Today’s market is characterized by unprecedented competition, technological advancements, and the growing demand for personalized services. Omnichannel banking trends are at the forefront of this transformation, driven by innovations such as artificial intelligence, big data analytics, and open banking frameworks. Financial institutions are no longer merely service providers; they are evolving into customer-centric hubs offering tailored experiences that cater to individual needs. The rise of mobile banking, chatbots, and integrated systems has enabled banks to connect with customers across multiple touchpoints, ensuring a consistent and engaging journey.

As we delve deeper into the evolving landscape of omnichannel banking trends, this blog will explore how these developments are shaping the future of finance. From emerging technologies to shifting customer expectations, we will uncover the opportunities and challenges that lie ahead for banks aiming to thrive in this new era of omnichannel innovation.

Table of Contents

- Overview of Omnichannel Banking Trends

- Current State of Omnichannel Banking Trends

- Evolution of Omnichannel Banking Trends

- Key Statistics and Market Trends

- Challenges Banks Currently Face

- Key Omnichannel Banking Trends

- AI and Personalization

- Enhanced Mobile Banking Apps

- Open Banking and API Integration

- Data-Driven Banking

- Seamless Cross-Channel Experiences

- Voice and Conversational Banking

- Focus on Cybersecurity

- ESG (Environmental, Social, and Governance) Banking

- Banking for the Underserved

- Real-Time Payments and Services

- Benefits of Adopting Omnichannel Banking Trends

- Strategies for Banks to Stay Ahead

- Emerging Technologies Shaping the Future of Omnichannel Banking Trends

- Predictions for the Next Decade in Omnichannel Banking

Overview of Omnichannel Banking Trends

The financial sector is undergoing a transformative period, with omnichannel banking trends playing a pivotal role in redefining how banks interact with their customers. By seamlessly integrating various customer touchpoints—both physical and digital—these trends enable financial institutions to provide a unified and consistent experience. This section explores the definition of omnichannel banking and its growing importance in the modern financial landscape.

Definition of Omnichannel Banking

Omnichannel banking refers to a holistic approach where banks integrate multiple communication and service channels to create a seamless customer experience. Unlike multichannel banking, where each channel operates independently, omnichannel banking ensures interconnectedness and continuity. Customers can begin a transaction on one platform, such as a mobile app, and complete it in a branch or through an online portal without losing context or data.

In today’s digital age, omnichannel banking trends emphasize the convergence of traditional banking methods with advanced digital technologies. Banks are no longer restricted to physical branches; they now incorporate mobile apps, websites, chatbots, social media platforms, and even voice banking systems into their service repertoire. For instance, a customer might receive personalized financial recommendations via email, which are consistent with the offers displayed on their banking app and in-branch promotions.

Identifying Current Omnichannel Banking Trends

Current omnichannel banking trends are characterized by innovation and a customer-first approach. Among these are:

- AI and Personalization: The use of artificial intelligence to analyze customer data and deliver personalized financial solutions. This trend enhances customer engagement by offering tailored products and services based on individual preferences.

- Mobile Banking Dominance: Mobile apps are evolving with features like biometric authentication, real-time payments, and intuitive interfaces, becoming the cornerstone of omnichannel strategies.

- Cross-Channel Integration: Ensuring that customer interactions across digital and physical channels are synchronized, offering continuity regardless of the channel chosen.

- Data-Driven Insights: Leveraging big data analytics to predict customer needs and optimize offerings across channels.

These trends are reshaping the financial services landscape, ensuring that banks not only meet but exceed the expectations of their increasingly tech-savvy customers.

Core Features of Omnichannel Banking Trends

Omnichannel banking trends are defined by several foundational features that distinguish them from traditional banking approaches:

- Interconnectivity Across Platforms: Omnichannel banking ensures that all customer interactions—whether via mobile apps, branches, or websites—are linked, providing a unified and uninterrupted experience.

- Consistency in Service Delivery: Customers receive the same level of service and information regardless of the channel used, fostering trust and satisfaction.

- Real-Time Data Utilization: By leveraging real-time customer data, banks can provide personalized services, faster transaction processing, and immediate problem resolution.

These features collectively form the backbone of omnichannel banking, enabling financial institutions to offer a customer-centric approach that adapts to evolving expectations.

Importance of Omnichannel Banking in Modern Finance

Omnichannel banking trends are not just technological advancements; they are strategic imperatives for banks aiming to remain competitive in today’s financial market. Their importance stems from three critical factors: evolving consumer expectations, the need for seamless customer experiences, and the competitive advantage they offer.

Changing Consumer Expectations

Modern customers demand convenience, speed, and personalization in every interaction. They expect banks to deliver the same level of service across channels, whether they are engaging with a chatbot, visiting a branch, or using a mobile app. Omnichannel banking trends address these expectations by ensuring that:

- Service is consistent and accessible across all channels: Customers can switch between channels without disruption, whether they start a loan application online and complete it in a branch or check account balances through a voice assistant.

- Interactions are personalized and relevant: Banks use customer data to provide customized experiences, such as offering tailored financial advice or pre-approved loans.

Need for Seamless Customer Experiences

A seamless customer experience is the hallmark of omnichannel banking trends. Unlike traditional banking, where customers often encounter friction when switching between channels, omnichannel banking eliminates these barriers. Key aspects of this seamless experience include:

- Unified Communication: All customer interactions are connected, allowing them to continue a conversation or transaction across different platforms without repeating information.

- Integrated Service Delivery: Banks can offer services like real-time updates on transactions, instant support via chatbots, and quick access to account details, ensuring an effortless experience.

- Customer-Centric Design: Omnichannel banking trends prioritize ease of use and accessibility, making banking convenient for all demographics.

Competitive Advantage for Banks

In a fiercely competitive market, omnichannel banking trends give banks an edge by enhancing customer satisfaction and loyalty. Banks that successfully adopt these trends can:

- Attract and retain tech-savvy customers: Millennials and Gen Z customers are drawn to banks that offer cutting-edge digital services alongside traditional options.

- Increase operational efficiency: Omnichannel banking reduces redundancies and improves collaboration across departments, resulting in faster response times and better service quality.

- Expand market reach: By incorporating digital platforms, banks can serve customers in remote or underserved areas, broadening their customer base.

By embracing omnichannel banking trends, financial institutions position themselves as innovative, customer-focused, and future-ready. This alignment with modern consumer expectations and market demands ensures their continued relevance and success in the evolving financial ecosystem.

Current State of Omnichannel Banking Trends

Omnichannel banking trends have become a transformative force in the financial services industry, revolutionizing the ways banks engage with customers and deliver services. With the rise of advanced technologies, evolving consumer demands, and a competitive market landscape, these trends are not merely optional enhancements but critical components for banks aiming to thrive in the modern era. The current state of omnichannel banking showcases a dynamic intersection of innovation, customer-centric strategies, and operational evolution. However, alongside these opportunities come challenges that financial institutions must address to fully unlock the potential of omnichannel banking.

Evolution of Omnichannel Banking Trends

Omnichannel banking trends have transformed how financial institutions engage with customers, evolving from basic online services to integrated, seamless experiences across digital and physical channels. This evolution reflects the industry’s response to technological advancements, changing consumer preferences, and the need for operational efficiency. From the early days of online banking to the sophisticated integration of mobile, in-branch, and online platforms, these trends continue to shape the future of banking.

Early Days of Online Banking

The foundation of omnichannel banking trends lies in the early days of online banking. In the 1990s, banks began exploring digital platforms to provide basic services like account inquiries and fund transfers. These initial efforts marked a significant departure from traditional banking models reliant on physical branches.

- Digital Beginnings: Early online banking systems were simplistic, offering static information and limited functionalities. However, they laid the groundwork for what would become a pivotal shift in banking operations.

- Emergence of Internet Banking: As Internet connectivity improved, banks expanded their services to include bill payments, loan applications, and secure messaging with customer service representatives. This era saw a surge in customer adoption, driven by convenience and time savings.

- Challenges in Adoption: Despite the promise of online banking, early adopters faced hurdles, such as slow internet speeds and concerns over data security. Banks had to invest heavily in infrastructure and customer education to overcome these barriers.

Integration of Mobile, In-Branch, and Online Channels

As technology advanced, omnichannel banking trends evolved to integrate multiple touchpoints, allowing customers to transition seamlessly between channels. This integration transformed the banking experience from siloed interactions to a cohesive journey.

- Mobile Banking Revolution: The proliferation of smartphones in the 2010s brought a new dimension to omnichannel banking. Mobile apps emerged as a primary channel, offering features like remote deposits, real-time notifications, and location-based services.

- Physical and Digital Convergence: Banks recognized the importance of blending physical branch experiences with digital offerings. For example, customers could initiate loan applications online and complete them in-branch, ensuring a personalized touch.

- Emerging Technologies: Innovations such as chatbots, AI-driven personalization, and biometric authentication further enhanced the omnichannel experience. These technologies bridged the gap between online convenience and in-person engagement.

Today, omnichannel banking trends reflect a mature model where customers can access consistent services, regardless of the channel. This evolution has not only improved customer satisfaction but also positioned banks as leaders in digital transformation.

Key Statistics and Market Trends

Omnichannel banking trends are reshaping the financial landscape, driven by the rapid adoption of technology, evolving customer preferences, and significant investments by financial institutions. This section delves into the current statistics, consumer behaviors, and strategic investments that define the state of omnichannel banking today.

Adoption Rates of Omnichannel Banking

Omnichannel banking trends have witnessed remarkable growth, underscoring the industry’s shift toward customer-centric and technology-driven models.

- Global Penetration: Surveys indicate that over 75% of global banking customers now use more than one channel to interact with their banks. Among these, mobile banking leads the way, accounting for nearly half of all interactions, highlighting its central role in the omnichannel ecosystem.

- Regional Variations: Developed markets like North America and Europe show high adoption rates of omnichannel banking trends, with customers regularly utilizing integrated services. Meanwhile, emerging markets in Asia and Africa are experiencing rapid growth, driven by increasing smartphone penetration and a growing preference for mobile-first banking solutions.

- Post-Pandemic Surge: The COVID-19 pandemic acted as a major catalyst, accelerating the adoption of omnichannel banking trends. Customers who previously relied on in-branch visits were compelled to transition to digital platforms, resulting in lasting changes in behavior. This shift has reinforced the importance of robust and accessible digital banking channels.

Consumer Behavior and Expectations

Understanding consumer behavior is at the heart of successful omnichannel banking trends. Customers today demand more than just functionality—they seek convenience, personalization, and security.

- Demand for Personalization: Personalization is no longer optional but a core expectation. Modern customers value AI-driven services that offer tailored financial solutions based on their preferences, such as targeted loan offers or customized savings plans. This level of personalization has become a key driver of customer satisfaction and loyalty.

- Preference for Convenience: Customers prioritize seamless access to services across multiple touchpoints. Omnichannel banking trends cater to this demand by integrating online, mobile, and in-branch interactions, ensuring consistent service delivery regardless of the channel. Features like instant fund transfers, real-time updates, and 24/7 availability resonate strongly with tech-savvy users.

- Focus on Security: While ease of use is critical, customers remain highly sensitive to data privacy and security. Banks must ensure robust security measures, such as two-factor authentication, end-to-end encryption, and secure digital identities, to maintain customer trust and confidence.

Investments in Digital Transformation by Financial Institutions

To align with omnichannel banking trends and meet growing customer expectations, banks are heavily investing in transformative technologies and partnerships.

- AI and Machine Learning: Financial institutions are leveraging AI to enhance customer interactions, predict behaviors, and automate routine processes. This includes the use of chatbots for instant support and machine learning algorithms for fraud detection and credit risk analysis.

- Cloud Computing: The shift to cloud-based operations has become a cornerstone of digital transformation. Cloud technology enables banks to scale services rapidly, reduce operational costs, and ensure real-time data access across all channels, enhancing the omnichannel experience.

- Partnerships with Fintechs: Banks are collaborating with fintech companies to accelerate innovation and expand their offerings. These partnerships often result in cutting-edge solutions like digital wallets, peer-to-peer lending platforms, and personalized investment tools that seamlessly integrate into the omnichannel framework.

As omnichannel banking trends continue to evolve, these statistics and market insights highlight the progress and potential within the financial sector. Understanding and responding to these trends is crucial for banks aiming to stay competitive and customer-focused in a rapidly changing landscape.

Challenges Banks Currently Face

Despite the remarkable progress in omnichannel banking trends, financial institutions face significant hurdles in implementing and maintaining these systems. The transition from traditional to omnichannel models involves overcoming technological, organizational, and operational barriers. Below is an in-depth look at the critical challenges banks must address to maximize the potential of omnichannel banking.

Siloed Operations

Siloed operations remain a fundamental obstacle to the seamless implementation of omnichannel banking trends. Many banks still rely on legacy structures that prevent different systems and departments from working cohesively.

- Lack of Integration Across Channels: One of the biggest challenges is the inability to unify data and services across all channels. For instance, customer data collected during an in-branch visit often does not sync with mobile or online platforms, resulting in disjointed experiences. This fragmentation disrupts the customer journey, making it difficult to deliver consistent service.

- Outdated Legacy Systems: Many banks operate on decades-old infrastructure, which lacks the scalability and flexibility required for modern omnichannel solutions. Upgrading or replacing these systems is costly and time-consuming, often requiring significant organizational restructuring.

- Departmental Disconnect: Inefficient communication between teams, such as marketing, IT, and customer service, further exacerbates siloed operations. Without clear collaboration, efforts to create a unified omnichannel experience are hindered.

Overcoming these silos involves implementing robust enterprise resource planning (ERP) systems and fostering interdepartmental collaboration to ensure all channels operate in harmony.

Data Security and Privacy Concerns

As omnichannel banking trends increasingly rely on digital interactions, ensuring data security and privacy has become a critical concern. With the growing sophistication of cyberattacks, banks are under immense pressure to protect sensitive customer information.

- Rising Cyber Threats: Banks are prime targets for cybercriminals due to the vast amounts of financial and personal data they handle. Threats such as phishing, ransomware, and account takeover attacks continue to evolve, requiring banks to invest in advanced cybersecurity measures.

- Regulatory Compliance and Data Privacy: Financial institutions operate under stringent data protection regulations, such as the GDPR in Europe or CCPA in California. Balancing compliance with seamless customer experiences can be challenging, as rigid measures may inadvertently impact usability.

- Maintaining Customer Trust: Security breaches not only lead to financial losses but also damage a bank’s reputation. Transparent communication about data protection efforts and swift responses to security incidents is crucial to maintaining customer confidence.

To address these challenges, banks must adopt proactive measures such as advanced encryption, real-time threat detection, and regular security audits to safeguard customer data while complying with regulatory standards.

Managing Consistent User Experiences Across Multiple Channels

Providing a seamless and consistent user experience across all channels is a cornerstone of omnichannel banking trends but is also one of the most difficult objectives to achieve.

- Catering to Diverse User Preferences: Customers interact with banks through various channels, including mobile apps, websites, in-branch visits, and voice assistants. Each touchpoint presents unique requirements and expectations, making it challenging to maintain consistency in service quality and functionality.

- Technological Limitations: Gaps in technology can lead to inconsistent experiences. For example, a mobile app might offer advanced features like biometric authentication or real-time transaction alerts, whereas the website may lag behind in functionality. Such disparities create friction for users switching between platforms.

- Synchronizing Real-Time Data: Achieving a unified customer journey requires real-time synchronization of data across all channels. This involves integrating multiple systems and ensuring that updates in one channel are immediately reflected across others. Without robust IT infrastructure, delays and discrepancies can disrupt the customer experience.

Banks can address these issues by investing in unified communication platforms, customer relationship management (CRM) systems, and advanced analytics to deliver consistent experiences across all touchpoints.

Resource Constraints and Cost Pressures

- High Implementation Costs: Transitioning to an omnichannel framework requires substantial investment in technology, infrastructure, and personnel training, which may strain financial resources, especially for smaller institutions.

- Ongoing Maintenance and Upgrades: Beyond the initial implementation, maintaining and continuously improving omnichannel systems involves recurring costs. Upgrades, system patches, and regular IT support are necessary to keep systems functional and secure.

- Talent Shortages: As banks move toward adopting more sophisticated technologies, there is a growing need for skilled professionals, such as data scientists, AI specialists, and cybersecurity experts. The scarcity of such talent can delay progress and inflate operational costs.

Customer Education and Adoption

Even with cutting-edge omnichannel solutions, banks face challenges in educating customers about new services and encouraging adoption.

- Resistance to Change: Some customers, particularly older demographics, may resist adopting new technologies and prefer traditional in-branch services. Ensuring inclusivity while promoting digital tools requires careful communication and support.

- Complexity of Features: Advanced features such as mobile wallets, voice banking, or AI-driven financial planning can overwhelm less tech-savvy users. Simplifying interfaces and providing user-friendly tutorials are essential to increase adoption rates.

- Building Awareness: Many customers remain unaware of the full range of services available through omnichannel platforms. Banks must invest in targeted marketing and customer education to highlight the benefits and ease of use.

The current state of omnichannel banking trends highlights both the tremendous progress made and the hurdles that remain. By addressing these challenges, financial institutions can further refine their strategies and harness the full potential of omnichannel banking to enhance customer experiences and drive business growth.

Key Omnichannel Banking Trends

Omnichannel banking trends are reshaping the financial services industry, reflecting a strategic shift toward creating unified and customer-centric experiences. These trends are driven by the integration of advanced technologies, the growing demand for personalization, and the need to bridge digital and physical interactions seamlessly. As banks strive to stay competitive, they are adopting innovative solutions to enhance customer satisfaction, streamline operations, and improve service delivery.

AI and Personalization

Artificial intelligence has become a cornerstone of omnichannel banking trends, empowering financial institutions to deliver highly personalized services tailored to the unique preferences and behaviors of their customers. The integration of AI into banking systems allows institutions to not only streamline operations but also enhance customer satisfaction by offering experiences that feel intuitive and relevant. Here, we explore the transformative role of AI and its ability to personalize banking services effectively.

Role of AI in Delivering Personalized Banking Experiences

AI plays a pivotal role in redefining how banks engage with their customers, ensuring that interactions are personalized, efficient, and meaningful. Omnichannel banking trends leverage AI to create customized financial journeys that resonate with individual needs, regardless of the channel customers use.

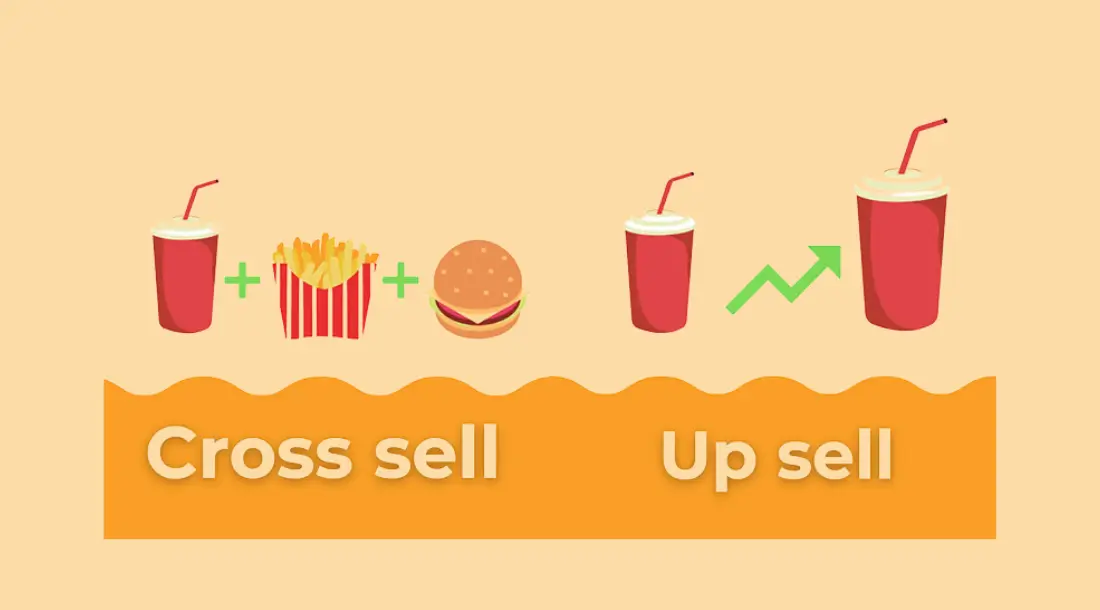

- Customized Financial Recommendations: One of the most impactful applications of AI in omnichannel banking trends is its ability to provide tailored financial recommendations. For example, AI systems can analyze a customer’s spending habits, income patterns, and savings goals to suggest personalized credit card offers, loan products, or investment portfolios. This level of customization builds trust and strengthens customer relationships.

- Real-Time Assistance Across Channels: AI-driven chatbots and virtual assistants are becoming key components of omnichannel banking trends, offering real-time assistance to customers across mobile apps, websites, and in-branch kiosks. These tools can handle a wide range of tasks, from answering queries about account balances to guiding users through complex processes like mortgage applications.

- Dynamic Customer Engagement: AI systems can dynamically adapt interactions based on customer behavior. For instance, if a customer frequently uses a mobile app for transactions, the bank might prioritize app-based alerts or notifications for personalized financial tips, ensuring the customer remains engaged on their preferred platform.

By harnessing AI, banks can ensure that each interaction feels relevant and valuable, fostering customer loyalty and driving long-term growth.

Use of Machine Learning Algorithms to Analyze Customer Behavior and Predict Needs

Machine learning, a subset of AI, is instrumental in driving the predictive capabilities of omnichannel banking trends. By processing vast amounts of data in real time, machine learning algorithms enable banks to anticipate customer needs and proactively deliver solutions, transforming the banking experience from reactive to proactive.

- Behavioral Analysis for Proactive Solutions: Machine learning algorithms analyze customer data, such as transaction history, spending patterns, and demographic information, to identify trends and predict future needs. For example, if a customer frequently makes payments to a utility company, the system might suggest setting up automatic bill payments or offer a related rewards program.

- Fraud Detection and Prevention: Machine learning models are adept at identifying anomalies in customer behavior that could indicate fraudulent activity. For instance, an unusual transaction pattern might trigger an immediate alert, ensuring the customer is informed and the issue is resolved quickly, regardless of the channel used.

- Enhancing Product Recommendations: As part of omnichannel banking trends, machine learning enables banks to refine their product recommendations. By analyzing factors like a customer’s risk tolerance, financial goals, and previous product interactions, banks can suggest relevant services, such as low-risk investment opportunities or savings accounts with higher interest rates.

- Anticipating Lifecycle Needs: Machine learning algorithms also excel at recognizing patterns tied to life stages. For instance, if a customer’s behavior indicates they are planning to purchase a home, the bank can proactively offer mortgage options, home-buying tips, and pre-approval processes across multiple channels.

By integrating machine learning into their omnichannel strategies, banks can move beyond one-size-fits-all solutions, delivering experiences that are not only personalized but also predictive, ensuring customers feel understood and valued.

The Strategic Impact of AI and Personalization on Omnichannel Banking Trends

The integration of AI and machine learning into omnichannel banking trends is more than a technological advancement; it is a strategic imperative. These technologies enable banks to:

- Build Deeper Customer Relationships: Personalized experiences foster trust and loyalty, positioning the bank as a reliable partner in the customer’s financial journey.

- Enhance Operational Efficiency: Automating routine tasks with AI reduces costs and frees up human resources for more complex customer interactions.

- Drive Competitive Advantage: Banks that excel in personalization stand out in a crowded market, attracting tech-savvy customers who prioritize seamless and tailored services.

As omnichannel banking trends continue to evolve, the role of AI and personalization will only grow, shaping the future of customer engagement in the financial industry. Banks that invest in these technologies today are well-positioned to meet the demands of tomorrow’s customers, creating experiences that are not just seamless but deeply meaningful.

Enhanced Mobile Banking Apps

Mobile banking apps have emerged as a cornerstone of omnichannel banking trends, playing a critical role in reshaping how customers interact with financial institutions. These apps have evolved far beyond simple account management tools, becoming comprehensive platforms that enable secure transactions, real-time updates, and highly personalized experiences. Enhanced mobile banking apps are driving innovation by integrating advanced features such as mobile wallets, peer-to-peer (P2P) transfers, biometric authentication, and voice banking. These advancements ensure seamless, efficient, and secure banking experiences, further cementing the importance of mobile technology in omnichannel strategies.

Integration of Advanced Features: Mobile Wallets, P2P Transfers, and Biometric Authentication

Enhanced mobile banking apps are defined by their ability to integrate cutting-edge technologies that address modern consumer needs. As part of omnichannel banking trends, these features ensure that customers can access a full suite of financial services at their fingertips.

- Mobile Wallets for Convenience: Mobile wallets have become a vital component of enhanced banking apps, enabling users to store debit, credit, and loyalty cards digitally. Customers can make in-store or online purchases, pay bills, and even split expenses with a few taps. For example, apps integrated with Apple Pay, Google Pay, or Samsung Pay allow users to make seamless transactions while providing a secure platform for storing sensitive payment data.

- Peer-to-Peer (P2P) Transfers: P2P transfer functionality is another significant enhancement. It allows users to send money instantly to friends, family, or businesses without needing additional payment platforms. These transfers are increasingly integrated into omnichannel banking trends, ensuring that they can be initiated via mobile apps, websites, or even chat interfaces, offering flexibility and convenience.

- Biometric Authentication for Security: As cyber threats increase, mobile apps are incorporating robust security features like biometric authentication. Fingerprint scanning, facial recognition, and iris detection ensure that customers can access their accounts securely without the hassle of remembering passwords. These technologies not only enhance security but also streamline the login process, improving overall user experience.

By integrating these features, mobile banking apps are aligning with omnichannel banking trends to provide a unified, user-friendly, and secure platform that meets the demands of today’s digital-savvy customers.

Incorporating Voice Banking for Hands-Free, On-the-Go Transactions

Voice banking is a rapidly emerging feature that aligns with the convenience-focused nature of omnichannel banking trends. By incorporating voice recognition technology into mobile apps, banks enable customers to perform transactions and access services using simple voice commands.

- Ease of Use for Everyday Tasks: Voice banking allows users to complete routine tasks, such as checking account balances, transferring funds, or paying bills, without manually navigating the app. This hands-free functionality is especially beneficial for customers who are multitasking or have limited access to traditional input methods.

- AI-Powered Voice Assistants: Many mobile banking apps now integrate with AI-powered voice assistants, such as Siri, Alexa, and Google Assistant. These assistants enhance the banking experience by providing quick responses to queries, such as “What’s my account balance?” or “How much did I spend last month?” By offering real-time answers, these tools exemplify how omnichannel banking trends prioritize user convenience.

- Enhanced Accessibility for All Customers: Voice banking significantly improves accessibility for users with visual impairments or physical disabilities. This inclusivity is a critical aspect of omnichannel banking trends, ensuring that financial services are accessible to all customers, regardless of their abilities.

- Natural Language Processing (NLP): The integration of NLP technology ensures that voice banking systems can understand and process conversational language. This feature enables more intuitive interactions, allowing users to request services or information without needing to learn specific commands.

Voice banking represents a major leap in the evolution of mobile apps, aligning perfectly with the goals of omnichannel banking trends to create seamless, convenient, and inclusive banking experiences.

Strategic Impact of Enhanced Mobile Banking Apps on Omnichannel Banking Trends

The continuous enhancement of mobile banking apps plays a pivotal role in the success of omnichannel banking trends. By integrating advanced features like mobile wallets, P2P transfers, biometric authentication, and voice banking, these apps offer several strategic advantages:

- Strengthening Customer Engagement: Enhanced mobile apps provide a personalized and convenient platform for customers, encouraging frequent interaction and fostering loyalty.

- Driving Digital Transformation: By adopting the latest technologies, banks demonstrate their commitment to innovation, reinforcing their relevance in a competitive market.

- Enhancing Cross-Channel Consistency: Mobile apps act as a bridge between digital and physical banking channels, ensuring that customers receive consistent service and information across touchpoints.

As omnichannel banking trends continue to evolve, enhanced mobile banking apps will remain a cornerstone of customer-centric strategies. Banks that invest in developing and refining these apps are well-positioned to meet the expectations of modern consumers, delivering secure, convenient, and seamless banking experiences.

Open Banking and API Integration

Open banking and API integration represent a paradigm shift in the financial services industry, significantly contributing to the advancement of omnichannel banking trends. These technologies empower banks to move beyond traditional operations by fostering collaboration with third-party providers, creating a more customer-centric ecosystem. Open banking leverages APIs to securely share financial data, enabling a host of innovative services that enhance customer experiences, streamline operations, and drive growth. This section explores how open banking and API integration play a critical role in shaping omnichannel banking trends and the value they bring to both customers and financial institutions.

How Open Banking Promotes Customer-Centric Services

Open banking is a regulatory-driven framework that allows customers to share their financial data securely with authorized third-party providers. This model shifts the power to the customers, offering them greater control and flexibility while enabling banks and fintechs to innovate collaboratively. Within the context of omnichannel banking trends, open banking ensures seamless and personalized interactions across all channels.

- Enhancing Customer Choice: Open banking empowers customers by giving them access to a wide range of third-party services, such as budgeting tools, investment platforms, and credit comparison sites. These services are often integrated into the bank’s ecosystem, ensuring a consistent and unified experience across channels.

- Personalized Financial Solutions: By sharing their data with authorized providers, customers can access tailored solutions that meet their unique needs. For instance, a customer seeking a loan can compare offers from multiple lenders within a banking app, benefiting from competitive rates and personalized recommendations.

- Seamless Payments and Transfers: Open banking facilitates direct account-to-account payments, eliminating the need for intermediaries like card networks. This feature aligns with omnichannel banking trends by enabling faster, more efficient transactions across mobile apps, websites, and in-branch systems.

- Transparency and Trust: Open banking mandates rigorous security measures, ensuring that customer data is protected at every step. The transparency offered by open banking fosters trust, a critical factor in driving adoption and loyalty.

Through open banking, financial institutions can provide a richer, more dynamic set of services, reinforcing the customer-first ethos at the heart of omnichannel banking trends.

Development of APIs to Connect Banks with Fintech Companies

APIs (Application Programming Interfaces) serve as the technological backbone of open banking, enabling secure and standardized data exchange between traditional banks and fintech companies. This integration is pivotal to the success of omnichannel banking trends, as it allows for seamless service delivery and innovation.

- Facilitating Collaboration: APIs enable banks and fintech companies to collaborate effectively, combining the stability of traditional banking systems with the agility of fintech innovation. For example, a fintech app specializing in personal finance management can integrate directly with a customer’s bank account, providing real-time insights and recommendations.

- Expanding Service Offerings: API integration allows banks to broaden their portfolio by embedding third-party services directly into their platforms. Customers can access tools like wealth management apps, insurance comparisons, or even non-financial services, all from a single interface.

- Driving Real-Time Functionality: APIs support real-time data synchronization, ensuring that customers receive up-to-date information regardless of the channel they use. For instance, a customer checking their balance via a mobile app will see the same data as when visiting a branch or using an ATM.

- Streamlining Onboarding and KYC Processes: Through APIs, banks can integrate with external databases and identity verification services to simplify onboarding and Know Your Customer (KYC) procedures. This reduces friction for customers while ensuring compliance with regulatory requirements.

API integration enhances the operational efficiency of banks, enabling them to deliver innovative and seamless services that align with the expectations of omnichannel banking trends.

Strategic Impact of Open Banking and API Integration on Omnichannel Banking Trends

The adoption of open banking and API integration has a profound impact on omnichannel banking trends, benefiting both financial institutions and customers.

- Enhanced Customer Experiences: Open banking enables banks to offer a more personalized and diverse range of services, ensuring that customers receive consistent and convenient experiences across all touchpoints.

- Accelerated Innovation: By leveraging APIs, banks can rapidly introduce new features and services, keeping pace with technological advancements and market demands.

- Improved Operational Efficiency: API integration reduces redundancies and automates data sharing, resulting in faster and more efficient service delivery.

- Increased Competitiveness: Banks that embrace open banking and APIs position themselves as forward-thinking and customer-focused, gaining a competitive edge in an increasingly crowded market.

As omnichannel banking trends continue to evolve, the role of open banking and API integration will only grow in importance. Future developments are likely to include greater interoperability between platforms, advanced AI-driven insights powered by shared data, and the integration of non-financial services into banking ecosystems. By investing in these technologies, financial institutions can ensure they remain at the forefront of innovation, offering unparalleled value to their customers. Open banking and APIs are not just enablers of omnichannel banking trends—they are the driving forces behind the future of customer-centric financial services.

Data-Driven Banking

Data-driven banking has emerged as a transformative force within the realm of omnichannel banking trends, enabling financial institutions to deliver highly personalized, efficient, and responsive services. By leveraging big data analytics, predictive modeling, and real-time insights, banks can gain a deeper understanding of their customers’ preferences, behaviors, and financial needs. This data-centric approach ensures that services are not only relevant but also seamlessly integrated across all channels, reinforcing the customer-first ethos that underpins omnichannel banking trends.

Use of Big Data Analytics to Track and Understand Customer Preferences and Behaviors

Big data analytics is at the heart of data-driven banking, offering banks the ability to process vast amounts of customer data from multiple sources, including mobile apps, websites, in-branch interactions, and social media platforms. This wealth of information enables banks to identify trends, track preferences, and understand behaviors with unprecedented accuracy.

- Comprehensive Customer Profiles: Big data analytics allows banks to create detailed profiles for each customer, encompassing transaction histories, spending habits, savings patterns, and engagement across various channels. This holistic view helps banks tailor their services to meet individual needs effectively.

- Identifying Patterns and Trends: By analyzing aggregated data, banks can identify broader patterns, such as popular transaction times, frequently used services, or preferred communication channels. These insights inform strategic decisions and help enhance the omnichannel experience.

- Enhanced Customer Engagement: Omnichannel banking trends thrive on personalization, and big data is a key enabler. For example, a bank might identify a customer’s preference for digital channels and prioritize communication through mobile apps or email, ensuring a seamless and satisfying experience.

By integrating big data analytics into their omnichannel strategies, banks can provide more relevant and engaging services, fostering stronger relationships with their customers.

Predictive Modeling for Personalized Financial Planning and Risk Assessment

Predictive modeling, a key component of data-driven banking, uses advanced algorithms to forecast customer needs and financial outcomes based on historical data and behavioral patterns. Within the context of omnichannel banking trends, predictive modeling enhances personalization and supports proactive service delivery.

- Customized Financial Planning: Predictive models can anticipate a customer’s financial needs, such as saving for a major purchase, planning for retirement, or managing unexpected expenses. Banks can use these insights to offer tailored solutions, such as investment options, savings plans, or insurance products, across all channels.

- Early Risk Detection: Predictive analytics is instrumental in identifying potential financial risks, both for customers and the bank. For instance, a sudden change in spending patterns might indicate financial distress, prompting the bank to offer support, such as flexible repayment plans or financial counseling.

- Optimized Lending Decisions: By analyzing credit histories, transaction data, and other factors, predictive models help banks assess the likelihood of loan repayments. This enables banks to extend credit responsibly while reducing default risks.

- Dynamic Customer Recommendations: Predictive modeling ensures that recommendations evolve with the customer’s circumstances. For example, as a customer’s income increases, the bank might suggest higher-yield investment opportunities or premium services.

Predictive modeling empowers banks to move beyond reactive service delivery, aligning with omnichannel banking trends by proactively addressing customer needs in real time.

Real-Time Data Insights Enabling Banks to Adapt Services Promptly

Real-time data insights are critical to the success of omnichannel banking trends, enabling banks to respond to customer needs and market changes instantly. By leveraging real-time analytics, banks can ensure that their services remain relevant, timely, and effective across all channels.

- Immediate Customer Support: Real-time data allows banks to identify and resolve customer issues as they arise. For instance, if a customer’s transaction is flagged for unusual activity, the bank can notify the customer instantly through a mobile app, SMS, or email, minimizing inconvenience and building trust.

- Dynamic Personalization: Real-time insights enable banks to tailor their offerings on the fly. For example, if a customer frequently uses their mobile app for transactions, the bank might offer app-exclusive discounts or features to enhance engagement.

- Operational Efficiency: Real-time analytics optimize back-end operations by identifying bottlenecks and inefficiencies. For instance, monitoring ATM usage data in real time allows banks to ensure cash availability, reducing downtime and improving customer satisfaction.

- Market Responsiveness: Real-time data also supports market analysis, enabling banks to adapt quickly to economic changes or emerging customer trends. This agility is essential for staying competitive in a fast-evolving financial landscape.

By integrating real-time data insights into their omnichannel strategies, banks can enhance both customer experiences and operational performance, ensuring they remain at the forefront of innovation.

Strategic Impact of Data-Driven Banking on Omnichannel Banking Trends

Data-driven banking is more than a technological innovation—it is a strategic imperative for financial institutions navigating the complexities of omnichannel banking trends. The ability to leverage big data, predictive modeling, and real-time insights offers several key advantages:

- Enhanced Personalization: Data-driven strategies ensure that every customer interaction is relevant, consistent, and meaningful, regardless of the channel used.

- Proactive Problem Solving: Predictive analytics and real-time insights enable banks to address customer needs before they become problems, fostering trust and loyalty.

- Competitive Differentiation: Banks that excel in data-driven banking position themselves as leaders in innovation, attracting tech-savvy customers who value personalized and seamless experiences.

- Operational Excellence: Real-time data analytics streamline operations, reduce costs, and improve decision-making, ensuring banks can deliver high-quality services efficiently.

As data-driven banking continues to evolve, it will remain a cornerstone of omnichannel banking trends, driving innovation and ensuring that financial institutions meet the ever-changing demands of their customers. By investing in advanced analytics and predictive technologies, banks can unlock new opportunities, create value, and build stronger connections with their audiences.

Seamless Cross-Channel Experiences

Seamless cross-channel experiences have become a cornerstone of omnichannel banking trends, reflecting the growing demand for unified, personalized, and efficient interactions across all customer touchpoints. Whether engaging with a mobile app, visiting a branch, or accessing an online portal, customers expect consistent and synchronized services. The integration of data, technology, and communication channels is critical for meeting these expectations, ensuring that every interaction contributes to a cohesive customer journey. This section explores the significance of seamless cross-channel experiences in omnichannel banking trends and highlights the pivotal role of CRM systems in delivering these experiences.

Importance of Providing a Unified Experience Across Online, In-Branch, and Mobile Channels

A seamless cross-channel experience ensures that customers can switch between banking channels effortlessly while maintaining continuity in their interactions. This is a defining feature of omnichannel banking trends, as it prioritizes customer convenience and fosters loyalty by eliminating friction.

- Consistency Across Channels: A unified experience ensures that customers receive the same level of service regardless of the channel they choose. For instance, a customer initiating a mortgage application online should be able to continue the process seamlessly at a branch without repeating information. This consistency builds trust and reinforces the bank’s commitment to customer satisfaction.

- Enhanced Accessibility: Seamless cross-channel experiences make banking more accessible to diverse demographics. A customer who prefers mobile banking for everyday transactions can still rely on in-branch services for complex queries, with both channels working in harmony to meet their needs.

- Personalized Interactions: By integrating customer data across channels, banks can provide personalized services that reflect individual preferences and behaviors. For example, a customer who frequently engages with financial planning tools on the bank’s website might receive tailored investment advice during an in-branch consultation or through a mobile notification.

- Improved Customer Retention: Omnichannel banking trends emphasize the importance of customer retention through superior service delivery. Seamless experiences reduce frustration and encourage customers to engage with the bank across multiple platforms, fostering long-term loyalty.

By prioritizing a unified approach, banks can align their services with the principles of omnichannel banking trends, ensuring that every interaction enhances the overall customer journey.

Role of CRM Systems in Integrating Customer Interactions and Data for Consistent Service

Customer relationship management (CRM) systems are integral to achieving seamless cross-channel experiences, as they enable banks to centralize, organize, and leverage customer data effectively. These systems are a key driver of omnichannel banking trends, ensuring that customer interactions are informed, relevant, and consistent.

- Centralized Customer Data: CRM systems act as a single source of truth, consolidating customer data from various touchpoints, such as mobile apps, branches, and online platforms. This centralized approach ensures that bank representatives have access to up-to-date information, enabling personalized and efficient interactions.

- Real-Time Data Synchronization: Omnichannel banking trends thrive on real-time updates. CRM systems synchronize data instantly, ensuring that changes made in one channel are reflected across all others. For example, if a customer updates their contact details via the mobile app, the new information is immediately available to branch staff and call center agents.

- Enhanced Customer Insights: By analyzing data within CRM systems, banks gain valuable insights into customer behaviors, preferences, and needs. These insights enable proactive service delivery, such as offering tailored financial products or addressing potential issues before they escalate.

- Automated Workflows: CRM systems streamline operations by automating routine tasks, such as sending reminders for upcoming payments or generating follow-up emails after customer inquiries. This automation supports the seamless delivery of services across channels, enhancing efficiency and consistency.

- Empowering Frontline Staff: CRM systems equip branch staff, call center agents, and digital support teams with the tools they need to provide exceptional service. For instance, a CRM system can display a customer’s recent interactions, enabling staff to address inquiries with context and precision.

Through the effective use of CRM systems, banks can align their operations with omnichannel banking trends, ensuring that every customer interaction contributes to a seamless and satisfying experience.

Strategic Impact of Seamless Cross-Channel Experiences on Omnichannel Banking Trends

Seamless cross-channel experiences offer significant strategic advantages for banks, reinforcing their position as customer-centric and innovative financial institutions.

- Elevating Customer Satisfaction: By eliminating friction and ensuring consistency, seamless cross-channel experiences create a sense of reliability and convenience, boosting customer satisfaction and loyalty.

- Strengthening Brand Identity: A unified approach to service delivery reflects positively on the bank’s brand, demonstrating its commitment to excellence and technological advancement.

- Optimizing Operational Efficiency: Integrating data and interactions through CRM systems reduces redundancies and streamlines workflows, improving overall efficiency and reducing costs.

- Driving Competitive Advantage: Banks that excel in providing seamless experiences stand out in a crowded market, attracting and retaining customers who prioritize convenience and consistency.

As omnichannel banking trends continue to evolve, the ability to deliver seamless cross-channel experiences will remain a critical differentiator. By investing in the technologies and strategies necessary to achieve this, banks can ensure that their services meet the demands of modern customers, creating a competitive edge in an increasingly digital landscape.

Voice and Conversational Banking

Voice and conversational banking are rapidly emerging as transformative elements within omnichannel banking trends, revolutionizing how customers interact with financial institutions. The integration of voice assistants and conversational AI is enabling banks to offer seamless, intuitive, and hands-free experiences that align with the needs of modern customers. From simplifying routine tasks to enhancing accessibility for diverse user groups, voice and conversational banking are redefining the concept of convenience in the banking sector. This section delves into the role of voice technology in driving omnichannel banking trends and its impact on customer engagement and satisfaction.

Rise of Voice Assistants Like Alexa and Siri Enabling Convenient Banking Interactions

Voice assistants such as Alexa, Siri, and Google Assistant have become integral to the daily lives of millions of users, offering a natural and efficient way to access information and perform tasks. Banks are leveraging these technologies to provide voice-enabled banking solutions that enhance customer experiences and streamline interactions.

- Hands-Free Banking Transactions: Voice assistants allow customers to perform essential banking functions, such as checking account balances, reviewing recent transactions, and making payments, without manually navigating through apps or websites. This hands-free functionality is particularly useful for multitasking users or those with physical disabilities.

- Seamless Integration with Existing Ecosystems: By integrating with widely used voice platforms, banks ensure that customers can access banking services through familiar interfaces. For example, a customer can ask Alexa to transfer funds between accounts or inquire about the latest interest rates, creating a frictionless experience.

- Time-Saving Convenience: Voice banking reduces the time spent on routine tasks by allowing customers to use conversational commands. For instance, instead of navigating through multiple screens to find account details, a simple voice query like “What’s my account balance?” delivers instant results.

The adoption of voice assistants in banking reflects the core principles of omnichannel banking trends: providing convenient, accessible, and integrated services that align with customer preferences.

Integration of Conversational AI for Tasks Like Balance Inquiries, Fund Transfers, and Financial Advice

Conversational AI builds on the capabilities of voice technology, enabling banks to offer more dynamic and personalized interactions. These AI-driven solutions combine natural language processing (NLP) and machine learning to understand and respond to customer queries effectively.

- Streamlining Routine Inquiries: Conversational AI simplifies tasks such as checking balances, tracking spending, or setting up bill payments. Customers can engage with chatbots or voice-enabled systems that respond in real time, ensuring a seamless experience across channels.

- Facilitating Complex Transactions: Beyond basic inquiries, conversational AI can guide customers through more intricate processes, such as applying for loans or transferring funds to international accounts. These systems provide step-by-step assistance, ensuring accuracy and reducing errors.

- Offering Financial Advice: AI-driven systems can analyze customer data to deliver tailored financial recommendations. For example, a conversational AI could suggest savings plans, investment options, or credit card upgrades based on a customer’s spending habits and financial goals.

- Multi-Language Support: Conversational AI often includes multilingual capabilities, making banking services accessible to a broader audience. This aligns with omnichannel banking trends by ensuring inclusivity and convenience for customers across different demographics.

The integration of conversational AI into banking channels not only enhances efficiency but also deepens customer engagement, making it a critical aspect of omnichannel banking trends.

Potential of Voice Technology in Increasing Accessibility and User Satisfaction

Voice technology holds immense potential for making banking services more accessible and user-friendly, particularly for underserved populations and individuals with disabilities. This aligns with the inclusive nature of omnichannel banking trends, which aim to provide equitable access to financial services.

- Improving Accessibility for All Users: Voice-enabled banking services cater to individuals with visual impairments, mobility challenges, or limited digital literacy. By offering an intuitive interface, voice technology ensures that these users can perform banking tasks independently and confidently.

- Enhancing Customer Satisfaction: The convenience of voice technology contributes significantly to customer satisfaction. Hands-free capabilities and instant responses eliminate common pain points, such as long wait times or complex navigation, fostering a positive user experience.

- Expanding Service Reach: Voice technology allows banks to extend their reach to customers in remote areas with limited access to physical branches or high-speed internet. By enabling voice interactions through basic devices, banks can bring essential services to underserved communities.

- Building Emotional Connection: Voice and conversational AI systems often simulate human-like interactions, creating a sense of personal connection. This emotional resonance can strengthen customer relationships and loyalty, reflecting the goals of omnichannel banking trends.

Strategic Impact of Voice and Conversational Banking on Omnichannel Banking Trends

Voice and conversational banking are more than just convenient tools; they represent a strategic evolution in the way banks deliver services and engage with customers. Their impact on omnichannel banking trends includes:

- Creating Differentiated Experiences: By adopting voice and conversational technologies, banks can offer unique and highly personalized experiences that set them apart from competitors.

- Enhancing Operational Efficiency: Automating routine interactions with voice assistants and conversational AI reduces the workload for customer service teams, enabling banks to allocate resources more effectively.

- Driving Customer Loyalty: The convenience and accessibility of voice-enabled banking build trust and satisfaction, fostering long-term customer relationships.

- Supporting Future Innovations: As voice technology evolves, its integration with other advancements like predictive analytics and IoT will further enhance omnichannel banking trends, ensuring that banks remain at the forefront of innovation.

Voice and conversational banking are transforming the financial services landscape by aligning with the principles of omnichannel banking trends: convenience, personalization, and inclusivity. As these technologies continue to advance, they will play an increasingly central role in shaping the future of customer engagement and satisfaction in the banking industry. Financial institutions that invest in and refine voice and conversational banking solutions are poised to meet the demands of a tech-savvy and diverse customer base, securing their position as leaders in the digital era.

Focus on Cybersecurity

As digital transformation accelerates within the financial sector, cybersecurity has become a critical element of omnichannel banking trends. With banks adopting advanced technologies to deliver seamless, integrated experiences across multiple channels, ensuring the security of these platforms is paramount. Cybersecurity is no longer just a back-end necessity—it is a strategic priority that underpins customer trust, operational integrity, and regulatory compliance. This section explores how cybersecurity trends are shaping the future of omnichannel banking, focusing on multi-factor authentication, AI-driven fraud prevention, and the delicate balance between robust security and user convenience.

Deployment of Multi-Factor Authentication and Biometrics to Secure Omnichannel Banking Platforms

Multi-factor authentication (MFA) and biometric technologies are becoming the gold standard for securing omnichannel banking platforms. These measures provide an additional layer of protection, ensuring that only authorized users can access sensitive accounts and services.

- Multi-Factor Authentication Across Channels: MFA requires users to verify their identity through multiple methods, such as a password, a one-time PIN sent to a registered device, or a biometric scan. This approach significantly reduces the risk of unauthorized access, especially in a landscape where phishing attacks and credential theft are on the rise. By deploying MFA across mobile apps, online portals, and in-branch systems, banks align their security protocols with the principles of omnichannel banking trends.

- Biometric Authentication for Enhanced Security: Biometric technologies such as fingerprint scanning, facial recognition, and voice authentication are gaining traction as secure and user-friendly alternatives to traditional passwords. These systems leverage unique physical or behavioral characteristics, making them nearly impossible to replicate. For example, a customer logging into their banking app can use facial recognition to gain instant access, bypassing the need for cumbersome passwords.

- Consistency Across Touchpoints: One of the defining aspects of omnichannel banking trends is consistency, and security measures like MFA and biometrics ensure that this extends to authentication. Whether a customer accesses their account via a mobile app or in-branch kiosk, the security protocols remain uniform, reinforcing trust and reliability.

By incorporating MFA and biometrics, banks can enhance the security of their platforms while maintaining the seamless experiences that define omnichannel banking trends.

Implementing AI-Driven Systems to Detect and Prevent Fraudulent Activities

The rise of omnichannel banking trends has expanded the attack surface for cybercriminals, making fraud prevention a top priority for financial institutions. AI-driven systems are proving invaluable in detecting and preventing fraudulent activities, leveraging advanced algorithms to identify anomalies and mitigate risks in real time.

- Real-Time Fraud Detection: AI systems analyze vast amounts of transaction data to identify unusual patterns or behaviors that may indicate fraud. For instance, an AI system might flag a sudden, high-value transaction made from an unfamiliar location as suspicious, triggering an alert or temporarily halting the transaction for verification.

- Behavioral Analysis for Risk Assessment: AI-driven tools can monitor customer behavior across channels to build detailed risk profiles. By understanding what constitutes “normal” activity for each user, these systems can quickly identify deviations, such as an unusually large withdrawal or multiple failed login attempts.

- Proactive Threat Mitigation: Beyond detecting fraud, AI systems can predict potential vulnerabilities and recommend preemptive measures. For example, an AI tool might identify patterns in phishing attempts targeting specific customer demographics and suggest targeted security updates or awareness campaigns.

- Reducing False Positives: Traditional fraud detection systems often generate false positives, inconveniencing customers and straining support teams. AI-driven systems minimize this issue by using machine learning to refine their accuracy over time, ensuring that legitimate transactions proceed smoothly.

The integration of AI in fraud prevention aligns seamlessly with omnichannel banking trends, as it enables banks to secure their platforms while maintaining the speed and convenience customers expect.

Balancing User Convenience with Robust Security Measures to Protect Customer Data

One of the most challenging aspects of cybersecurity in omnichannel banking trends is balancing the need for robust security with the demand for user-friendly experiences. Customers expect frictionless interactions, but security measures that are too intrusive or complex can lead to frustration and abandonment.

- Streamlined Authentication Processes: Security measures such as biometric authentication and single sign-on (SSO) strike a balance between convenience and protection. For example, a customer might use a fingerprint scan to log into a mobile app and access all linked services without re-authenticating for each task.

- Transparency in Security Protocols: Customers are more likely to embrace security measures when they understand their purpose and benefits. Banks can build trust by clearly communicating how data is protected and why specific authentication steps are necessary.

- Adaptive Security Models: Adaptive security systems adjust their protocols based on the user’s behavior and risk level. For instance, a customer accessing their account from a trusted device may encounter minimal security checks, while an unfamiliar device might trigger additional verifications. This dynamic approach ensures that security is both responsive and unobtrusive.

- Investing in Customer Education: Educating customers about best practices, such as recognizing phishing attempts or creating strong passwords, empowers them to play an active role in maintaining security. This collaboration reinforces the protective framework of omnichannel banking trends.

Balancing security and convenience is essential for ensuring that omnichannel banking platforms remain both user-friendly and resilient against threats. By adopting customer-centric approaches to cybersecurity, banks can protect sensitive data without compromising the seamless experiences that define omnichannel banking trends.

Strategic Impact of Cybersecurity on Omnichannel Banking Trends

The focus on cybersecurity is not just a technical requirement but a strategic imperative for banks operating within the framework of omnichannel banking trends. Its impact includes:

- Building and Sustaining Customer Trust: Robust security measures reassure customers that their data and finances are safe, fostering loyalty and long-term engagement.

- Meeting Regulatory Requirements: Adhering to data protection laws and industry standards demonstrates a commitment to compliance, reducing the risk of legal and financial penalties.

- Enhancing Operational Resilience: Proactive cybersecurity measures minimize the impact of cyberattacks, ensuring that services remain operational and customer experiences are uninterrupted.

- Driving Competitive Advantage: Banks that excel in cybersecurity position themselves as trustworthy and innovative, attracting customers who prioritize safety and reliability.

As cyber threats evolve, the emphasis on cybersecurity within omnichannel banking trends will only grow. Financial institutions that prioritize cutting-edge technologies and customer-focused strategies will be well-equipped to navigate the complexities of the digital banking landscape, delivering secure and seamless experiences that set them apart in an increasingly competitive market.

ESG (Environmental, Social, and Governance) Banking

In recent years, environmental, social, and governance (ESG) principles have become integral to the strategies of financial institutions worldwide. These principles emphasize sustainability, inclusivity, and ethical governance, aligning closely with evolving customer expectations and regulatory pressures. Omnichannel banking trends are playing a pivotal role in the integration of ESG values into banking operations. By leveraging technology and innovation, banks are adopting paperless processes, promoting eco-friendly practices, and implementing inclusive financial solutions that cater to underserved populations. This section explores how ESG banking aligns with omnichannel banking trends and its impact on the financial sector.

How Omnichannel Platforms Enable Paperless Banking and Eco-Friendly Practices

One of the most tangible ways omnichannel banking trends contribute to ESG objectives is by enabling paperless operations and promoting environmentally conscious practices. By digitizing processes and reducing the reliance on physical resources, banks can minimize their carbon footprint while enhancing operational efficiency.

- Digital Documentation and Transactions: Omnichannel platforms allow customers to complete transactions, open accounts, and sign documents electronically, eliminating the need for paper forms. For instance, loan applications can be processed entirely online, with customers uploading digital documents and signing agreements through secure e-signature tools. This shift reduces waste and streamlines workflows.

- e-Statements and Notifications: Paperless statements and digital notifications are now standard offerings in most omnichannel banking ecosystems. By delivering account summaries, transaction alerts, and promotional updates via email or mobile apps, banks save on printing and mailing costs while supporting environmental sustainability.

- Remote and Mobile Banking Services: Omnichannel banking trends have made it possible for customers to manage their finances without visiting a branch. This reduces the environmental impact associated with travel and physical infrastructure while improving accessibility.

- Eco-Friendly Payment Solutions: Digital payment systems, such as mobile wallets and contactless cards, further reduce the need for physical checks and cash transactions, supporting greener financial ecosystems.

By integrating these eco-friendly practices, banks align with both ESG goals and omnichannel banking trends, demonstrating their commitment to sustainability and innovation.

Incorporating Social Responsibility Through Inclusive Banking Solutions

In addition to environmental initiatives, omnichannel banking trends support social responsibility by fostering financial inclusion and delivering equitable services to all customers. This alignment with ESG principles ensures that banking services are accessible to underserved communities and individuals.

- Reaching Underserved Populations: Omnichannel platforms enable banks to extend their reach to remote and rural areas through digital channels. Mobile banking apps and agent networks provide essential financial services, such as savings accounts and microloans, to populations that lack access to traditional banking infrastructure.

- Catering to Diverse Customer Needs: Omnichannel banking trends emphasize inclusivity by offering multi-language support, user-friendly interfaces, and accessibility features for individuals with disabilities. For example, voice-enabled banking services cater to visually impaired customers, ensuring equitable access to financial tools.

- Promoting Financial Literacy: Many banks use omnichannel platforms to deliver educational content, such as tutorials on saving, investing, and budgeting. These initiatives empower customers to make informed financial decisions, reducing economic disparities.

- Customized Products for Social Impact: Banks are increasingly offering products that align with ESG goals, such as green loans for renewable energy projects or impact investment funds. Omnichannel platforms ensure these products are easily accessible to customers, with personalized recommendations based on their preferences and goals.

Through these inclusive banking solutions, financial institutions can address social inequalities and build stronger relationships with their customers, aligning with the broader objectives of omnichannel banking trends.

Strategic Impact of ESG Banking on Omnichannel Banking Trends

The integration of ESG principles into omnichannel banking trends represents a significant shift in how financial institutions operate, providing both ethical and strategic benefits.

- Enhancing Brand Reputation: By adopting eco-friendly and socially responsible practices, banks can position themselves as forward-thinking and ethical organizations, appealing to environmentally and socially conscious customers.

- Driving Customer Loyalty: Customers increasingly prefer to engage with brands that share their values. ESG banking initiatives reinforce trust and loyalty, particularly among younger demographics that prioritize sustainability.

- Meeting Regulatory Requirements: Adhering to ESG standards ensures compliance with evolving regulations, reducing the risk of legal penalties and enhancing operational resilience.

- Creating Long-Term Value: By focusing on sustainability and inclusivity, banks contribute to broader societal goals while unlocking new business opportunities, such as green financing and impact investments.

As ESG principles gain prominence, their integration with omnichannel banking trends will continue to evolve. Future developments may include AI-driven sustainability metrics, blockchain-enabled transparency in ESG investments, and expanded access to green financial products. By embracing these innovations, financial institutions can strengthen their commitment to ESG values while delivering seamless and impactful services to their customers. ESG banking is not just a trend—it is a transformative approach that aligns ethical responsibility with the technological advancements of omnichannel banking trends.

Banking for the Underserved

One of the most impactful aspects of omnichannel banking trends is their potential to address financial inequality by extending services to underserved and remote populations. These trends leverage technology to create accessible and inclusive banking ecosystems, bridging gaps for individuals who traditionally lacked access to financial institutions. By integrating mobile banking solutions, agent networks, and digital inclusion strategies, banks are fostering economic empowerment and driving social change. This section explores how omnichannel banking trends are transforming the landscape for underserved communities and their broader impact on financial inclusion.

Leveraging Omnichannel Platforms to Provide Financial Services to Remote and Underserved Populations

Omnichannel banking trends have revolutionized how financial services are delivered, particularly in regions where traditional banking infrastructure is scarce. By integrating multiple touchpoints—such as mobile apps, online platforms, and agent-assisted services—banks can reach remote populations while maintaining consistent and efficient service delivery.

- Expanding Reach Through Digital Channels: Omnichannel platforms enable banks to offer services such as account opening, savings deposits, and microloans to individuals in remote areas. Customers can access these services through mobile apps or community-based agent networks, eliminating the need for physical branches.

- Facilitating Seamless Customer Journeys: For underserved populations, a seamless experience across channels is crucial. For example, a customer might start a loan application through a mobile app and finalize the process with assistance from a local agent, ensuring convenience and accessibility.

- Overcoming Physical Barriers: By digitizing core services, omnichannel banking trends remove the barriers of distance and limited infrastructure. A farmer in a remote village, for instance, can manage their finances, apply for a loan, or receive payments digitally without traveling to the nearest bank branch.

- Catering to Diverse Needs: Omnichannel platforms allow banks to customize their offerings based on the unique needs of underserved populations. This includes providing multilingual interfaces, intuitive designs for first-time users, and localized services tailored to specific communities.

By leveraging omnichannel platforms, banks can address the financial needs of underserved populations effectively, contributing to economic development and reducing inequality.

Role of Mobile Banking in Bridging Financial Gaps Through Agent Networks and Digital Inclusion