Building upon the theoretical and functional framework introduced in Part 1: Foundations and Core Applications, this section brings AI for B2B to life through global real-world examples. It highlights how enterprises across industries—Salesforce, HubSpot, DHL, Siemens, Maersk, Mastercard, and Pfizer—have implemented AI to revolutionize operations, customer engagement, and decision-making. Each case study includes a breakdown of the strategy, implementation, and outcome, giving readers a tangible understanding of how AI drives business value across marketing, logistics, and compliance.

The diversity of use cases illustrates that AI’s value in B2B extends beyond automation. From predictive maintenance to generative design, from content assistance to fraud detection, these stories show that intelligence is both scalable and adaptable across domains. AI enhances accuracy, reduces risk, and empowers human teams to make data-informed decisions faster. Yet, as the landscape expands, challenges such as data integration, workforce readiness, and ethical governance become critical. The next step, detailed in Part 3: Strategy, Challenges, and Future Trends, explores how to navigate these realities strategically—ensuring that AI adoption is both transformative and sustainable. For foundational concepts and frameworks that underpin these successes, revisit Part 1: Foundations and Core Applications.

While theoretical discussions and predictions highlight the potential of AI for B2B, nothing demonstrates its value more clearly than real-world examples. Across industries, enterprises are deploying AI to improve marketing and sales performance, optimize logistics, ensure compliance, and accelerate product innovation. These case studies show that AI for B2B is not a distant future technology but a present-day enabler of measurable business outcomes. By examining specific examples, we see how companies leverage AI to gain a competitive advantage, strengthen relationships, and transform their operations.

Table of Contents

Case Studies in B2B Marketing & Sales

Marketing and sales in B2B involve long cycles, multiple decision-makers, and high-value contracts. AI for B2B has redefined these processes by enabling predictive insights, hyper-personalization, and improved deal forecasting.

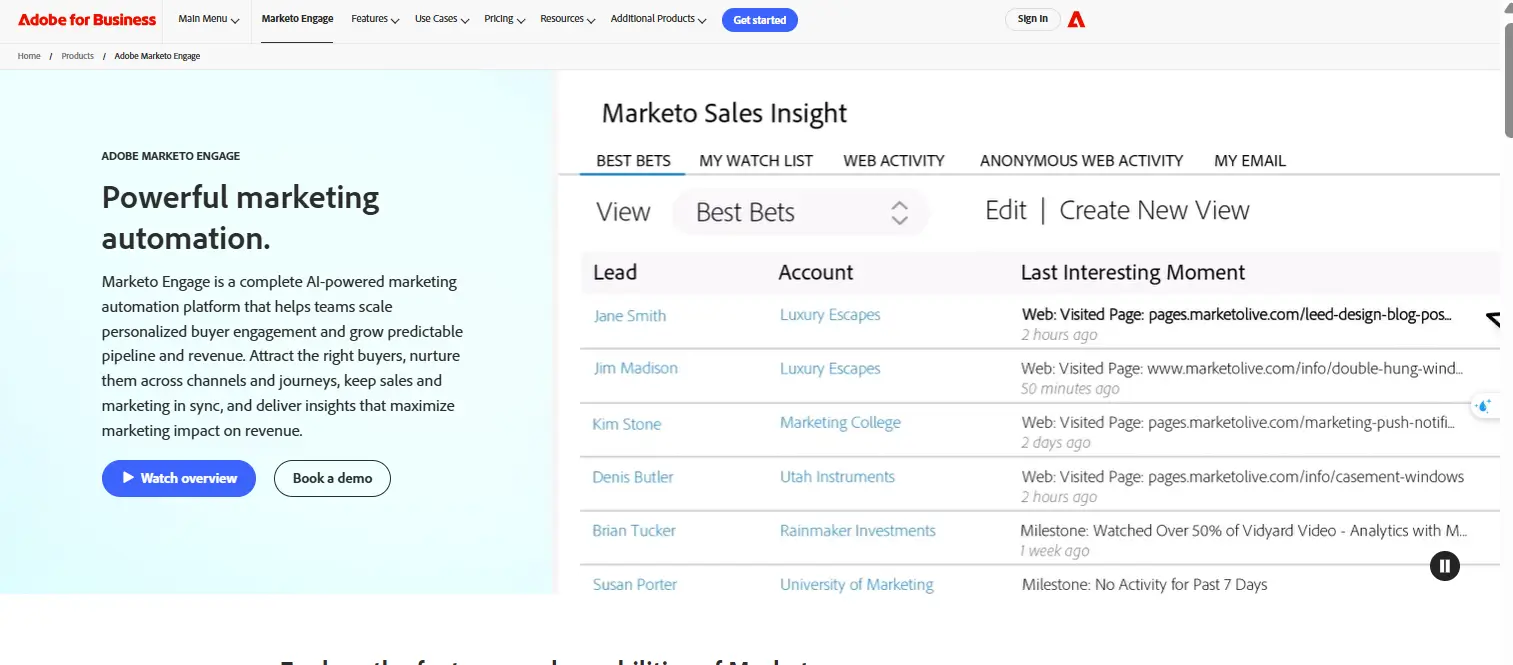

Adobe + Marketo Engage

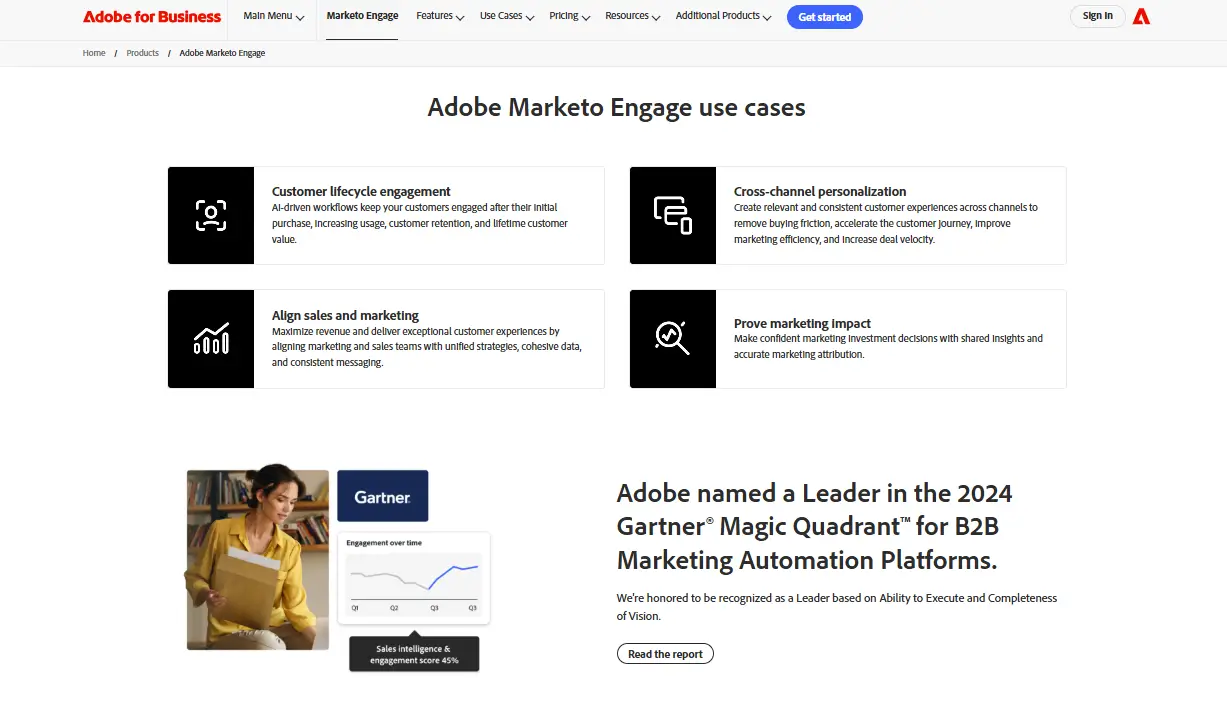

Adobe’s Marketo Engage is one of the most widely recognized B2B marketing automation platforms, especially known for its effectiveness in account-based marketing (ABM). In B2B contexts, marketing is rarely about one-to-one quick conversions; instead, it is about nurturing long-term relationships, targeting enterprise accounts with multiple stakeholders, and creating campaigns that resonate across complex buyer journeys. Adobe recognized that the traditional methods of marketing automation—static segmentation, mass email campaigns, and rule-based workflows—were no longer sufficient in a digital-first economy. Enterprises needed tools that could dynamically adapt to evolving customer behaviors, and this is where AI for B2B became a natural fit.

Marketo Engage, under Adobe’s stewardship, has evolved into more than just a marketing automation platform. It has become a data-driven intelligence hub where predictive analytics, personalization engines, and campaign optimization work in harmony. This transformation reflects the broader shift in AI for B2B, where enterprises are no longer satisfied with tools that only automate repetitive tasks—they now demand platforms that can anticipate customer needs, personalize engagement at scale, and generate measurable business results.

For ABM-focused organizations, Marketo Engage provides the perfect example of how AI for B2B can revolutionize traditional marketing. Instead of treating all accounts equally, the platform empowers enterprises to identify their highest-value targets, design hyper-personalized campaigns, and measure engagement across multiple buyer touchpoints. The platform’s AI capabilities serve as the “brain” behind this strategy, ensuring that businesses don’t just deliver content but deliver the right content to the right decision-maker at the right time.

AI B2B Strategy

Adobe’s AI integration into Marketo Engage was deliberate and comprehensive. At its core, the strategy aimed to transform how B2B marketers could use data—not just as static insights but as a predictive and prescriptive tool. AI for B2B within Marketo Engage analyzes enormous datasets that include customer demographics, firmographics, engagement history, website behavior, social media interactions, and even third-party intent data. By synthesizing this information, the platform predicts which accounts represent the greatest potential and how marketers should prioritize their outreach.

One of the most powerful elements of this strategy is predictive account scoring. In traditional B2B marketing, marketers often rely on manual criteria to determine account value, such as company size, industry, or revenue. While useful, this approach misses nuances in customer behavior. AI for B2B in Marketo Engage automates this process, applying machine learning to weigh hundreds of variables and assign predictive scores that reflect an account’s likelihood to convert. This allows sales and marketing teams to focus on the accounts that matter most, dramatically improving resource allocation.

Personalization is another cornerstone of Adobe’s AI-driven B2B strategy. Instead of relying on generic messaging, AI for B2B within Marketo Engage tailors content across multiple buyer touchpoints. For instance, a procurement manager may receive a cost-benefit analysis whitepaper, while a CTO from the same account is presented with a technical case study highlighting system performance and integration benefits. The AI ensures that each stakeholder receives messaging that aligns with their role and pain points, increasing engagement and accelerating consensus building.

Finally, AI for B2B in Marketo Engage emphasizes continuous optimization. Campaigns are no longer static “launch and forget” initiatives. Instead, AI algorithms monitor engagement in real time, testing variations of content, timing, and channel. Based on this analysis, the system automatically adjusts campaign parameters to maximize effectiveness. This makes B2B marketing campaigns dynamic, adaptive, and more aligned with actual buyer behavior.

By embedding AI into every stage of the ABM lifecycle—account identification, content personalization, and campaign optimization—Adobe created a platform that exemplifies how AI for B2B can turn marketing into a science of precision.

Outcome & Evaluation

The results of integrating AI for B2B into Marketo Engage have been profound, with enterprises reporting measurable improvements across key performance indicators. One of the most significant outcomes is the impact on conversion rates. By prioritizing high-value accounts and tailoring content with AI-driven personalization, businesses achieved up to a 30% increase in lead-to-opportunity conversions compared to generic campaigns. This demonstrates how AI for B2B personalization directly translates into stronger pipeline growth.

Engagement levels also rose significantly. In ABM campaigns powered by Marketo’s AI capabilities, stakeholders within target accounts reported higher interaction with content, whether through increased webinar attendance, more frequent downloads of personalized assets, or higher response rates to tailored outreach. By aligning messaging to individual roles, AI for B2B ensures that every interaction feels relevant, which strengthens relationships and builds trust over time.

From a cost perspective, the adoption of AI for B2B has reduced cost-per-acquisition (CPA). Traditional campaigns often wasted resources on accounts unlikely to convert, inflating marketing costs. Predictive scoring allowed companies to concentrate their efforts on the accounts most likely to deliver ROI, ensuring that marketing budgets were used more effectively. For enterprises managing hundreds of accounts, this efficiency translates into millions of dollars in savings.

Another critical dimension of the evaluation is organizational alignment. Historically, sales and marketing teams in B2B companies often worked in silos, leading to misalignment and inefficiencies. With AI for B2B predictive insights and shared account scoring, both teams now operate with a unified view of account priorities. This fosters collaboration, reduces conflict over lead quality, and ensures smoother handoffs between marketing-qualified and sales-qualified accounts.

Importantly, enterprises using Marketo Engage with AI for B2B reported greater agility in responding to market changes. Because campaigns are continuously optimized based on real-time data, businesses can adapt faster to shifts in buyer behavior, emerging trends, or competitive pressures. For example, if an account begins engaging heavily with content about a new product line, AI algorithms automatically adjust targeting and messaging to capitalize on that interest. This level of responsiveness is impossible with traditional static campaigns.

The long-term evaluation of AI for B2B in Marketo Engage highlights a fundamental truth: personalization, when done at scale with AI, is not just a marketing advantage—it is a competitive necessity. By outperforming generic campaigns in both engagement and conversions, AI-driven personalization redefines what success looks like in B2B marketing. Enterprises that embrace these capabilities not only achieve stronger short-term results but also build lasting client relationships that drive recurring revenue.

The Adobe Marketo Engage case study demonstrates the real-world power of AI for B2B in transforming marketing and sales. By combining predictive scoring, hyper-personalization, and real-time optimization, Adobe has created a platform that sets a new standard for ABM in the digital era. The outcomes—higher conversions, stronger engagement, lower acquisition costs, and better sales-marketing alignment—underscore why AI for B2B is no longer optional but essential for enterprises competing in complex markets.

This case also illustrates the broader lesson that B2B marketing is shifting from generic mass communication to intelligent, individualized engagement. AI for B2B is the technology that makes this possible, turning data into actionable insights and personalization at a scale previously unimaginable. For enterprises evaluating their next steps in digital transformation, Adobe’s Marketo Engage serves as proof that AI is not only the future of B2B marketing—it is the present.

Salesforce Einstein at Schneider Electric

Schneider Electric is a global leader in energy management and automation, serving enterprises across industrial, commercial, and residential sectors. Its clients include utility providers, large-scale manufacturers, data centers, and infrastructure developers. With such a broad range of stakeholders and a presence in over 100 countries, Schneider Electric faces one of the most complex B2B sales environments in the world. The company manages thousands of sales representatives, millions of data points, and long, consultative deal cycles that involve multiple stakeholders on both sides of the transaction.

Historically, Schneider Electric encountered challenges that are familiar to many large-scale B2B enterprises. Sales forecasting often relied on subjective input from sales representatives, making projections prone to bias and inaccuracy. Lead prioritization was equally problematic. With thousands of potential clients in the pipeline at any given time, determining which leads deserved immediate attention was difficult. Sales teams often invested significant time pursuing accounts that had low conversion potential, while high-value opportunities were missed due to lack of visibility.

The company recognized that relying on traditional CRM functionalities was no longer sufficient. Standard dashboards and manual reporting could not keep pace with the sheer volume and complexity of its data. What Schneider Electric needed was intelligence embedded into its CRM—an engine that could interpret vast datasets, reveal patterns invisible to human analysts, and guide sales teams toward the most promising opportunities. This led to the adoption of Salesforce Einstein, an AI for B2B solution integrated directly into the Salesforce CRM ecosystem.

AI B2B Strategy

The core of Schneider Electric’s AI B2B strategy was to transform its CRM from a static record-keeping system into a dynamic, predictive tool. Salesforce Einstein provided the ideal platform, offering AI-powered capabilities that analyzed historical data, evaluated customer behaviors, and applied predictive models to identify leads most likely to close.

At the heart of the implementation was predictive lead scoring. Instead of relying solely on demographics or firmographics, Salesforce Einstein considered dozens of behavioral and transactional variables. It analyzed email engagement, website interactions, historical purchasing patterns, and even social media signals to calculate a likelihood-to-convert score for each lead. With this, sales representatives no longer had to rely on intuition or guesswork; they had AI for B2B insights that objectively ranked accounts based on conversion potential.

Equally important was pipeline forecasting. Schneider Electric had previously struggled with forecasting accuracy, a common issue in B2B industries where deal cycles span months or even years. Salesforce Einstein applied machine learning to CRM data, evaluating historical deal outcomes, sales cycle lengths, and macroeconomic factors. The platform produced predictive revenue forecasts that were more accurate and adaptable than human-generated estimates. These forecasts gave leadership a clearer view of expected revenue, resource needs, and potential risks, enabling better strategic planning.

The AI B2B strategy also included alignment between sales and marketing. Salesforce Einstein’s predictive insights extended into marketing campaigns, enabling Schneider Electric to align messaging with the most promising accounts. Marketing teams could create campaigns tailored to high-value leads identified by the AI, ensuring that sales representatives received better-qualified opportunities. This eliminated friction between departments, fostering collaboration instead of misalignment.

Training and adoption were integral to the strategy’s success. Schneider Electric invested in equipping sales teams to use AI-driven insights effectively. This included training on interpreting predictive scores, leveraging Einstein dashboards, and integrating AI recommendations into daily workflows. By embedding AI for B2B directly into the CRM tools that sales teams already used, Schneider Electric ensured adoption was seamless rather than disruptive.

Overall, the AI B2B strategy centered on three pillars: predictive lead scoring to focus on high-value opportunities, forecasting accuracy to support strategic planning, and cross-department alignment to unify sales and marketing. These pillars reflected Schneider Electric’s broader vision of using AI for B2B not just as a technological upgrade, but as a transformation of how the organization approached its customers and managed growth.

Outcome & Evaluation

The impact of Salesforce Einstein at Schneider Electric was measurable and significant. The most immediate improvement came in sales team efficiency. With predictive lead scoring, representatives no longer wasted valuable time chasing low-potential accounts. Instead, they concentrated their efforts on leads flagged by AI for B2B as having the highest likelihood of conversion. This shift in focus improved win rates across multiple regions, as sales resources were applied more strategically.

Forecasting accuracy also improved dramatically. Prior to Salesforce Einstein, revenue forecasts often deviated significantly from actual outcomes, creating challenges in resource allocation and strategic decision-making. With AI for B2B predictive modeling, Schneider Electric increased forecasting accuracy by more than 25%. This improvement gave leadership greater confidence in financial planning, budget allocation, and long-term strategy development. In industries where multi-million-dollar deals are common, a 25% improvement in accuracy can represent billions in more reliable projections.

The evaluation also revealed stronger alignment between sales and marketing teams. With shared access to AI for B2B insights, both departments worked from the same predictive account scoring and pipeline forecasts. Marketing campaigns became more targeted, nurturing high-potential accounts that were already prioritized by sales. This eliminated the long-standing tension between departments, as both could now measure success using unified metrics and shared goals.

From a cultural perspective, the adoption of AI for B2B instilled greater confidence across Schneider Electric’s sales organization. Reps felt empowered by having data-driven guidance, which reduced the uncertainty and subjectivity traditionally associated with B2B selling. Managers also reported improved coaching opportunities, as predictive scores and deal risk indicators allowed them to focus support on the opportunities most in need of intervention.

Importantly, the AI for B2B initiative did not eliminate the human element of sales—it enhanced it. Sales representatives still engaged in consultative selling and relationship-building, but AI gave them sharper tools to prioritize accounts, tailor messaging, and predict outcomes. This balance between human expertise and machine intelligence was central to the initiative’s success.

On a broader scale, Schneider Electric’s adoption of Salesforce Einstein demonstrated the scalability of AI for B2B. As a global enterprise with thousands of employees, the company showed that AI could be deployed consistently across regions, product lines, and customer segments. The lessons learned extended beyond sales to influence other parts of the organization, inspiring further exploration of AI for B2B in areas such as operations, customer service, and product innovation.

In conclusion, the Salesforce Einstein case at Schneider Electric illustrates how AI for B2B can deliver tangible outcomes when applied strategically. By focusing on predictive lead scoring, pipeline forecasting, and cross-departmental alignment, Schneider Electric achieved measurable improvements in efficiency, accuracy, and collaboration. The results—higher win rates, more reliable forecasts, and reduced cost-per-acquisition—highlight why AI for B2B is not just a supporting tool but a central driver of competitive advantage in modern enterprise sales.

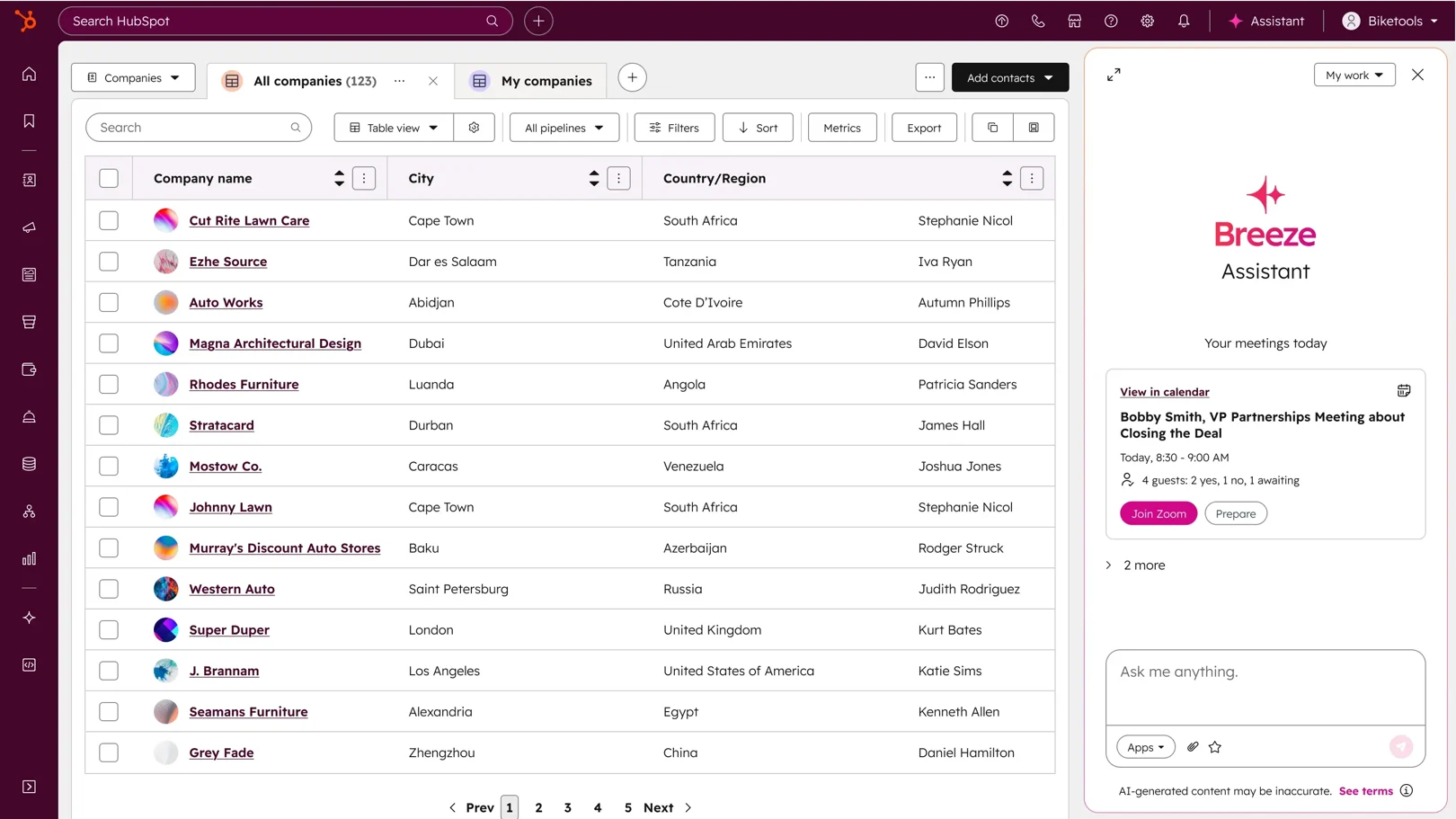

HubSpot Content Assistant

HubSpot has long been recognized as a leading provider of inbound marketing, CRM, and sales enablement tools for businesses of all sizes. Over the years, the platform has become an essential resource for B2B organizations that want to attract, engage, and delight customers across complex buyer journeys. Recognizing the increasing demand for faster, more personalized communication in the B2B space, HubSpot introduced its AI Content Assistant—a generative AI-powered tool designed to help sales and marketing teams create written content with speed, consistency, and precision.

For B2B enterprises, content creation is not a minor task; it is the backbone of client engagement. From drafting requests for proposals (RFPs) and technical documents to sending personalized follow-up emails, businesses invest significant time and resources into written communication. Yet, traditional methods often slow down sales cycles. Drafting a single proposal may require multiple team members and take several days, while crafting tailored email campaigns can stretch marketing teams thin. HubSpot’s Content Assistant was built to solve this challenge by applying AI for B2B contexts, giving teams a tool that could generate professional-grade content in minutes rather than hours or days.

The introduction of the Content Assistant reflects a broader trend in AI for B2B: the shift from basic automation to intelligent, generative systems that augment human creativity. Instead of replacing human expertise, HubSpot’s AI aims to accelerate productivity, free up employees from repetitive drafting, and ensure that B2B communications remain consistent, accurate, and tailored to the specific needs of clients and prospects.

AI B2B Strategy

The strategy behind HubSpot’s Content Assistant centered on embedding generative AI into the daily workflows of B2B sales and marketing teams. HubSpot understood that its users—many of whom work in resource-constrained teams—needed an AI for B2B solution that was not just powerful, but also intuitive and seamlessly integrated into their existing platform. The goal was to remove friction from the writing process while amplifying the impact of every piece of communication.

One of the core use cases for the Content Assistant is drafting RFP responses and business proposals. In B2B transactions, RFPs are often lengthy and highly technical, requiring businesses to provide detailed answers about capabilities, pricing structures, and compliance. Traditionally, sales reps and subject matter experts spend days compiling and editing these responses. HubSpot’s AI for B2B transforms this process by using generative models to analyze past proposals, draw from content libraries, and generate draft responses tailored to the specific requirements of each client. While human oversight is still necessary for accuracy and compliance, the time saved is substantial.

Another major application is in email campaigns. B2B email marketing is complex because it involves reaching multiple stakeholders within an organization, each with distinct needs and priorities. HubSpot’s Content Assistant leverages AI for B2B personalization by drafting tailored email sequences based on CRM data, buyer personas, and engagement history. For instance, a procurement officer might receive an email focusing on cost efficiencies, while a CTO might receive technical content emphasizing integration and scalability. This kind of tailored communication at scale would be nearly impossible to achieve manually without significant resources.

In addition to RFPs and emails, the Content Assistant supports broader content needs such as blog posts, sales collateral, and follow-up documentation. The AI for B2B functionality ensures that all content is aligned with brand voice, optimized for engagement, and adapted to the context of the target audience. The integration within HubSpot’s CRM means that the AI can leverage real-time data, ensuring that communications are both timely and relevant.

Ultimately, HubSpot’s AI B2B strategy was not just about adding another tool to its suite. It was about reimagining how B2B organizations approach written communication, positioning AI as a partner in the sales and marketing process. The focus on generative AI reflects a recognition that speed, personalization, and consistency are no longer “nice-to-haves” but essential for success in modern B2B commerce.

Outcome & Evaluation

The deployment of HubSpot’s Content Assistant has delivered tangible outcomes for B2B companies across industries. One of the most significant results has been the acceleration of turnaround times for client communications. Tasks that previously required days of drafting and editing—such as RFP responses or complex proposals—can now be completed in hours. Sales representatives reported that AI for B2B enabled them to respond to client requests faster, positioning their companies as more agile and responsive partners. This speed advantage often translates into higher win rates, as timely responses are critical in competitive bidding processes.

Higher response rates in email campaigns have also been a notable outcome. Personalized content generated by HubSpot’s AI Content Assistant resonated more effectively with decision-makers. Instead of generic outreach, prospects received messages tailored to their unique pain points, industry context, and stage in the buying journey. By leveraging AI for B2B personalization, companies reported improved open rates, click-through rates, and engagement metrics. In many cases, these improvements directly contributed to stronger pipeline growth and higher-quality leads.

Another key outcome has been improved sales productivity. B2B sales representatives often juggle multiple responsibilities—prospecting, client engagement, administrative tasks, and reporting. Content creation can consume a disproportionate amount of their time, limiting their ability to focus on revenue-generating activities. With HubSpot’s Content Assistant handling much of the initial drafting, reps can dedicate more time to relationship-building, negotiation, and consultative selling. Evaluation of AI for B2B adoption revealed a reduction in workload per representative, as well as a measurable increase in the number of opportunities managed effectively.

Personalization at scale was one of the most important aspects highlighted in evaluations. Without AI, personalization often required significant manual effort and was therefore limited in scope. With HubSpot’s AI for B2B solution, personalization became scalable, enabling companies to deliver tailored experiences to hundreds of accounts simultaneously. This capability strengthened client relationships, as stakeholders felt their unique needs were being recognized and addressed.

From a broader perspective, the evaluation also emphasized cultural benefits within organizations. Marketing and sales teams felt empowered by the AI rather than threatened by it. Instead of fearing automation, employees embraced the Content Assistant as a partner that made their jobs easier and more impactful. Managers noted that the quality of output improved as teams were freed from repetitive drafting and could focus more on strategic initiatives.

Financially, enterprises using HubSpot’s Content Assistant reported reductions in cost-per-acquisition and improvements in overall marketing ROI. The combination of faster turnaround, higher engagement, and better resource allocation ensured that AI for B2B was not just a productivity tool but a direct driver of revenue growth.

The HubSpot Content Assistant case study highlights how AI for B2B can revolutionize sales and marketing operations by addressing one of the most time-consuming aspects of B2B commerce: content creation. By automating the drafting of RFPs, proposals, and tailored campaigns, HubSpot has shown that generative AI is not only a tool for efficiency but also a driver of stronger engagement and personalization.

The outcomes—faster client communications, higher response rates, improved productivity, and scalable personalization—demonstrate that AI for B2B is more than an incremental improvement. It represents a shift in how enterprises approach communication, collaboration, and client engagement. HubSpot’s strategy illustrates the broader truth that generative AI is becoming indispensable for B2B organizations competing in complex, fast-moving markets.

For companies still evaluating AI adoption, the HubSpot example provides a compelling roadmap: start with a clear pain point (time-consuming content creation), integrate AI seamlessly into existing workflows, and focus on outcomes that deliver measurable value. By doing so, enterprises can harness the full potential of AI for B2B, turning it into a powerful ally in achieving growth, efficiency, and stronger client relationships.

Case Studies in Operations & Logistics

Operations and logistics are among the most challenging areas for enterprises due to supply chain complexity, fluctuating demand, and rising costs. AI for B2B has been crucial in optimizing these processes, making them more resilient and efficient.

DHL & IBM Watson

DHL, headquartered in Germany, is one of the world’s largest logistics and supply chain companies, operating across more than 220 countries and territories. With millions of packages moving daily through its global network, DHL faces extraordinary complexity in managing deliveries, inventory, and warehousing. The logistics industry is a cornerstone of B2B commerce, as companies across sectors—from manufacturing and retail to healthcare and technology—depend on efficient, reliable logistics partners to keep supply chains flowing smoothly.

Historically, logistics companies like DHL relied heavily on manual planning, static algorithms, and human judgment to make decisions about delivery routing, package flows, and warehouse operations. While effective to an extent, these methods struggled to keep up with the growing demands of globalization, the rise of eCommerce, and increasing expectations for same-day or next-day delivery. To remain competitive, DHL needed to evolve from a traditional logistics provider into a data-driven, technology-powered enterprise.

Recognizing these challenges, DHL partnered with IBM Watson, one of the world’s most advanced AI platforms, to embed artificial intelligence into every layer of its logistics operations. The collaboration focused on applying AI for B2B use cases that could improve decision-making, optimize supply chain efficiency, and provide predictive insights at a global scale. By combining DHL’s operational expertise with IBM Watson’s cognitive AI capabilities, the partnership set out to transform not just individual processes, but the entire logistics ecosystem.

AI B2B Strategy

The AI B2B strategy at DHL was designed to tackle multiple pain points across the logistics value chain, from warehouse operations to last-mile delivery. The collaboration with IBM Watson was structured around three main priorities: route optimization, demand forecasting, and warehouse automation.

- Optimizing Routing and Delivery Flows: DHL handles millions of deliveries each day, and small inefficiencies in routing can lead to massive costs over time. IBM Watson’s AI models were integrated into DHL’s logistics systems to analyze real-time traffic data, weather conditions, delivery volumes, and historical performance. The AI for B2B algorithms generated optimal delivery routes dynamically, reducing delays and fuel consumption. For example, a driver delivering to multiple business clients in urban areas could receive AI-driven route updates that adjusted in real time based on traffic congestion or delivery priority. This not only improved punctuality but also reduced the carbon footprint of DHL’s delivery network.

- Predicting Package Flows with Demand Forecasting: Another core aspect of the AI for B2B strategy was predicting package flows. DHL’s network depends on anticipating how many packages will pass through sorting hubs and warehouses at any given time. By leveraging IBM Watson’s predictive analytics, DHL could forecast package volumes with over 95% accuracy. The system considered variables such as seasonal demand, client activity, macroeconomic trends, and regional fluctuations. This allowed DHL to allocate resources—staff, vehicles, and warehouse space—more efficiently. Forecasting also enabled the company to prepare for surges in demand, such as those during holiday seasons or global events, ensuring smooth operations without costly bottlenecks.

- Warehouse Automation and Robotics: Warehouses are critical nodes in logistics networks, yet traditionally they relied heavily on manual labor. DHL and IBM Watson integrated AI for B2B robotics automation to streamline warehouse processes such as package sorting, picking, and inventory management. IBM Watson’s cognitive AI analyzed workflows and directed robots to execute repetitive tasks, reducing errors and speeding up throughput. By automating mundane tasks, human workers could focus on higher-value responsibilities like exception management and customer service. This integration of AI and robotics exemplified how AI for B2B is redefining operational models across industries.

Beyond these three pillars, DHL also used IBM Watson’s natural language processing (NLP) capabilities to enhance customer interactions and improve internal communication. For example, AI chatbots were deployed to provide B2B customers with real-time updates on shipments, invoices, and delivery schedules, reducing strain on call centers while improving customer satisfaction.

Outcome & Evaluation

The partnership between DHL and IBM Watson yielded measurable outcomes that validated the power of AI for B2B in logistics. One of the most significant results was the reduction in delivery times. Route optimization powered by AI shortened transit periods, helping DHL meet or exceed customer expectations for on-time delivery. This improvement was especially valuable in B2B contexts where delayed deliveries can disrupt production schedules, strain supplier relationships, and cause financial losses.

Operational costs also decreased significantly. By optimizing routes and predicting package flows with high accuracy, DHL reduced fuel consumption, minimized overtime labor costs, and eliminated inefficiencies in resource allocation. Evaluations showed that the implementation of AI for B2B led to a 15% reduction in operational inefficiencies. In an industry where margins are often slim, such reductions translate into substantial financial gains.

Warehouse throughput increased dramatically as well. With AI-driven robotics and process automation, DHL achieved faster package sorting and improved inventory management. The efficiency gains not only reduced delays but also enhanced scalability, allowing warehouses to handle higher volumes without proportional increases in labor costs. Evaluations indicated that throughput times were reduced by double-digit percentages, enabling DHL to process more packages within the same time frame and space.

Demand prediction accuracy was another highlight of the evaluation. DHL achieved over 95% accuracy in forecasting package flows across its global network. This level of precision empowered the company to anticipate demand surges, allocate resources in advance, and avoid costly bottlenecks. For B2B customers, this meant greater reliability and confidence in DHL’s ability to deliver on time, even during peak seasons.

The cultural impact within DHL was equally important. Employees reported that the integration of AI for B2B tools made their work more manageable and less repetitive. Instead of spending hours manually sorting packages or planning routes, staff could focus on oversight, problem-solving, and delivering customer value. This not only improved job satisfaction but also positioned DHL as a forward-thinking employer in a competitive industry.

From the customer perspective, the improvements in service reliability and delivery speed enhanced DHL’s reputation as a trusted logistics partner. In B2B supply chains, reliability is paramount—delays can disrupt manufacturing schedules or prevent retailers from stocking shelves on time. By leveraging AI for B2B solutions through IBM Watson, DHL strengthened client relationships and gained a competitive edge over logistics providers that had yet to embrace AI at scale.

The DHL and IBM Watson partnership serves as a powerful example of how AI for B2B can transform operations and logistics at a global scale. By focusing on route optimization, demand forecasting, and warehouse automation, DHL was able to shorten delivery times, cut operational costs, and significantly increase throughput. The results—over 95% accuracy in demand prediction and a 15% reduction in inefficiencies—demonstrate the tangible business value of applying AI for B2B to complex, global supply chains.

Beyond numbers, the case highlights a broader truth: AI for B2B is not simply a tool for incremental improvement but a catalyst for rethinking how industries operate. In logistics, where reliability, efficiency, and scalability are non-negotiable, AI provides the intelligence needed to deliver consistently high performance. For enterprises evaluating AI adoption, the DHL case illustrates the importance of combining technological expertise with operational knowledge, and of implementing AI in a way that empowers employees and enhances customer satisfaction.

As global supply chains continue to face challenges—from rising demand to geopolitical disruptions—AI for B2B will only become more critical. DHL’s success with IBM Watson demonstrates that enterprises willing to invest in AI can future-proof their operations, strengthen client relationships, and lead the industry into a new era of intelligent logistics.

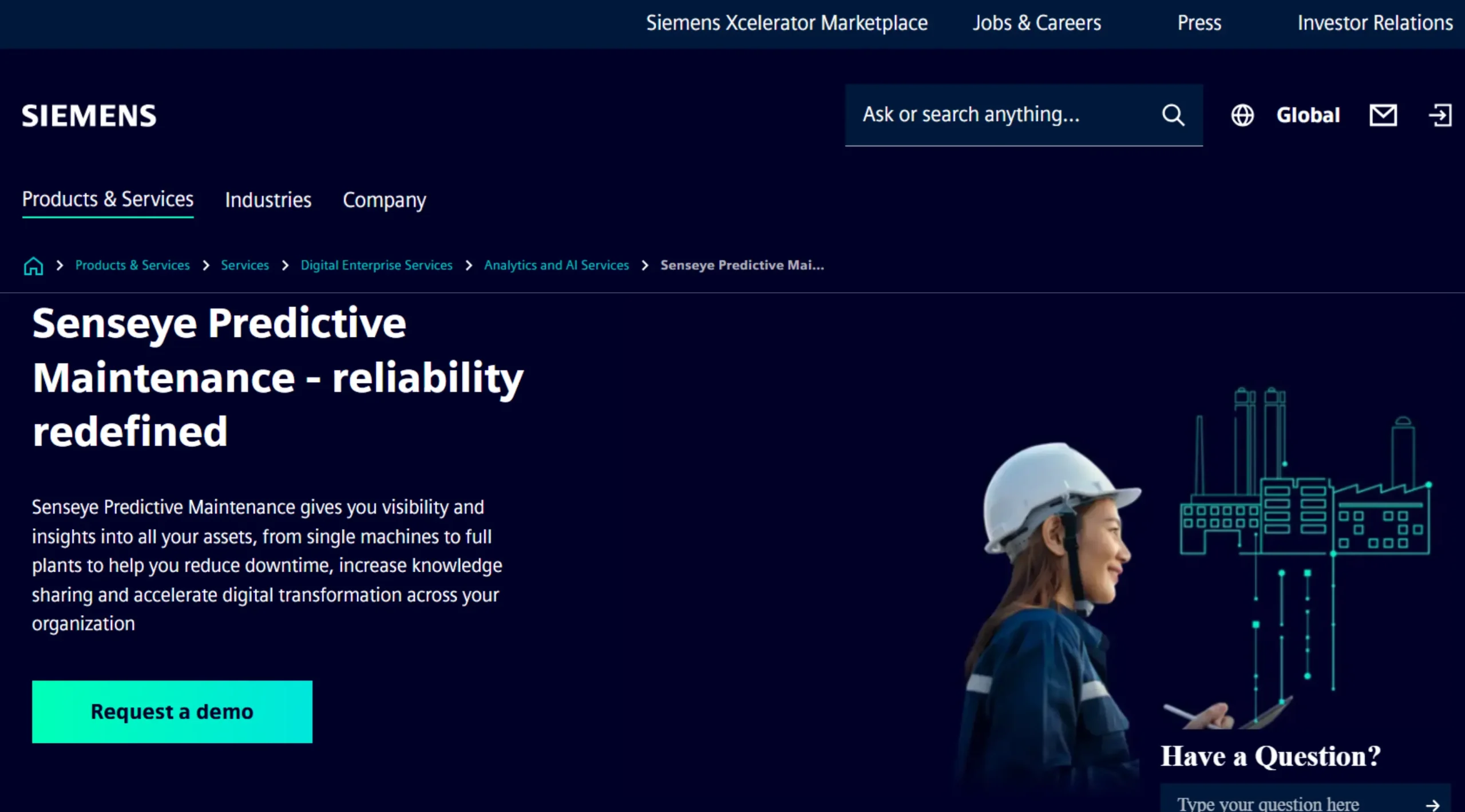

Siemens Predictive Maintenance

Siemens is one of the largest industrial manufacturing conglomerates in the world, with operations spanning energy, automation, healthcare, mobility, and infrastructure. Its role as both a manufacturer and a service provider for industrial equipment makes it a critical partner in countless B2B ecosystems. From turbines in power plants to automation systems in factories, Siemens delivers and maintains machinery that underpins the daily operations of its B2B clients. For these customers, reliability is paramount. Unplanned equipment failures can bring entire production lines to a halt, disrupt supply chains, and cause financial losses worth millions of dollars.

Traditionally, equipment maintenance followed two models: reactive maintenance, which meant fixing machinery after it failed, and scheduled maintenance, where machinery was serviced at set intervals regardless of condition. Both approaches had serious drawbacks. Reactive maintenance led to unexpected downtime and expensive emergency repairs, while scheduled maintenance often wasted resources by replacing parts prematurely. In both cases, B2B clients suffered from either excessive costs or operational disruptions.

Recognizing the need for a smarter, more proactive approach, Siemens turned to AI for B2B solutions. By embedding artificial intelligence into its industrial equipment and service offerings, Siemens could shift from reactive and scheduled maintenance to predictive maintenance. This meant using AI algorithms to analyze real-time sensor data from machines, identify signs of wear or anomalies, and predict potential failures before they happened. The result was a revolutionary change in how Siemens and its B2B partners managed the lifecycle of critical equipment.

AI B2B Strategy

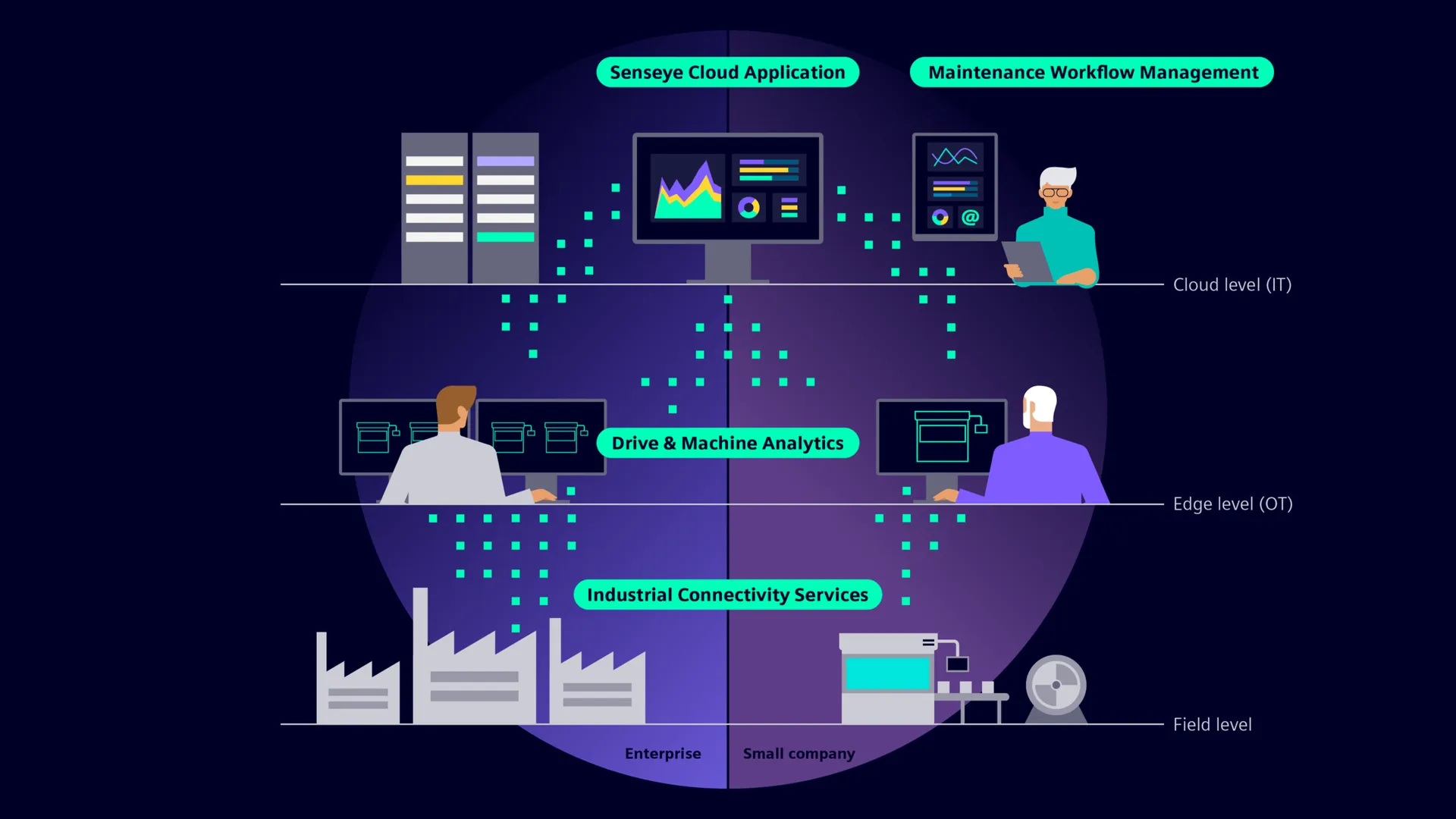

The AI B2B strategy at Siemens revolved around integrating advanced machine learning and IoT analytics into its industrial products and service frameworks. The goal was to build a predictive maintenance system that not only improved machine reliability but also created measurable value for B2B clients by reducing downtime, lowering costs, and extending equipment lifespan.

At the core of the strategy was the collection of sensor data from industrial equipment. Modern Siemens machinery is equipped with thousands of sensors measuring variables such as temperature, vibration, pressure, energy consumption, and noise. These sensors produce massive amounts of data every second, far too much for human operators to analyze manually. By applying AI for B2B to this data stream, Siemens built predictive models that could detect subtle anomalies long before they became visible to engineers.

The predictive models worked by comparing real-time sensor readings with historical performance data. For instance, a turbine that consistently runs at a certain vibration pattern may suddenly show minor deviations. While imperceptible to human observation, AI for B2B algorithms flag this change as a potential early warning of bearing failure. Engineers are then notified to inspect the component, order replacement parts, or adjust operating conditions—preventing the failure before it escalates.

Another key component of the strategy was Siemens’ MindSphere, its industrial IoT platform. MindSphere acts as the data backbone for predictive maintenance, enabling B2B clients to connect their equipment to the cloud and access real-time analytics powered by AI. Through MindSphere, Siemens not only deployed predictive maintenance for its own machinery but also offered AI for B2B predictive analytics as a service to other industrial partners. This expanded the reach of predictive maintenance across industries including automotive, energy, chemicals, and manufacturing.

The AI B2B strategy also prioritized scalability and adaptability. Predictive maintenance solutions were designed to handle fleets of equipment across multiple geographies. A multinational manufacturing client, for example, could monitor hundreds of machines across plants worldwide through a single dashboard. AI models continually refined themselves as more data was collected, improving accuracy over time.

Finally, Siemens emphasized collaboration with clients as part of its AI for B2B approach. Predictive maintenance was not simply a product feature—it became a partnership model. Siemens worked with clients to integrate AI insights into their maintenance workflows, train staff to interpret predictive alerts, and redesign operational strategies to maximize uptime. This partnership ensured that AI for B2B was not an abstract technology but a practical tool embedded into daily business operations.

Outcome & Evaluation

The outcomes of Siemens’ predictive maintenance strategy have been profound, demonstrating the real-world impact of AI for B2B in operations and logistics. Perhaps the most striking result has been the significant reduction in equipment downtime. By predicting failures before they occurred, Siemens helped its B2B clients cut downtime by 30–50%. For companies where even one hour of halted production can cost millions, this reduction translated into substantial savings and competitive advantages.

Maintenance costs also decreased dramatically. Traditional maintenance approaches often involved replacing parts on a fixed schedule, leading to waste when components still had usable life left. With AI for B2B predictive maintenance, components were serviced or replaced only when necessary, based on real-time condition monitoring. Clients avoided both the expense of unnecessary replacements and the higher costs of emergency repairs. Evaluations showed that predictive maintenance reduced overall maintenance costs by double-digit percentages, contributing directly to improved profitability.

Client satisfaction improved significantly as well. For B2B relationships, reliability and trust are central. When Siemens delivered machinery that not only performed well but also predicted its own failures, clients viewed Siemens as a strategic partner rather than just a supplier. The ability to guarantee higher uptime and more predictable operations strengthened customer loyalty and deepened long-term partnerships.

The evaluation of Siemens’ AI for B2B initiative also highlighted measurable ROI. Clients reported not only reduced downtime and lower costs but also increased productivity. Production lines operated with fewer disruptions, supply chains flowed more smoothly, and employees could focus on higher-value tasks instead of firefighting breakdowns. In some cases, the ROI was realized within months, as the cost of deploying AI for B2B predictive maintenance was quickly offset by the savings from avoided shutdowns.

Another important outcome was the cultural shift within client organizations. Maintenance teams moved from reactive firefighting to proactive strategy. Instead of being seen as a cost center, maintenance became a source of competitive advantage, powered by AI for B2B insights. Engineers gained confidence in their ability to anticipate problems and prevent disruptions, while executives valued the increased predictability and transparency in operations.

Beyond individual clients, Siemens itself benefited from this AI for B2B strategy. By embedding predictive maintenance into its offerings, Siemens created a new revenue stream through service contracts, data analytics subscriptions, and digital solutions. This transformed its business model from one focused purely on selling equipment to one that generated recurring value through ongoing partnerships.

The Siemens predictive maintenance case study underscores how AI for B2B can fundamentally transform operations and logistics across industries. By applying AI to analyze sensor data and predict failures before they happen, Siemens not only improved equipment reliability but also reshaped how B2B clients manage their operations. The outcomes—30–50% reductions in downtime, lower maintenance costs, improved client satisfaction, and measurable ROI—prove that predictive maintenance is not just a technological upgrade but a business game-changer.

More importantly, the Siemens example illustrates the broader potential of AI for B2B. Predictive maintenance is only one application, but it shows how AI can unlock hidden value in massive data streams, reduce inefficiencies, and create new business models. For industrial enterprises facing the constant pressure of efficiency, reliability, and competitiveness, Siemens’ approach demonstrates that AI for B2B is not optional—it is essential.

As supply chains become more global and machinery more complex, predictive maintenance powered by AI will become a standard expectation in B2B industries. Siemens’ leadership in this space provides a roadmap for how enterprises can integrate AI into their operations, partner with clients for mutual value, and turn challenges into opportunities through data-driven intelligence.

Maersk & Microsoft Azure AI

Maersk is the world’s largest container shipping company, responsible for transporting one-fifth of the world’s traded goods. With a fleet of over 700 vessels, hundreds of ports of call, and millions of containers in circulation at any given time, Maersk sits at the heart of global commerce. The company’s B2B relationships are vast and diverse—serving manufacturers, retailers, energy companies, and governments across continents. In this environment, reliability and efficiency are not just operational goals, but critical promises to B2B customers whose own supply chains depend on Maersk’s ability to deliver.

The scale of Maersk’s operations introduces extraordinary complexity. Factors such as unpredictable weather conditions, port congestion, labor disputes, geopolitical risks, and fluctuating customer demand create constant challenges. Traditionally, shipping companies relied on historical data, experience, and rule-based models to manage these risks. However, as global trade volumes increased and customer expectations shifted toward more precise and transparent supply chain operations, traditional approaches became insufficient.

To address these challenges, Maersk partnered with Microsoft to deploy Azure AI across its shipping and logistics operations. The collaboration sought to integrate artificial intelligence into forecasting, routing, and risk management processes, making Maersk’s operations smarter, more adaptable, and more resilient. By embedding AI for B2B into its supply chain ecosystem, Maersk aimed to transform not just its own business model, but also the efficiency and reliability of the countless enterprises that depend on its services.

AI B2B Strategy

The AI B2B strategy between Maersk and Microsoft Azure was designed around three core pillars: forecasting shipping demand, optimizing container routes, and predicting disruptions caused by external risks such as weather events or port congestion. Each of these pillars addressed a critical pain point in global shipping and demonstrated the value of AI for B2B in large-scale logistics.

- Forecasting Shipping Demand: Predicting customer demand in global shipping is a monumental task. Demand fluctuates due to seasonality, economic cycles, consumer trends, and unforeseen events such as pandemics or geopolitical crises. Traditionally, inaccurate forecasts led to underutilized vessels, empty container repositioning, or capacity shortages that strained customer relationships. By using Microsoft Azure AI, Maersk developed predictive models that analyzed trade patterns, historical shipment data, macroeconomic indicators, and real-time market signals. These AI for B2B models provided more accurate demand forecasts, allowing Maersk to adjust capacity in advance, align resources more efficiently, and meet client needs with greater precision.

- Optimizing Container Routes: One of the largest inefficiencies in shipping is empty container repositioning—moving containers without cargo simply to balance supply and demand across ports. This practice consumes significant resources and increases emissions without generating revenue. Through Azure AI, Maersk implemented algorithms that dynamically optimized container routes based on real-time demand, port activity, and vessel schedules. These AI for B2B solutions reduced unnecessary repositioning by predicting where containers would be needed and proactively directing them to those locations. The result was improved asset utilization, reduced operational waste, and lower costs for both Maersk and its B2B customers.

- Predicting Delays and External Risks: Delays in shipping can have cascading effects across supply chains. A late arrival at one port can disrupt factory production schedules, retail stock availability, and even downstream transportation. Maersk and Microsoft used Azure AI to analyze external risk factors such as weather forecasts, port congestion reports, and global trade disruptions. AI for B2B predictive models provided early warnings of potential delays, enabling Maersk to reroute vessels, adjust schedules, or proactively communicate with clients. This risk management capability not only improved on-time delivery but also strengthened trust with B2B customers who valued transparency and proactive problem-solving.

The strategy emphasized integration with Maersk’s existing digital platforms, such as TradeLens, the blockchain-based supply chain solution it co-developed. By embedding Azure AI into these platforms, Maersk created a holistic digital ecosystem where clients, partners, and internal teams could access predictive insights in real time. This seamless integration ensured that AI for B2B became a natural part of everyday decision-making rather than an isolated technology project.

Outcome & Evaluation

The outcomes of the Maersk and Microsoft Azure collaboration illustrate the transformative potential of AI for B2B in global logistics. The most immediate result was improved on-time delivery. With predictive insights into demand, optimized routes, and early detection of delays, Maersk significantly reduced the unpredictability of its shipping operations. For B2B customers, this translated into more reliable supply chains, fewer disruptions, and greater confidence in planning production and distribution schedules.

Asset utilization also improved considerably. By reducing the need for empty container repositioning, Maersk cut operational waste and maximized the revenue potential of its container fleet. This efficiency directly impacted profitability, while also contributing to sustainability goals by reducing unnecessary fuel consumption and emissions. Evaluations showed that AI for B2B enabled Maersk to achieve a measurable decline in repositioning costs, which had historically represented a substantial burden for shipping companies.

Scalability was another critical outcome. As Maersk applied Azure AI across its global network, the benefits multiplied. Predictive models became more accurate as they ingested more data, creating a virtuous cycle of improvement. This scalability allowed Maersk to extend the benefits of AI for B2B to clients of all sizes, from multinational corporations to smaller businesses reliant on global trade. For clients, the knowledge that their logistics partner could scale predictive intelligence across continents provided an additional layer of trust and competitive advantage.

The evaluation also highlighted improved client relationships. In B2B logistics, transparency is as important as efficiency. Maersk’s ability to provide proactive updates, share predictive insights, and collaborate with clients on contingency planning strengthened trust. Enterprises valued the fact that they were no longer left in the dark about delays but could instead plan around them with accurate, data-driven information. This enhanced trust positioned Maersk not just as a logistics provider but as a strategic partner in clients’ supply chain strategies.

From an internal perspective, Maersk employees benefited from AI for B2B tools that streamlined workflows and reduced manual planning. Operations managers who once spent hours analyzing spreadsheets could now rely on predictive dashboards powered by Azure AI. This freed human talent to focus on higher-value tasks, such as strategic optimization and customer engagement. The cultural shift from reactive management to proactive strategy improved employee satisfaction and positioned Maersk as a technology-forward employer in the logistics sector.

Financially, the collaboration demonstrated clear ROI. By cutting repositioning costs, improving delivery reliability, and enhancing asset utilization, Maersk reduced operational inefficiencies that had long eroded profitability. The measurable impact on both costs and revenues validated the decision to embed AI for B2B into its core business processes.

The Maersk and Microsoft Azure AI partnership represents a milestone in applying AI for B2B to one of the world’s most complex industries. By focusing on demand forecasting, route optimization, and risk prediction, Maersk transformed its logistics operations into a model of efficiency, scalability, and transparency. The outcomes—improved on-time delivery, reduced empty container costs, enhanced scalability, and stronger client trust—demonstrate how AI for B2B is not only a technological upgrade but a fundamental rethinking of how global supply chains should operate.

This case also highlights the broader implications for B2B enterprises. In industries where complexity and uncertainty are constant, AI for B2B provides the predictive intelligence and adaptability needed to stay ahead. Maersk’s success illustrates the importance of combining domain expertise with cutting-edge AI platforms like Microsoft Azure, creating solutions that are both technologically sophisticated and operationally practical.

As global trade continues to face pressures from economic fluctuations, environmental challenges, and shifting customer expectations, the role of AI for B2B will only grow. Maersk’s collaboration with Microsoft demonstrates that enterprises willing to embrace AI at scale can not only survive but thrive in this environment—delivering value not just to their shareholders but to the countless businesses and communities that depend on their services.

Case Studies in Legal, Finance & Compliance

Legal, finance, and compliance are areas where errors can result in severe penalties, reputational damage, or loss of trust. AI for B2B plays a pivotal role here by automating compliance monitoring, detecting fraud, and ensuring due diligence.

Kira Systems with PwC and Deloitte

Kira Systems, now part of Litera, is one of the pioneers in applying artificial intelligence to the complex world of legal and financial document analysis. At its core, Kira is designed to process and understand massive volumes of unstructured text, extracting key clauses, financial terms, and compliance requirements with a level of speed and accuracy far beyond human capability. For industries such as law, finance, and compliance—where accuracy is non-negotiable and errors can result in multimillion-dollar liabilities—this technology represented a game-changing advancement.

Consulting giants PwC and Deloitte quickly recognized the potential of Kira and began integrating it into their workflows for audits, mergers and acquisitions (M&A) due diligence, and regulatory compliance reviews. Both firms work with enormous document sets on behalf of global B2B clients, ranging from multinational corporations preparing for complex mergers to financial institutions facing evolving regulatory requirements. Traditional manual review methods required armies of lawyers, auditors, and analysts to sift through thousands of contracts and compliance documents, a process that was not only time-consuming but also susceptible to human oversight.

By adopting Kira, PwC and Deloitte sought to enhance their advisory services with AI for B2B solutions that could scale quickly, reduce costs, and improve accuracy. In doing so, they positioned themselves not merely as service providers but as technology-enabled partners capable of delivering faster, more reliable insights to clients navigating high-stakes decisions.

AI B2B Strategy

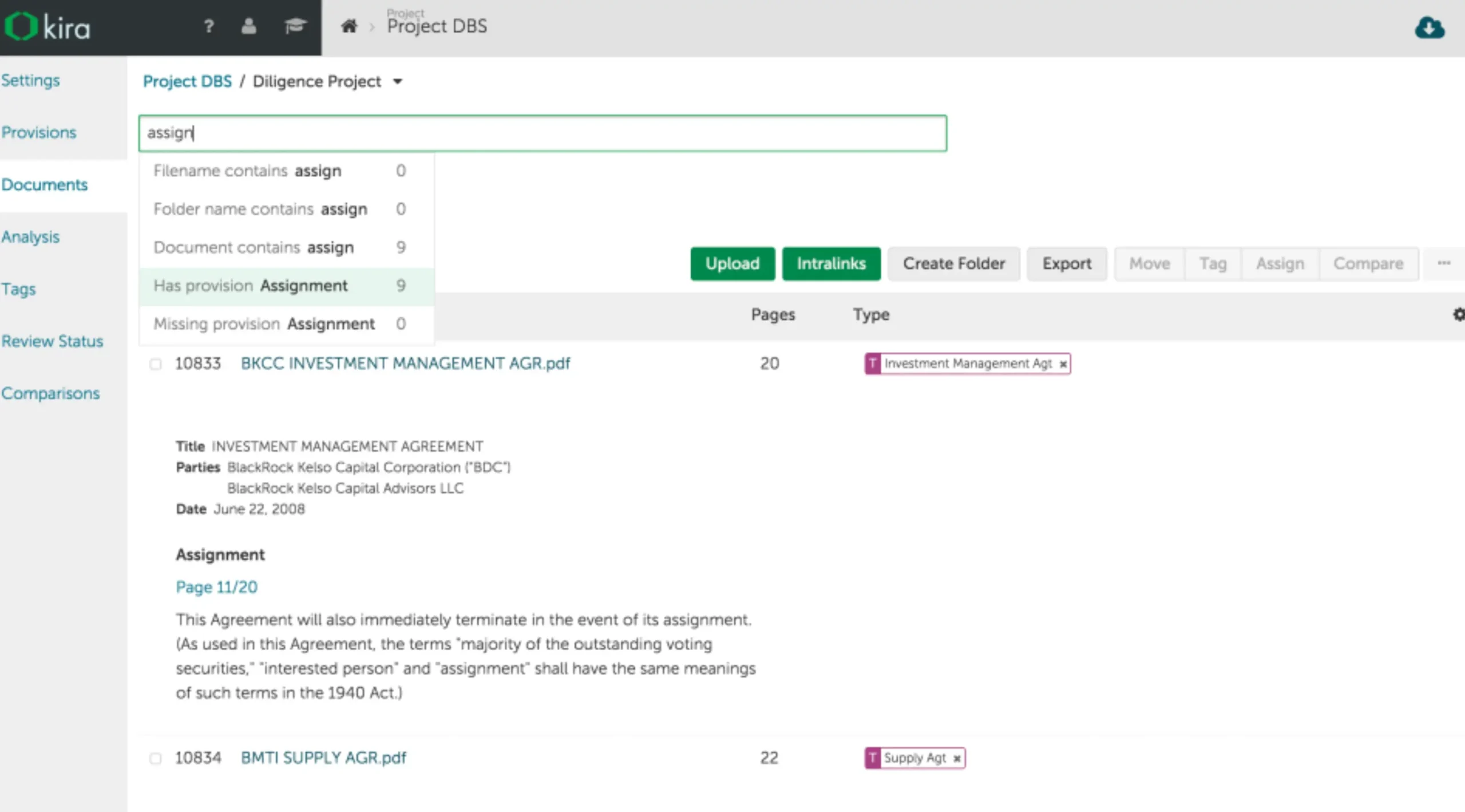

The strategy behind PwC and Deloitte’s use of Kira revolved around one central challenge: the overwhelming volume of documentation involved in corporate transactions and compliance processes. A single M&A transaction, for instance, may involve the review of tens of thousands of contracts. Each contract must be analyzed for key clauses such as change-of-control provisions, termination rights, and financial obligations that could impact the transaction’s value or feasibility. Without AI for B2B, this review process often took weeks or months and consumed significant billable hours.

Kira’s AI engine was designed to solve this problem by applying machine learning to document analysis. PwC and Deloitte trained the system on thousands of examples of legal clauses and financial terms, enabling it to recognize patterns and extract relevant data automatically. Instead of manually reading every page, analysts could upload document sets into Kira, which would quickly identify the critical sections for review. This freed human experts to focus on interpreting results and advising clients rather than spending their time on rote data extraction.

For compliance, Kira was particularly valuable in areas such as financial services, where regulations evolve rapidly and organizations must continually verify that contracts, disclosures, and filings meet current standards. By using AI for B2B document review, PwC and Deloitte could help clients stay ahead of compliance risks, identifying gaps or inconsistencies before they escalated into legal penalties.

In due diligence, the AI B2B strategy emphasized speed and accuracy. Time is often of the essence in M&A deals, where delays can derail negotiations or cause a company to lose its competitive advantage. By embedding Kira into their due diligence workflows, PwC and Deloitte reduced turnaround times significantly. This allowed clients to move faster, make informed decisions, and close deals with greater confidence.

Another key element of the strategy was scalability. Both consulting firms serve clients across industries and geographies, each with unique regulatory frameworks and contract structures. Kira’s machine learning algorithms could be trained for new contexts, meaning PwC and Deloitte could adapt the platform for different jurisdictions or industries without rebuilding processes from scratch. This flexibility made AI for B2B not just a specialized tool but a strategic asset for global consulting firms.

Outcome & Evaluation

The results of PwC and Deloitte’s adoption of Kira demonstrate the real-world value of AI for B2B in legal, finance, and compliance settings. One of the most immediate outcomes was the dramatic reduction in time required for document review. Studies and internal evaluations showed that audit and due diligence times were cut by up to 40%. Tasks that previously required weeks of manual labor could now be completed in days, enabling clients to act quickly in high-pressure situations such as M&A negotiations.

Accuracy also improved significantly. Human reviewers, even the most experienced, are prone to fatigue and oversight when reviewing thousands of pages of dense legal text. Kira’s AI for B2B algorithms maintained consistent accuracy across entire document sets, flagging critical clauses with reliability. Evaluations indicated that error rates decreased substantially, reducing legal and financial risks for clients. In industries where a single overlooked clause can alter the outcome of a transaction, this improvement in accuracy provided tremendous value.

The reduction in legal risks was another key outcome. By systematically extracting and analyzing compliance requirements, Kira helped PwC and Deloitte identify potential liabilities early in the process. Clients could address risks before they escalated into disputes, regulatory penalties, or deal-breaking issues. This proactive approach not only safeguarded clients but also enhanced the reputation of the consulting firms as trusted advisors.

Financially, the ROI was clear. By leveraging AI for B2B document analysis, PwC and Deloitte reduced labor costs, increased efficiency, and were able to handle a greater volume of client work without expanding their workforce proportionally. This scalability allowed them to grow their advisory services and take on more projects, enhancing revenue while maintaining quality standards. Clients also benefited financially, as shorter review cycles and lower error rates translated into reduced transaction costs and faster time to market.

From a client satisfaction perspective, evaluations showed that B2B enterprises valued the transparency and speed provided by AI-driven reviews. Instead of waiting weeks for preliminary reports, executives could receive insights in near real time, enabling faster decision-making. This responsiveness strengthened trust between clients and their consulting partners, fostering long-term relationships.

Internally, the adoption of Kira also had cultural benefits. Analysts and lawyers, freed from repetitive document review, could focus on higher-value activities such as risk assessment, strategic planning, and client engagement. Employees reported higher job satisfaction and felt empowered by AI for B2B tools that enhanced their expertise rather than replacing it. This balance between human judgment and machine efficiency proved essential to the long-term success of the initiative.

The case of Kira Systems with PwC and Deloitte demonstrates the transformative potential of AI for B2B in the legal, finance, and compliance sectors. By deploying AI-powered document analysis, these consulting giants achieved measurable outcomes: audit and due diligence times cut by up to 40%, improved accuracy, reduced legal risks, and stronger client relationships. The results underscore how AI for B2B is not only about efficiency but also about risk management, scalability, and competitive differentiation.

More broadly, this case highlights the role of AI for B2B as a catalyst for redefining professional services. In an era where clients demand faster, more accurate insights, consulting firms that embrace AI can position themselves ahead of competitors and deliver value that traditional methods cannot match. Kira’s integration into PwC and Deloitte’s workflows illustrates how human expertise and artificial intelligence can complement each other, creating a model for the future of advisory services.

As regulations become more complex and transactions more global, the demand for AI-driven document analysis will only increase. Enterprises that fail to adopt these tools risk slower processes, higher costs, and greater exposure to compliance failures. PwC and Deloitte’s success with Kira serves as a blueprint for how organizations can implement AI for B2B effectively, ensuring not only efficiency gains but also long-term trust and resilience in a fast-changing business environment.

Mastercard Decision Intelligence

Mastercard is one of the most widely recognized players in the global financial ecosystem, processing billions of transactions across more than 200 countries and territories. While traditionally associated with consumer payments, Mastercard has a massive presence in the B2B domain, providing payment solutions for enterprises, financial institutions, governments, and merchants. In the world of B2B payments, security and trust are paramount. The value of a single transaction can often reach millions of dollars, and the reputational damage of fraud or false declines can cripple relationships between businesses and their payment providers.

The scale of Mastercard’s operations presents unique challenges. Every second, its network processes thousands of transactions that need to be verified, approved, or flagged for risk. Traditional rule-based fraud detection systems, which rely on fixed thresholds or pre-defined scenarios, proved insufficient in this environment. Fraudsters continuously evolve their methods, exploiting new vulnerabilities in the system. Meanwhile, overly rigid fraud detection models often generate false positives—transactions that are legitimate but incorrectly flagged as suspicious. For B2B enterprises, false positives can be just as damaging as fraud itself, leading to delayed shipments, strained supplier relationships, and lost revenue.

To address these challenges, Mastercard introduced Decision Intelligence, an AI-powered fraud detection system that operates at a global scale. Decision Intelligence represents a shift from static rule-based monitoring to dynamic, adaptive intelligence. By applying AI for B2B payments, Mastercard created a system capable of analyzing billions of transactions in real time, identifying subtle patterns of fraud, and reducing false positives that disrupt legitimate business activity. This initiative not only improved transaction security but also strengthened Mastercard’s reputation as a trusted partner in the global B2B payments ecosystem.

AI B2B Strategy

The AI B2B strategy behind Mastercard Decision Intelligence was rooted in building a system that could scale across the company’s vast global network while adapting to evolving threats. Rather than relying on static fraud rules, Mastercard leveraged machine learning models that continuously learn from transaction data, allowing the system to detect anomalies and fraudulent behavior more effectively.

At its core, Decision Intelligence processes billions of data points per day, analyzing transaction history, geolocation, merchant behavior, device information, and spending patterns. For example, if a corporate account that normally makes payments to a European supplier suddenly initiates multiple high-value transfers to an unknown entity in another continent, the system can flag it as suspicious. By using AI for B2B in this context, Mastercard created a fraud detection engine that is dynamic, context-aware, and capable of adapting in real time.

A critical part of the strategy was balancing fraud prevention with customer experience. In the B2B world, false positives can disrupt critical supply chains, delay payments to vendors, or prevent partners from receiving funds on time. Decision Intelligence uses AI models to reduce these false positives by 50% compared to traditional systems. The models not only assess risk but also contextualize transactions, allowing legitimate payments to pass smoothly while stopping fraudulent ones. This focus on precision was central to Mastercard’s AI B2B strategy, ensuring that fraud prevention enhanced—rather than hindered—business operations.

Another strategic element was collaboration with financial institutions and merchants. Mastercard did not deploy AI for B2B fraud detection in isolation. Instead, it created a system that could integrate with banks, acquirers, and merchants, sharing insights and strengthening defenses across the ecosystem. By using AI-powered fraud detection as a collaborative tool, Mastercard built trust and expanded adoption of its services in the B2B sector.

Finally, Mastercard designed Decision Intelligence to be transparent and explainable. For B2B clients, understanding why a transaction is flagged is crucial for compliance, auditing, and maintaining client relationships. The AI system provided explanations for its decisions, helping businesses understand risk assessments and giving them confidence in the technology. This emphasis on transparency further strengthened Mastercard’s position as a trusted partner in AI for B2B payments.

Outcome & Evaluation

The deployment of Mastercard Decision Intelligence produced tangible and measurable outcomes that validated the power of AI for B2B in financial compliance and fraud detection. The most immediate impact was the sharp decline in fraudulent transactions. By analyzing massive volumes of data and learning from evolving patterns, Decision Intelligence was able to identify fraudulent activity more accurately and earlier in the process. This proactive detection helped prevent financial losses and safeguarded B2B relationships that depend on secure, timely payments.

Equally important was the reduction of false positives. Traditional fraud detection systems often generated a high volume of false alerts, leading to unnecessary friction in B2B transactions. With AI-driven intelligence, false positives were reduced by 50%. This improvement had significant implications for B2B clients, as fewer legitimate payments were delayed or blocked. Businesses experienced smoother financial operations, ensuring suppliers, vendors, and partners were paid on time, which in turn strengthened trust across supply chains.

Another outcome was the improvement in operational scalability. Mastercard processes an enormous number of transactions daily, and manual review or static rules simply could not scale effectively. AI for B2B provided the scalability needed to monitor billions of transactions in real time, without compromising accuracy. This scalability allowed Mastercard to expand its fraud detection capabilities globally, protecting both large corporations and smaller enterprises participating in cross-border trade.

Evaluations of Mastercard’s AI initiative revealed broader ecosystem benefits as well. Banks and merchants reported stronger confidence in Mastercard’s payment network, leading to increased adoption of its B2B services. For financial institutions, Decision Intelligence reduced the burden of manual fraud investigations, freeing up compliance teams to focus on more strategic tasks. Merchants valued the ability to process payments with less disruption, improving customer satisfaction and reducing operational overhead.

Client trust was one of the most important outcomes highlighted in evaluations. In the B2B payments sector, where relationships are built on reliability, the ability to guarantee both security and smooth operations gave Mastercard a competitive edge. Enterprises were more willing to adopt Mastercard’s solutions, knowing that their transactions would be protected by state-of-the-art AI for B2B systems.

From a financial perspective, the ROI was clear. Reduced fraud losses, fewer false positives, and increased service adoption all contributed to stronger revenues and lower operating costs. At the same time, Mastercard’s investment in AI positioned it as an innovation leader, ensuring long-term competitiveness in a rapidly evolving payments landscape.

The Mastercard Decision Intelligence case study illustrates how AI for B2B can transform fraud detection and compliance in the financial sector. By analyzing billions of transactions in real time, learning from evolving patterns, and reducing false positives, Mastercard not only enhanced security but also improved the overall efficiency and reliability of B2B payments. The outcomes—significant reductions in fraudulent transactions, a 50% drop in false positives, enhanced scalability, and stronger client trust—demonstrate the tangible value of embedding AI for B2B into critical financial infrastructure.

More broadly, this case highlights the importance of precision and balance in AI adoption. Fraud prevention must not come at the expense of customer experience, particularly in B2B ecosystems where delays can have severe downstream effects. Mastercard’s strategy shows that with AI for B2B, it is possible to achieve both goals simultaneously: secure transactions and seamless payment flows.

As fraudsters become more sophisticated and global payment networks more complex, the role of AI for B2B will continue to expand. Mastercard’s success with Decision Intelligence offers a blueprint for financial institutions and enterprises worldwide, demonstrating that AI is not only a defense mechanism but also a strategic enabler of trust, growth, and resilience in the digital economy.

HSBC + Ayasdi

HSBC, one of the world’s largest banking and financial services organizations, operates in more than 60 countries and serves millions of customers, including a substantial B2B client base that spans multinational corporations, SMEs, and institutional investors. Its scale and global footprint mean that HSBC processes an enormous volume of transactions every day, across borders, currencies, and industries. This makes the bank not only a leader in international finance but also a prime target for financial crime, including money laundering, fraud, and regulatory breaches.

For decades, banks like HSBC relied on rule-based systems to detect suspicious activity. These systems, while useful, were often rigid and simplistic, flagging transactions based on predefined thresholds such as unusually large transfers or repeated payments to high-risk jurisdictions. In the modern world of financial crime, however, such approaches were no longer sufficient. Criminal organizations became increasingly sophisticated, employing complex networks, shell companies, and layered transactions to disguise illicit activity. At the same time, regulators heightened their scrutiny of banks’ anti-money laundering (AML) programs, imposing heavy fines on institutions that failed to meet compliance standards.

HSBC faced the dual challenge of protecting itself from financial crime while avoiding regulatory penalties. Traditional monitoring systems generated overwhelming volumes of alerts, most of which turned out to be false positives. Investigators were forced to spend countless hours reviewing these alerts manually, slowing down compliance teams and making it harder to focus on genuine risks. To address this challenge, HSBC turned to AI for B2B, seeking a solution that could provide deeper insights, automate investigations, and deliver compliance outcomes at scale.

The bank partnered with Ayasdi, an AI company known for its expertise in topological data analysis and advanced machine learning. Together, HSBC and Ayasdi sought to transform AML and trade finance compliance by uncovering hidden patterns in transaction data that human analysts and rule-based systems could not detect.

AI B2B Strategy

The strategy behind HSBC’s partnership with Ayasdi revolved around leveraging machine learning to move from reactive compliance monitoring to proactive risk detection. Instead of relying on rigid, one-size-fits-all rules, HSBC needed AI for B2B tools capable of analyzing vast transaction datasets dynamically and identifying patterns that might indicate illicit behavior.

Ayasdi’s approach was centered on advanced unsupervised learning techniques, particularly topological data analysis (TDA). This method enabled HSBC to visualize and interpret high-dimensional data, revealing clusters, anomalies, and hidden relationships that traditional statistical models often overlooked. For example, Ayasdi’s AI could map relationships between clients, counterparties, and intermediaries, highlighting suspicious networks where multiple transactions converged in ways consistent with money laundering schemes.

By applying AI for B2B in AML, HSBC could detect not just individual suspicious transactions but also the broader behavioral patterns of criminal networks. This capability was critical in identifying sophisticated schemes such as “smurfing” (where criminals break large transactions into smaller ones) or trade-based money laundering (where goods and invoices are manipulated to disguise value transfers).

Another strategic element was reducing false positives. One of the biggest inefficiencies in compliance monitoring was the flood of alerts generated by traditional systems, most of which did not represent real risks. Ayasdi’s AI models improved the precision of alerts, ensuring investigators could focus their time on high-risk cases. This directly addressed HSBC’s challenge of limited investigative resources while improving the speed and effectiveness of compliance teams.

The strategy also emphasized scalability and integration. HSBC operates globally, with compliance requirements that vary across jurisdictions. Ayasdi’s AI for B2B tools were designed to scale across multiple markets, languages, and regulatory frameworks, making it possible for HSBC to apply a unified compliance approach worldwide. Integration with existing compliance workflows ensured that investigators could access AI-generated insights within their normal systems, minimizing disruption and encouraging adoption.

Finally, the AI B2B strategy included a strong focus on regulatory transparency. Regulators demand not only that banks detect and prevent financial crime but also that they can explain how their systems work. Ayasdi’s models provided interpretable outputs, allowing HSBC to demonstrate to regulators how suspicious activity was identified and why certain transactions were flagged. This interpretability helped HSBC strengthen its relationships with regulators while showing commitment to compliance excellence.

Outcome & Evaluation

The partnership between HSBC and Ayasdi delivered significant outcomes, demonstrating the value of AI for B2B in the financial and compliance domain. One of the most immediate results was a 20–30% reduction in AML investigation times. By automating the identification of suspicious patterns and prioritizing high-risk alerts, the AI system allowed investigators to work faster and more effectively. This efficiency gain meant that HSBC could process more cases without increasing headcount, an essential benefit in a resource-intensive compliance environment.