This part brings theory to life through real-world case studies that define AI for B2C excellence. From Amazon’s recommendation engine and Sephora’s virtual artist to Capital One’s chatbot Eno and Netflix’s recommendation system, these stories prove that intelligence is the new competitive advantage. Each case showcases how strategy, technology, and measurable outcomes combine to elevate customer satisfaction and business performance. The diversity of these examples shows that AI for B2C is not limited to one industry or company size—it’s a scalable framework adaptable to different consumer touchpoints. These successes also highlight what’s next: the move toward generative AI, system-wide deployment, and ethical scaling. As you continue to Part 3: Generative AI and Future Outlook for B2C, you’ll discover how businesses can operationalize these innovations sustainably while maintaining transparency, data integrity, and trust. For context on the conceptual backbone behind these examples, you can revisit Part 1: Foundations and Applications Across the B2C Journey to connect insight with implementation.

One of the best ways to understand the impact of AI for B2C is to look at how it is being applied across industries. While theoretical explanations highlight potential, real-world implementations demonstrate tangible value. In sectors such as retail and eCommerce, banking and finance, travel and hospitality, and entertainment and media, AI for B2C has already redefined customer experiences, streamlined operations, and created new opportunities for growth. These examples showcase how different industries adapt AI technologies to meet their unique consumer demands while sharing the same underlying goals: personalization, efficiency, and long-term loyalty.

Retail & eCommerce

Retail and eCommerce are perhaps the most visible and advanced adopters of AI for B2C. The highly competitive nature of the industry, combined with constantly evolving consumer preferences, has driven companies to leverage AI aggressively. From personalized shopping recommendations to intelligent inventory management, AI for B2C has become integral to the digital shopping journey.

Amazon – Recommendation Engine Strategy

When discussing AI for B2C in retail and eCommerce, Amazon inevitably becomes the most prominent example. As the largest online marketplace in the world, Amazon serves millions of customers daily and processes billions of product interactions every month. Managing such scale with conventional tools would be impossible. Instead, Amazon has relied on AI for B2C, particularly through its sophisticated recommendation engine, to personalize the shopping experience for each consumer.

The recommendation engine at Amazon has become the benchmark for personalization in eCommerce. It does not simply suggest random products but leverages complex algorithms to anticipate what each shopper is likely to buy next. From the “Customers who bought this item also bought” carousel to personalized email campaigns and home page recommendations, AI for B2C is deeply embedded into Amazon’s user experience. This system has not only driven massive revenue growth but also fundamentally shaped how consumers expect digital retail platforms to operate.

Strategy

Amazon’s recommendation engine strategy is built on three key pillars: data collection, algorithmic modeling, and personalized delivery. Each of these elements showcases the power of AI for B2C to transform raw consumer data into actionable insights.

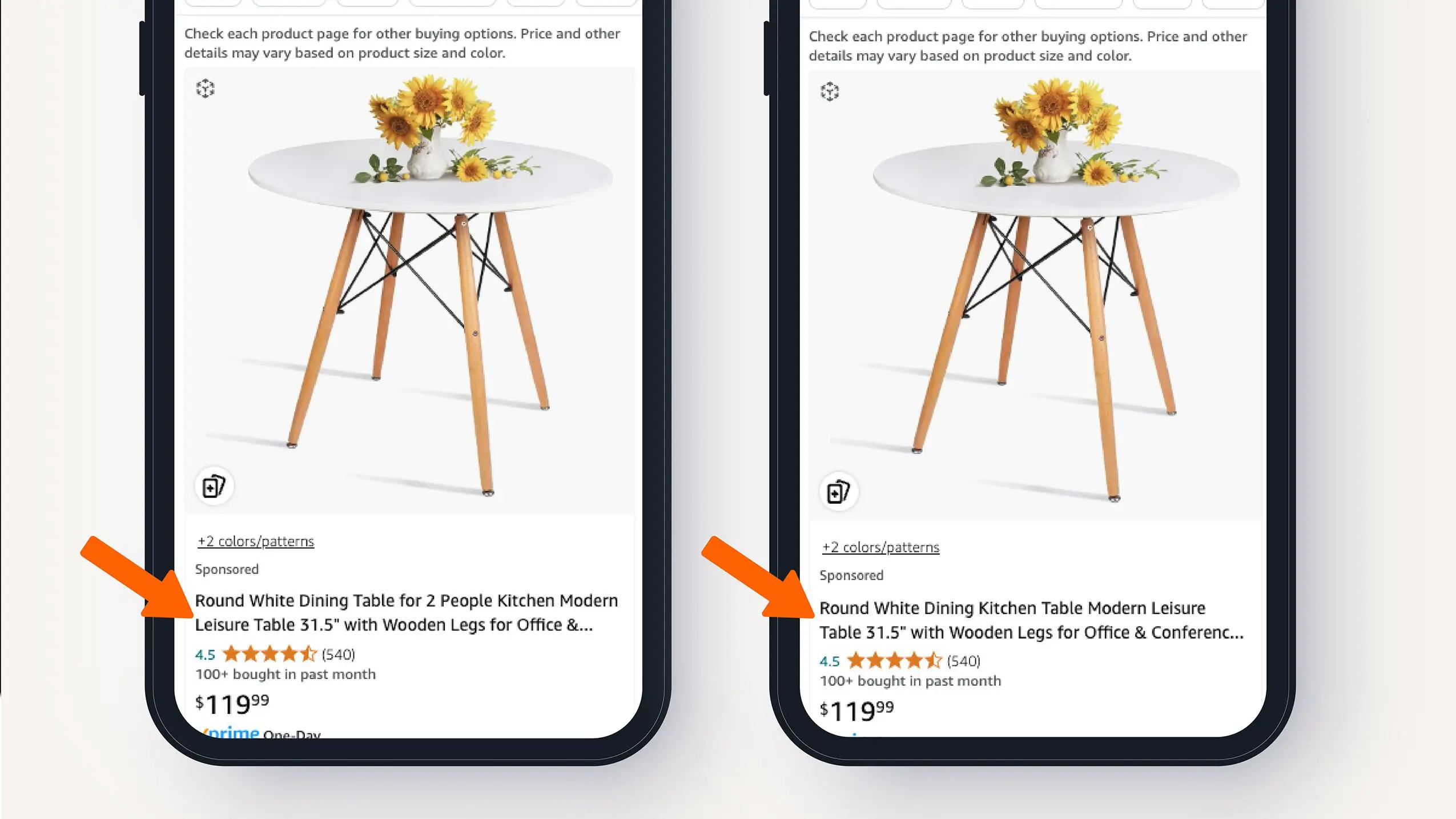

- Data Collection: At the foundation of Amazon’s strategy is its ability to collect enormous amounts of consumer data. Every click, search query, purchase, review, and even time spent on a product page feeds into the AI for B2C ecosystem. This data creates a comprehensive profile of each shopper, enabling the system to track evolving preferences. Unlike traditional retailers who rely primarily on purchase data, Amazon captures pre-purchase intent through browsing patterns, wish lists, and abandoned carts.

- Algorithmic Modeling: Amazon applies advanced machine learning techniques such as collaborative filtering, deep learning, and natural language processing to analyze consumer data. Collaborative filtering identifies patterns among users with similar interests, suggesting products based on what others in the same group have purchased. Deep learning models further refine these recommendations by recognizing subtle patterns in consumer behavior. Natural language processing, meanwhile, helps the system interpret search queries and reviews to better understand context and sentiment. AI for B2C at Amazon also extends to predictive analytics. By analyzing seasonal trends, historical data, and real-time activity, the system forecasts what products will be in high demand. This allows Amazon to not only recommend products but also adjust inventory and logistics accordingly, creating a seamless link between personalization and supply chain optimization.

- Personalized Delivery: The final stage of Amazon’s strategy is delivering recommendations in a way that feels natural and valuable to consumers. AI for B2C ensures that recommendations appear across multiple touchpoints: on product pages, in shopping carts, within email newsletters, and on the Amazon app home screen. These recommendations are not static but adapt in real time as consumers interact with the platform. For example, if a shopper is browsing for camping gear, the recommendation engine may suggest tents, sleeping bags, and portable stoves. If that same shopper later shifts interest toward hiking boots, the recommendations instantly adapt. This level of responsiveness makes the shopping experience fluid and engaging, ensuring consumers stay longer on the platform and discover more products aligned with their intent.

Outcome & Evaluation

The results of Amazon’s AI for B2C recommendation engine strategy are extraordinary, both in terms of revenue and customer engagement. Industry studies estimate that 30% to 35% of Amazon’s total revenue is directly generated by its recommendation engine. With annual revenues exceeding hundreds of billions of dollars, this means tens of billions are attributable to AI-powered personalization alone.

For consumers, the outcome is a shopping journey that feels effortless. Instead of browsing through millions of items, shoppers are guided toward products that align with their needs and preferences. This reduces decision fatigue and enhances customer satisfaction. Consumers perceive Amazon not merely as a retailer but as a platform that understands their tastes, budgets, and even long-term shopping patterns.

Another significant outcome is improved customer loyalty. AI for B2C at Amazon ensures that shoppers continually return because they trust the platform to simplify discovery. The more a consumer engages with Amazon, the more data the system gathers, and the more accurate the recommendations become. This creates a self-reinforcing cycle where personalization strengthens loyalty, and loyalty generates more data for personalization.

Operationally, Amazon also benefits from improved inventory management. By forecasting demand based on recommendation activity, the company can optimize stock levels across its warehouses. This reduces overstocking and understocking, minimizing costs while ensuring fast delivery. Thus, AI for B2C is not only a tool for sales but also for operational efficiency.

- Strengths

- The most obvious strength is personalization at an unprecedented level. Amazon’s use of AI for B2C has set new industry standards for relevance and convenience. By analyzing both explicit signals (such as purchases) and implicit signals (such as browsing behavior), the system achieves a holistic understanding of consumers.

- Another strength is scalability. Amazon’s recommendation engine is capable of processing billions of data points daily without compromising performance. This demonstrates how AI for B2C can handle personalization at global scale, making it relevant not just for large corporations but also as a model for smaller businesses aiming to grow.

- Finally, Amazon’s strategy illustrates the synergy between customer-facing personalization and backend operations. By connecting recommendations to inventory and logistics, AI for B2C creates an integrated ecosystem that benefits both consumers and the business.

- Challenges

- However, there are challenges. One concern is data privacy. As AI for B2C relies heavily on collecting and analyzing consumer data, questions about transparency and ethical use remain. Consumers are increasingly aware of how their data is used, and companies like Amazon must ensure compliance with regulations such as GDPR and CCPA.

- Another challenge is over-reliance on algorithms. While AI for B2C recommendations are highly effective, they can sometimes create “filter bubbles,” limiting exposure to new or diverse products. This could potentially stifle discovery and innovation if not carefully managed.

- Lastly, the competitive landscape means that other retailers are rapidly adopting similar AI for B2C strategies. Amazon must continue innovating to maintain its leadership, whether through deeper personalization, improved voice commerce, or integration with emerging technologies like augmented reality.

Amazon’s recommendation engine strategy is one of the clearest demonstrations of how AI for B2C can transform retail and eCommerce. Through data-driven personalization, intelligent modeling, and seamless delivery, Amazon has created a system that generates billions in revenue, improves customer satisfaction, and strengthens loyalty. At the same time, it highlights the ethical and operational challenges businesses must address as they scale AI for B2C.

For other companies, Amazon serves as both an inspiration and a roadmap. While not every business has the resources of Amazon, the principles—collecting diverse consumer data, applying advanced algorithms, and delivering personalized experiences—are replicable at different scales. As AI for B2C continues to evolve, the Amazon case demonstrates that personalization is not a luxury but a necessity in the modern digital marketplace.

Sephora – Virtual Artist & Chatbot Customer Service

Sephora, one of the world’s most influential beauty retailers, has long been a leader in embracing digital innovation to enhance customer experiences. With thousands of products across skincare, makeup, fragrance, and haircare, Sephora faces the challenge of guiding customers through a wide and sometimes overwhelming selection. In a market where personalization, instant support, and immersive experiences are critical, Sephora turned to AI for B2C as a strategic solution.

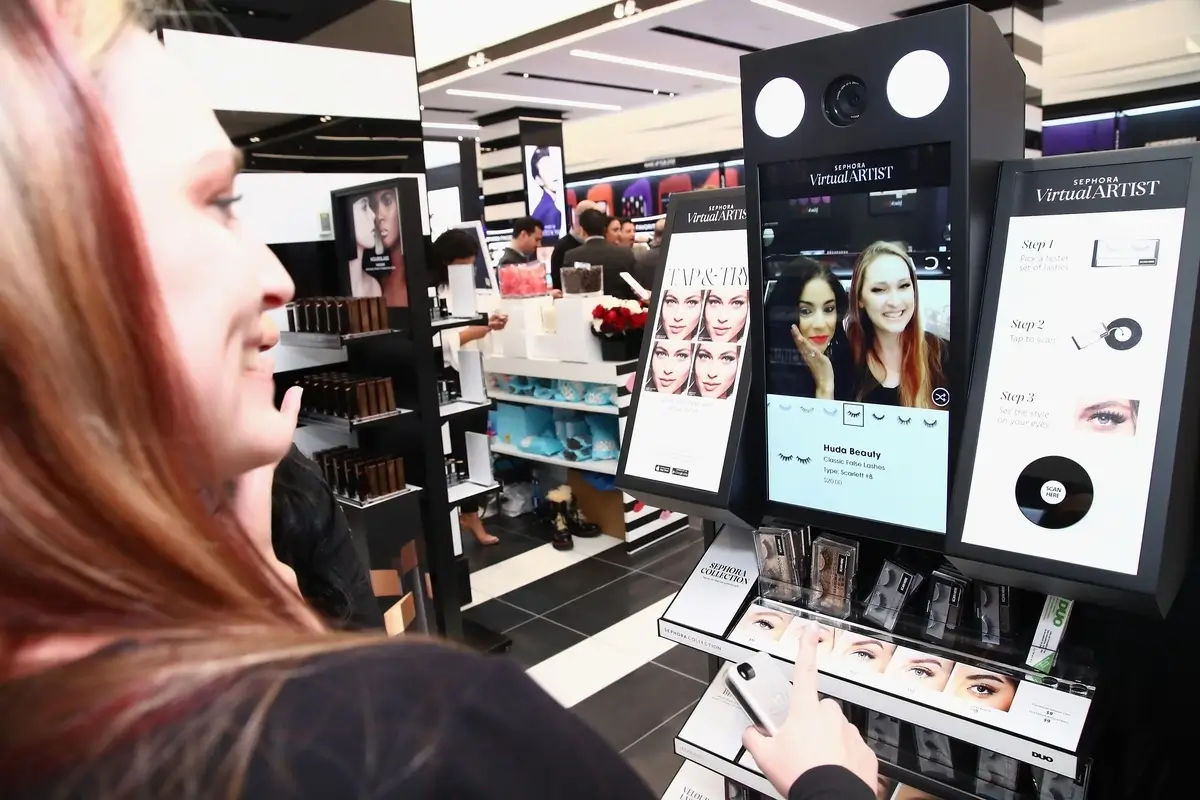

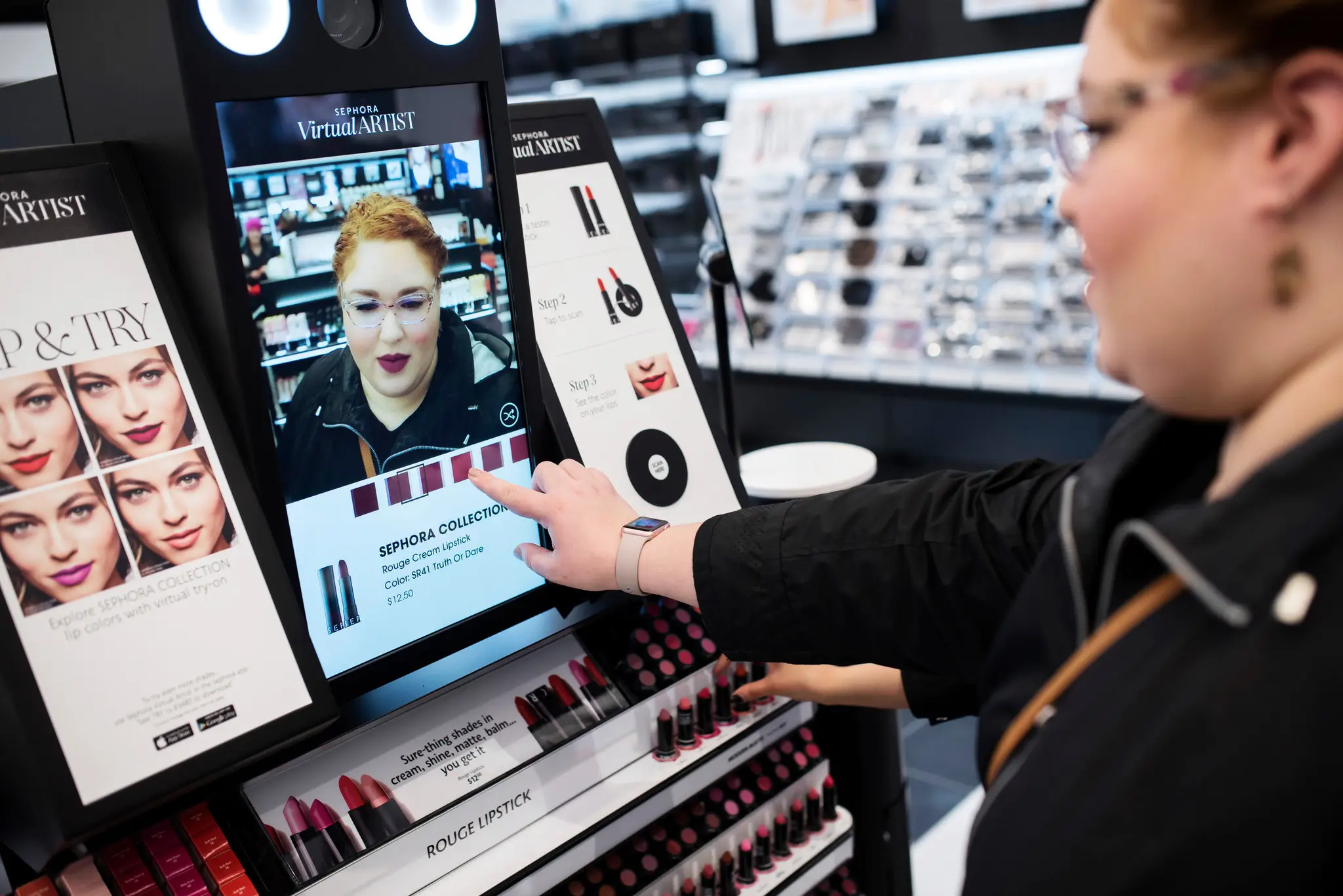

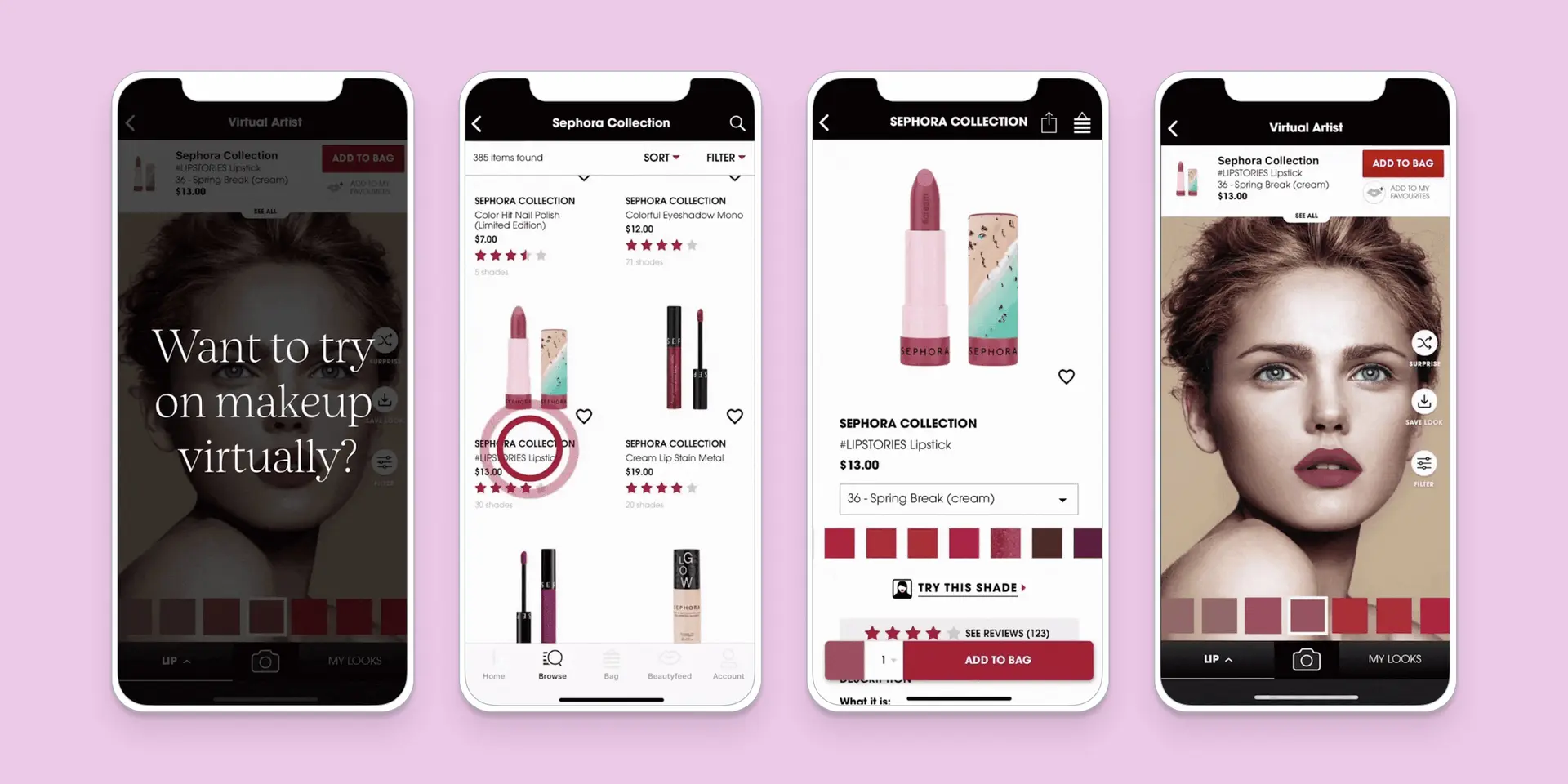

Sephora’s adoption of AI for B2C is exemplified through two flagship innovations: the Sephora Virtual Artist, an augmented reality (AR) powered by computer vision and AI, and Sephora’s chatbot-based customer service solutions. These technologies have redefined how consumers discover, try, and purchase beauty products online and in stores. By combining visual try-on capabilities with conversational support, Sephora creates a highly engaging, personalized, and supportive beauty shopping journey that builds confidence and drives loyalty.

Strategy

Sephora’s strategy in applying AI for B2C revolves around three interconnected goals: empowering customers with personalized product experiences, providing instant and intelligent support, and collecting valuable data to refine business decisions.

- Virtual Artist for Immersive Shopping: The Sephora Virtual Artist leverages AI for B2C and AR to allow customers to try on makeup virtually. By using a smartphone camera or in-store digital mirrors, customers can see how products like lipsticks, foundations, and eyeshadows look on their own faces in real time. Computer vision technology maps facial features with precision, while AI interprets skin tone, lighting conditions, and product characteristics to deliver a realistic try-on experience. This application of AI for B2C solves a long-standing problem in the beauty industry: uncertainty. Consumers are often hesitant to purchase products without testing them first, particularly for items like foundation shades or bold lipstick colors. The Virtual Artist eliminates guesswork, builds confidence, and reduces the likelihood of returns.

- Chatbots for Customer Support: Sephora also deploys chatbots powered by natural language processing to deliver fast and personalized customer service. Through messaging platforms and the Sephora app, these AI for B2C chatbots can answer product-related questions, recommend items based on consumer preferences, and assist with booking in-store services like makeup consultations. Unlike static FAQ pages, Sephora’s chatbots create interactive experiences that mimic conversations with beauty advisors. Customers can ask, “What’s the best foundation for oily skin?” and receive tailored product suggestions supported by explanations. This not only reduces friction in the purchase journey but also makes the experience feel more personalized and human-like.

- Data-Driven Personalization: Behind the scenes, Sephora’s AI for B2C strategy relies on data collection and analysis. Virtual try-ons generate insights into which products consumers experiment with most, while chatbot conversations reveal preferences and concerns. This data feeds into Sephora’s broader personalization ecosystem, enabling the company to refine recommendations, adjust marketing campaigns, and even identify trends for future product development. By aligning the Virtual Artist with chatbots and data analytics, Sephora has created an integrated AI for B2C framework that touches every aspect of the consumer journey, from discovery to purchase and post-sales engagement.

Outcome & Evaluation

The implementation of AI for B2C through the Virtual Artist and chatbots has delivered measurable and impressive results for Sephora, such as:

- Increased Engagement and Conversions: The Sephora Virtual Artist has dramatically increased customer engagement, with millions of users trying out products virtually. Shoppers who use the Virtual Artist spend more time on the platform and are significantly more likely to convert. By reducing uncertainty, AI for B2C has boosted conversion rates for products that traditionally faced high hesitation, such as bold makeup colors or foundations.

- Reduced Product Returns: One of the biggest challenges in eCommerce is product returns, especially in categories like cosmetics where shades and textures matter greatly. By allowing customers to try before they buy, the Virtual Artist reduces mismatches and dissatisfaction. Fewer returns translate into cost savings for Sephora and a more seamless experience for consumers.

- Improved Customer Satisfaction: Chatbots have streamlined Sephora’s customer service, offering instant responses and reducing waiting times. Customers appreciate the convenience of receiving recommendations or support 24/7, whether they are shopping late at night or preparing for a special event. The ability of AI for B2C chatbots to mimic the role of beauty advisors has enhanced customer satisfaction and reinforced Sephora’s reputation for excellence in service.

- Valuable Data for Business Insights: The data generated through these AI for B2C tools has become an asset in its own right. Sephora gains insights into popular shades, trending products, and common customer questions. This helps the brand refine its inventory, plan new product launches, and tailor marketing messages to evolving consumer preferences.

Overall, Sephora has positioned itself as an innovator in applying AI for B2C, using these technologies to not only drive immediate sales but also strengthen long-term brand loyalty.

The evaluation of Sephora’s Virtual Artist and chatbot strategy highlights both the successes and challenges of adopting AI for B2C at scale.

- Strengths

- Enhanced Personalization: Sephora demonstrates the power of AI for B2C in delivering deeply personalized experiences. By combining virtual try-ons with conversational recommendations, the brand ensures that customers feel understood and supported at every step.

- Omnichannel Integration: Sephora successfully integrates AI for B2C across online and offline channels. Customers can use the Virtual Artist both at home and in stores, while chatbots seamlessly connect digital and physical shopping experiences.

- Brand Differentiation: In a crowded beauty market, Sephora’s innovative use of AI for B2C differentiates it as a forward-thinking, customer-centric brand. This innovation enhances its competitive edge against rivals who may still rely on traditional shopping models.

- Operational Efficiency: Chatbots reduce the burden on human customer service agents, lowering costs and enabling staff to focus on more complex queries. Virtual try-ons reduce returns and streamline inventory management.

- Challenges

- Data Privacy Concerns: As with any AI for B2C application, data collection raises privacy issues. Customers may worry about how facial data and chatbot interactions are stored and used. Sephora must ensure strict compliance with data protection regulations to maintain trust.

- Technology Limitations: While advanced, the Virtual Artist is not flawless. Variations in lighting, camera quality, and device performance can affect accuracy. Ensuring consistent results across diverse user environments remains a challenge.

- Over-Reliance on AI: While chatbots handle many queries efficiently, they cannot fully replicate human empathy or expertise. For complex skincare concerns or unique makeup needs, human advisors remain irreplaceable. Sephora must balance automation with personal touch to avoid alienating customers.

- Competitive Pressure: Competitors are rapidly adopting similar AI for B2C technologies. To maintain its leadership, Sephora must continue innovating, integrating emerging technologies such as generative AI for personalized content creation or advanced AR for even more realistic try-ons.

Sephora’s use of AI for B2C through the Virtual Artist and chatbot customer service exemplifies how technology can transform retail and eCommerce. By addressing consumer pain points—uncertainty in product selection and delays in customer support—Sephora has created a shopping experience that is immersive, convenient, and highly personalized. The outcomes include higher engagement, increased conversions, reduced returns, and improved customer satisfaction, all powered by AI for B2C.

The Sephora case underscores the importance of aligning AI for B2C with both consumer needs and business goals. It demonstrates how personalization, convenience, and data insights can be achieved simultaneously when AI technologies are applied strategically. While challenges remain around data privacy, technology accuracy, and balancing automation with human touch, Sephora has set a benchmark for how beauty retailers can integrate AI for B2C successfully.

For other businesses, Sephora’s example offers a roadmap: start by identifying key consumer pain points, implement AI tools that directly address those challenges, and continuously refine strategies through data-driven insights. As AI for B2C continues to evolve, the Sephora model highlights the potential for blending technology and creativity to deliver experiences that are not only efficient but also delightful and emotionally resonant.

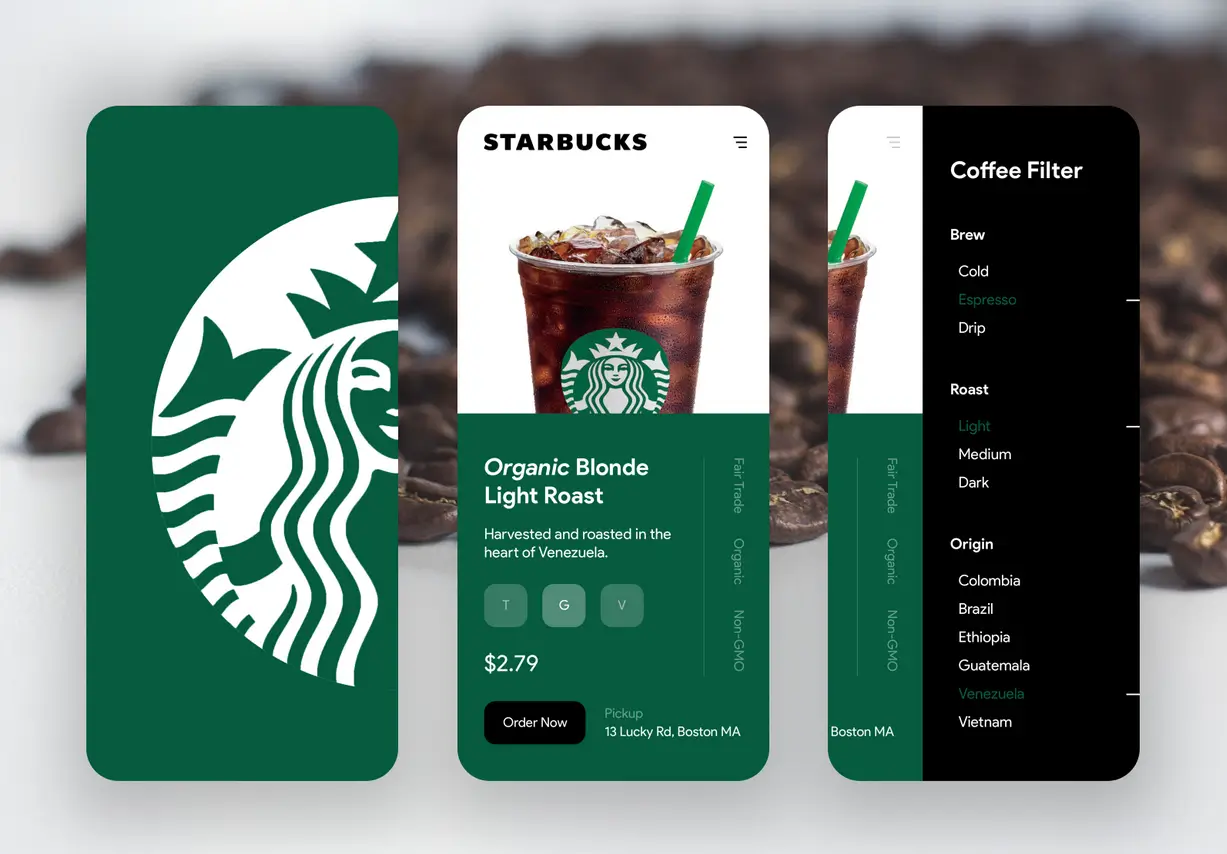

Starbucks – DeepBrew Personalization System

Starbucks is not only one of the world’s largest coffeehouse chains but also one of the most innovative adopters of digital technology in the food and beverage sector. Serving millions of customers across thousands of stores worldwide, Starbucks has long understood that personalization is key to building loyalty. With a product portfolio that allows endless customization—different coffee blends, milk options, flavors, and toppings—Starbucks faced the challenge of delivering individualized experiences at scale.

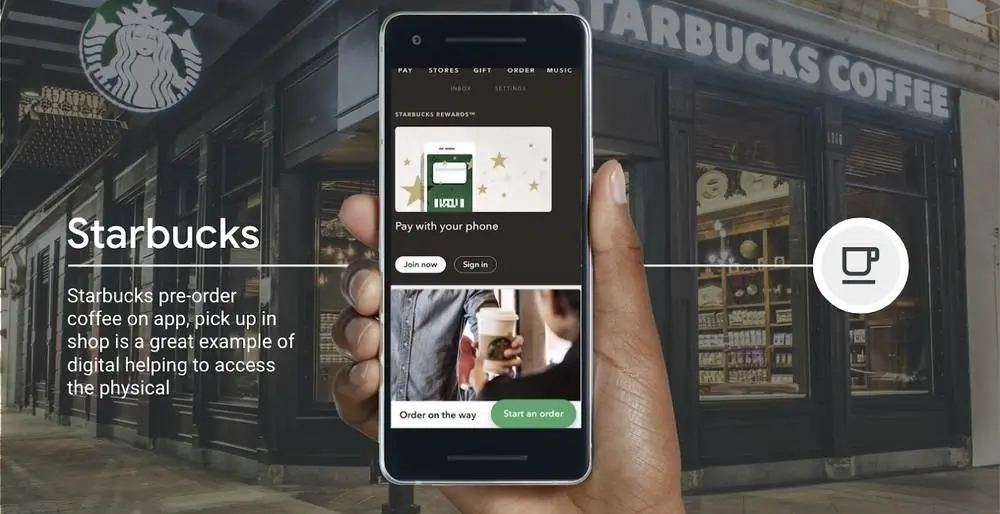

The answer was DeepBrew, Starbucks’ proprietary artificial intelligence platform designed specifically to enhance customer personalization. DeepBrew represents a significant application of AI for B2C, using advanced data analytics and machine learning to understand consumer behavior, predict preferences, and personalize interactions across digital and physical touchpoints. Whether it is recommending a drink through the mobile app, tailoring promotions in loyalty programs, or optimizing in-store operations, DeepBrew showcases how AI for B2C can drive deeper engagement and higher sales.

Strategy

Starbucks’ strategy for implementing DeepBrew revolves around embedding AI for B2C throughout the customer journey. The company designed the system to leverage data from its extensive loyalty program, mobile app, and point-of-sale systems to craft hyper-personalized experiences.

- Data Integration through Loyalty and Mobile Platforms: At the core of DeepBrew’s strategy is Starbucks Rewards, the company’s loyalty program with tens of millions of members. Through this program, Starbucks gathers rich consumer data including purchase history, frequency, favorite stores, seasonal preferences, and spending behavior. When combined with mobile app interactions—such as browsing menus, customizing drinks, and pre-ordering—DeepBrew gains a comprehensive picture of each consumer. This seamless data collection is the foundation for AI for B2C personalization at Starbucks. Unlike generic loyalty programs that offer one-size-fits-all discounts, DeepBrew tailors suggestions and rewards to each member’s unique tastes and behaviors.

- Personalized Product Recommendations: DeepBrew uses machine learning models to recommend beverages and food items based on past purchases, time of day, seasonality, and even local weather. For example, a customer who frequently orders iced lattes in the summer may be prompted to try a new cold brew flavor when the temperature rises. Similarly, a customer who buys bakery items in the morning may receive suggestions for pairing them with their favorite coffee blend. AI for B2C personalization goes beyond suggesting similar products—it anticipates future needs. If DeepBrew identifies that a customer has not purchased their usual morning coffee for a few days, it may offer a personalized incentive to re-engage them.

- Optimizing Promotions and Loyalty Rewards: Another key strategy of DeepBrew is the optimization of promotions within Starbucks Rewards. Instead of sending the same discount to all members, AI for B2C ensures that each offer is relevant. For instance, a customer who usually avoids sugary drinks might receive a reward for a sugar-free latte, while another who regularly buys Frappuccinos might be offered a seasonal variation. By tailoring promotions to individual preferences, Starbucks avoids the inefficiencies of mass marketing and increases the likelihood that offers lead to purchases. This targeted approach not only improves sales but also strengthens customer satisfaction by demonstrating that the brand “knows” its customers.

- Enhancing In-Store and Digital Experiences: DeepBrew is not limited to digital interactions—it also supports store-level personalization. AI for B2C algorithms analyze local trends and store performance to optimize product availability. For example, if DeepBrew predicts a surge in demand for pumpkin spice lattes during autumn in a specific region, Starbucks ensures stores are adequately stocked. Additionally, the mobile app powered by DeepBrew delivers seamless ordering experiences, suggesting pickup times and even anticipating when customers are likely to place orders based on past behavior. This integration of AI for B2C into both physical and digital channels makes personalization truly omnichannel.

Outcome & Evaluation

The results of Starbucks’ DeepBrew personalization system demonstrate the significant value of AI for B2C in retail and eCommerce, including but not limited to:

- Increased Engagement with Starbucks Rewards: DeepBrew has played a major role in growing membership and activity in Starbucks Rewards. With personalized offers and recommendations, members engage more frequently with the app and loyalty program. Personalized experiences create a stronger emotional connection, encouraging repeat visits and higher lifetime value.

- Higher Sales and Ticket Sizes: By suggesting complementary products and relevant promotions, AI for B2C has driven higher average ticket sizes at Starbucks. A customer ordering a latte may be prompted to add a breakfast sandwich, while another may try a seasonal specialty drink they would not have discovered otherwise. This cross-selling and upselling powered by DeepBrew directly increases revenue.

- Improved Customer Satisfaction and Loyalty: Consumers increasingly expect personalization in their interactions with brands. DeepBrew meets this expectation by making Starbucks experiences more convenient and tailored. Customers feel recognized and appreciated when offers and suggestions align with their preferences. This satisfaction translates into loyalty, with many consumers choosing Starbucks over competitors precisely because of the personalized experience.

- Operational Efficiency: DeepBrew’s predictive capabilities extend to inventory and staffing optimization, indirectly improving customer satisfaction. By forecasting demand for specific products, Starbucks ensures that popular items are available and wait times are minimized. AI for B2C thus benefits not only the customer-facing side of the business but also back-end operations that support consistent service quality.

Evaluating Starbucks’ DeepBrew personalization strategy reveals both the advantages and challenges of implementing AI for B2C at scale.

- Strengths

- Holistic Personalization: DeepBrew integrates customer data across digital and physical channels, creating a unified view that supports omnichannel personalization. Few brands have achieved this level of integration in AI for B2C.

- Enhanced Loyalty: The system has strengthened Starbucks Rewards, making it one of the most successful loyalty programs in retail. Personalized offers and suggestions keep members engaged and reduce churn.

- Revenue Growth: DeepBrew has driven measurable increases in sales, ticket sizes, and frequency of visits. Its ability to upsell and cross-sell demonstrates the financial power of AI for B2C personalization.

- Brand Differentiation: In a highly competitive coffee and quick-service market, Starbucks stands out for its digital innovation. DeepBrew has reinforced its brand image as customer-centric and forward-thinking.

- Challenges

- Data Privacy Concerns: Like all AI for B2C applications, DeepBrew relies heavily on consumer data. Starbucks must carefully manage privacy issues and comply with regulations such as GDPR and CCPA to maintain trust.

- Dependence on Technology: While personalization improves engagement, over-reliance on algorithms may risk alienating customers if recommendations feel repetitive or overly promotional. Starbucks must ensure AI suggestions remain fresh and authentic.

- Scaling Across Markets: Implementing DeepBrew globally poses challenges due to cultural differences, regulatory environments, and consumer preferences. Personalization strategies that work in North America may not resonate the same way in Asia or Europe.

- Competitive Pressure: Other quick-service chains and coffee retailers are rapidly adopting AI for B2C strategies. Starbucks must continue innovating to maintain leadership, potentially expanding DeepBrew with generative AI or voice-enabled personalization.

Starbucks’ DeepBrew personalization system represents one of the most advanced applications of AI for B2C in the retail and eCommerce sector. By leveraging consumer data to deliver individualized recommendations, optimize loyalty rewards, and streamline operations, DeepBrew has transformed how Starbucks engages with its customers. The outcomes—higher sales, stronger loyalty, and improved customer satisfaction—highlight the immense potential of AI for B2C when aligned with both consumer needs and business objectives.

At the same time, Starbucks’ journey illustrates the broader challenges of AI for B2C, particularly around data privacy, algorithmic dependence, and global scalability. For other businesses, DeepBrew serves as both a benchmark and a roadmap. The key takeaway is clear: personalization powered by AI for B2C is not just about offering convenience; it is about creating a lasting emotional connection that turns everyday transactions into experiences of recognition and value.

As AI technologies evolve, Starbucks will likely continue refining DeepBrew, integrating even more advanced capabilities such as generative AI for personalized marketing content or predictive voice ordering. For now, DeepBrew remains a powerful example of how AI for B2C can redefine consumer engagement in an industry where personal taste and daily rituals matter more than ever.

Banking & Finance

The banking and finance sector has embraced AI for B2C to meet rising consumer expectations for convenience, security, and personalization. With millions of transactions happening daily, AI systems help detect fraud, deliver personalized financial advice, and streamline customer service.

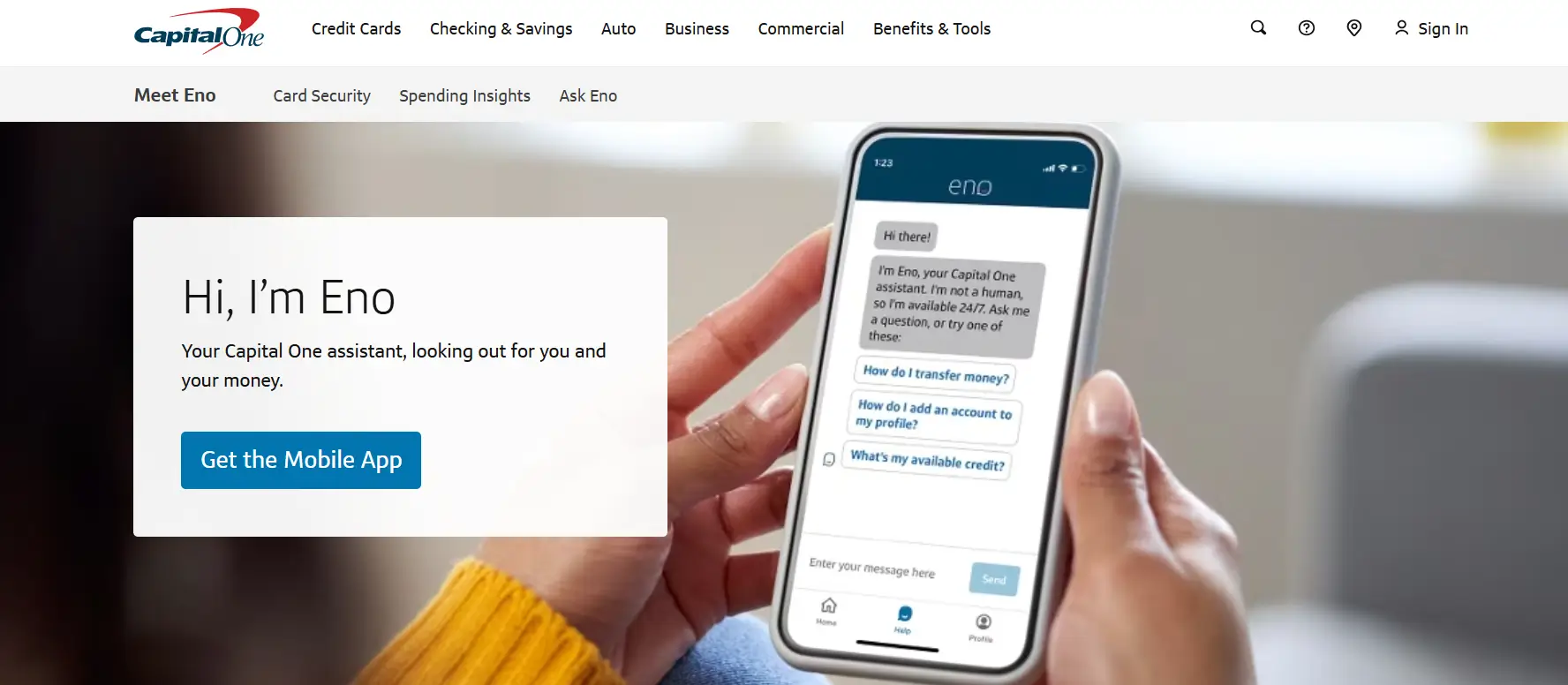

Capital One – AI-Powered Chatbot Eno

Capital One, one of the largest financial institutions in the United States, has always been at the forefront of digital banking innovation. As consumer expectations shifted toward instant support, personalized service, and secure digital interactions, Capital One recognized the need to integrate artificial intelligence into its customer experience strategy. This led to the development of Eno, an AI-powered chatbot that represents one of the most visible examples of AI for B2C in the financial sector.

Eno was launched in 2017 and quickly became a cornerstone of Capital One’s digital engagement ecosystem. Designed to provide real-time, conversational support for millions of customers, Eno leverages natural language processing, machine learning, and predictive analytics to deliver assistance that feels intuitive and human-like. From answering basic account questions to detecting fraudulent charges, Eno demonstrates how AI for B2C can reshape consumer engagement in an industry where trust, speed, and accuracy are paramount.

By deploying Eno, Capital One was able to address the growing demand for 24/7 digital banking support while simultaneously strengthening customer trust through proactive fraud alerts and transaction insights. It represents how AI for B2C is not limited to retail or entertainment but is equally vital in industries where the stakes involve financial well-being.

Strategy

The strategy behind Eno was to create a consumer-facing AI system that could handle the complexity of financial interactions while maintaining simplicity for the user. Capital One structured Eno’s development and deployment around three pillars: conversational banking, proactive financial monitoring, and seamless integration across platforms.

- Conversational Banking with Natural Language Processing: Eno’s conversational interface is powered by natural language processing (NLP), allowing it to understand customer queries in plain English rather than rigid commands. Customers can ask Eno questions such as “What’s my balance?” or “Show me my recent transactions,” and receive instant, accurate responses. This application of AI for B2C makes banking more accessible, particularly for consumers who may not be tech-savvy. Instead of navigating complex app menus, users simply type or speak their requests, and Eno interprets intent. The chatbot can even handle variations in phrasing, spelling mistakes, and shorthand, making interactions feel natural and effortless.

- Proactive Fraud Detection and Financial Monitoring: A defining feature of Eno is its proactive monitoring of consumer accounts. AI for B2C algorithms analyze transaction patterns to detect unusual activity, such as duplicate charges, unusually high payments, or transactions from unfamiliar locations. When anomalies are detected, Eno sends instant alerts to customers, empowering them to take action quickly. Beyond fraud detection, Eno provides insights into consumer spending. For instance, it can identify recurring subscriptions and notify customers of upcoming charges. It can also highlight when a bill is higher than usual, offering early warning signs that something may need attention. This proactive approach transforms AI for B2C from a reactive support tool into an active financial partner.

- Integration Across Multiple Channels: Eno is designed to meet consumers wherever they are. It is integrated into the Capital One mobile app, website, and even messaging platforms like SMS. This omnichannel strategy ensures that AI for B2C enhances the customer journey consistently across touchpoints. Whether a customer prefers interacting via mobile notifications or directly through the app, Eno is always available. The integration also extends to customer service operations. When queries exceed Eno’s capabilities, the chatbot seamlessly transfers conversations to human agents with full context, ensuring continuity. This hybrid model optimizes efficiency while maintaining a human safety net for complex cases.

Outcome & Evaluation

The outcomes of Capital One’s Eno chatbot illustrate the powerful impact of AI for B2C in the financial sector.

- Improved Customer Engagement: Eno has become a daily digital companion for millions of Capital One customers. By offering conversational, user-friendly access to account information and financial insights, Eno increases engagement with the Capital One ecosystem. Customers are more likely to interact with the app regularly, leading to stronger brand loyalty and higher satisfaction.

- Enhanced Fraud Prevention and Security: One of the most significant outcomes of AI for B2C through Eno is improved fraud prevention. By continuously analyzing transactions, Eno has saved countless customers from financial loss. Quick fraud alerts empower customers to take immediate action, while Capital One benefits from reduced fraud-related costs. The proactive fraud detection feature has become a key differentiator in the market, enhancing trust in the brand.

- Operational Efficiency: AI for B2C has also reduced the load on Capital One’s call centers and customer support staff. By handling routine inquiries—such as balance checks, bill reminders, or subscription alerts—Eno frees human agents to focus on complex issues. This not only reduces costs but also improves service quality, as wait times for escalated cases are shorter.

- Data-Driven Insights: Every interaction with Eno generates data that feeds back into Capital One’s broader analytics strategy. Insights into customer behavior, spending habits, and common concerns help the bank refine products, improve services, and design more relevant marketing campaigns. AI for B2C here is not just about direct customer engagement; it also fuels long-term strategic decision-making.

- Strengthened Customer Trust: Perhaps most importantly, Eno strengthens trust. In financial services, where consumer relationships hinge on security and transparency, an AI for B2C solution that actively protects customers and provides clarity around their finances creates emotional as well as practical value.

Evaluating Capital One’s Eno chatbot reveals both the strengths and challenges of implementing AI for B2C in banking.

- Strengths

- 24/7 Accessibility: Eno provides round-the-clock support, aligning with consumer expectations for always-available digital services.

- Proactive Engagement: Unlike many chatbots that wait for user input, Eno initiates conversations to warn consumers about fraud, duplicate charges, or unusual spending. This proactive nature demonstrates the true potential of AI for B2C in financial services.

- Personalization and Convenience: By tailoring interactions to individual spending behaviors and preferences, Eno delivers personalized advice at scale. This level of customization improves the user experience and encourages ongoing engagement.

- Scalability: Capital One’s large customer base benefits equally from Eno’s services, proving that AI for B2C can scale effectively in industries with millions of users.

- Challenges

- Data Privacy and Regulation: AI for B2C in finance requires handling sensitive consumer data. Compliance with regulations like GDPR and CCPA is essential, and any misstep could damage trust significantly.

- Limitations of Conversational AI: While Eno is advanced, it still faces limitations in handling complex or nuanced financial queries. Customers with unique or highly specific needs may find the chatbot insufficient, requiring escalation to human agents.

- Consumer Adaptation: Not all customers are comfortable relying on AI for B2C for financial management. Some still prefer human interactions, and Capital One must balance innovation with inclusivity for all user types.

- Competitive Landscape: As other banks and fintech companies adopt similar AI for B2C solutions, maintaining differentiation will require continuous innovation. Competitors may deploy even more advanced conversational AI, forcing Capital One to keep evolving.

Capital One’s Eno chatbot is one of the strongest examples of how AI for B2C can transform the banking and finance industry. By combining natural language processing, proactive monitoring, and omnichannel integration, Eno provides customers with instant, personalized, and secure financial support. The outcomes—improved engagement, enhanced fraud prevention, operational efficiency, and strengthened trust—showcase the power of AI for B2C when aligned with consumer needs.

At the same time, Eno highlights key considerations for other financial institutions. Data privacy, regulatory compliance, and the limits of AI technology remain challenges that must be carefully managed. Yet the success of Eno demonstrates that AI for B2C is not just a technological add-on but a strategic necessity in modern banking.

For other businesses looking to replicate Capital One’s success, the lesson is clear: start with consumer pain points, leverage AI to provide proactive and personalized solutions, and integrate seamlessly across digital and physical channels. In doing so, AI for B2C can elevate financial services from transactional interactions to trusted partnerships, reshaping the future of consumer banking.

PayPal – Fraud Detection Using AI

PayPal is one of the world’s most widely used digital payment platforms, processing billions of transactions annually across more than 200 countries. With such massive global reach, the company faces constant threats from fraudulent activities, ranging from stolen credit card numbers to sophisticated phishing schemes and account takeovers. Traditional fraud detection systems that relied on static rules or manual checks were no longer sufficient to deal with the scale, speed, and complexity of modern financial crime.

To address this challenge, PayPal turned to artificial intelligence. Fraud detection powered by AI for B2C has become central to PayPal’s strategy for protecting its users while ensuring smooth, uninterrupted transactions. By using advanced machine learning models and real-time analytics, PayPal can identify fraudulent behavior within milliseconds and stop it before it impacts consumers. The system balances two critical goals: safeguarding users against fraud while minimizing false positives that could disrupt legitimate transactions.

The implementation of AI for B2C in PayPal’s fraud detection system is not just a security upgrade; it is a business necessity. In digital payments, consumer trust is the currency of growth. By deploying AI for B2C, PayPal ensures that customers feel confident when using its services, reinforcing its position as a global leader in secure financial technology.

Strategy

PayPal’s strategy for fraud detection using AI for B2C combines several layers of advanced technologies and operational practices. The focus is on building a real-time, adaptive system that learns continuously, scales globally, and provides reliable security without compromising user convenience.

- Machine Learning at Scale: PayPal processes hundreds of millions of transactions daily. To detect fraud in this enormous volume of data, PayPal employs machine learning algorithms that analyze transaction patterns, device fingerprints, geolocation data, and behavioral signals. The models are trained on historical datasets of legitimate and fraudulent transactions, allowing them to identify anomalies that deviate from expected behavior. AI for B2C enables PayPal to move beyond simple rule-based systems, which fraudsters can easily circumvent. Instead, dynamic machine learning models evolve as new fraud patterns emerge. For example, if fraudsters begin using a new method to disguise stolen credit card information, the system can quickly learn to recognize the signals and block future attempts.

- Real-Time Analysis and Decision-Making: One of the critical strengths of AI for B2C at PayPal is its ability to make decisions in real time. Transactions are analyzed within milliseconds, with the system assessing whether they are legitimate or fraudulent. If a payment is flagged as high-risk, PayPal can block it instantly or request additional verification from the user. This speed is crucial. Consumers expect transactions to be completed seamlessly, and any delay can lead to dissatisfaction. By embedding AI for B2C into its fraud detection, PayPal ensures that fraudulent payments are intercepted without slowing down legitimate transactions.

- Behavioral Analytics: In addition to transactional data, PayPal’s fraud detection system incorporates behavioral analytics powered by AI for B2C. The system monitors user behavior patterns such as login frequency, device switching, or unusual browsing activity. For instance, if a user who typically logs in from the United States suddenly attempts multiple transactions from an unfamiliar device in another country, the system flags it as suspicious. Behavioral analytics is particularly powerful because fraudsters may replicate stolen credentials, but replicating authentic behavioral patterns is far more difficult. AI for B2C models excel at identifying these subtle irregularities, adding a deeper layer of protection.

- Continuous Learning and Global Adaptation: Fraud tactics vary across regions, cultures, and economic conditions. PayPal’s AI for B2C fraud detection system adapts globally by continuously learning from new data. Every blocked or flagged transaction feeds into the models, helping them evolve and improve accuracy. This ensures that PayPal can respond quickly to emerging threats in any market, whether in North America, Europe, Asia, or Africa.

- Hybrid Model with Human Oversight: While AI for B2C is highly effective, PayPal complements its fraud detection system with human oversight. Fraud analysts review flagged transactions, refine detection models, and provide feedback to improve accuracy. This hybrid approach ensures that the system maintains high levels of precision while reducing false positives that could inconvenience customers.

Outcome & Evaluation

The results of PayPal’s AI for B2C fraud detection strategy are evident in its ability to protect users while maintaining smooth transaction experiences.

- Reduced Fraud Losses: PayPal has significantly reduced financial losses related to fraud by using AI for B2C. The system’s real-time decision-making prevents fraudulent transactions from being completed, saving both the company and its customers from potential losses. By scaling globally, PayPal can protect millions of users simultaneously, regardless of where they are transacting.

- Improved Detection Accuracy: AI for B2C has dramatically improved the accuracy of fraud detection. Unlike static rule-based systems that often generated false positives, PayPal’s AI models minimize disruptions to legitimate users. This balance between catching fraud and maintaining smooth experiences is critical in digital payments, where consumer trust depends on reliability.

- Enhanced Customer Trust and Loyalty: Trust is the foundation of PayPal’s success. By preventing fraud effectively, AI for B2C strengthens customer confidence in using PayPal for everyday transactions, from online shopping to international money transfers. When customers feel their accounts are protected, they are more likely to continue using the service and recommend it to others.

- Operational Efficiency: AI for B2C reduces the workload on PayPal’s human fraud analysts by automating the majority of detection and prevention. Analysts can then focus on investigating complex or borderline cases, improving overall efficiency. This scalability allows PayPal to manage fraud detection at global scale without proportionally increasing operational costs.

- Competitive Advantage: By leading in fraud detection, PayPal differentiates itself in the crowded digital payments market. Consumers choose PayPal not only for convenience but also for the assurance of security. AI for B2C has become a strategic asset that strengthens PayPal’s competitive position against both traditional banks and emerging fintech rivals.

PayPal’s use of AI for B2C in fraud detection showcases both strengths and challenges that other businesses can learn from.

- Strengths

- Real-Time Protection: AI for B2C ensures that fraud is intercepted before it impacts customers, providing immediate value.

- Scalability: The system can handle billions of transactions across global markets, demonstrating the power of AI for B2C to operate at massive scale.

- Behavioral Intelligence: By incorporating behavioral analytics, PayPal adds a layer of sophistication that makes fraud detection more resilient against evolving tactics.

- Trust Building: Effective fraud prevention reinforces consumer trust, which is essential in financial services where reputation directly impacts growth.

- Challenges

- Data Privacy and Compliance: Handling sensitive financial and behavioral data requires strict compliance with international regulations like GDPR and CCPA. Missteps in this area could damage consumer trust.

- Evolving Threat Landscape: Fraudsters constantly innovate, and AI for B2C systems must evolve rapidly to stay ahead. This requires ongoing investment in technology and expertise.

- False Positives: While reduced, false positives remain a challenge. Legitimate transactions occasionally get flagged, potentially frustrating customers. Achieving the perfect balance between security and convenience is an ongoing effort.

- Resource Intensity: Building and maintaining advanced AI for B2C systems requires significant financial and technical resources, which may be a barrier for smaller companies attempting to replicate PayPal’s success.

PayPal’s fraud detection system is one of the clearest examples of AI for B2C in action within the financial sector. By leveraging machine learning, real-time analytics, and behavioral intelligence, PayPal protects millions of users from fraud every day while ensuring smooth transaction experiences. The outcomes—reduced fraud losses, improved detection accuracy, enhanced customer trust, and greater operational efficiency—highlight the transformative impact of AI for B2C when applied strategically.

At the same time, PayPal’s journey illustrates important lessons. AI for B2C is not a one-time implementation but an ongoing process of learning, adaptation, and compliance. Success requires balancing the sophistication of algorithms with transparency, privacy, and consumer trust.

For other financial institutions and fintech companies, PayPal’s example serves as a roadmap: invest in AI for B2C systems that are real-time, adaptive, and consumer-centric; complement algorithms with human expertise; and focus on building trust as the ultimate measure of success. In an era where digital transactions dominate, the ability to protect consumers while keeping experiences seamless will define the leaders of the financial services industry.

HSBC – Predictive Credit Risk Modeling

HSBC, one of the largest banking and financial services organizations in the world, operates across more than 60 countries and serves tens of millions of retail and corporate customers. With such a vast and diverse customer base, effective credit risk management is essential to protecting both the institution and its clients. Historically, credit assessments relied heavily on rigid scoring models based on income, repayment history, and other structured data. While effective to some extent, these systems often failed to capture the full financial reality of individual consumers, leaving room for errors in lending decisions.

To address these limitations, HSBC has embraced predictive credit risk modeling powered by artificial intelligence. This adoption of AI for B2C enables the bank to assess consumer creditworthiness more accurately, reduce default rates, and extend financial products to a broader range of people. By analyzing both structured and unstructured data, predictive models go beyond traditional metrics, incorporating behavioral patterns, transaction data, and even real-time financial activities.

The implementation of AI for B2C in credit risk modeling reflects HSBC’s commitment to innovation and customer-centric banking. By leveraging advanced analytics, HSBC aims to create a system that is fairer, faster, and more adaptive to the complexities of modern consumer finance.

Strategy

HSBC’s strategy in deploying predictive credit risk modeling through AI for B2C is built around three core pillars: expanding the data universe, applying advanced machine learning techniques, and integrating insights into operational decision-making.

- Expanding the Data Universe: Traditional credit scoring models typically rely on a narrow set of structured data points such as credit history, outstanding debt, income, and repayment patterns. HSBC, however, recognized that many consumers—especially younger generations, freelancers, and people in emerging markets—may lack extensive credit histories. To create a more inclusive system, HSBC uses AI for B2C to expand the scope of data inputs. This includes analyzing transactional data from checking and savings accounts, spending behaviors, and even utility or rental payments. By incorporating alternative data sources, HSBC can evaluate the financial responsibility of consumers who might otherwise be excluded from credit opportunities. This strategy not only broadens access to credit but also creates a more holistic view of risk.

- Machine Learning and Predictive Modeling: At the heart of HSBC’s AI for B2C credit risk modeling strategy is machine learning. Predictive algorithms are trained on vast datasets of historical loan performance, repayment behavior, and default patterns. These models identify correlations and hidden signals that human analysts or traditional scoring systems might miss. For example, a sudden increase in discretionary spending paired with delayed utility bill payments may serve as an early warning of financial strain. Conversely, consistent on-time payments for small recurring expenses can signal creditworthiness even in the absence of a formal credit history. Prescriptive modeling takes this further by recommending specific lending actions, such as adjusting credit limits or offering restructuring options for at-risk customers. By combining predictive and prescriptive analytics, HSBC enhances both risk detection and proactive intervention.

- Real-Time Decision-Making Integration: HSBC integrates predictive models into its real-time decision-making systems. This allows the bank to assess credit applications instantly while maintaining accuracy. Customers applying for credit cards, personal loans, or mortgages can receive faster approvals without compromising risk assessment standards. Real-time analysis also supports dynamic credit management. If a customer’s risk profile changes due to unexpected events, AI for B2C systems can flag the account, prompting HSBC to take preventive action. This might include sending alerts, offering financial advice, or adjusting credit terms to prevent defaults.

- Ethical and Responsible AI Practices: Given the sensitivity of financial decisions, HSBC has emphasized the ethical deployment of AI for B2C. Predictive credit risk models are designed to minimize bias and ensure fairness. The bank implements transparency mechanisms so that customers understand how decisions are made, aligning with regulatory frameworks such as GDPR and other financial compliance standards.

Outcome & Evaluation

The outcomes of HSBC’s predictive credit risk modeling highlight the transformative potential of AI for B2C in banking and finance.

- Improved Accuracy in Risk Assessment: By leveraging AI for B2C, HSBC has achieved greater precision in identifying high-risk and low-risk customers. Predictive models capture nuanced financial behaviors that traditional credit scoring systems often overlook. This results in fewer false negatives (granting credit to high-risk customers) and fewer false positives (rejecting creditworthy individuals). The outcome is a more balanced and accurate credit portfolio.

- Faster Credit Approvals: Consumers increasingly expect quick, seamless digital experiences, even for complex financial services. AI for B2C allows HSBC to process loan and credit applications in real time. What once took days to evaluate can now be completed in minutes, significantly improving customer satisfaction. Faster decisions also enable HSBC to remain competitive in a market where fintech startups are redefining consumer expectations.

- Expanded Financial Inclusion: One of the most significant outcomes of HSBC’s strategy is greater financial inclusion. By incorporating alternative data sources and behavioral analytics, the bank can responsibly extend credit to consumers who lack traditional credit histories. This includes younger individuals, self-employed workers, and customers in emerging markets. AI for B2C helps democratize access to financial services, allowing more people to build credit and achieve financial goals.

- Reduced Default Rates: AI for B2C predictive models enable HSBC to spot early warning signals of financial distress and take preventive measures. For example, customers identified as at-risk can receive targeted financial advice, restructuring options, or adjusted repayment schedules. These proactive interventions reduce default rates, protecting both the bank’s bottom line and the consumer’s financial well-being.

- Enhanced Regulatory Compliance and Transparency: HSBC’s predictive credit risk modeling also supports compliance with increasingly strict financial regulations. AI for B2C systems provide detailed audit trails, demonstrating how decisions are made and ensuring that models are not discriminatory. Transparency and fairness in credit assessments strengthen consumer trust and reduce reputational risks.

Evaluating HSBC’s predictive credit risk modeling highlights the strengths and challenges of using AI for B2C in financial services.

- Strengths

- Holistic Risk Profiles: AI for B2C enables HSBC to move beyond limited credit history data, capturing broader consumer behaviors that provide more accurate assessments.

- Speed and Efficiency: Real-time decision-making improves customer satisfaction while maintaining rigorous risk assessment.

- Financial Inclusion: By evaluating alternative data sources, HSBC extends opportunities to underserved populations, aligning with its mission of expanding access to financial services.

- Proactive Risk Mitigation: Predictive models empower the bank to intervene before defaults occur, reducing losses and improving customer outcomes.

- Ethical AI Deployment: HSBC’s focus on minimizing bias and ensuring transparency demonstrates leadership in responsible AI for B2C implementation.

- Challenges

- Data Privacy and Security: Expanding the scope of consumer data increases the importance of protecting sensitive information and complying with regulations like GDPR and CCPA.

- Model Bias Risks: Even with safeguards, predictive models can inadvertently reflect biases present in training data, leading to fairness concerns. Continuous monitoring is required.

- Complexity of Implementation: Building and maintaining predictive models requires significant technical expertise and financial investment, which may be challenging for smaller institutions.

- Consumer Trust: While many consumers appreciate faster credit approvals, some may be uncomfortable with AI-driven decisions. Ensuring transparency and providing explanations is essential to maintaining trust.

- Global Adaptation: Credit behaviors vary across countries and cultures. HSBC must continuously adapt its AI for B2C models to local conditions, which increases complexity.

HSBC’s adoption of predictive credit risk modeling demonstrates how AI for B2C can transform one of the most critical functions in banking. By moving beyond traditional credit scoring, HSBC has developed a system that is faster, fairer, and more accurate. The outcomes—improved risk assessment, faster approvals, expanded financial inclusion, reduced defaults, and enhanced compliance—showcase the tangible benefits of embedding AI for B2C into financial decision-making.

At the same time, HSBC’s experience highlights important lessons for the industry. Success in AI for B2C requires not only technical sophistication but also a commitment to ethical practices, transparency, and consumer trust. Predictive credit risk modeling is not just about reducing risk for the bank; it is about enabling consumers to access credit responsibly and build stronger financial futures.

For other financial institutions, HSBC’s example provides a roadmap: integrate diverse data sources, leverage advanced analytics, ensure ethical oversight, and use AI for B2C to balance institutional protection with consumer empowerment. As digital transformation accelerates across the financial sector, predictive credit risk modeling will likely become a standard practice, redefining how banks assess, serve, and support their customers.

Travel & Hospitality

In travel and hospitality, AI for B2C improves convenience, personalizes services, and enhances customer satisfaction. From chatbots that handle booking queries to predictive models for pricing, AI technologies redefine how consumers plan and enjoy their trips.

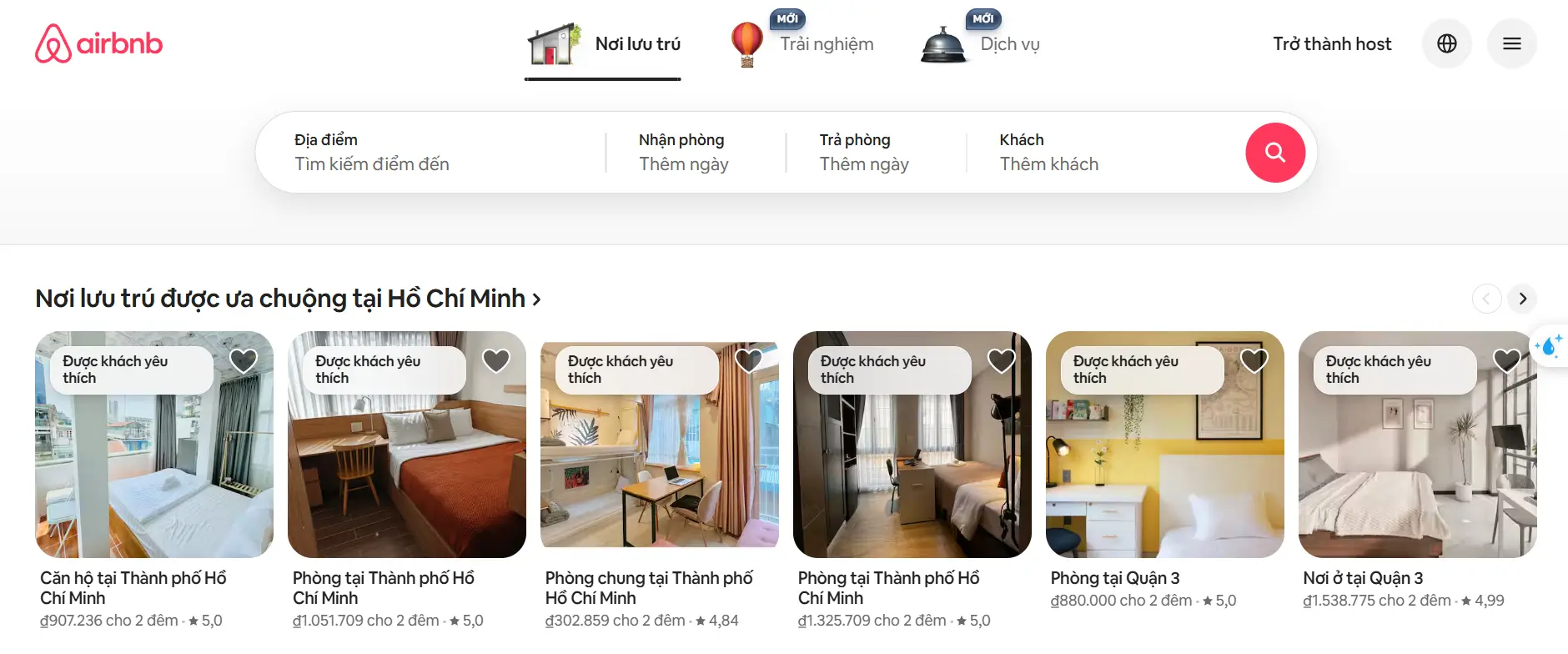

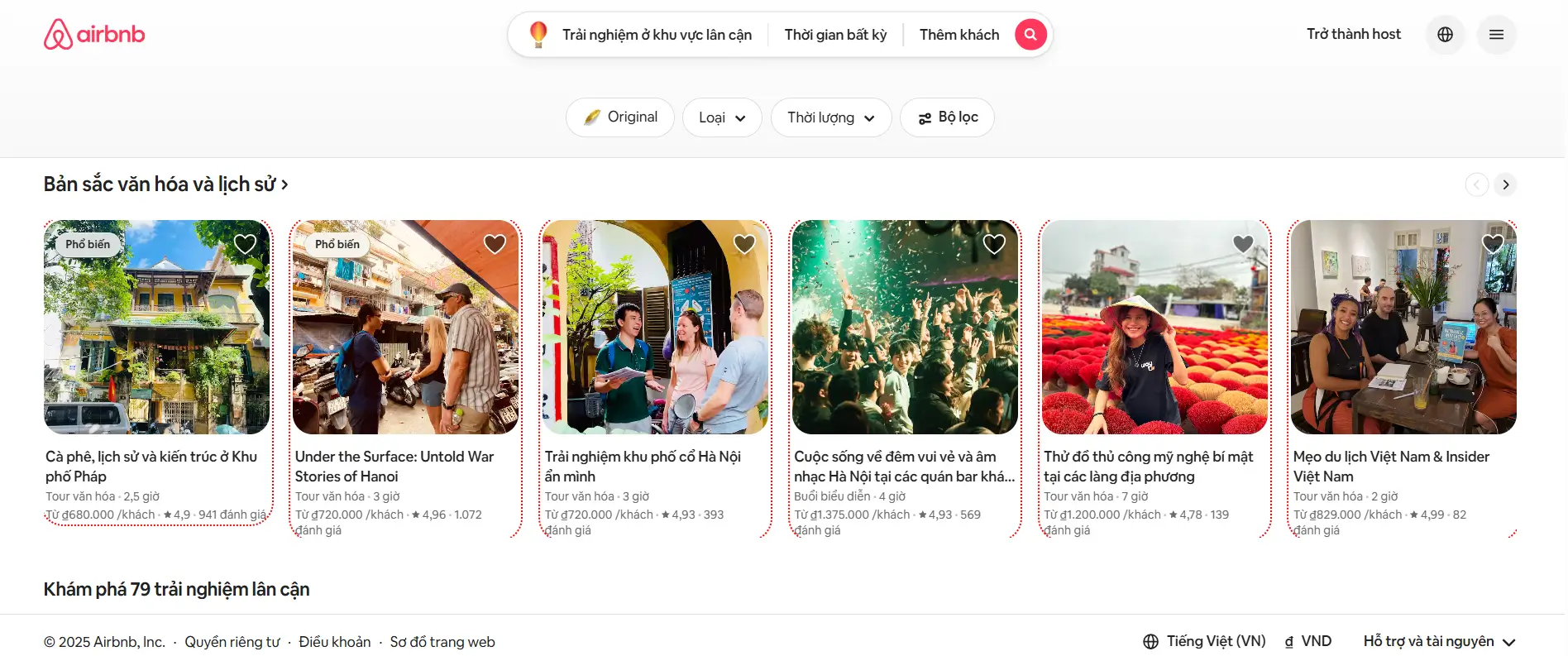

Airbnb – Dynamic Pricing AI

Airbnb has revolutionized the travel and hospitality sector by offering a platform where individuals can rent out their homes, apartments, or spare rooms to travelers worldwide. Unlike traditional hotels with standardized pricing structures, Airbnb operates in a marketplace where millions of listings vary by location, amenities, demand patterns, and host strategies. Managing pricing in such a diverse ecosystem is a challenge. If prices are set too high, properties remain vacant; if they are set too low, hosts lose potential revenue.

To tackle this challenge, Airbnb introduced dynamic pricing powered by artificial intelligence. The system, often referred to as Smart Pricing, is one of the clearest applications of AI for B2C in the travel and hospitality industry. It analyzes a vast array of factors in real time—seasonality, local events, booking patterns, competitor prices, and guest demand—to recommend optimal prices for each listing. This allows hosts to maximize occupancy and revenue while ensuring travelers see fair and competitive prices.

Dynamic pricing reflects Airbnb’s broader commitment to creating a sustainable two-sided marketplace. By using AI for B2C, Airbnb balances the interests of hosts and guests, enhancing trust in the platform while driving growth.

Strategy

Airbnb’s strategy for implementing AI-driven dynamic pricing centers on three main goals: maximizing host earnings, improving platform competitiveness, and enhancing the guest experience. The system’s design integrates massive data collection, advanced machine learning models, and real-time adaptation.

- Data Collection at Scale: Airbnb’s dynamic pricing system relies on vast datasets generated by millions of interactions on its platform. Data inputs include:

- Historical booking data (e.g., occupancy rates, booking windows, cancellations).

- Seasonal and temporal patterns (e.g., weekends, holidays, high-travel seasons).

- Geographical variables (e.g., location popularity, neighborhood competition).

- External factors such as local events, festivals, or even weather forecasts.

By analyzing this data, AI for B2C uncovers patterns that influence how travelers book accommodations and how prices affect demand. Unlike static pricing rules, AI models can adapt continuously as new data flows in.

- Machine Learning Models for Price Recommendations: The core of Airbnb’s strategy is machine learning. Algorithms are trained to predict the optimal price for a listing on any given day. These models account for complex relationships between multiple variables. AI for B2C here doesn’t just provide static suggestions; it continuously learns and adapts as new data emerges.For example:

- If a major concert is announced in a city, the algorithm predicts a spike in demand and adjusts prices upward.

- If competing listings in a neighborhood lower their rates, the system may recommend a price reduction to maintain competitiveness.

- If a host’s property has higher-than-average reviews, the system factors in the premium value when suggesting prices.

- Host Empowerment and Transparency: Airbnb designed its dynamic pricing tool to empower hosts rather than dictate decisions. While the AI recommends optimal prices, hosts retain full control over whether to accept, adjust, or ignore them. The tool provides transparency by showing how suggested prices were calculated, including references to local events or market trends. This strategy reflects Airbnb’s recognition that trust is essential in applying AI for B2C. By making the system transparent and optional, Airbnb encourages adoption without alienating hosts who prefer manual pricing.

- Balancing Guest Affordability: Dynamic pricing also benefits guests by ensuring prices remain competitive and reflective of real-time market conditions. AI for B2C helps prevent price inflation by taking into account broader market averages, discouraging extreme overpricing. This balance between host profitability and guest affordability strengthens Airbnb’s reputation as a fair and reliable platform.

Outcome & Evaluation

The outcomes of Airbnb’s dynamic pricing strategy powered by AI for B2C highlight significant advantages for hosts, guests, and the platform itself.

- Increased Host Revenue: One of the most direct outcomes is improved host earnings. By setting prices that reflect real-time demand, hosts maximize both occupancy and nightly rates. Internal studies by Airbnb have shown that hosts who adopt Smart Pricing typically earn more compared to those who set static prices. AI for B2C ensures that prices adjust automatically to demand surges, such as during local events, leading to higher revenues.

- Improved Occupancy Rates: Dynamic pricing also helps reduce vacancy rates. For example, if a property is not attracting bookings, AI may recommend lowering the price slightly to make it more competitive. Conversely, if a property is receiving too much interest too quickly, the system may suggest raising the price to capture additional value. This responsiveness ensures that listings remain attractive to travelers while optimizing host profitability.

- Guest Satisfaction: Travelers benefit from more transparent and market-driven pricing. Guests are less likely to encounter inflated or inconsistent rates, which can damage trust. Instead, they see prices that reflect the current demand and market conditions, making the booking process feel fair. Guest satisfaction is further enhanced by the variety of affordable options available due to AI-driven pricing adjustments.

- Platform Growth and Competitiveness: For Airbnb as a company, dynamic pricing strengthens its competitiveness against traditional hotels and rival platforms. By ensuring hosts can maximize revenue and guests can access fair prices, Airbnb fosters long-term platform loyalty. This contributes to higher booking volumes and market share growth.

- Data-Driven Insights for Continuous Improvement: Every interaction with the pricing system generates data that further refines the algorithms. For example, if many hosts override a suggested price, the model learns from this behavior to improve future recommendations. This feedback loop demonstrates the self-improving nature of AI for B2C systems.

Evaluating Airbnb’s dynamic pricing AI reveals both the successes and limitations of applying AI for B2C in the travel and hospitality industry.

- Strengths

- Scalable Personalization: AI for B2C allows Airbnb to offer personalized pricing recommendations for millions of listings simultaneously, something that would be impossible manually.

- Revenue Optimization: Hosts benefit from improved earnings while maintaining competitive rates, reinforcing the value of the platform.

- Guest-Centric Fairness: Dynamic pricing maintains affordability and transparency, enhancing guest trust.

- Data Feedback Loop: Continuous learning ensures that the system adapts to new booking trends and market dynamics, keeping it effective over time.

- Optional and Transparent Adoption: By giving hosts control over final decisions, Airbnb avoids resistance and builds trust in AI recommendations.

- Challenges

- Host Reluctance: Despite its benefits, not all hosts adopt dynamic pricing. Some distrust AI for B2C recommendations or prefer manual control. Convincing hosts of the system’s long-term value remains a challenge.

- Perceived Unfairness During Events: While prices naturally rise during high-demand events, some guests perceive these increases as unfair or opportunistic. Managing perceptions is as important as managing prices.

- Data Privacy and Accuracy: AI for B2C relies on vast data collection, raising concerns about how information is stored, processed, and protected. Inaccurate event data or flawed inputs can also lead to misguided pricing recommendations.

- Global Adaptation: Pricing behaviors vary widely across regions. What works in a U.S. city may not be appropriate in rural areas of emerging markets. AI for B2C models must be tailored to local conditions to remain effective.

- Balancing Marketplace Dynamics: Dynamic pricing must balance the needs of hosts and guests. Over-prioritizing host revenue could lead to affordability issues, while prioritizing guest affordability too heavily could reduce host earnings.

Airbnb’s use of dynamic pricing powered by AI for B2C represents a landmark innovation in travel and hospitality. By analyzing vast datasets and predicting demand in real time, Airbnb helps hosts optimize revenue while ensuring guests receive competitive, fair prices. The outcomes—higher earnings, better occupancy, guest satisfaction, and platform growth—highlight how AI for B2C can create win-win scenarios in consumer-facing industries.

At the same time, Airbnb’s experience underscores key lessons. Successful implementation of AI for B2C requires transparency, user empowerment, and continuous adaptation to global and local contexts. Dynamic pricing cannot operate as a one-size-fits-all solution; it must evolve alongside consumer behaviors, host expectations, and regulatory environments.

For other companies in the travel and hospitality sector, Airbnb’s example offers a roadmap: collect and analyze comprehensive data, build predictive models that adapt in real time, ensure fairness for both providers and customers, and maintain transparency to build trust. As AI for B2C technologies continue to evolve, dynamic pricing will likely become the standard not only for travel accommodations but also for a wide range of consumer-facing services, from airlines to car rentals to event ticketing.

Airbnb’s journey shows that when applied thoughtfully, AI for B2C is more than just a technological enhancement—it is a strategic tool that reshapes markets, redefines customer experiences, and creates sustainable value for all stakeholders.

Hilton – AI Concierge “Connie”

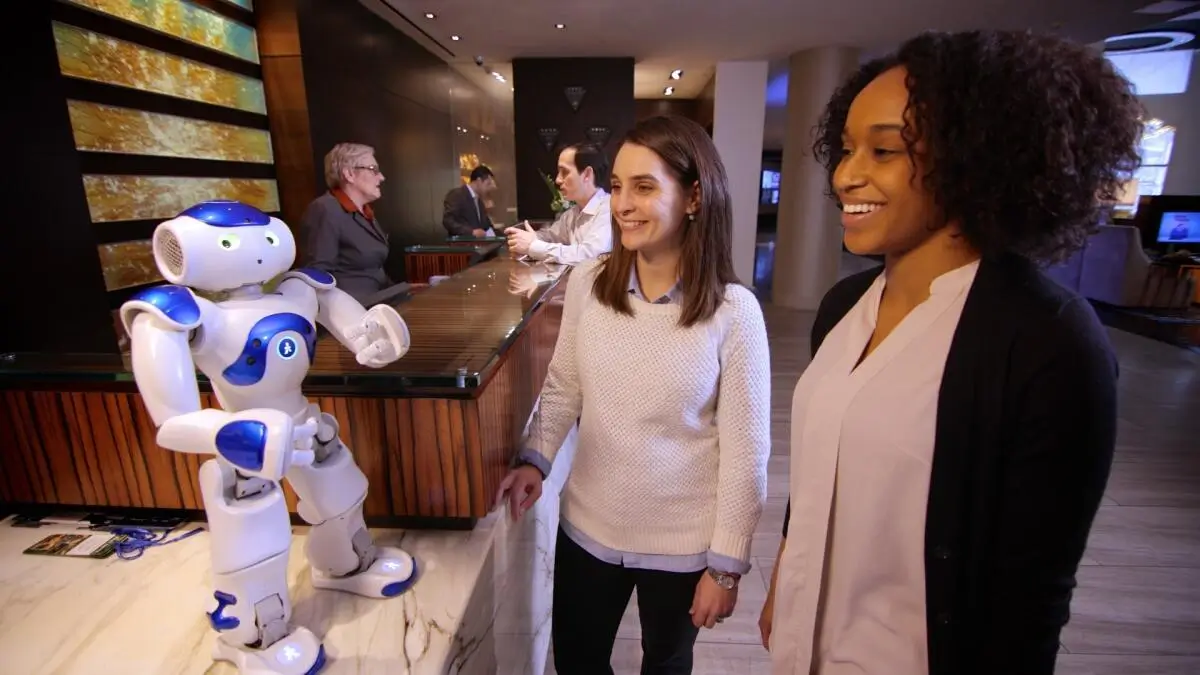

Hilton Worldwide Holdings, one of the most iconic names in global hospitality, has long been at the forefront of adopting technology to enhance guest experiences. With thousands of hotels across multiple brands, Hilton faces the constant challenge of delivering consistent, high-quality service while personalizing experiences for millions of guests worldwide. As travelers increasingly expect seamless, innovative, and personalized interactions, Hilton recognized the opportunity to integrate artificial intelligence into its operations.

In 2016, Hilton introduced Connie, the world’s first AI-powered hotel concierge robot, developed in collaboration with IBM Watson and WayBlazer. Standing about two feet tall, Connie was designed to interact with guests in hotel lobbies, answering questions, offering personalized recommendations, and assisting with navigation around the property and local area. Connie represented a pioneering application of AI for B2C in the hospitality sector, blending natural language processing, machine learning, and robotics to create a unique guest-facing experience.

By deploying Connie, Hilton signaled its commitment to digital transformation and to using AI for B2C not only as a back-end efficiency tool but also as a direct guest engagement platform. The project illustrated how AI could enhance service delivery, reduce pressure on staff, and create memorable, innovative experiences that differentiate Hilton from competitors.

Strategy

Hilton’s strategy for developing and implementing Connie was centered on three goals: improving guest interactions, reinforcing the brand’s reputation for innovation, and gathering data to better understand customer needs.

- Leveraging IBM Watson’s Cognitive Capabilities: Connie’s intelligence is powered by IBM Watson, one of the most advanced AI systems available at the time. Watson enables Connie to understand natural language queries and respond conversationally. Guests can ask Connie questions such as “What’s a good restaurant nearby?” or “What time does the pool open?” and receive contextually relevant answers. AI for B2C plays a central role here by enabling real-time, two-way communication. Unlike static kiosks or pamphlets, Connie adapts to each query, learning from interactions to improve future responses. This conversational capability was designed to make information access intuitive and engaging, reducing the need for guests to wait in line at the front desk for simple queries.

- Providing Personalized Recommendations: Connie was not limited to answering factual questions. Hilton’s strategy also involved using AI for B2C to personalize recommendations. By drawing on WayBlazer’s travel recommendation engine and Watson’s cognitive computing, Connie could suggest restaurants, tourist attractions, or activities tailored to the preferences inferred from guest questions. For example, if a guest asked about family-friendly dining, Connie could highlight nearby options suitable for children. If another inquired about nightlife, Connie might recommend local bars or clubs. This ability to deliver context-aware suggestions demonstrated the power of AI for B2C to enhance personalization in hospitality.

- Enhancing Staff Productivity and Service Quality: Connie’s deployment also aimed to support hotel staff by handling routine inquiries. Front desk associates and concierges often field repetitive questions, which can divert attention from more complex service tasks. By offloading these basic interactions to Connie, Hilton freed up human employees to focus on delivering higher-value, personalized services. This integration of AI for B2C into frontline operations aligned with Hilton’s strategy of blending technology with human hospitality. Rather than replacing staff, Connie was designed as a complementary tool that amplified service quality.

- Creating a Brand Differentiator: Hilton positioned Connie as more than just a functional tool—it was also a symbol of innovation. Guests interacting with Connie often found the experience novel and memorable, enhancing their perception of Hilton as a forward-thinking brand. This brand differentiation strategy reflects how AI for B2C can be leveraged not only to solve operational challenges but also to shape brand identity in competitive industries.

Outcome & Evaluation

The outcomes of Hilton’s deployment of Connie illustrate the wide-ranging benefits of integrating AI for B2C into guest-facing operations.

- Improved Guest Experience: Connie enhanced the guest journey by providing instant answers to common questions and personalized recommendations. Guests no longer needed to wait for staff to be available to access basic information, making the experience more efficient and enjoyable. The novelty of interacting with an AI concierge also added an element of surprise and delight, making visits more memorable.

- Increased Staff Efficiency: By handling routine questions, Connie reduced the workload of front desk staff and concierges. Employees could devote more time to resolving complex guest needs, upselling premium services, or focusing on personalized attention. This improved service quality while also contributing to employee satisfaction by reducing repetitive tasks.

- Brand Differentiation and Publicity: Hilton’s introduction of Connie generated significant media coverage and positioned the brand as a leader in hospitality innovation. This positive publicity not only boosted Hilton’s reputation among tech-savvy travelers but also reinforced the perception that Hilton was setting new standards in guest service. AI for B2C, in this case, became a marketing asset as much as an operational tool.

- Data Collection and Insights: Connie’s interactions with guests provided Hilton with valuable data on frequently asked questions, guest preferences, and areas where information was most in demand. This data, aggregated and anonymized, offered insights into customer behavior that Hilton could use to refine services, adjust staff training, and enhance marketing strategies. AI for B2C thus played a dual role: improving real-time service and generating actionable insights for long-term improvements.

- Guest Engagement and Loyalty: Guests who interacted with Connie often reported higher satisfaction levels, which correlated with stronger brand loyalty. The innovative use of AI for B2C helped Hilton build emotional connections with guests, showing that the brand was attentive not only to their functional needs but also to creating engaging and unique experiences.

While Hilton’s Connie project demonstrated the exciting possibilities of AI for B2C, it also highlighted challenges and limitations that must be considered in future deployments.

- Strengths

- Innovation Leadership: Hilton became the first global hotel brand to deploy an AI-powered concierge robot, reinforcing its reputation for innovation.

- Enhanced Guest Experience: Connie provided quick, accurate, and personalized responses, improving the overall customer journey.

- Operational Support: By handling routine tasks, Connie increased staff productivity and allowed human employees to focus on complex service interactions.

- Memorable Differentiation: Connie’s novelty factor created memorable experiences, boosting Hilton’s appeal among tech-forward travelers.

- Data-Driven Insights: The system generated valuable data on guest interactions, informing long-term strategy and service improvements.

- Challenges

- Technology Limitations: Connie’s conversational AI, while advanced, was not perfect. It sometimes struggled with complex or ambiguous queries, which could frustrate guests expecting human-level comprehension.

- Scalability: Deploying Connie across Hilton’s thousands of properties presented logistical and financial challenges. Ensuring consistent performance and maintenance at global scale required significant resources.

- Guest Expectations: While many guests enjoyed interacting with Connie, others still preferred traditional human service. Striking the right balance between AI for B2C and human hospitality remains a delicate challenge.

- Privacy Concerns: Collecting and analyzing guest interaction data raises privacy issues. Hilton had to ensure compliance with data protection regulations and maintain transparency to preserve trust.

- Competitive Catch-Up: As other hotel chains and travel companies adopt AI for B2C tools, Hilton must continue to innovate to maintain its first-mover advantage.

Hilton’s AI concierge “Connie” stands as a pioneering example of how AI for B2C can redefine guest experiences in the travel and hospitality industry. By leveraging natural language processing, cognitive computing, and robotics, Hilton created a tool that not only enhanced service efficiency but also delighted guests with a unique, futuristic experience. The outcomes included improved guest satisfaction, increased staff efficiency, valuable customer insights, and powerful brand differentiation.

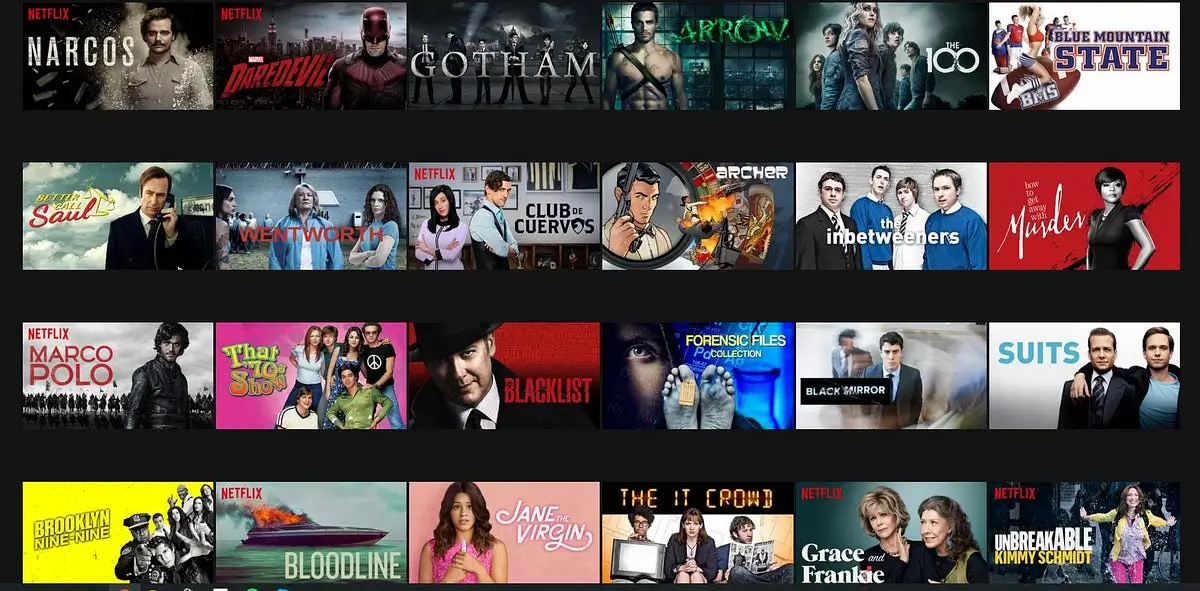

At the same time, Connie highlighted important lessons for the broader hospitality sector. AI for B2C must balance technological innovation with human service, ensure scalability, and address privacy concerns. While Connie was a groundbreaking project, its long-term success depended on Hilton’s ability to refine the technology, integrate it seamlessly with human staff, and adapt it to different cultural and market contexts.