPal supports multiple currencies, making it easier for Magento 2 stores to cater to a global customer base.

- Secure Transactions: With advanced encryption and fraud detection systems, PayPal ensures high levels of security for all transactions.

- Magento 2 PayPal Multi-Currency Extension: This extension allows for accepting payments in various currencies, enhancing the store’s appeal to international customers.

Pros and Cons of PayPal for Magento 2

- Pros:

- Recognized and trusted by a vast global user base

- Supports a range of payment methods

- Robust security measures protect against fraud and unauthorized transactions

- User-Friendly interface

- Flexible Payment Solutions: Buy now, pay later, and subscription payment options

- 24/7 Support

- Cons:

- Transaction fees can be higher compared to some other gateways

- Occasional freezing of accounts for security checks, which can delay transactions

- Additional fees for currency conversions in international transactions

- Some users report complexities in resolving disputes and chargebacks

Stripe

Stripe stands as a prominent name in the world of Magento 2 payment gateways, boasting dual headquarters in San Francisco and Dublin. The company is renowned for its extensive collaboration with a vast network of financial institutions and banks, significantly simplifying financial complexities for online businesses. Its integration as a payment gateway for Magento 2 makes it a top choice for eCommerce platforms, offering a secure, PCI-compliant, and scalable payment solution.

Stripe’s global reach is notable, supporting online payments in over 25 languages and 135 currencies. Trusted by millions and utilized by leading brands like Google, Amazon, Shopify, and Microsoft, Stripe has established itself as a globally recognized payment gateway.

Key Features

- No Setup and Hidden Fees: This Magento payment gateway offers a straightforward approach with no setup or hidden monthly charges.

- Mobile Integration: Provides integration options for Android and iOS, enabling in-app payments.

- Flexible Subscription Options: Offers unlimited options for plan types, along with coupons and free trial periods.

- Advanced Reporting: Delivers comprehensive reporting tools for better financial management.

- Team Collaboration: Allows the creation of teams with assignable permission levels for efficient management.

- Bitcoin Integration: Supports Bitcoin payments with a low transaction fee of 0.8% per transaction.

- Instant Debit Card Transfers: Facilitates quick transfers to debit cards for faster access to funds.

Pros and Cons of Stripe for Magento 2

- Pros

- Offers extensive customization and development opportunities for tech-savvy users

- Users have the liberty to modify every aspect of their payment gateway

- Support Global Payment

- Supports modern payment methods like Bitcoin, appealing to a diverse customer base

- Advanced reporting features provide valuable insights for business decision-making

- Enables in-app payments, catering to the growing trend of mobile commerce

- Cons:

- Does not provide 3D secure services

- Increased adjustments and functionalities may lead to additional charges

Authorize.net

Authorize.net, a renowned payment service provider owned by Visa, is a key player in the Magento 2 payment gateways. It has established a strong reputation for simplifying electronic and credit card payments, making it one of the top choices for Magento 2 payment gateways. Serving over 400 thousand merchants worldwide, Authorize.net is celebrated for its commitment to payment security and reliability, essential aspects of running a successful online business.

The payment gateway offered by Authorize.net comes equipped with advanced fraud protection tools, ensuring a secure transaction environment. It’s designed to accommodate various payment methods and currencies, enhancing the customer’s convenience and expanding the merchant’s global reach.

Key Features

- Diverse Online Payment Options: Supports debit cards, credit cards, eChecks, Apple Pay, and PayPal, providing a range of choices for customers.

- Virtual Point of Sale (VPOS): Enables in-person payment with credit cards.

- Mobile Payments: Offers support for payments made using mobile devices, catering to the growing trend of mobile shopping.

- Phone Payments: Utilizes a Virtual Terminal for secure and quick order submission.

- Flexible Billing: Allows setup for billing subscriptions and lets customers choose their preferred payment methods, boosting loyalty.

- eCheck Payments: Ideal for various scenarios like bill payments, recurring transactions, and contactless payments.

- Custom Digital Invoicing: Merchants can send invoices via email.

- Authorize.net Customer Information Manager (CIM): Enables customers to save credit card data for future transactions.

- Built-in Fraud Detection: Identifies suspicious transactions and IP addresses, enhancing security.

Pros and Cons of Authorize.net for Magento 2

- Pros:

- Offers a wide range of payment methods to cater to different customer preferences

- Streamlines the checkout process, enhancing the customer experience

- Offers clear, predictable pricing, making it easier for businesses to manage finances

- Provides flexibility for businesses without the worry of contractual obligations for early termination

- Cons: The admin panel’s interface may feel outdated, impacting the user experience for merchants

Barclaycard

Barclaycard, a division of Barclays Bank PLC, is a prominent name in the world of credit card services, particularly within the United Kingdom. As one of the best Magento 2 payment gateways, it serves a global clientele across more than 40 countries, emphasizing secure and reliable payment solutions. This focus on security and reliability makes Barclaycard a preferred choice for Magento 2 store owners, especially those whose primary customer base is in the UK.

Key Features

- Enhanced Security Layers: Incorporates multiple levels of security to safeguard transactions, providing peace of mind for both merchants and customers.

- Focus on UK Market: Ideal for stores with a primary customer base in the UK, offering a familiar and trusted payment option.

- Global Reach: Despite its UK focus, Barclaycard caters to clients worldwide, making it a versatile choice for international transactions.

- Fraud Detection Systems: Advanced systems in place to detect and prevent fraudulent activities, enhancing transaction security.

- Customer Comfort and Familiarity: Provides a payment option that is well-known and trusted, particularly in the UK market.

Pros and Cons of Barclaycard for Magento 2

- Pros:

- Ensures the safety of online transactions with advanced security protocols

- Being part of Barclays Bank PLC, it carries a strong reputation, especially in the banking sector

- Robust systems to detect and mitigate fraudulent activities, providing additional security

- Cons: While global, it may be more recognized and trusted primarily in the UK, potentially limiting its appeal in other regions

Sage Pay

Sage Pay, now known as Opayo following its acquisition by Elavon, a subsidiary of U.S. Bank, has been a prominent name in the UK’s payment industry. Renowned for its security, reliability, and innovative payment solutions, Opayo has continued to evolve and improve, making it a strong contender among the best Magento 2 payment gateways. This gateway is particularly noted for its effectiveness in handling global payments in multiple currencies, making it a go-to choice for merchants looking to expand their reach.

For Magento 2 store owners, particularly in the UK and Ireland, Opayo offers a seamless integration experience. The Magento 2 Opayo Payments extension by Magenest simplifies the integration process, allowing merchants to leverage the full potential of this PCI-compliant payment solution.

Magenest stands as a distinguished partner of Elavon, one of the leading payment solution providers. As a collaboration that brings together expertise and innovation, Magenest leverages Elavon’s robust and secure payment infrastructure to offer advanced payment solutions tailored to diverse business needs. With a focus on enhancing the customer experience and streamlining transaction processes, Magenest integrates Elavon’s cutting-edge technology to deliver seamless, secure, and efficient payment services.

Key Features

- Global Payment Support: Accepts payments in various currencies, catering to a worldwide customer base.

- User-Friendly Dashboard: An intuitive dashboard for managing transactions and viewing detailed reports.

- Fraud Risk Analysis: Each transaction undergoes a fraud risk analysis to ensure security.

- Quick Settlements with Leading Banks: Collaborates with major banks in the UK and Ireland for prompt payment settlements.

- PCI-Compliant: Adheres to the highest standards of payment security.

- Magento 2 Integration: The Magenest extension facilitates easy integration with Magento 2 platforms.

Pros and Cons of SagePay for Magento 2

- Pros:

- Support global currency

- Simplifies transaction management and provides valuable insights through its dashboard

- Strong focus on security with PCI compliance and fraud risk analysis

- Partnerships with major banks ensure quick and efficient payment settlements

- Cons:

- While global, it may be particularly favored by merchants in the UK and Ireland

- Merchants outside the UK and Ireland may find integration and operations slightly more complex

Braintree

Braintree, a subsidiary of PayPal, has emerged as a significant player in the online payment solutions arena in the USA. Integrated by default into the Magento 2 core, Braintree offers Magento store owners a versatile and efficient means to process payments. This integration allows customers to choose from various payment methods, including PayPal, debit and credit cards, Venmo, Apple Pay, and Google Pay.

Braintree’s inclusion in the list of top Magento 2 payment gateways is justified by its ability to facilitate secure and convenient transactions, including support for recurring payments. With robust security features designed to identify risky transactions and potential threats, Braintree stands as a reliable choice for eCommerce businesses. It’s a preferred payment gateway for notable online businesses like Animoto, Skyscanner, and Uber.

Key Features

- Transaction Fees: Charges a standard rate of 2.9% + $0.30 per transaction.

- No Monthly Fees: Absence of regular monthly fees, making it cost-effective for businesses.

- Pricing Options: Offers both flat rate and interchange plus pricing options.

- Optimized Acceptance Rates: Enhances the likelihood of successful transaction processing.

- Ready-made UI: Provides a secure and user-friendly checkout interface for websites or apps.

- Global Payment Support: Accepts various international payment methods, including China UnionPay.

Pros and Cons of Braintree for Magento 2

- Pros:

- Offer a robust security framework, ensuring safe transactions

- Only charges per transaction with no monthly fees, making it budget-friendly for various business sizes

- Include support for 3D Secure

- Support global payment methods

- User-Friendly interface

- Cons: No fee returns on partial refunds

Moneris

Moneris Solutions Corporation, commonly known as Moneris, is the foremost payment processing company in Canada. It caters to a diverse range of industries by offering varied payment solutions and services. Moneris is known for its comprehensive array of payment processing options, including credit and debit card processing, online payment solutions, and mobile payment solutions.

For Magento 2 store owners, Moneris payment gateway provided by Magenest is a valuable tool. It enables the acceptance of a wide variety of payment methods directly on the website, enhancing customer convenience. A notable feature of this integration is that it allows customers to complete purchases without being redirected to an external page, streamlining the checkout process.

Moneris is recognized for its role in significantly boosting conversion rates for online stores and retaining repeat customers, making it a vital addition to any Magento 2 eCommerce platform.

Key Features

- Direct On-Site Payment: Allows customers to make payments directly on the website without redirection.

- Customer Credit Vault: Securely stores customer payment information for faster and more convenient future transactions.

- Range of Payment Methods: Supports various payment options, including credit and debit cards.

- Mobile Payment Solution: Offers a mobile payment option for on-the-go transactions.

Pros and Cons of Moneris for Magento 2

- Pros:

- Enhance customer experience

- Have secure card storage

- Have diverse payment options

- Contributes to higher conversion rates

- Cons:

- As a Canadian company, it may primarily cater to Canadian businesses and customers

- May not offer the same level of service or integration outside of Canada

WorldPay

WorldPay, a renowned name in the payment solutions sector since 1997, stands out as a leading multi-currency best payment gateway Magento. Acquired by Fidelity Information Services, WorldPay has become one of the most essential Magento 2 payment gateways for Magento store owners seeking a reliable and versatile payment processing solution. Its ability to easily handle global payments makes it particularly valuable for eCommerce businesses with an international customer base.

The Magento 2 Worldpay Payment and Subscriptions extension offers a smooth and secure transaction process, contributing to higher customer satisfaction and potentially increased revenue. The focus on securing payments with features like 3D Secure and PCI DSS compliance adds an extra layer of trust and safety.

Key Features of WorldPay for Magento 2

- Multi-Currency Support: Facilitates global transactions by supporting various currencies.

- Quick Payouts and Enhanced Cash Flow: Efficient processing of payments that aids in maintaining a healthy cash flow.

- Secure Payments: Incorporates 3D Secure and adheres to PCI DSS Compliance standards.

- Magento 2 Integration: The Magenest extension provides seamless integration with Magento 2, offering an improved checkout experience.

- Lifetime Upgrades and Updates: Continual upgrades and updates ensure that the extension stays current with the latest eCommerce trends and security standards.

Pros and Cons of WorldPay for Magento 2

- Pros:

- Own global transaction capability

- Improve checkout experience

- Have advanced security features

- Update to the Magento 2 extension to ensure compatibility and security regularly

- Have quick payment processing

- Cons:

- The pricing and fee structure can be complex, potentially making it challenging for some businesses to understand

- Some users may find the integration process with Magento 2 to be a bit complex

Amazon Pay

Amazon Pay is one of the dynamic and secure Magento 2 payment gateways renowned for its flexibility and multi-currency support. It offers an innovative approach to eCommerce payments, allowing customers to use their Amazon accounts to pay on various eCommerce platforms, including Magento 2. This integration not only streamlines the checkout process but also brings the trusted Amazon experience to other online shopping environments. Supporting 12 currencies and multiple languages, Amazon Pay is particularly effective in reducing checkout times and enhancing customer convenience.

Key Features of Amazon Pay for Magento 2

- Diverse Payment Methods: Accepts various credit and debit cards including Mastercard, Visa, American Express, Discover, Diners Club, and JCB.

- Integrated Payment Option: Seamlessly incorporated in the shopping cart; customers can choose Amazon Pay in widgets without leaving the site.

- Fraud Protection: Inherits the same level of fraud protection as Amazon.com, ensuring transaction security.

- Broad Platform Compatibility: Easily integrates with Magento, Shopify, BigCommerce, and other eCommerce platforms.

- Mobile-Friendly User Experience: Designed to provide a smooth and intuitive experience on mobile devices.

Pros and Cons of Amazon Pay for Magento 2

- Pros:

- Easy checkout for Amazon users

- Support Multi-Currency payments

- No Monthly Fees or Setup Costs

- Adds a futuristic edge by enabling voice-controlled purchases and order tracking

- Mobile-Friendly UX

- Cons:

- Some additional costs may be incurred for cross-border transactions

- Refunds may take longer to process in case of transaction disputes

2Checkout

2Checkout, now rebranded as Verifone, is a global payment processing service known for its innovative approach to simplifying international transactions. It aims to provide customers with a local shopping experience by enabling payments in local currencies and languages. This flexibility is a significant advantage for Magento 2 store owners looking to expand their reach globally.

With support for over 100 currencies, 30 languages, 45 payment methods, and coverage in more than 200 countries and territories, this Magento eCommerce payment gateway stands out as a comprehensive solution for global eCommerce. The platform’s focus on intelligent payment routing and multi-currency management makes it an ideal choice for international eCommerce sellers. Whether it’s small businesses or large enterprises, 2Checkout offers a range of services to navigate the complexities of digital commerce and expand customer reach.

Key Features:

- 2Checkout Monetization Platform: Offers modular solutions for digital commerce, global payments, subscription billing, risk management, global tax and financial services, and partner sales.

- 2Sell: Facilitates safe and seamless payment processing in over 200 countries, with integration for over 120 shopping carts and localized buying experiences.

- 2Subscribe: Enables easy management of subscriptions, including various payment methods, churn avoidance, and automatic billing.

- 2Monetize: An all-in-one solution tailored for digital product sales to optimize the buying process.

- Multiple Payment Options: Merchants can receive payments in USD, EUR, or GBP via wire transfer, ACH, PayPal, and Payoneer.

Pros and Cons of 2Checkout for Magento 2

- Pros:

- Offer a localized experience for global customers, increasing comfort and trust

- Support recurring payments, essential for subscription-based business models

- Include standard and inline checkout options, enhancing flexibility for different user preferences

- Provide strong security measures to protect both sellers and buyers from fraud

- Cons: Limit merchants who may also require offline payment processing

Factors to Consider When Choosing a Payment Gateway for Magento 2

The Market You Currently Operating

When choosing a payment gateway for Magento 2, several critical factors need to be considered to ensure you select the right one for your business needs. One of the most important considerations is the market in which you are operating, as different markets often have distinct preferences for certain payment gateways.

Each geographical market may have specific preferences or dominant payment gateways. For example, in Vietnam, gateways like VNPay and OnePay are popular, while in Canada, options like WorldPay and Moneris are more commonly used. It’s essential to understand the preferred payment methods in your target market to ensure customer convenience and satisfaction.

Security and Compliance (PCI DSS Standards, SSL Encryption)

One of the paramount factors to consider is security and compliance, particularly adherence to Payment Card Industry Data Security Standards (PCI DSS) and the use of SSL encryption. This consideration is crucial because it directly impacts the safety of transaction data and the overall trustworthiness of the eCommerce platform.

The Payment Card Industry Data Security Standards are a set of requirements designed to ensure that all companies processing, storing, or transmitting credit card information maintain a secure environment. A payment gateway that is PCI DSS compliant is essential because it signifies that the gateway adheres to the highest security standards. This compliance is not just about protecting cardholder data but also about safeguarding your business from the potentially devastating impact of data breaches. By choosing a PCI DSS-compliant payment gateway, Magento 2 store owners can assure their customers that their card information is being handled safely and responsibly.

Secure Socket Layer (SSL) encryption is another critical security feature for payment gateways. SSL encryption ensures that any data transferred between the user’s web browser and the server remains encrypted and inaccessible to malicious entities. When a payment gateway uses SSL encryption, it means that sensitive information such as credit card numbers, personal data, and login credentials are securely transmitted. Customers can identify SSL-secured websites through the HTTPS protocol in the website’s URL, which has become a symbol of trust in e-commerce. Online shoppers are becoming increasingly security-conscious, and many look for HTTPS before entering their details, making SSL encryption not just a security feature, but also a necessity for customer trust and confidence.

Integrating Easily with Magento 2

Ease of integration is a pivotal factor that can significantly influence both the merchant’s and the customer’s experience. The ease of Magento 2 payment gateways integration refers to how smoothly a payment gateway can be incorporated into the existing Magento 2 platform, affecting everything from installation and configuration to the day-to-day management of transactions.

From a technical perspective, the payment gateway should be compatible with the Magento 2 architecture. This compatibility includes support for the latest versions of Magento 2, compliance with Magento coding standards, and the ability to coexist with other extensions and customizations already present in the store. A technically compatible payment gateway minimizes the chances of conflicts or issues arising post-integration, which can impact store functionality and user experience.

The Magento 2 payment gateway integration should offer a straightforward setup and configuration process. Store owners or administrators should be able to easily configure payment methods, set transaction fees, manage currency settings, and customize other relevant options without needing extensive technical knowledge. Additionally, the gateway should provide efficient management tools, such as dashboards or reporting features, that integrate well with Magento’s backend to monitor transactions and manage payments effectively.

Supporting Apple Pay – Google Pay

When selecting a payment gateway for Magento 2, one crucial factor to consider is the support for popular mobile payment systems such as Apple Pay and Google Pay. These platforms have gained immense popularity due to their convenience, speed, and enhanced security features. Customers are increasingly seeking out these payment options for their ease of use; a simple touch or glance can authorize a transaction without the need to enter card details.

Hence, choosing a payment gateway that integrates seamlessly with Apple Pay and Google Pay not only caters to customer preferences but also positions your store as a modern, customer-centric business. It’s essential to ensure that the payment gateway is capable of handling the unique tokenization process these services use, which enhances security and reduces the risk of fraud.

Additionally, integrating Apple Pay and Google Pay goes beyond just meeting customer expectations; it can significantly impact your conversion rates. Customers are more likely to complete a purchase when the process is quick and hassle-free. Therefore, a payment gateway that supports these options is likely to reduce cart abandonment rates.

Moreover, as mobile commerce continues to grow, offering these payment methods will become increasingly critical. Businesses should also consider the geographic reach and the demographic of their target audience when evaluating these features. Younger, tech-savvy consumers, in particular, might expect and appreciate the availability of these modern payment methods. Therefore, ensuring your chosen payment gateway supports Apple Pay and Google Pay is not just about keeping up with technology but also about strategic customer engagement and retention.

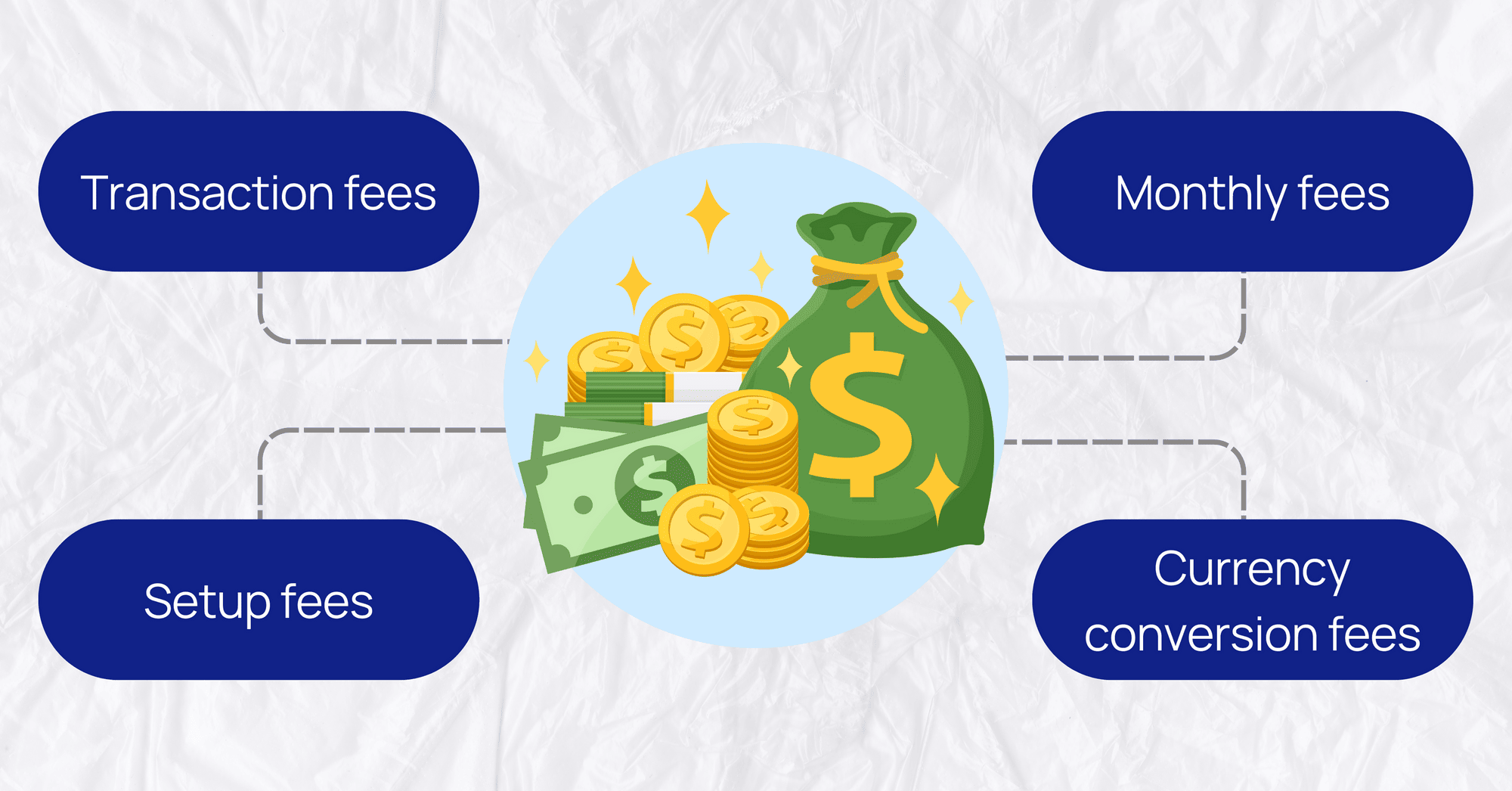

Transaction Fees and Payment Structures

Another essential factor to consider is the transaction fees and payment structures associated with the gateway. This aspect is critical because it directly affects the profitability of your online store and the pricing strategy for your products and services.

Transaction fees are charges that the payment gateway imposes for processing each transaction. These fees usually vary depending on the type of transaction, the payment methods used (such as credit card, debit card, or digital wallets), and sometimes the transaction volume. Magento 2 store owners need to understand how these fees are structured – whether as a flat rate per transaction, a percentage of the transaction value, or a combination of both. Some gateways also have different rates for domestic and international transactions, which is crucial for stores serving a global customer base.

The choice of a payment gateway with a favorable fee structure is essential for maintaining healthy profit margins. High transaction fees can lead to increased costs for the business, which might necessitate higher prices for customers or reduced profit margins for the business. Therefore, it’s important to select a gateway that offers competitive rates while still providing reliable and secure service.

Supported Currencies and Countries

When choosing a payment gateway for Magento 2, considering the supported currencies and countries is a crucial factor, especially in today’s globalized eCommerce landscape. This consideration directly impacts your ability to cater to a diverse, international customer base and influences the expansion potential of your online store.

In an increasingly interconnected market, customers from different parts of the world expect to make purchases in their local currency. A payment gateway that supports multiple currencies can provide a more localized and comfortable shopping experience for these customers. This Magento payment processing not only enhances customer satisfaction but also reduces the likelihood of cart abandonment due to currency conversion concerns. For Magento 2 store owners looking to reach a global audience, choosing a payment gateway that offers a broad range of currency options is crucial.

The extent of a payment gateway’s support for different countries is equally important. Some gateways have a global reach, allowing transactions from nearly any part of the world, while others might be more region-specific, catering to particular geographical areas. The choice here should align with your current market presence and future expansion plans. If your business strategy includes reaching customers in specific countries or regions, ensure that the payment gateway is well-equipped to handle transactions in those areas.

User Experience and Interface

The user experience and interface of the gateway are factors of paramount importance. These aspects have a direct impact on the customer’s interaction with your online store and can significantly influence their purchasing decisions and overall satisfaction.

The top Magento 2 payment gateways should offer a smooth and intuitive user experience. This means that from the moment a customer decides to purchase the final transaction completion, the process should be straightforward and hassle-free. A gateway with a complicated or time-consuming checkout process can lead to increased cart abandonment rates. Customers value simplicity and speed in online transactions, so the payment gateway should facilitate a quick and easy checkout process.

The interface of the payment gateway should seamlessly integrate with the overall design and theme of the Magento 2 store. A sudden change in design or layout during the payment process can confuse customers and may even raise concerns about the security of the transaction. Ideally, the payment gateway should allow for customization to match the store’s branding, maintaining consistency in design and instilling confidence in the transaction process.

Customer Support and Service Reliability

Customer support and service reliability are crucial factors that significantly impact both the merchant’s and the customer’s experience. These elements are fundamental in ensuring smooth, uninterrupted service and in providing assistance when issues arise.

The level of customer support offered by a payment gateway can make a substantial difference, especially during critical situations like transaction failures, refunds, or fraud detection. A gateway with a strong support system, offering multiple channels of assistance such as 24/7 live chat, email, and phone support, is invaluable. The speed and effectiveness of their response can not only solve issues more efficiently but also help maintain the trust and confidence of both merchants and customers.

The reliability of a payment gateway is measured by its uptime and ability to process transactions smoothly without interruptions. Frequent downtimes or issues in processing payments can lead to lost sales and negatively affect the reputation of an eCommerce business. Therefore, choosing a gateway known for high reliability and consistent performance is crucial.

In conclusion,

The choice of Magento 2 payment gateways is a critical decision that can significantly influence the success of your store. Each gateway comes with its own set of strengths and limitations, and the right choice depends on a variety of factors including your target market, preferred currencies, security requirements, and the specific needs of your business and customers.

From globally recognized Magento payments like PayPal and Stripe, offering extensive currency support and robust security, to region-specific gateways like Moneris and WorldPay, catering to specific geographic preferences, the range of available choices is diverse. Some gateways stand out for their advanced features like multi-currency support and easy integration, while others are favored for their user-friendly interfaces and reliable customer support.

If you’re looking to tailor your payment gateway to better suit your specific business needs or if you’re facing any conflicts with your current setup, don’t hesitate to reach out. Our team of experts is ready to assist you with customized solutions that align perfectly with your Magento 2 store. Contact us today to enhance your eCommerce experience and take the first step towards a more efficient, secure, and personalized payment system.