Finding the right eCommerce pricing strategies for your company can be difficult. You want to make sure you’re getting the best deals possible, but you also don’t want to sacrifice quality or service. Luckily, there are a few tips and tricks that can help you find the perfect price point for your business. This post will discuss why you need an eCommerce pricing strategy as well as the most popular pricing techniques utilized by eCommerce companies. Keep reading to learn more!

Table of Contents

What is an eCommerce pricing strategy?

An eCommerce pricing strategy is a well-thought-out plan that helps you decide how to appropriately price things to boost sales and profits while remaining competitive. Various eCommerce pricing strategies are employed based on the type of products sold, product demand, and competition.

Why is it important to define eCommerce pricing strategies?

Each company requires a customized eCommerce pricing approach. Additionally, a company’s strategy could need to change as it expands. The true cost per order and/or acquisition cost may increase as your organization expands, and expenditures could increase dramatically as well.

You need eCommerce pricing strategies for online purchases that will enable you to grow your firm. eCommerce companies use a variety of pricing tactics that don’t have a long-term negative impact on their revenues.

Even if your eCommerce company is currently profitable, there may be potential to increase revenues if you keep reviewing and improving your pricing approaches.

How to pick the best eCommerce pricing strategy

As we’ll see in a moment, there are a number of widely used tactics. However, there is no such thing as a one-size-fits-all pricing structure in eCommerce. Determine what appeals to your target market and choose a pricing strategy that works for your company.

eCommerce pricing strategies aren’t only about making money. It also depends on how you want to be viewed by customers: as a premium brand, a budget retailer, or something in between. All business models may be accommodated by eCommerce pricing techniques, and you can even mix a few of them to broaden your appeal.

You need to acquire information on people’s preferred methods of browsing and purchasing to begin with, as well as pay close attention to customer behaviors and online shopping habits. You can choose a price plan that matches important client characteristics with the aid of analytics software, and a digital operations platform can track the results.

Refine your ideal customer profiles

An ideal customer profile (ICP) is a hypothetical representation of the kind of business you hope to do business with. You’re describing a company that is very likely to purchase your goods, remain devoted to you, and refer you to others.

You must choose a few traits of your ideal client to include in this profile. Typical firmographics in an ICP include business size and history, company finances and revenue, industry classification, and location.

ICPs assist in aligning your pricing strategy with present and future consumer needs in addition to boosting revenue by focusing on the correct clients. It is important for all teams or departments to agree on who the ideal customer is.

In addition, an ICP should not be mistaken with a buyer persona, which characterizes the people within the target firm and is based on factors like role, function, seniority, and income.

Solidify your unique selling proposition

It’s challenging for any eCommerce business to stand out in a competitive field. However, the goal is to distinguish at least one component of your service from your competition. This is your unique selling point (USP).

A unique selling point (USP) is something that distinguishes your business or product and gives buyers a reason to select you over someone else. It’s a way of sharing your values and demonstrating to them how you (and only you) can provide this specific advantage.

It is easier to settle on a pricing plan when all departments understand the USP. You can charge a premium if your specialized service is not available elsewhere. However, in most circumstances, you must consider rival pricing.

Study customer behaviors

Customer behavior involves both their purchasing habits and the elements that impact their purchasing decisions. Analyzing these behaviors and beliefs will assist you in aligning your business with the thinking of your customers.

Because of the digital age, consumer behavior is evolving at an accelerated rate. A greater need for speed is posing issues for retail inventory management, from quick websites to next-day delivery possibilities.

People have embraced online shopping because it is convenient and because the prices are lower. Customers are considerably savvier about locating discounts, and they are more likely to back out of a purchase before paying if they locate the same item for less elsewhere.

10 Recommended pricing strategies for eCommerce

We’ve developed a list of the top ten eCommerce pricing strategies for you to pick from based on the facts above. Any one of these could greatly enhance your company’s needs.

1. Cost-plus pricing

The cost-plus pricing approach, sometimes referred to as “markup pricing,” “breakeven pricing,” or “cost-based pricing,” makes money by raising a product’s cost by a certain percentage margin.

Because of its simplicity and ease of calculation, cost-plus is one of the most fundamental and uncomplicated pricing techniques for new and/or smaller eCommerce enterprises.

- Pros:

As long as your rates are greater than the real cost per order, cost-plus is a common pricing technique because it is simple. You may simply set up a cost-plus tracking system to monitor the performance of your company with the aid of your accountant or finance team.

- Risks:

When employing cost-plus pricing, the estimates could be off. Your company could lose money on every sale if anything is done incorrectly. You will lose money if material costs unexpectedly rise while product prices remain unchanged. Although you might raise your prices, this would discourage current customers from returning to your store.

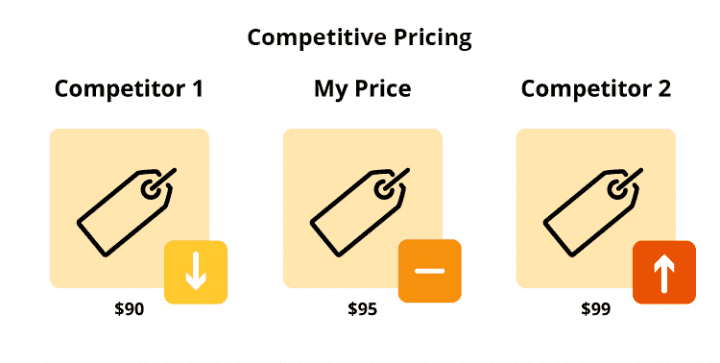

2. Competition-based pricing

Competition-based pricing is centered on providing better prices than your rivals and is most frequently utilized for commodities. This entails comparing your prices to those of comparable goods sold across channels by your rivals and adjusting your pricing as necessary.

- Pros:

By drawing in their customers with lower costs, competition-based pricing can help you outperform the competition. This is an excellent strategy if you want to draw customers that are cost-conscious because they are willing to forgo brand loyalty in order to save money.

- Risks:

In the end, all types of competition-based pricing only hurt the merchants. Customers are the only ones to gain profit from this strategy, as they will quickly and surely shop on other eCommerce sites in a matter of seconds if they don’t like your prices, unlike with brick-and-mortar establishments. You will begin to lose revenue if you can’t keep your expenditures down to satisfy budget-conscious customers.

A “race to the bottom” may result from price competition. If a rival decides to go head-to-head with you on pricing, both businesses will likely keep raising/decreasing prices, which could make your product appear less valuable and appealing in the end.

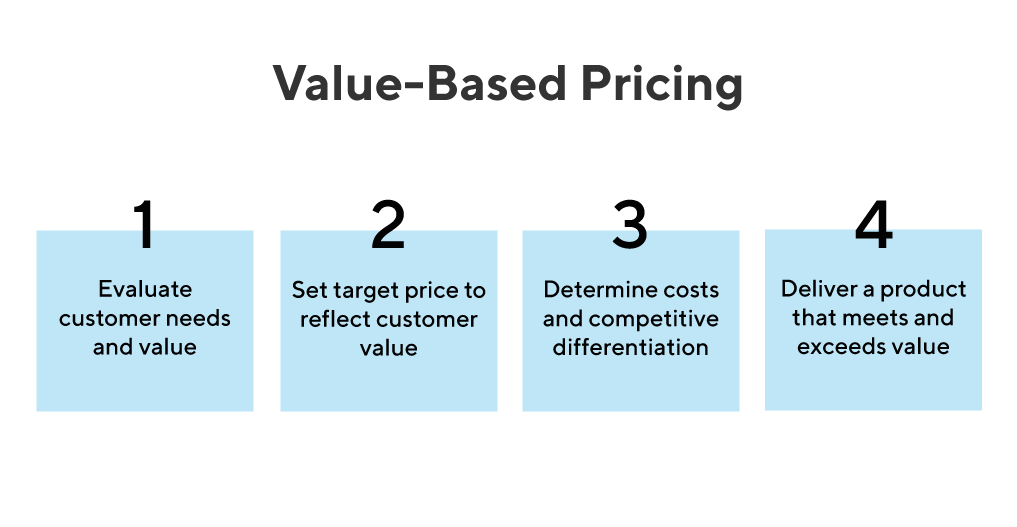

3. Value-based pricing

Value-based pricing concentrates on determining the highest price a consumer will willingly pay for your product. This pricing strategy will work with customers who place a higher value on quality and “fairness” than anything else do. Customers like this have high standards for the items you’re offering, like being the highest caliber, obtained fairly, environmentally friendly, and/or difficult to locate.

- Pros:

Due to the perceived value of the product, value-based pricing can be used for all types of products/services (as long as the quality of your products/services is supreme). Understanding your products’ value is aided by value pricing. You might launch a new line of products at a higher price if you discover that clients are prepared to pay more than you are now asking.

- Risks:

Getting value-based pricing correctly is extremely challenging. To identify the ideal pricing point that keeps clients satisfied without creating a reduction in sales, you must invest time in studies and focus groups. A product’s perceived worth will also surely alter over time.

4. Consumer-based pricing strategy

When a business sets prices based on how its customers perceive the value of its goods and services, this is known as a consumer-based pricing strategy. Being one of the most popular eCommerce pricing strategies, this one seeks to ensure that clients are prepared to pay such rates based on the value they receive.

This customer-centered strategy relies on constant analysis and interaction with customers. Giving customers what they want is a terrific strategy to increase brand exposure and loyalty.

- Pros:

Consumer-based pricing also allows you the freedom to charge various amounts to various clients. You can determine who is most likely to buy what and when using segmentation data, and you can adjust prices accordingly. You must pay close attention to factors like social media usage and buying patterns.

- Risks:

Customer value perception measurement is a difficult task. These opinions are subjective and will change depending on the customer and the situation. You can’t let your focus stray because quick changes in the market and in client behavior will also have an impact on the statistics.

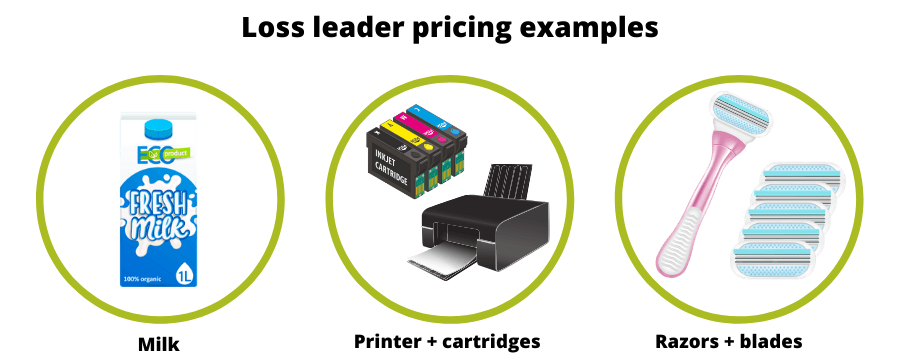

5. Loss-leader pricing

Loss-leader pricing is concerned with selling products at a loss in order to attract people to purchase a more expensive product offering. Customers compensate for the loss by purchasing additional goods required to make the supplied product useful The additional items can be acquired at the time of the initial sale or later.

Loss-leader pricing encourages customers to buy the complementary item in addition to the extremely discounted item, where they may be ready to add more items to their basket because they already feel like they are getting a deal.

- Pros:

Loss-leader pricing is an excellent strategy to persuade customers to make the first purchase and then have them return to your online store to buy other products, boosting their customer lifetime value (LTV). To make up for the loss of selling the initial goods, you can make use of this opportunity to develop product bundles or offer product accessories.

- Risks:

Loss-leader pricing is ineffective if customers don’t make any more purchases or if the cost of shipping an online order exceeds the value of the cart. Customer fidelity to the brand and/or product is a key component of the eCommerce pricing strategy.

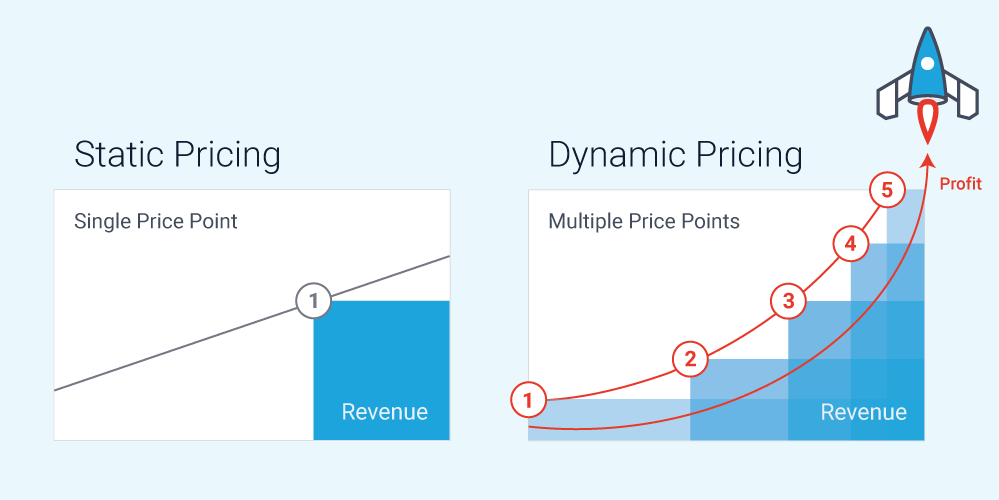

6. Dynamic pricing

Flexible pricing is the key to dynamic pricing: because of the ongoing shifts in demand, prices are never fixed and may alter at any time.

Surge pricing is another name for dynamic pricing. Dynamic pricing is used by apps like Uber and Lyft when there is an increase in the number of people in the area who require a trip due to inclement weather, significant events, etc.

- Pros:

With dynamic pricing, prices can be lowered to boost sales if they drop below a preset volume. Or, if you notice a sudden increase in requesting orders, you might boost prices to make more money. If your competitors modify their rates, you can still keep your prices competitive by combining dynamic pricing with competitor-based pricing.

- Risks:

If prices are constantly changing, dynamic pricing might significantly lower your conversion rates. Customers are more inclined to hold off on making a purchase if they anticipate price reductions in the future.

In some circumstances, too many pricing changes can make clients hesitant to make any purchases from your eCommerce business and damage their faith.

7. Premium pricing

A product’s value is indicated by its price. Premium pricing is a technique used to set the price of valued luxury or expensive goods. The purpose of premium pricing is to convey that your brand or items are well-known and/or represent status. The most prominent illustration of this is designer apparel and accessories.

- Pros:

Because you’re just focusing on people who can buy your items, premium pricing might be a profitable strategy. As you aren’t targeting the general market, you have reduced ad expenses with improved targeting.

Additionally, a premium price increases the likelihood that celebrities or other well-known people may wear your stuff. With the help of celebrities, you can execute marketing efforts to raise brand recognition and position your company as a luxury brand.

- Risks:

The quantity of prospective clients you can reach with premium pricing is constrained. You may attract a large number of “window shoppers” who don’t become paying customers if your brand messaging and advertising initiatives are directed at the incorrect demographic.

Customers who purchase a product at a premium pricing will also anticipate more from your brand, such as premium shipping. You’ll have a difficult time closing a deal without a strong brand reputation, favorable client feedback, and proof that your products are of excellent quality.

8. Anchor pricing

When clients are evaluating products, anchor pricing provides them with a reference price point (the anchor). For instance, your website can show the original price next to the discounted price when running a discount offer for a product. To illustrate to the consumer how much money they are saving, an online retailer can advertise a product as ‘$100 $75′ even though it normally sells for $75.

- Pros:

Customers who are seeking a deal or a discount are drawn to anchor pricing. It may also cause a feeling of urgency. Customers will feel pressured to buy immediately or risk missing out on a promotion if the higher anchor price point is used.

In some circumstances, a discount is provided in exchange for committing to a number of items or orders, and the customer can check the savings at the checkout to make sure they would benefit financially from doing so.

- Risks:

Anchor pricing can be carried too far, causing you to lose customers. If the price difference between the anchor and the new price point is too great, it may indicate that the product has flaws or has lost value.

9. Bundle pricing strategy

Retailers frequently use the approach of bundling prices to offer a number of related products as a single unit. The bundled pricing is typically less expensive than the total prices of the individual products.

The technique is frequently used in the technology market, such as a laptop with accessories, or cosmetic products (like a complete skincare set). These are items that the buyer would buy normally, but selling them in a package provides convenience and the thrill of a good deal.

- Pros:

Although each item is officially sold at a discount, bundle pricing can actually generate revenue by simplifying the purchasing process and encouraging larger-volume sales. Customers usually consider the value of a bundle to be larger than the worth of separate products.

- Risks:

If you’re going to provide bundle pricing, make sure you’re offering the proper bundles. If you don’t package some things in a way that is valuable to the buyer, you may wind up diminishing their worth.

Bundle pricing can also result in product cannibalization, resulting in a decrease in sales. When you sell two things together but also separately, more of them will be sold at a discount through the bundle, resulting in lesser profits for the individual product.

10. Price skimming

The practice of lowering a product’s initial price over time is known as price skimming. For electronic items that lose value or become obsolete when new technology is developed, price skimming is prevalent. Older product models become more affordable to buy when newer models become available.

There is a group of consumers known as “early adopters” who tend to become the first purchasers of technological devices like smartphones, televisions, computers, and video game consoles. These clients will spend more money to get the newest and best products.

- Pros:

Price skimming is an excellent marketing tactic for companies that provide high-demand goods, cutting-edge technology, or seasonal merchandise. Customers will most certainly desire newer things as time goes on, but you can still profit by offering last year’s products at a discount to draw in budget buyers.

- Risks:

For newer and smaller online businesses, price skimming is not a wise choice. Also, price skimming is ineffective for businesses that sell commonplace goods or commodities. For example, price skimming may not be the greatest strategy if your firm offers cosmetics because makeup has a short shelf life and is a highly saturated industry.

To conclude

In order to find the right eCommerce pricing strategies for your business, it’s important to take a variety of factors into account. You need to consider your overhead costs, how much you want to make in profit, what the competition is doing, and what the market will bear. Working with an experienced eCommerce consultant can help you navigate these waters and come up with a price point that saves you money while still allowing you to turn a profit. Leave your messages to us right below and our eCommerce experts will be with you in the shortest time.