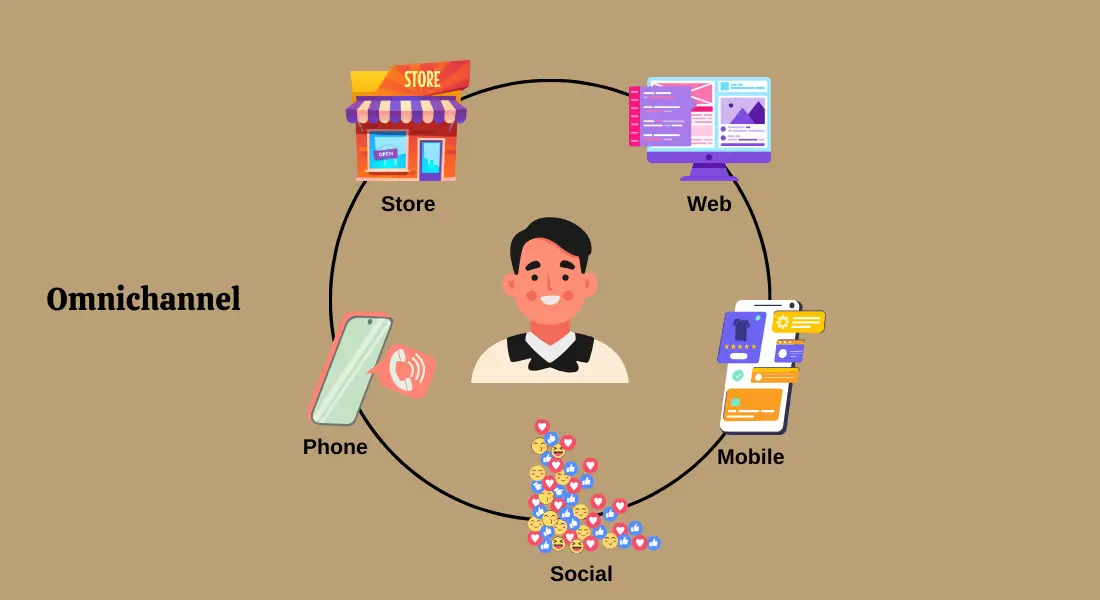

Omnichannel banking refers to a seamless and integrated approach to delivering banking services across multiple channels—both digital and physical. Unlike traditional multi-channel strategies, where channels operate in isolation, omnichannel banking ensures that all customer touchpoints are interconnected, providing a unified experience regardless of the medium. Whether customers engage through mobile apps, internet banking portals, ATMs, in-branch visits, or call centers, omnichannel banking enables a consistent and personalized experience that adapts to their preferences and needs.

At its core, omnichannel banking integrates data, processes, and technology to break down silos between channels. This interconnected approach empowers banks to offer tailored solutions, track customer interactions across platforms, and ensure that no matter where or how a customer engages, their journey remains fluid and coherent.

For customers, omnichannel banking translates to an enhanced experience where they can start a transaction on one platform and seamlessly complete it on another. For instance, a customer might initiate a loan application online, consult with a relationship manager over a video call, and finalize the paperwork during an in-branch visit—all while receiving consistent updates and personalized recommendations throughout the process.

For banks, omnichannel banking drives efficiency and fosters loyalty. By leveraging data from interconnected channels, banks can gain deeper insights into customer behavior, anticipate their needs, and deliver targeted offerings. This not only improves customer satisfaction but also opens opportunities for cross-selling and upselling financial products.

Table of Contents

Evolution of Banking from Single-Channel to Omnichannel

The journey of the banking industry from single-channel operations to the integrated experience of omnichannel banking reflects the profound transformation brought about by technological advancements and changing customer demands. This evolution highlights how banking has shifted its focus from purely transactional interactions to delivering seamless and personalized experiences across multiple touchpoints.

Early Days of In-Branch Services

In the earliest days of modern banking, customer interactions were limited to physical branches. These in-branch services were the sole means for individuals and businesses to access financial assistance, deposit or withdraw funds, and engage in essential banking activities. Each branch operated as a localized hub, serving customers within its immediate geographic area.

This single-channel approach was heavily reliant on manual processes, with records maintained in physical ledgers and transactions requiring face-to-face interactions. While this system fostered a personal connection between customers and bankers, it lacked efficiency and scalability. Customers were often constrained by banking hours and faced long waiting times, making banking a time-consuming task.

The limitations of this model became apparent as banks expanded their operations to cater to growing populations and increasingly diverse financial needs. Customers demanded faster, more flexible services, setting the stage for innovations that would redefine banking.

Introduction of Multi-Channel Approaches

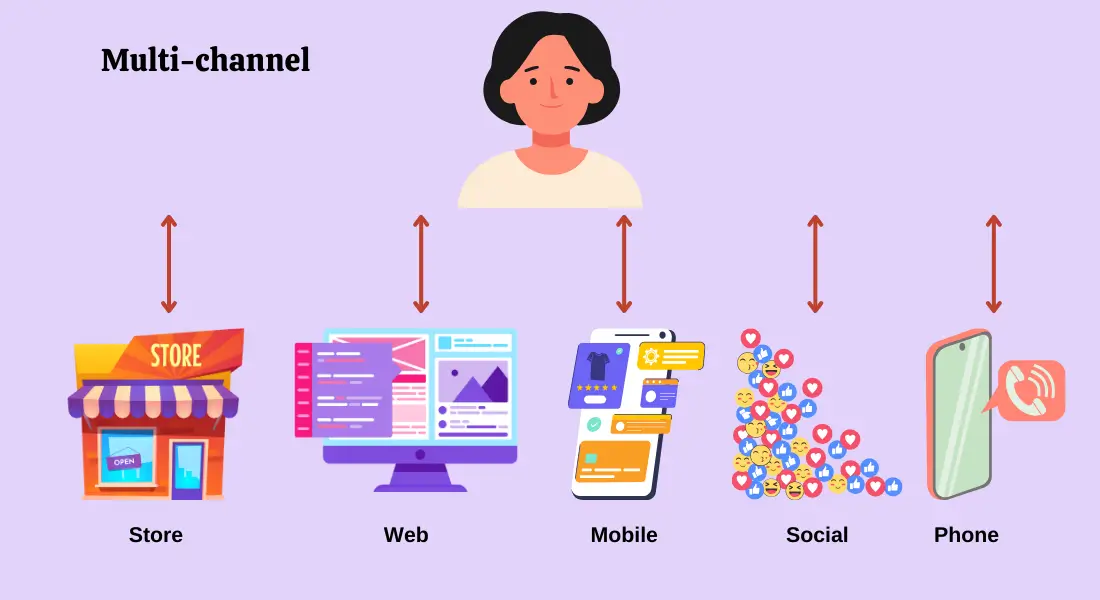

The next phase in the evolution of banking came with the introduction of multi-channel strategies. This approach allowed banks to extend their services beyond the branch by incorporating new channels like ATMs, telephone banking, and later, internet banking.

ATMs revolutionized customer convenience by providing 24/7 access to cash withdrawals and basic banking functions. Telephone banking enabled customers to perform transactions and inquiries without visiting a branch, marking the beginning of remote banking services. The rise of the internet in the late 1990s further expanded these possibilities with online banking platforms, where customers could transfer funds, pay bills, and monitor their accounts from the comfort of their homes.

Multi-channel banking represented a significant leap forward, offering customers more options and greater convenience. However, these channels often operated independently, creating silos within banking operations. Customers might start a transaction online but need to visit a branch or call customer service to complete it, leading to inconsistent experiences and frustration.

This lack of integration highlighted the need for a more unified approach—one that would seamlessly connect all channels to create a cohesive experience. This necessity led to the emergence of omnichannel banking.

Transition to Omnichannel Banking

Omnichannel banking represents the culmination of decades of innovation and the banking industry’s response to modern consumer expectations. Unlike multi-channel strategies, which offered disconnected services across different platforms, omnichannel banking unites these channels into a seamless ecosystem.

In an omnichannel banking system, customers can start a transaction on one platform, such as a mobile app, and continue it on another, like an in-branch visit, without losing continuity or context. For instance, a customer applying for a loan online can later visit a branch to finalize the paperwork, with the bank staff already having access to all previous interactions and details.

This transformation has been made possible by advancements in technology, such as cloud computing, real-time data synchronization, and the integration of customer relationship management (CRM) systems. These technologies enable banks to offer personalized, context-aware services that cater to individual customer preferences and behaviors.

Omnichannel banking also emphasizes consistency in brand messaging and user experience across all touchpoints. Whether a customer interacts through a chatbot, mobile app, or physical branch, they encounter the same high level of service, fostering trust and loyalty.

The transition to omnichannel banking has not only improved customer satisfaction but also enabled banks to optimize their operations. By leveraging data from interconnected channels, banks can gain insights into customer behavior, streamline processes, and reduce operational costs.

Objectives of Omnichannel Banking

Omnichannel banking has become an essential strategy for modern financial institutions, driven by the need to meet evolving customer expectations, foster deeper relationships, and optimize operational efficiencies. By integrating digital and physical channels, omnichannel banking aims to achieve specific objectives that redefine how banks interact with their customers and manage their resources. These objectives—seamless customer experience, enhanced engagement and loyalty, and cost optimization—are at the core of its transformative potential.

Seamless Customer Experience

One of the primary objectives of omnichannel banking is to deliver a seamless customer experience. Customers today expect to interact with their banks across multiple channels without encountering disruptions or inconsistencies. Whether using a mobile app to check account balances, visiting a branch for loan advice, or chatting with a customer service representative online, the expectation is that these interactions will be interconnected and cohesive.

Omnichannel banking ensures that customers can switch between channels effortlessly. For example, a customer might start a credit card application on the bank’s website, upload required documents through a mobile app, and complete the process during an in-branch visit. Throughout this journey, all channels remain synchronized, preserving the customer’s information and progress.

Achieving this level of integration requires advanced technology such as centralized databases, real-time data synchronization, and intelligent customer relationship management systems. Banks leveraging omnichannel banking provide a unified interface where customers feel valued and understood, regardless of the channel they choose. This reduces friction in the customer journey and fosters trust, positioning banks as responsive and reliable partners in managing financial needs.

Enhanced Engagement and Loyalty

Another key objective of omnichannel banking is to deepen customer engagement and foster long-term loyalty. In a competitive financial landscape, retaining customers is as critical as acquiring new ones, and omnichannel banking offers tools to build strong, enduring relationships.

By leveraging data from interconnected channels, banks can personalize interactions, tailoring services and recommendations to individual customer needs. For instance, a customer who frequently saves for travel might receive targeted advice on travel-specific savings plans or credit card offers. Personalized engagement makes customers feel valued, increasing their emotional connection with the bank.

Omnichannel banking also empowers banks to stay relevant in their customers’ lives. Features such as push notifications for bill payments, personalized financial tips, or proactive fraud alerts demonstrate a bank’s commitment to supporting its customers. Furthermore, consistency in brand messaging and service quality across all touchpoints reinforces trust, encouraging customers to rely on the bank for a broader range of financial needs.

In addition to enhancing engagement, omnichannel banking strengthens loyalty by reducing frustrations that might drive customers to competitors. When customers encounter a unified, hassle-free experience, they are more likely to continue using the bank’s services and recommend it to others.

Cost Optimization

While customer satisfaction and loyalty are vital, omnichannel banking also aims to optimize costs for financial institutions. By integrating channels and automating processes, banks can reduce redundancies, streamline operations, and improve resource allocation.

For instance, omnichannel banking reduces the need for repetitive manual tasks by automating workflows. Customers who self-serve through mobile apps or chatbots can complete transactions and inquiries without requiring in-person assistance, freeing branch staff to focus on high-value interactions. This shift not only enhances efficiency but also lowers operational costs.

Moreover, omnichannel banking enables banks to better manage their physical and digital assets. With data-driven insights, banks can identify underperforming branches and reallocate resources to digital platforms that deliver higher returns. This hybrid approach balances customer preferences while optimizing expenditures.

In addition to operational efficiencies, omnichannel banking minimizes errors that can arise from fragmented systems. By unifying channels, banks can ensure data consistency, reducing the costs associated with rectifying errors or handling disputes. The long-term savings from such improvements contribute significantly to the bank’s profitability.

Key Components of Omnichannel Banking

Omnichannel banking is a sophisticated approach that ensures customers experience seamless and interconnected interactions across all banking channels. To deliver this level of service, banks must implement key components that form the backbone of an effective omnichannel banking strategy. These components—unified customer data, digital and physical channels, human-assisted touchpoints, and interconnectivity—are essential for creating a cohesive and customer-centric banking ecosystem.

Unified Customer Data

Unified customer data is the cornerstone of omnichannel banking, empowering banks to deliver a consistent and personalized experience across all touchpoints. It involves consolidating customer information from multiple channels into a centralized system, ensuring that every department and platform operates with the same comprehensive dataset.

Centralized Data Repository

At the heart of unified customer data is a centralized data repository, which serves as a single source of truth for all customer-related information. This repository aggregates data from various channels, including mobile apps, internet banking portals, in-branch visits, ATMs, and customer service interactions. By consolidating data into one system, banks can eliminate silos that traditionally hindered collaboration and customer service.

For example, a customer visiting a branch to inquire about a loan would benefit from the bank staff accessing their full history of digital interactions, including previous loan applications or chats with online representatives. The centralized repository ensures that this information is available in real time, allowing the bank to provide more informed and efficient service.

Moreover, this comprehensive view enables banks to identify patterns and trends in customer behavior, helping them tailor their offerings and improve decision-making. With a centralized repository, omnichannel banking becomes more than just a collection of services—it becomes a cohesive, customer-centric strategy.

Real-Time Data Synchronization Across Platforms

While a centralized data repository is essential, its true potential is realized through real-time data synchronization across platforms. Omnichannel banking thrives on the ability to update and share information instantaneously, ensuring that customers experience continuity no matter where or how they interact with their bank.

For instance, if a customer begins applying for a mortgage online but decides to complete the process at a branch, real-time synchronization ensures that the branch staff can access the partially completed application. This continuity eliminates redundancy and enhances the customer experience by reducing the need to repeat information or restart processes.

Real-time synchronization is also vital for delivering timely and personalized communications. Imagine a customer making a significant purchase with their credit card and then receiving a fraud alert via their mobile app, followed by a phone call from the bank’s support team. The ability to synchronize data across platforms ensures that the customer is protected and informed without delay.

Additionally, this capability enables banks to react quickly to customer needs. For example, a customer reaching out to a chatbot for account assistance may escalate the query to a human representative. Real-time synchronization ensures that the representative has immediate access to the conversation history, allowing for a seamless transition and faster resolution.

Real-time data synchronization also strengthens operational efficiency. By connecting systems and channels in real time, banks can avoid errors caused by outdated information and reduce the resources spent on reconciling discrepancies. This not only improves the quality of service but also enhances the bank’s internal processes.

Digital Channels

Digital channels are the backbone of omnichannel banking, offering the flexibility and accessibility that modern customers demand. These channels allow banks to meet customers where they are, providing services anytime, anywhere, and on any device. Let’s explore the three most prominent digital channels driving the success of omnichannel banking.

Mobile Banking Apps

Mobile banking apps are perhaps the most significant digital channel in omnichannel banking. With the increasing reliance on smartphones, these apps provide customers with a convenient and personalized way to manage their finances. Whether checking account balances, transferring funds, or applying for loans, customers can complete nearly any banking task through a mobile app.

A key feature of mobile banking apps in omnichannel banking is their ability to integrate seamlessly with other channels. For example, a customer might begin a loan application on their app and later visit a branch to finalize the process. Because the app syncs data in real time with the bank’s centralized system, branch staff can pick up right where the customer left off.

In addition to convenience, mobile apps in omnichannel banking often include advanced features such as biometric authentication, voice-activated commands, and spending analytics. These functionalities enhance the user experience, making it not only easier but also more secure and engaging for customers to interact with their banks.

Mobile banking apps also play a pivotal role in personalized customer engagement. By leveraging customer data, these apps can offer tailored insights, such as budget tips or notifications about upcoming bills, creating a more proactive banking experience.

Internet Banking Portals

Internet banking portals are another critical digital channel in omnichannel banking. These platforms offer customers a comprehensive suite of banking services accessible via desktops or laptops, catering to those who prefer a more traditional digital interface.

Internet banking portals complement other channels by providing in-depth account management features. Customers can view transaction histories, download account statements, or manage multiple accounts from a single dashboard. In the context of omnichannel banking, these portals serve as an extension of mobile apps and in-branch services, ensuring consistency and accessibility across devices.

A hallmark of internet banking portals in omnichannel banking is their role in bridging digital and human-assisted channels. For example, a customer seeking investment advice may start by exploring options through the bank’s online portal and then schedule a video call with a financial advisor directly from the platform. This fluid transition between self-service and expert consultation exemplifies the seamless experience that omnichannel banking aims to provide.

Additionally, internet banking portals often serve as a hub for educational resources, offering tools such as loan calculators, tutorials, and financial planning guides. These resources empower customers to make informed decisions, reinforcing their trust in the bank’s commitment to their financial well-being.

Chatbots and AI-Driven Support

Chatbots and AI-driven support systems have emerged as indispensable components of digital channels in omnichannel banking. These tools provide instant assistance to customers, addressing queries and resolving issues without the need for human intervention.

In an omnichannel banking ecosystem, chatbots serve as the first line of support, capable of handling tasks such as resetting passwords, providing account balances, or answering frequently asked questions. By integrating with the bank’s centralized database, chatbots can access customer information in real time, delivering personalized responses that align with the customer’s history and preferences.

AI-driven support goes beyond simple queries by offering predictive and proactive assistance. For example, an AI system might alert a customer about unusual account activity or recommend tailored financial products based on spending patterns. These capabilities not only enhance customer satisfaction but also demonstrate the bank’s commitment to providing value-added services.

Chatbots also play a critical role in ensuring continuity across channels. A conversation initiated with a chatbot on a mobile app can seamlessly transition to a live agent via phone or in-person support at a branch, with the agent fully informed about the previous interaction. This integration exemplifies the seamless connectivity that defines omnichannel banking.

Moreover, the use of natural language processing and machine learning allows chatbots to continuously improve their understanding of customer needs, making them increasingly effective over time. As a result, banks can provide efficient, round-the-clock support while reducing the burden on human staff.

Physical Channels

While digital banking has seen rapid adoption, physical channels remain a cornerstone of omnichannel banking, bridging the gap between high-tech and high-touch experiences. These channels cater to diverse customer needs, from complex transactions that require face-to-face assistance to quick, self-service operations that enhance convenience.

In-Branch Banking

In-branch banking continues to hold significance in omnichannel banking, serving as a vital touchpoint for customers seeking personalized interactions and solutions for complex financial needs. While the role of bank branches has evolved, they remain essential for fostering trust and building long-term relationships with customers.

- Enhanced Customer Interactions: Branches offer opportunities for direct engagement between customers and bank staff. This personal interaction is especially important for services like mortgage applications, investment advice, and wealth management, where customers often prefer discussing options with a knowledgeable representative. In an omnichannel banking framework, these interactions are enhanced by access to unified customer data. Bank employees can review a customer’s history, preferences, and ongoing activities across channels, enabling them to provide tailored advice and a seamless experience.

- Adapting to Modern Expectations: Modern in-branch experiences are designed to align with the principles of omnichannel banking. Many branches now incorporate digital tools such as interactive kiosks or tablets to facilitate faster service. For example, a customer might use a kiosk to initiate a transaction before being directed to a teller for finalization, ensuring efficiency and reducing wait times.

- Role in Complex Transactions: While routine transactions are increasingly handled through digital channels, branches are vital for handling high-value or intricate processes that require documentation, validation, or expert input. Omnichannel banking ensures that these processes are integrated with other channels, allowing customers to begin the journey online and complete it in-branch seamlessly.

- Supporting the Digital Divide: Not all customers are equally comfortable with digital banking. Branches play a critical role in serving those who prefer face-to-face interactions, ensuring that omnichannel banking remains inclusive and accessible to all demographics.

ATMs and Kiosks

ATMs and kiosks are among the earliest innovations in expanding banking services beyond branch walls. In the context of omnichannel banking, these self-service machines have evolved to provide more than just basic functions, acting as versatile tools that integrate seamlessly with other channels.

- Convenience and Accessibility: ATMs have long been valued for their ability to provide 24/7 access to cash withdrawals, deposits, and account inquiries. In an omnichannel banking ecosystem, they serve as an extension of the bank’s services, ensuring that customers have continuous access to essential functions even outside branch hours.

- Advanced Capabilities: Modern ATMs and kiosks offer features that go beyond traditional transactions. Customers can use these machines to make bill payments, transfer funds, or even apply for certain financial products. With omnichannel banking, these interactions are integrated into the customer’s profile, ensuring that any activity conducted at an ATM is reflected across other platforms. For instance, a deposit made at an ATM will immediately update the customer’s account balance in their mobile app or online banking portal.

- Interactive Kiosks: Kiosks are an increasingly popular addition in branches and high-traffic areas. Equipped with touchscreens and user-friendly interfaces, these machines allow customers to perform a wide range of activities, from account opening to obtaining detailed product information. In an omnichannel banking setup, kiosks can also act as a bridge between digital and human-assisted channels. For example, a customer using a kiosk to explore loan options can request live assistance from a representative via video conferencing, creating a hybrid experience.

- Integration with Digital Platforms: Omnichannel banking ensures that ATMs and kiosks are not isolated tools but fully integrated components of the banking ecosystem. For example, a customer can initiate a money transfer on their mobile app and complete it at an ATM. Similarly, receipts or notifications from ATM transactions are synced with the customer’s digital profile, providing a consistent and transparent experience across all touchpoints.

- Data Collection and Personalization: Advanced ATMs and kiosks also contribute to omnichannel banking by collecting valuable customer data. These insights can be used to personalize interactions and improve service delivery. For example, a kiosk might display tailored offers or recommendations based on the customer’s transaction history or profile preferences.

Human-Assisted Channels

While digital tools and self-service platforms dominate modern banking, human-assisted channels remain indispensable for addressing complex queries, providing specialized advice, and resolving issues that require personal attention. These channels, when integrated into an omnichannel banking framework, ensure that customers experience continuity and consistency regardless of how they choose to interact with the bank.

Contact Centers

Contact centers are one of the most critical human-assisted channels in omnichannel banking. They act as the central hub for resolving customer queries, handling complaints, and providing real-time assistance across various platforms, such as phone calls, emails, and live chats.

- Centralized Customer Support: Contact centers in omnichannel banking provide centralized support that is accessible through multiple communication channels. Customers can reach out via their preferred medium—whether it’s a phone call, email, or chat—and receive prompt and consistent assistance. The integration of these interactions with the bank’s centralized database ensures that support agents have a complete view of the customer’s profile, recent activities, and ongoing issues, enabling them to provide informed and efficient service.

- Real-Time Problem Resolution: One of the defining features of contact centers in omnichannel banking is their ability to resolve issues in real time. For instance, a customer experiencing a payment failure on a mobile app can contact the center, where the agent can immediately access transaction logs and identify the problem. This instant support not only improves customer satisfaction but also reduces the likelihood of complaints escalating to higher levels.

- Personalization Through Data Integration: Omnichannel banking contact centers leverage integrated data to offer personalized assistance. For example, if a customer calls to inquire about loan eligibility, the agent can review the customer’s financial history and tailor recommendations based on their specific situation. This level of personalization fosters trust and loyalty by demonstrating the bank’s commitment to understanding and addressing individual needs.

- Proactive Outreach: In addition to handling inbound queries, contact centers in omnichannel banking often engage in proactive outreach. This might include notifying customers about potential fraud, reminding them of upcoming payments, or offering tailored product recommendations. These proactive efforts, powered by insights from integrated systems, enhance customer engagement and ensure that the bank remains relevant in their financial journey.

- Hybrid Support with Digital Channels: Contact centers in omnichannel banking seamlessly integrate with digital channels, allowing customers to transition effortlessly between automated and human-assisted interactions. For example, a customer who begins troubleshooting with a chatbot can escalate the issue to a live agent without losing context, as the agent has access to the chat history. This hybrid model ensures a smooth and cohesive experience.

Relationship Managers

For high-value customers or those with complex financial needs, relationship managers are a crucial component of human-assisted channels in omnichannel banking. These professionals provide personalized advice, manage portfolios, and act as trusted advisors, strengthening the bank’s relationship with its clients.

- Personalized Financial Guidance: Relationship managers in omnichannel banking offer tailored advice that aligns with the customer’s financial goals, risk tolerance, and investment preferences. Whether it’s helping a client plan for retirement or recommending suitable investment opportunities, these interactions are informed by a deep understanding of the customer’s profile, enabled by the bank’s integrated data systems.

- High-Touch Service: Unlike digital or self-service channels, relationship managers provide a high-touch service that prioritizes personal interaction. This is especially valuable for customers seeking reassurance or guidance during significant financial decisions, such as buying a home or starting a business. The human element in these interactions builds trust and reinforces the bank’s reputation as a reliable financial partner.

- Seamless Integration with Other Channels: In omnichannel banking, relationship managers are fully integrated into the broader banking ecosystem. For instance, a customer might begin exploring investment options through the bank’s mobile app, schedule a consultation with their relationship manager, and finalize the investment online. Throughout this process, the customer benefits from consistent and informed service, as all channels are interconnected and share the same data.

- Proactive Relationship Building: Relationship managers play a proactive role in strengthening customer loyalty by anticipating needs and offering timely solutions. For example, they might reach out to a client nearing the end of a fixed deposit term to discuss reinvestment options or provide updates on market trends that could impact the client’s portfolio. These proactive efforts demonstrate the bank’s commitment to its clients’ financial well-being, fostering deeper trust and long-term engagement.

- Enhancing the Customer Experience: By serving as a dedicated point of contact, relationship managers simplify the customer experience in omnichannel banking. Clients have the assurance of knowing they can rely on a trusted advisor who understands their financial needs and can coordinate with other departments or channels to deliver seamless service.

Human-assisted channels like contact centers and relationship managers are indispensable in creating a well-rounded omnichannel banking experience. They complement digital platforms by providing personalized, empathetic, and high-quality service that meets the needs of diverse customer segments.

Interconnectivity and Integration

Interconnectivity and integration are the backbone of omnichannel banking, allowing banks to break down silos and create a cohesive framework where every channel—digital, physical, and human-assisted—works in harmony. Without robust integration, achieving the seamless and personalized experience promised by omnichannel banking would be impossible.

API Integration

APIs are essential for enabling the interconnectivity that defines omnichannel banking. APIs act as bridges between different systems, allowing them to communicate and share data in real time. In the context of banking, API integration facilitates the seamless flow of information between internal systems, third-party services, and customer-facing platforms.

- Connecting Disparate Systems: Modern banks use a variety of systems for different functions, including core banking, payment processing, fraud detection, and customer engagement. APIs enable these systems to work together as a single, integrated platform. For instance, an API can connect a bank’s mobile app to its core banking system, ensuring that customers see real-time updates on their account balances and transactions.

- Enhanced Customer Experience: API integration is crucial for creating the seamless experience that omnichannel banking promises. For example, a customer could begin a loan application on the bank’s website, continue the process on their mobile app, and finalize it at a branch—all while the API ensures that their progress and data are consistently updated across all platforms.

- Third-Party Integration: APIs also enable banks to integrate with third-party services, such as payment gateways, fintech platforms, and financial planning tools. This not only expands the range of services a bank can offer but also enhances the customer experience by providing more options and convenience. For instance, customers might use a budgeting app connected to their bank account via an API to manage their finances more effectively.

- Open Banking and Innovation: The rise of open banking has further highlighted the importance of API integration in omnichannel banking. Open banking regulations require banks to share customer data securely with authorized third parties through APIs, enabling new innovations and services. For example, an API could allow a customer to view accounts from multiple banks in a single dashboard, enhancing their overall financial visibility.

- Security and Compliance: While APIs enable seamless integration, they must also ensure robust security and compliance. Banks implementing API integration for omnichannel banking must use advanced encryption and authentication protocols to protect sensitive customer data and comply with regulatory requirements.

CRM and ERP System Role in Banking

Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems play a pivotal role in supporting the interconnected framework of omnichannel banking. These systems provide the foundation for managing customer interactions, data, and internal operations, ensuring that every touchpoint delivers a consistent and informed experience.

- Centralized Data Management: CRM systems in omnichannel banking serve as centralized repositories for customer information, capturing data from all interactions, whether digital or physical. This comprehensive view of the customer allows banks to deliver personalized experiences. For instance, a CRM system can analyze a customer’s transaction history to recommend relevant products or services during their next interaction.

- Streamlined Operations: ERP systems contribute to the efficiency of omnichannel banking by managing internal processes such as accounting, compliance, and resource allocation. By integrating with other banking systems, ERP solutions ensure that operations are streamlined and data flows smoothly across departments. This reduces redundancies and improves service delivery.

- Personalization and Customer Insights: The combination of CRM and ERP systems in omnichannel banking enables advanced data analytics and customer insights. For example, CRM systems can identify patterns in customer behavior, allowing banks to proactively address their needs. Meanwhile, ERP systems ensure that the necessary resources are allocated to fulfill these needs efficiently.

- Support for Real-Time Interactions: CRM systems are particularly vital for supporting real-time interactions in omnichannel banking. For example, when a customer contacts a call center, the CRM system can instantly provide the agent with a complete view of the customer’s history, preferences, and ongoing issues. This ensures that the agent can resolve the query quickly and effectively, contributing to a seamless customer experience.

- Integration with Digital Channels: In omnichannel banking, CRM and ERP systems are integrated with digital channels such as mobile apps, internet banking portals, and chatbots. This ensures that all customer interactions—whether automated or human-assisted—are informed by the same data, creating a unified and consistent experience.

- Scalability and Adaptability: CRM and ERP systems are designed to scale with the bank’s growth and adapt to changing customer needs. This flexibility is essential for omnichannel banking, as it allows banks to introduce new channels, services, or features without disrupting the existing ecosystem.

Interconnectivity and integration are fundamental to the success of omnichannel banking. By leveraging API integration and CRM and ERP systems, banks can create a seamless and efficient ecosystem where every channel works together to deliver a superior customer experience.

Benefits of Omnichannel Banking

Omnichannel banking has revolutionized the way financial institutions interact with customers by providing a unified and integrated approach to delivering services. Among its many advantages, one of the most impactful benefits is the enhancement of the customer experience. By prioritizing personalization and consistency, omnichannel banking meets modern customers’ demand for seamless, tailored, and high-quality interactions across all channels.

Enhanced Customer Experience

The essence of omnichannel banking lies in its ability to transform customer interactions into meaningful and convenient experiences. By combining advanced technology with integrated data systems, banks can deliver a level of service that fosters satisfaction, trust, and long-term loyalty.

Personalized Services

Personalization is a cornerstone of enhanced customer experiences in omnichannel banking. Customers today expect banks to understand their unique needs and preferences, offering tailored solutions that align with their financial goals and behaviors.

- Using Data for Tailored Interactions: Omnichannel banking leverages centralized customer data to provide personalized services at every touchpoint. For example, a customer who frequently saves for travel might receive notifications about travel-specific savings accounts or credit card offers with travel rewards. This level of customization makes customers feel valued and understood.

- Proactive Engagement: With advanced analytics and machine learning, omnichannel banking enables banks to anticipate customer needs and offer proactive solutions. For instance, a bank might notify a customer nearing their credit card limit and suggest options to increase their limit or switch to a more suitable card. These proactive measures enhance convenience and build trust in the bank’s commitment to supporting its customers.

- Dynamic Recommendations: By analyzing transaction histories, spending patterns, and preferences, omnichannel banking can deliver real-time, context-aware recommendations. Whether suggesting a financial product, promoting an investment opportunity, or offering budgeting tips, personalized insights strengthen the relationship between the bank and the customer.

- Enhanced Accessibility: Personalized services in omnichannel banking are accessible across all channels, ensuring that customers receive consistent and relevant information, whether they interact via a mobile app, visit a branch, or use an ATM. This accessibility empowers customers to engage with the bank on their terms, enhancing their overall experience.

- Building Emotional Connections: Personalization fosters emotional connections by demonstrating that the bank genuinely understands and prioritizes its customers’ needs. This emotional bond encourages customer loyalty, making them more likely to choose the bank for future financial needs.

Consistency Across Channels

Consistency is a vital component of an enhanced customer experience in omnichannel banking. It ensures that customers receive seamless and reliable service no matter which channel they use, eliminating confusion and frustration.

- Unified Messaging and Branding: Omnichannel banking ensures that the bank’s messaging and branding are consistent across all platforms. Whether a customer interacts with the bank through a website, mobile app, or in-person visit, they experience the same tone, style, and level of professionalism. This consistency strengthens the bank’s identity and builds customer trust.

- Integrated Data Systems: A hallmark of omnichannel banking is its use of integrated data systems to synchronize customer information across channels. This integration allows customers to transition effortlessly between platforms without needing to re-enter information or repeat requests. For example, a customer applying for a loan online can visit a branch to complete the process, with the branch staff having full access to the application details.

- Eliminating Service Silos: Traditional banking models often suffered from service silos, where different channels operated independently, leading to disjointed experiences. Omnichannel banking breaks down these silos by connecting all channels through a centralized system. This integration ensures that customers receive consistent responses and solutions regardless of the platform they use.

- Reliability Across Touchpoints: Consistency in omnichannel banking also extends to the reliability of services. Customers expect their interactions to be seamless, whether they’re checking their account balance on a mobile app, withdrawing cash from an ATM, or speaking with a call center agent. Omnichannel banking ensures that all these touchpoints function cohesively, delivering a smooth and dependable experience.

- Strengthening Customer Confidence: Consistency across channels reassures customers that their bank is organized, efficient, and trustworthy. Knowing that they can rely on the bank for accurate and unified service increases customer satisfaction and encourages long-term engagement.

Enhanced customer experience is a key driver of the success of omnichannel banking. By focusing on personalized services and consistency across channels, banks can create meaningful connections with customers, foster loyalty, and differentiate themselves in an increasingly competitive market.

Increased Customer Retention and Loyalty

In a competitive financial landscape, retaining customers is as important as acquiring new ones. Omnichannel banking addresses this challenge by prioritizing customer convenience and engagement, making it easier for individuals to interact with their bank and feel valued throughout their journey.

Convenience in Interactions

Convenience is a key driver of customer satisfaction, and omnichannel banking is designed to provide unparalleled ease of access and use. By integrating digital, physical, and human-assisted channels into a cohesive system, banks can deliver services that align with their customers’ preferences and lifestyles.

- 24/7 Accessibility Across Channels: Omnichannel banking ensures that customers can access banking services anytime, anywhere. Whether they are checking their account balance on a mobile app late at night, withdrawing cash from an ATM on a weekend, or speaking to a customer service representative during business hours, omnichannel banking removes traditional barriers and maximizes convenience.

- Seamless Transitions Between Channels: Customers often start a transaction on one channel and complete it on another. For example, a customer might begin applying for a credit card online, receive further guidance via a call center, and finalize the application in-branch. Omnichannel banking ensures that these transitions are seamless, with all customer data synchronized across channels, eliminating the need to repeat information or restart processes.

- Effortless Self-Service Options: Many customers prefer handling routine tasks independently. Omnichannel banking supports this by offering user-friendly digital platforms, such as mobile apps and internet banking portals, where customers can perform activities like fund transfers, bill payments, and account management with just a few clicks. These self-service options save time and reduce friction, enhancing overall satisfaction.

- Personalized Convenience: Omnichannel banking takes convenience a step further by personalizing interactions based on customer preferences and behaviors. For instance, a customer who frequently uses mobile banking might receive reminders or alerts via the app, while another who prefers in-branch interactions could receive notifications about upcoming appointments or new services available locally.

- Reducing Wait Times: By integrating all channels, omnichannel banking optimizes workflows and reduces wait times. Customers visiting a branch or calling a contact center benefit from staff who are already informed about their needs, thanks to centralized data systems. This efficiency improves the overall experience and encourages repeat interactions.

Customer Engagement Strategies

Increased customer retention and loyalty in omnichannel banking is not just about convenience; it also relies on strategic engagement efforts that deepen relationships and foster trust. Omnichannel banking enables banks to implement data-driven, targeted engagement strategies that resonate with their customers.

- Proactive Communication: Omnichannel banking empowers banks to engage with customers proactively by anticipating their needs and offering timely solutions. For example, a bank might notify a customer about an upcoming loan payment due date or suggest investment opportunities based on their transaction history. These proactive efforts demonstrate attentiveness and build trust.

- Personalized Marketing Campaigns: With access to unified customer data, omnichannel banking enables banks to design marketing campaigns that are highly relevant to individual customers. A customer with a history of international travel might receive tailored offers for travel insurance or a credit card with foreign transaction perks. Personalization enhances the effectiveness of engagement strategies, making customers feel valued.

- Loyalty Programs and Rewards: Loyalty programs are an effective way to retain customers, and omnichannel banking allows these programs to be integrated seamlessly across all channels. For example, customers could earn points for specific activities, such as making digital payments or referring friends, which they can redeem online or in-branch. Such initiatives strengthen the emotional connection customers have with their bank.

- Two-Way Communication Channels: Engagement in omnichannel banking is not just about reaching out to customers but also giving them a platform to share feedback and ask questions. Integrated systems enable banks to capture feedback from multiple channels—whether it’s an app review, an in-branch survey, or a chatbot interaction—and use it to improve services. This open dialogue builds trust and demonstrates a commitment to customer satisfaction.

- Interactive Digital Experiences: Omnichannel banking leverages interactive tools, such as financial planning calculators, virtual assistants, and educational resources, to keep customers engaged. These tools provide value beyond basic transactions, helping customers make informed financial decisions and reinforcing their loyalty to the bank.

- Consistent Engagement Across Channels: Omnichannel banking ensures that customer engagement strategies are consistent across all platforms. Whether a customer interacts with the bank through social media, an email newsletter, or an in-branch event, they experience the same level of attentiveness and professionalism, creating a cohesive and positive impression.

By combining convenience in interactions with effective customer engagement strategies, omnichannel banking significantly enhances customer retention and loyalty. When customers find it easy to interact with their bank and feel genuinely valued through personalized engagement, they are more likely to remain loyal and recommend the bank to others.

Improved Operational Efficiency

Operational efficiency is a cornerstone of modern banking strategies, and omnichannel banking provides the tools and technologies needed to achieve it. By leveraging digital channels and streamlining processes, banks can reduce operational redundancies, lower costs, and enhance service delivery.

Cost Reduction Through Digital Channels

One of the most significant operational benefits of omnichannel banking is the ability to reduce costs through the use of digital channels. By shifting routine transactions and services to digital platforms, banks can minimize their reliance on costly physical infrastructure and manual processes.

- Lower Overhead Costs: Digital channels like mobile apps and internet banking portals significantly reduce the need for large branch networks and the associated expenses, including rent, utilities, and staffing. Customers who previously visited branches for basic transactions, such as balance inquiries or fund transfers, can now perform these tasks online, cutting down the operational load on physical locations.

- Efficient Resource Allocation: By automating routine tasks, omnichannel banking allows banks to reallocate resources to areas that require human expertise, such as relationship management or complex financial consulting. This shift not only reduces costs but also enhances the quality of personalized services provided to customers.

- Reduced Paperwork and Administrative Costs: Omnichannel banking emphasizes paperless transactions, which reduces the need for physical documentation and storage. Digital account statements, e-signatures, and online forms eliminate administrative burdens, saving both time and money. For example, customers can apply for loans entirely online, streamlining the process for both the bank and the customer.

- Economies of Scale in Technology Investments: Omnichannel banking enables banks to centralize their operations through integrated platforms, achieving economies of scale. Investments in technologies like cloud computing, artificial intelligence, and customer relationship management systems benefit all channels, making it more cost-effective to maintain and upgrade services across the board.

- Self-Service Options: The incorporation of self-service tools, such as chatbots and interactive kiosks, further reduces the need for human intervention in routine interactions. These digital assistants are available 24/7, providing customers with immediate support while lowering staffing costs for the bank.

Streamlined Processes

Streamlining processes is another critical benefit of omnichannel banking, as it eliminates inefficiencies and ensures smooth operations across all channels. By integrating systems and automating workflows, banks can enhance productivity and deliver faster, more reliable services.

- Unified Data Management: Omnichannel banking relies on centralized data systems that synchronize customer information across all touchpoints. This integration ensures that all departments and channels operate with the same up-to-date information, reducing errors and redundancies. For instance, a customer who updates their address through a mobile app will see the change reflected across all systems, from branch records to call center databases.

- Automation of Routine Tasks: Automated workflows are a hallmark of omnichannel banking. Tasks like loan approvals, fraud detection, and account updates can be handled by intelligent systems, reducing the need for manual intervention. For example, a loan application submitted online might be automatically processed and approved within minutes, thanks to automated credit checks and risk assessments.

- Faster Transaction Processing: Streamlined processes enable banks to handle transactions more quickly, improving both customer satisfaction and operational efficiency. Real-time payment systems, automated reconciliation, and digital fund transfers ensure that transactions are completed promptly, even during high-volume periods.

- Cross-Channel Coordination: Omnichannel banking eliminates silos by ensuring that all channels work together seamlessly. For instance, a customer starting a service request online can complete it in a branch without delays, as the branch staff has instant access to the digital records. This level of coordination minimizes bottlenecks and ensures a consistent experience for the customer.

- Error Reduction: Manual processes are prone to human error, which can lead to costly delays and customer dissatisfaction. Omnichannel banking reduces these risks by implementing automated systems that handle repetitive tasks with precision. For example, automated fraud monitoring systems can detect suspicious activities more accurately than manual reviews, enhancing security while reducing operational workload.

- Improved Workforce Efficiency: By streamlining processes and automating routine tasks, omnichannel banking allows employees to focus on high-value activities. This not only boosts productivity but also improves job satisfaction, as staff can engage in more meaningful and impactful work, such as personalized customer support or strategic planning.

Improved operational efficiency is a critical factor in the success of omnichannel banking. By leveraging digital channels to reduce costs and streamlining processes to enhance productivity, banks can optimize their operations while delivering better services to their customers.

The cost savings achieved through digital transformation and the streamlined workflows enabled by integration and automation allow banks to invest in innovation and customer-centric initiatives. This creates a virtuous cycle of efficiency and growth, positioning financial institutions to thrive in a competitive and rapidly evolving market.

Competitive Advantage

The ability to differentiate in a competitive industry and respond effectively to new challenges is crucial for the success of any bank. Omnichannel banking provides this advantage by addressing both customer needs and operational efficiency in ways that traditional banking approaches cannot.

Differentiating in a Crowded Market

With numerous banks and financial institutions competing for the same customer base, differentiation is critical. Omnichannel banking helps banks carve out a unique identity by offering exceptional customer experiences that resonate with modern consumers.

- Customer-Centric Experiences: Omnichannel banking prioritizes customer convenience and satisfaction, creating seamless transitions between physical, digital, and human-assisted channels. For example, a customer could start a mortgage application on a mobile app, consult with a relationship manager via video call, and finalize the process in a branch. This integrated approach sets banks apart from competitors that offer fragmented or inconsistent experiences.

- Personalization at Scale: By leveraging unified customer data, omnichannel banking allows banks to offer personalized services tailored to individual needs. For instance, a bank might send a personalized loan offer based on a customer’s spending habits or financial goals. This level of personalization creates a strong emotional connection with customers, making the bank more memorable and trusted than competitors offering generic services.

- Innovative Service Offerings: Banks implementing omnichannel banking can introduce innovative services that differentiate them in the market. These might include AI-driven financial planning tools, interactive chatbots, or hybrid in-branch experiences that combine digital kiosks with human support. These innovations signal to customers that the bank is forward-thinking and committed to meeting their evolving needs.

- Enhanced Brand Reputation: Consistency across channels and exceptional service delivery in omnichannel banking build a bank’s reputation as a reliable and customer-focused institution. A positive brand image not only attracts new customers but also strengthens loyalty among existing ones, giving the bank a distinct competitive advantage.

- Appealing to Tech-Savvy Consumers: Omnichannel banking is particularly effective in appealing to younger, tech-savvy customers who value convenience, speed, and digital-first experiences. By meeting these expectations, banks can capture a key demographic that is vital for long-term growth.

Keeping Up with Fintech Disruptors

The rise of fintech companies has disrupted the traditional banking industry, introducing innovative financial services that challenge the status quo. To remain relevant and competitive, banks must embrace omnichannel banking, which equips them with the tools and agility needed to compete with fintech disruptors.

- Adopting Fintech-Level Agility: Fintech companies are known for their ability to innovate quickly and adapt to changing market demands. Omnichannel banking enables traditional banks to achieve similar agility by integrating digital tools and processes into their operations. For instance, automated workflows and real-time data synchronization allow banks to roll out new features, such as contactless payments or instant loan approvals, at a pace that matches or exceeds fintech offerings.

- Leveraging Data for Competitive Insights: Omnichannel banking relies on centralized data systems that provide a comprehensive view of customer behaviors and preferences. This data empowers banks to identify emerging trends, anticipate customer needs, and develop targeted strategies to compete effectively with fintech companies.

- Expanding Digital Capabilities: Fintech disruptors often thrive on their ability to offer specialized digital services, such as peer-to-peer payments or robo-advisory platforms. By implementing omnichannel banking, traditional banks can integrate similar capabilities into their ecosystem, ensuring that they remain competitive without losing the trust and stability associated with established financial institutions.

- Enhancing Customer Trust: While fintech companies excel in innovation, traditional banks often have the advantage of established trust. Omnichannel banking allows banks to combine this trust with the convenience and innovation of digital services, creating a unique value proposition that fintech companies may struggle to match. For example, a bank could offer secure digital wallets integrated with fraud detection systems, providing customers with both convenience and peace of mind.

- Collaborating with Fintechs: Omnichannel banking also opens the door for strategic partnerships with fintech companies. By integrating fintech solutions into their omnichannel ecosystem, banks can offer customers a broader range of services while benefiting from the agility and innovation of fintech technologies.

- Competing on Customer Experience: Fintech disruptors often focus heavily on customer experience, providing intuitive interfaces and fast, efficient services. Omnichannel banking equips banks with the tools to compete on this front by ensuring seamless, consistent, and personalized experiences across all channels.

By differentiating themselves in a crowded market and keeping pace with fintech disruptors, banks that adopt omnichannel banking can secure a significant competitive advantage. This approach not only helps banks retain and attract customers but also positions them as leaders in innovation and customer-centric service delivery.

Revenue Growth

The seamless and interconnected framework of omnichannel banking not only enhances customer experiences but also creates a solid foundation for revenue expansion. By aligning customer needs with tailored product offerings and leveraging advanced analytics, banks can effectively boost their profitability.

Cross-Selling and Upselling Opportunities

Omnichannel banking provides banks with a unique opportunity to cross-sell and upsell financial products and services, thanks to its holistic view of customer data and seamless integration across channels.

- Leveraging Unified Customer Profiles: In omnichannel banking, customer data from all touchpoints is centralized, creating a comprehensive profile for each customer. This profile includes transaction history, spending habits, and product preferences. By analyzing this data, banks can identify relevant products or services that align with the customer’s financial goals, enabling effective cross-selling. For instance, a customer with significant savings might be offered an investment product, while one with frequent credit card use could be introduced to a rewards-based credit card.

- Tailored Product Recommendations: The ability to personalize recommendations is a key advantage of omnichannel banking. By using customer insights, banks can offer products and services that resonate with individual needs. For example, a customer applying for a home loan might also be recommended for home insurance, enhancing their financial safety while increasing the bank’s revenue.

- Proactive Upselling Strategies: Omnichannel banking enables proactive engagement with customers. For instance, if a customer has consistently maintained a high account balance, the bank could proactively recommend premium accounts with additional benefits. Similarly, customers nearing their credit card limit might be offered an upgrade to a higher-limit card.

- Integrated Cross-Selling Campaigns: Omnichannel banking ensures that cross-selling and upselling efforts are cohesive across all channels. A campaign initiated via email can be followed up with in-app notifications or a personalized consultation in-branch, ensuring consistency and increasing the likelihood of success.

- Building Long-Term Customer Value: Cross-selling and upselling in omnichannel banking do more than boost immediate revenue; they deepen customer relationships by demonstrating that the bank understands and anticipates customer needs. This increases customer lifetime value and fosters long-term loyalty.

Improved Conversion Rates Through Data-Driven Insights

Data is the driving force behind the success of omnichannel banking. By harnessing advanced analytics and machine learning, banks can use customer data to optimize their marketing efforts and significantly improve conversion rates.

- Real-Time Data Analysis: Omnichannel banking relies on real-time data collection and analysis to track customer behaviors and preferences. For example, if a customer frequently checks loan rates on the bank’s website but has not yet applied, the bank can use this data to target the customer with a personalized loan offer via email or a mobile app notification. This timely intervention increases the likelihood of conversion.

- Segmented Marketing Campaigns: With access to unified customer data, banks can segment their audience based on demographics, financial goals, or transaction patterns. Segmented campaigns allow banks to deliver highly relevant messages that resonate with specific customer groups. For example, young professionals might receive offers for student loan refinancing, while retirees are targeted with retirement savings plans.

- Predictive Analytics for Customer Behavior: Omnichannel banking employs predictive analytics to anticipate customer actions and preferences. By analyzing historical data, banks can identify customers who are most likely to purchase a particular product or service. For instance, predictive models might highlight customers who are likely to be interested in wealth management services, enabling the bank to prioritize these leads.

- A/B Testing Across Channels: Omnichannel banking facilitates A/B testing across multiple platforms, helping banks determine the most effective messaging, timing, and channels for their campaigns. For instance, a bank might test two different credit card promotions via email and app notifications to see which generates higher conversions. Insights from these tests can be applied across the omnichannel framework to refine strategies further.

- Seamless Follow-Ups: One of the key benefits of omnichannel banking is the ability to follow up seamlessly across channels. If a customer abandons a loan application on the mobile app, the bank can send a reminder via email or have a call center representative offer assistance. This targeted follow-up increases the chances of conversion while maintaining a positive customer experience.

- Optimizing Customer Journeys: Omnichannel banking allows banks to map and optimize customer journeys, identifying points where customers drop off and implementing strategies to re-engage them. For instance, simplifying the loan application process or providing instant approval notifications can address friction points and boost conversion rates.

The ability to drive revenue growth is one of the most tangible benefits of omnichannel banking. By capitalizing on cross-selling and upselling opportunities and using data-driven insights to improve conversion rates, banks can significantly enhance their financial performance while delivering value to their customers.

Omnichannel Banking Strategies

To fully leverage the benefits of omnichannel banking, financial institutions must implement robust and well-coordinated strategies. These strategies not only ensure seamless integration across physical and digital channels but also enhance customer engagement, operational efficiency, and competitive positioning. Let’s explore the core strategies banks can adopt to create a successful omnichannel banking ecosystem.

Personalization and Data Analytics

Personalization and data analytics lie at the heart of successful omnichannel banking strategies. These elements enable banks to understand individual customer needs, predict behaviors, and provide relevant solutions, ensuring a more engaging and efficient banking experience.

Use of AI and ML for Customer Insights

Artificial intelligence and machine learning have revolutionized the way banks analyze customer data and derive actionable insights. These technologies empower omnichannel banking by enabling precise targeting, efficient service delivery, and proactive customer engagement.

- Data Collection and Analysis: AI and ML technologies analyze vast amounts of customer data, including transaction histories, spending patterns, and interaction preferences, across all channels. This data is then processed to identify trends and generate insights, such as predicting a customer’s likelihood of requiring a loan or switching to a new financial product.

- Behavioral Predictions: Machine learning algorithms excel at predicting customer behavior. For instance, they can identify customers who are likely to churn and trigger personalized retention strategies, such as exclusive offers or tailored outreach from a relationship manager. These proactive measures ensure banks maintain strong customer relationships and minimize attrition.

- Fraud Detection and Prevention: AI-driven systems in omnichannel banking help identify anomalies in customer behavior that might indicate fraudulent activity. For example, if a customer suddenly makes transactions from an unfamiliar location or for unusually high amounts, AI systems can flag this activity and alert the customer immediately.

- Enhanced Customer Service: Chatbots and virtual assistants powered by AI are integral to omnichannel banking. They provide real-time support and are capable of addressing routine queries, such as checking account balances or transferring funds. By analyzing customer interactions, these tools also improve their responses over time, ensuring a consistently high-quality experience.

- Sentiment Analysis: Banks can use AI tools to gauge customer sentiment by analyzing interactions through emails, chats, or social media. Understanding customer emotions and opinions enables banks to refine their services and enhance the overall experience.

Tailored Product Recommendations

Personalized product recommendations are a powerful tool for increasing customer satisfaction and driving revenue growth in omnichannel banking. Tailoring recommendations based on individual needs not only fosters customer loyalty but also ensures that banks remain competitive in a dynamic financial landscape.

- Leveraging Unified Customer Profiles: A centralized data system in omnichannel banking provides a 360-degree view of each customer. By combining demographic information, financial history, and real-time activity, banks can generate personalized product recommendations. For instance, a customer with a history of frequent travel may receive offers for travel-specific credit cards or insurance policies.

- Real-Time Recommendations: Omnichannel banking enables banks to deliver real-time product recommendations during customer interactions. For example, a customer browsing mortgage rates on a bank’s website might receive personalized offers via email or mobile notifications, encouraging them to take the next step.

- Cross-Selling and Upselling Opportunities: Tailored recommendations allow banks to effectively cross-sell and upsell products. For instance, a customer who recently opened a savings account might be offered investment opportunities or a financial planning consultation. This targeted approach ensures relevance and increases the likelihood of conversion.

- Dynamic Adjustments: ML models continuously refine recommendations based on changing customer behaviors and preferences. For example, if a customer’s spending patterns indicate a shift toward eCommerce purchases, the bank might recommend a rewards-based credit card aligned with these activities.

- Personalized Engagement Across Channels: Omnichannel banking ensures that personalized recommendations are delivered consistently across all platforms. For instance, a customer who receives an offer on a mobile app can seamlessly access the same information in-branch or through a call center. This consistency reinforces trust and enhances the overall experience.

- Boosting Financial Wellness: Banks can use tailored recommendations to promote financial wellness among customers. For instance, a bank might suggest budgeting tools, low-interest loans, or automated savings plans based on a customer’s financial goals. This proactive approach positions the bank as a trusted advisor and strengthens the customer relationship.

The Role of Personalization and Data Analytics in Omnichannel Banking

Personalization and data analytics are integral to the success of omnichannel banking strategies. By harnessing AI and ML technologies, banks can derive meaningful insights from customer data and use them to offer tailored solutions that align with individual needs. These personalized experiences not only enhance customer satisfaction but also drive long-term loyalty and profitability.

As the financial industry becomes increasingly competitive, the ability to leverage data for personalized interactions will differentiate leading banks from their peers. Through continuous innovation and strategic implementation of AI-driven analytics, omnichannel banking will remain a key enabler of customer-centric financial services.

Mobile-First Approach

A mobile-first approach in omnichannel banking focuses on designing and optimizing services for mobile devices before extending them to other platforms. This strategy ensures that mobile banking apps become the primary touchpoint for customers, offering unparalleled convenience and functionality.

Prioritizing App Development

Mobile apps are central to omnichannel banking, serving as a versatile platform for transactions, communication, and personalized services. Prioritizing app development allows banks to create a robust and user-friendly experience that meets the demands of digitally savvy customers.

- Intuitive User Interface (UI) and User Experience (UX): An effective mobile-first strategy begins with designing an intuitive and visually appealing interface. Omnichannel banking apps must be easy to navigate, with streamlined menus and features that cater to both tech-savvy users and those less familiar with digital banking. A seamless UX encourages regular app usage and enhances customer satisfaction.

- Comprehensive Features: Mobile apps in omnichannel banking must offer a full suite of features, including account management, fund transfers, bill payments, loan applications, and investment tracking. By providing a one-stop solution for all financial needs, banks can make their app the preferred channel for customers.

- Speed and Performance Optimization: Customers expect fast and responsive apps. A mobile-first approach prioritizes performance optimization to ensure quick load times, minimal glitches, and smooth functionality. These factors are critical for retaining users and maintaining a positive brand reputation.

- Cross-Platform Compatibility: While mobile apps are the primary focus, they must also integrate seamlessly with other channels in an omnichannel banking ecosystem. For instance, data entered into a mobile app should synchronize in real time with internet banking portals and in-branch systems, providing a consistent experience across all touchpoints.

- Regular Updates and Innovations: Technology evolves rapidly, and customer expectations change alongside it. Regular updates to introduce new features, enhance security, and improve usability are vital for maintaining the app’s relevance and competitiveness in the omnichannel banking landscape.

Offering App-Exclusive Features

A mobile-first approach also involves offering app-exclusive features that add value and differentiate the app from other banking channels. These features create incentives for customers to engage with the app, enhancing loyalty and satisfaction.

- Biometric Authentication: Mobile apps can leverage device-specific features such as fingerprint scanning or facial recognition for secure and convenient login. These advanced authentication methods enhance security while simplifying access, making the app more appealing to customers.

- Push Notifications: Personalized push notifications allow banks to communicate with customers in real time. These messages can include account updates, transaction alerts, promotional offers, or reminders for bill payments. By delivering timely and relevant information, banks can keep customers engaged and informed.

- Mobile-Specific Rewards Programs: Offering rewards programs exclusive to mobile app users incentivizes adoption and usage. For instance, customers might earn points for completing transactions via the app, which can be redeemed for discounts, cashback, or other benefits.

- AI-Powered Chatbots: Mobile apps in omnichannel banking can integrate AI-driven chatbots to provide instant customer support. These virtual assistants handle routine queries, such as checking account balances or resetting passwords, and escalate complex issues to human agents when necessary.

- Contactless Payments: Many customers rely on their smartphones for in-store and online payments. Mobile apps that offer integrated digital wallets or QR code payments enable seamless, contactless transactions, aligning with modern consumer behavior.

- Personalized Financial Insights: Omnichannel banking apps can analyze user behavior and provide personalized financial insights through the app interface. For example, customers might receive monthly spending summaries, budgeting advice, or tailored investment recommendations, enhancing their overall financial wellness.

- Exclusive App-Only Products or Offers: Banks can introduce products or promotional offers that are available exclusively through the app. For instance, a bank might offer lower interest rates on loans or higher savings account returns for customers who apply via the mobile app, driving engagement with the platform.

- Offline Capabilities: App-exclusive offline features, such as saving transaction histories or generating digital account statements, allow customers to access essential information without an internet connection. This functionality enhances convenience and ensures accessibility.

The Role of a Mobile-First Approach in Omnichannel Banking

A mobile-first approach is essential for achieving the goals of omnichannel banking, as it aligns with the preferences of today’s digital-first consumers. By prioritizing app development and offering app-exclusive features, banks can create a compelling mobile experience that drives engagement, fosters loyalty, and enhances customer satisfaction.

In a competitive banking environment, the ability to deliver seamless, innovative, and personalized mobile services is a key differentiator. As the cornerstone of an omnichannel banking strategy, a mobile-first approach ensures that banks remain relevant, agile, and customer-focused in an ever-evolving digital landscape.

AI and Automation

Artificial intelligence and automation are transforming the financial sector, and their integration into omnichannel banking strategies offers unparalleled opportunities for innovation and efficiency. These technologies not only optimize internal processes but also enhance the customer journey, making banking more accessible and convenient.

Chatbots and Virtual Assistants

Chatbots and virtual assistants are key components of AI-driven omnichannel banking, providing real-time customer support and facilitating smooth interactions across multiple platforms.

- Instant Support Across Channels: Chatbots powered by AI ensure 24/7 availability for customers, addressing common queries such as account balances, transaction histories, and loan eligibility in real time. This availability enhances customer satisfaction and reduces dependency on human agents, particularly during peak service hours.

- Seamless Integration in Omnichannel Banking: A hallmark of omnichannel banking is the consistency of customer experiences across platforms. Chatbots can transition seamlessly between channels, such as from a mobile app to a web portal or even a branch visit. For instance, a customer who starts a loan inquiry via chatbot on a mobile app can later receive detailed follow-up information in a branch, with all prior interactions recorded and accessible to branch staff.

- Personalized Interactions: Advanced chatbots use machine learning and natural language processing to analyze customer behavior and preferences. This enables them to deliver personalized recommendations, such as tailored credit card offers or savings plans, improving the relevance and effectiveness of customer engagements.

- Cost-Effective Customer Service: By automating routine tasks, chatbots significantly reduce the operational costs of customer service. Human agents can then focus on more complex queries, improving service quality while maintaining cost efficiency.